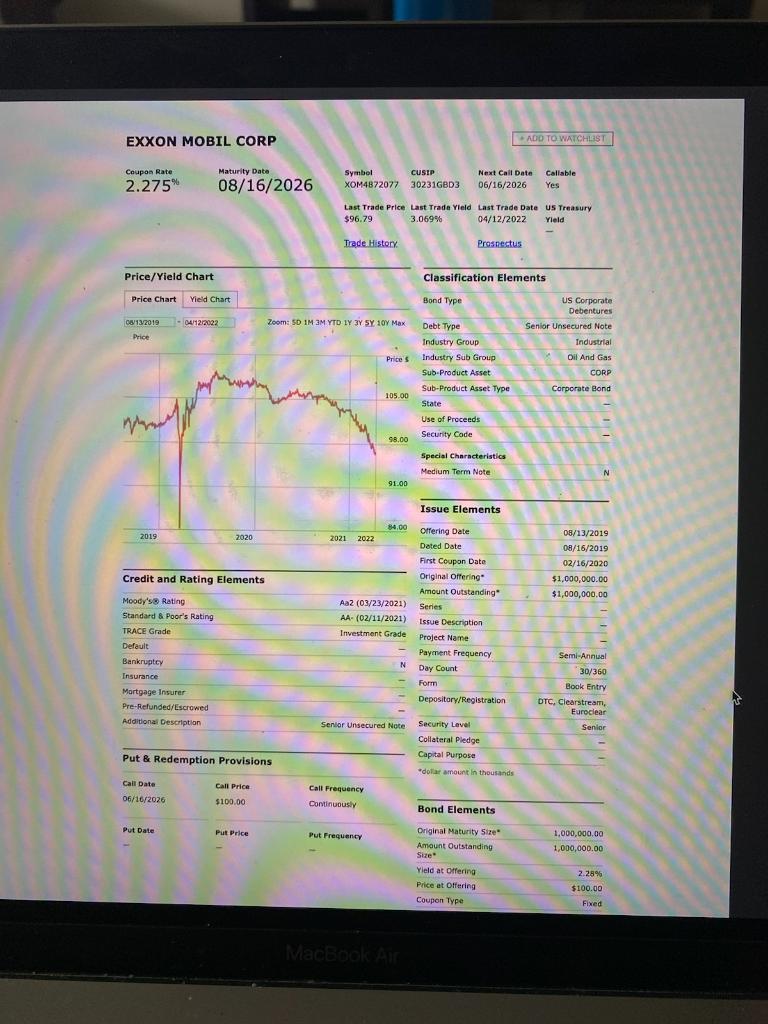

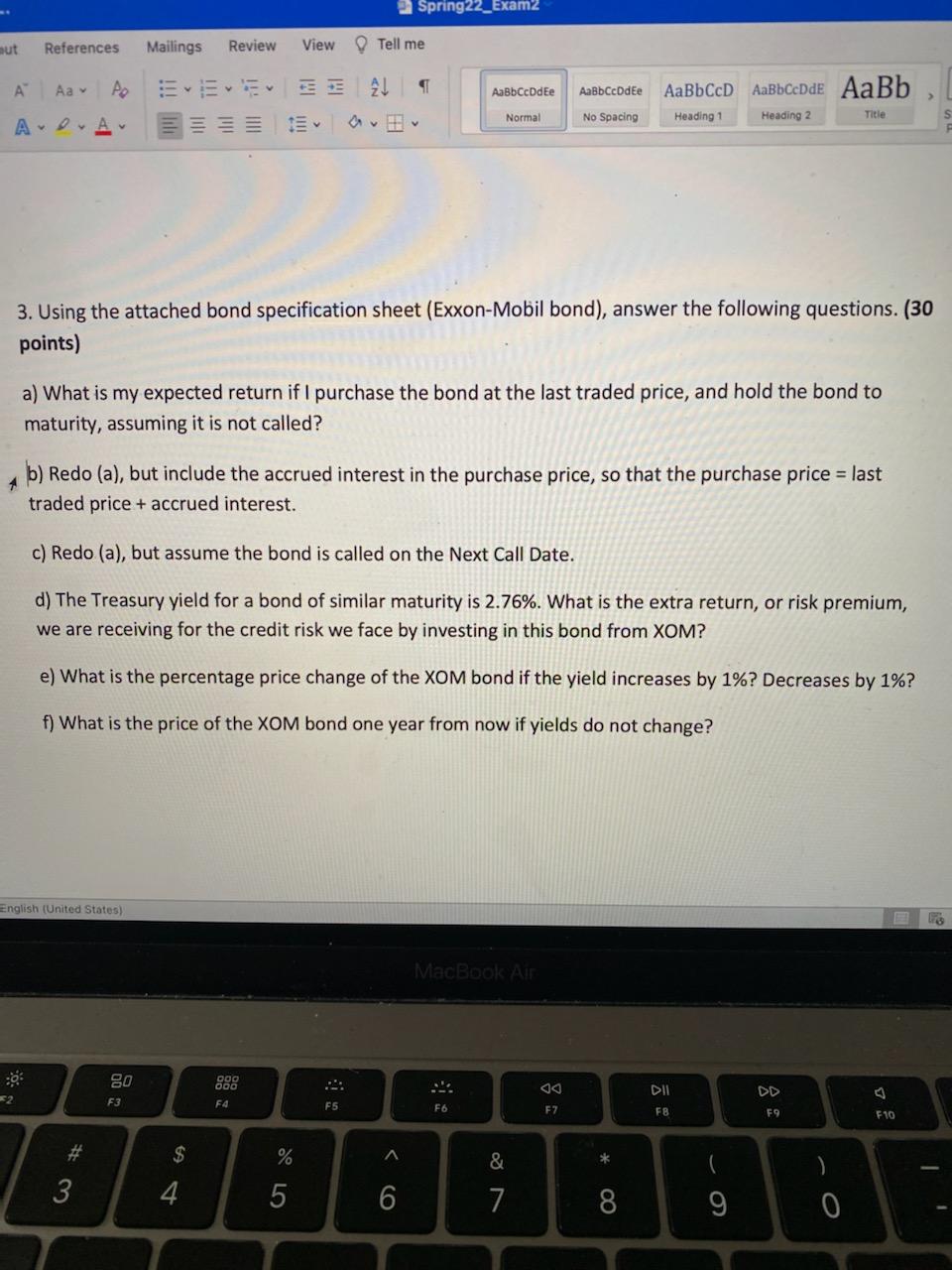

EXXON MOBIL CORP ADD TO WATCHLIST Coupon Rate Maturity Date 2.275" 08/16/2026 Symbol CUSIP XOM4872077 30231GBD3 Next Call Date 06/16/2026 Callable Yes Last Trade Price Last Trade Yield Last Trade Date US Treasury $96.79 3,069% 04/12/2022 Yield Trade History Prospectus Price/Yield Chart Classification Elements Price Chart Yield Chart Bond Type 08/12/2019 - 04/12/2022 Price Zoom:SD 1M 3M YTD IY BY SY 10Y Max Debt Type Industry Group Price's Industry Industry Sub Group Sub-Product Asset Sub-Product Asset Type 105.00 State US Corporate Debentures Senior Unsecured Note Industrial Oil And Gas CORP Corporate Bond Use of Proceeds Security Code 98.00 Special Characteristics Medium Term Note N 91.00 Issue Elements 84,00 2019 2020 2021 2022 08/13/2019 08/16/2019 02/16/2020 $1,000,000.00 $1,000,000.00 Credit and Rating Elements Aa2 (03/23/2021) AA- (02/11/2021) Moody's Rating Standard & Poor's Rating TRACE Grade Default Offering Date Dated Date First Coupon Date Original Offering" Amount Outstanding Series Issue Description Project Name Payment Frequency Day Count Form Depository/Registration Investment Grade Semi-Annual Bankruptcy N Insurance Mortgage Insurer Pre-Refunded/Escrowed Additional Description 30/360 Book Entry DTC, Clearstream, Euroclear Senior Unsecured Note Senior Security Level Collateral Pledge Capital Purpose Put & Redemption Provisions dollar amount in thousands Call Date Call Price 06/16/2026 Call Frequency Continuously $100.00 Bond Elements Put Date Put Price Put Frequency Original Maturity Size Amount Outstanding Size 1,000,000.00 1,000,000.00 Yield at Offering Price at Offering Coupon Type 2.28% $100.00 Fixed MacEKAIT Spring22_Exam2 sut References Mailings Review View Tell me Aa v po AL AaBbCcDdEe AaBbCcDdEe AaBbCD AaBbCcDde AaBb Normal No Spacing Heading 1 Heading 2 Title ADA 3. Using the attached bond specification sheet (Exxon-Mobil bond), answer the following questions. (30 points) a) What is my expected return if I purchase the bond at the last traded price, and hold the bond to maturity, assuming it is not called? A b) Redo (a), but include the accrued interest in the purchase price, so that the purchase price = last traded price + accrued interest. c) Redo (a), but assume the bond is called on the Next Call Date. d) The Treasury yield for a bond of similar maturity is 2.76%. What is the extra return, or risk premium, we are receiving for the credit risk we face by investing in this bond from XOM? e) What is the percentage price change of the XOM bond if the yield increases by 1%? Decreases by 1%? f) What is the price of the XOM bond one year from now if yields do not change? English (United States) MacBook AIF 80 ..: DIL F3 F4 00 F7 F5 F6 FB 59 F10 # $ A & 3 4 % 5 * 0 6 7 8 9 0 EXXON MOBIL CORP ADD TO WATCHLIST Coupon Rate Maturity Date 2.275" 08/16/2026 Symbol CUSIP XOM4872077 30231GBD3 Next Call Date 06/16/2026 Callable Yes Last Trade Price Last Trade Yield Last Trade Date US Treasury $96.79 3,069% 04/12/2022 Yield Trade History Prospectus Price/Yield Chart Classification Elements Price Chart Yield Chart Bond Type 08/12/2019 - 04/12/2022 Price Zoom:SD 1M 3M YTD IY BY SY 10Y Max Debt Type Industry Group Price's Industry Industry Sub Group Sub-Product Asset Sub-Product Asset Type 105.00 State US Corporate Debentures Senior Unsecured Note Industrial Oil And Gas CORP Corporate Bond Use of Proceeds Security Code 98.00 Special Characteristics Medium Term Note N 91.00 Issue Elements 84,00 2019 2020 2021 2022 08/13/2019 08/16/2019 02/16/2020 $1,000,000.00 $1,000,000.00 Credit and Rating Elements Aa2 (03/23/2021) AA- (02/11/2021) Moody's Rating Standard & Poor's Rating TRACE Grade Default Offering Date Dated Date First Coupon Date Original Offering" Amount Outstanding Series Issue Description Project Name Payment Frequency Day Count Form Depository/Registration Investment Grade Semi-Annual Bankruptcy N Insurance Mortgage Insurer Pre-Refunded/Escrowed Additional Description 30/360 Book Entry DTC, Clearstream, Euroclear Senior Unsecured Note Senior Security Level Collateral Pledge Capital Purpose Put & Redemption Provisions dollar amount in thousands Call Date Call Price 06/16/2026 Call Frequency Continuously $100.00 Bond Elements Put Date Put Price Put Frequency Original Maturity Size Amount Outstanding Size 1,000,000.00 1,000,000.00 Yield at Offering Price at Offering Coupon Type 2.28% $100.00 Fixed MacEKAIT Spring22_Exam2 sut References Mailings Review View Tell me Aa v po AL AaBbCcDdEe AaBbCcDdEe AaBbCD AaBbCcDde AaBb Normal No Spacing Heading 1 Heading 2 Title ADA 3. Using the attached bond specification sheet (Exxon-Mobil bond), answer the following questions. (30 points) a) What is my expected return if I purchase the bond at the last traded price, and hold the bond to maturity, assuming it is not called? A b) Redo (a), but include the accrued interest in the purchase price, so that the purchase price = last traded price + accrued interest. c) Redo (a), but assume the bond is called on the Next Call Date. d) The Treasury yield for a bond of similar maturity is 2.76%. What is the extra return, or risk premium, we are receiving for the credit risk we face by investing in this bond from XOM? e) What is the percentage price change of the XOM bond if the yield increases by 1%? Decreases by 1%? f) What is the price of the XOM bond one year from now if yields do not change? English (United States) MacBook AIF 80 ..: DIL F3 F4 00 F7 F5 F6 FB 59 F10 # $ A & 3 4 % 5 * 0 6 7 8 9 0