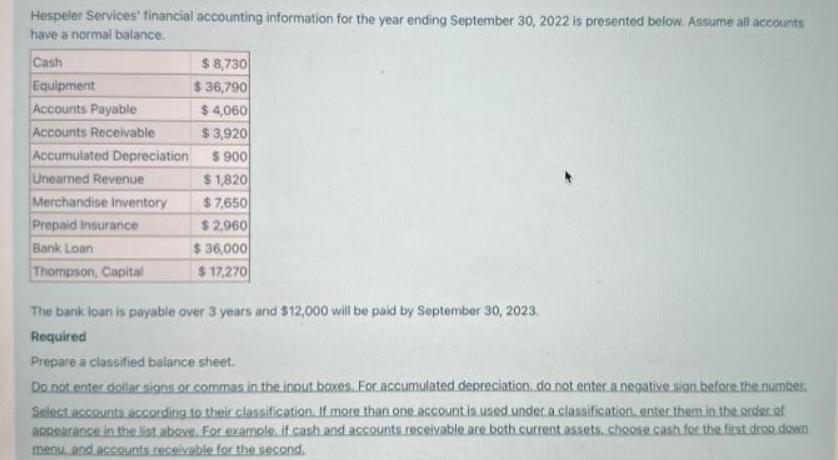

Hespeler Services financial accounting information for the year ending September 30, 2022 is presented below. Assume all accounts have a normal balance. Cash Equipment

Hespeler Services financial accounting information for the year ending September 30, 2022 is presented below. Assume all accounts have a normal balance. Cash Equipment Accounts Payable Accounts Receivable Accumulated Depreciation Unearned Revenue Merchandise Inventory Prepaid Insurance Bank Loan Thompson, Capital $8,730 $36,790 $4,060 $3,920 $ 900 $1,820 $7,650 $ 2,960 $36,000 $17,270 The bank loan is payable over 3 years and $12,000 will be paid by September 30, 2023. Required Prepare a classified balance sheet. Do not enter dollar signs or commas in the input boxes. For accumulated depreciation, do not enter a negative sign before the number. Select accounts according to their classification. If more than one account is used under a classification, enter them in the order of appearance in the list above. For example, if cash and accounts receivable are both current assets. choose cash for the first drop down menu, and accounts receivable for the second.

Step by Step Solution

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Balance sheet as at March 20 Pl Cussent Assets Cash Accounts Receivable In...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started