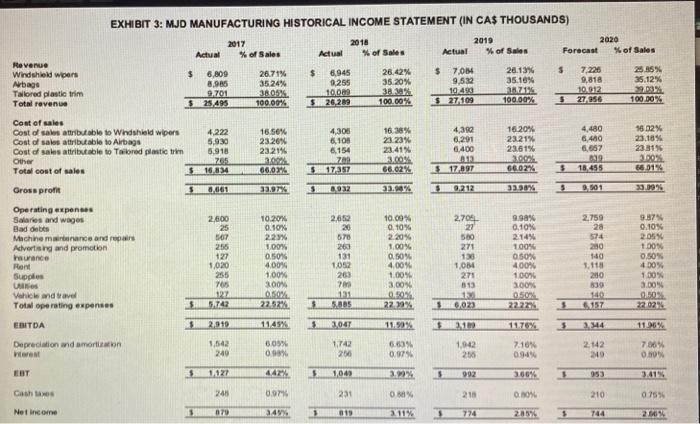

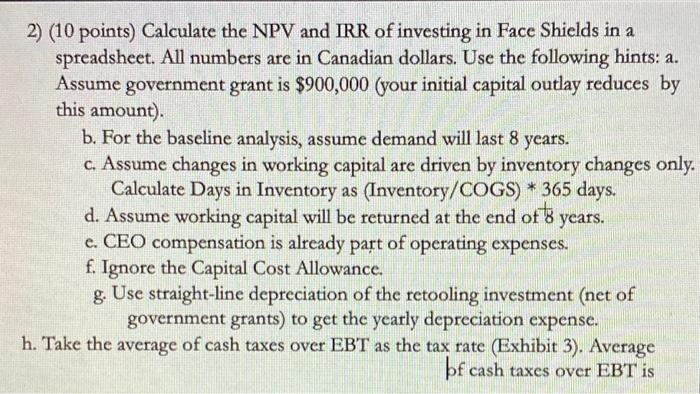

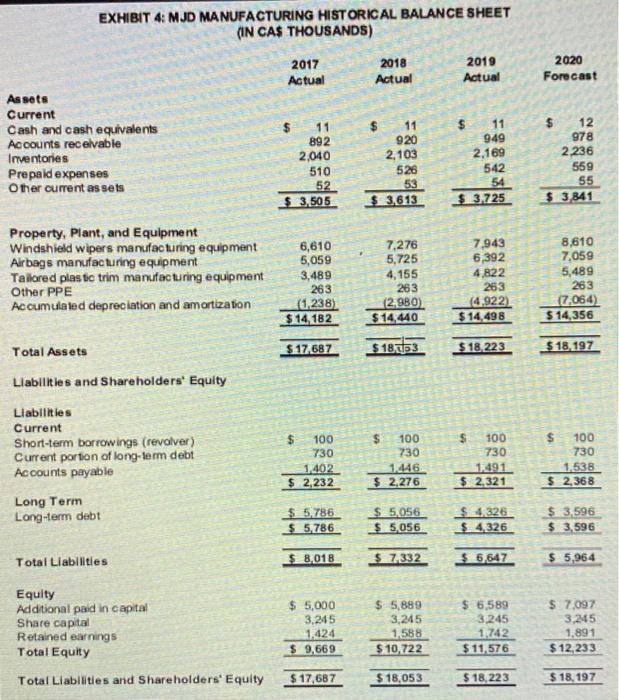

EYHIRIT 3. M.IN MANIIFACTURING HISTORICAL INCOME STATEMENT (IN CAS THOUSANDS) 2) ( 10 points) Calculate the NPV and IRR of investing in Face Shields in a spreadsheet. All numbers are in Canadian dollars. Use the following hints: a. Assume government grant is $900,000 (your initial capital outlay reduces by this amount). b. For the baseline analysis, assume demand will last 8 years. c. Assume changes in working capital are driven by inventory changes only. Calculate Days in Inventory as (Inventory/COGS) * 365 days. d. Assume working capital will be returned at the end of 8 years. e. CEO compensation is already part of operating expenses. f. Ignore the Capital Cost Allowance. g. Use straight-line depreciation of the retooling investment (net of government grants) to get the yearly depreciation expense. h. Take the average of cash taxes over EBT as the tax rate (Exhibit 3). Average bf cash taxes over EBT is EXHIBIT 4: MJD MANUFACTURING HISTORICAL BALANCE SHEET (IN CAS THOUSANDS) 2017Actual2018Actual2019Actual2020Forecast Assets Current Cash and cash equivalents Accounts recelvable Imentorles Prepaid expenses O ther current assets Property, Plant, and Equipment Llabilities and Shareholders' Equity Llabilities Current Short-term borrowings (revalver) Current partion of long-lerm debt Accounts payable Long Term Long-term debt Total Liabilities Equity Additional paid in captal Share captal Retained earrings Total Equity Total Llabilities and Shareholders' Equity EYHIRIT 3. M.IN MANIIFACTURING HISTORICAL INCOME STATEMENT (IN CAS THOUSANDS) 2) ( 10 points) Calculate the NPV and IRR of investing in Face Shields in a spreadsheet. All numbers are in Canadian dollars. Use the following hints: a. Assume government grant is $900,000 (your initial capital outlay reduces by this amount). b. For the baseline analysis, assume demand will last 8 years. c. Assume changes in working capital are driven by inventory changes only. Calculate Days in Inventory as (Inventory/COGS) * 365 days. d. Assume working capital will be returned at the end of 8 years. e. CEO compensation is already part of operating expenses. f. Ignore the Capital Cost Allowance. g. Use straight-line depreciation of the retooling investment (net of government grants) to get the yearly depreciation expense. h. Take the average of cash taxes over EBT as the tax rate (Exhibit 3). Average bf cash taxes over EBT is EXHIBIT 4: MJD MANUFACTURING HISTORICAL BALANCE SHEET (IN CAS THOUSANDS) 2017Actual2018Actual2019Actual2020Forecast Assets Current Cash and cash equivalents Accounts recelvable Imentorles Prepaid expenses O ther current assets Property, Plant, and Equipment Llabilities and Shareholders' Equity Llabilities Current Short-term borrowings (revalver) Current partion of long-lerm debt Accounts payable Long Term Long-term debt Total Liabilities Equity Additional paid in captal Share captal Retained earrings Total Equity Total Llabilities and Shareholders' Equity