Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EZ-Boy Furniture makes sofas, loveseats, and recliners. The company allocates manufacturing overhead based on direct labor hours. E-Z-Boy estimated a total of $2 million of

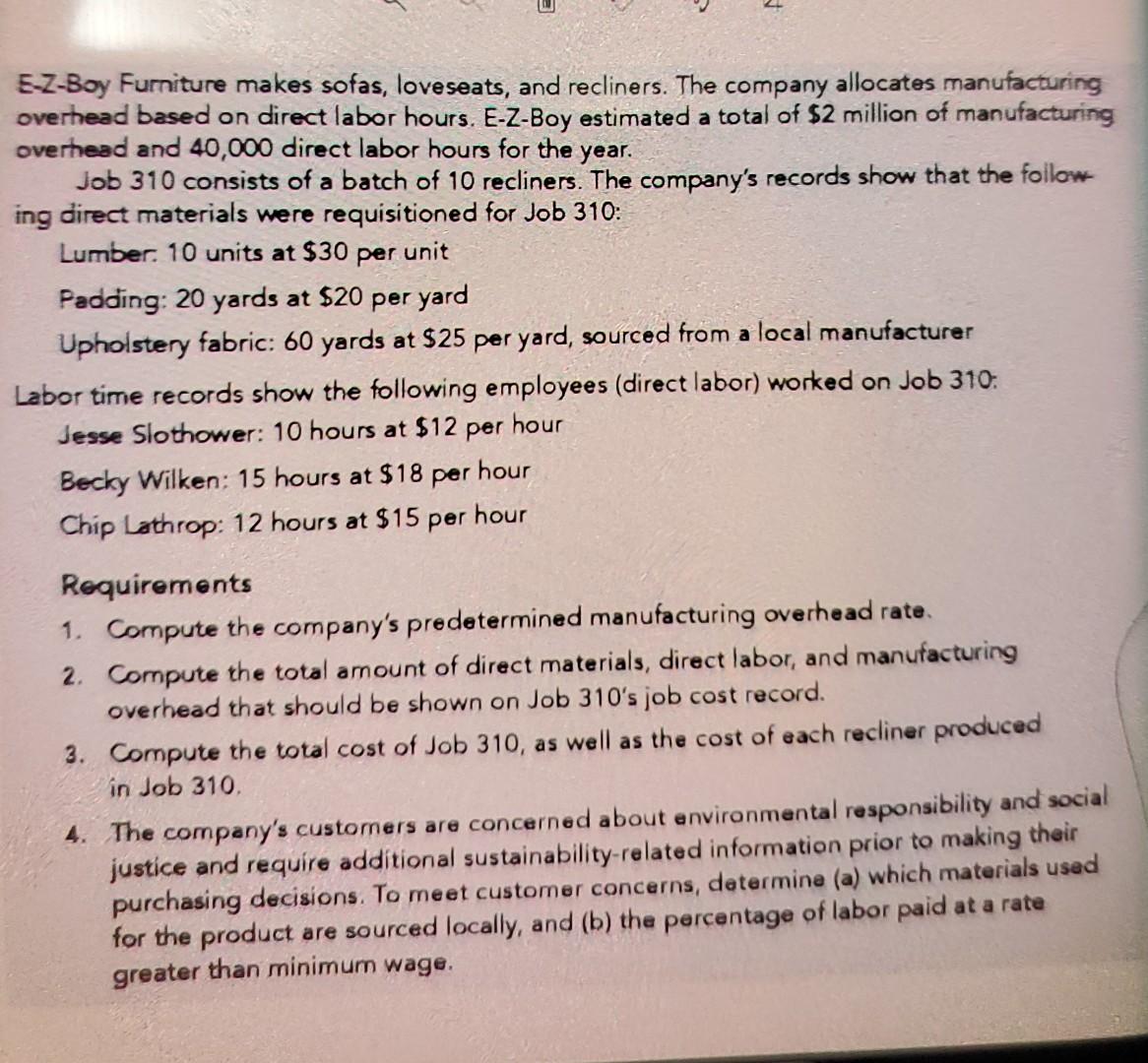

EZ-Boy Furniture makes sofas, loveseats, and recliners. The company allocates manufacturing overhead based on direct labor hours. E-Z-Boy estimated a total of $2 million of manufacturing overhead and 40,000 direct labor hours for the year. Job 310 consists of a batch of 10 recliners. The company's records show that the follow ing direct materials were requisitioned for Job 310: Lumber. 10 units at $30 per unit Padding: 20 yards at $20 per yard Upholstery fabric: 60 yards at $25 per yard, sourced from a local manufacturer Labor time records show the following employees (direct labor) worked on Job 310 Jesse Slothower: 10 hours at $12 per hour Becky Wilken: 15 hours at $18 per hour Chip Lathrop: 12 hours at $15 per hour Requirements 1. Compute the company's predetermined manufacturing overhead rate. 2. Compute the total amount of direct materials, direct labor, and manufacturing overhead that should be shown on Job 310's job cost record. 3. Compute the total cost of Job 310, as well as the cost of each recliner produced in Job 310, 4. The company's customers are concerned about environmental responsibility and social justice and require additional sustainability-related information prior to making their purchasing decisions. To meet customer concerns, determine (a) which materials used for the product are sourced locally, and (b) the percentage of labor paid at a rate greater than minimum wage

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started