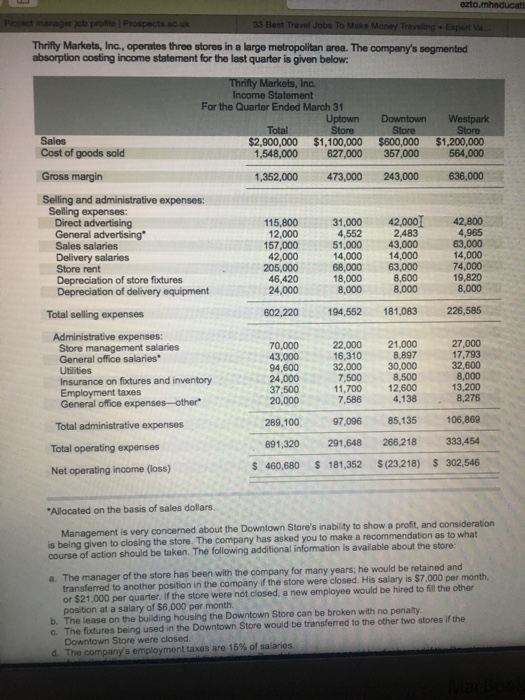

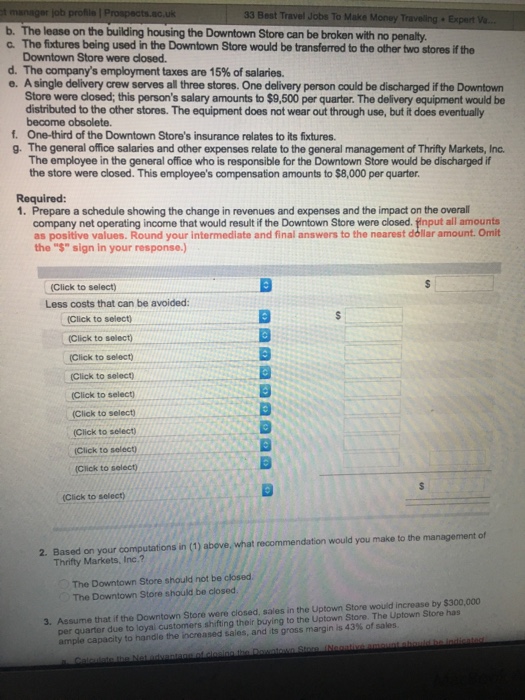

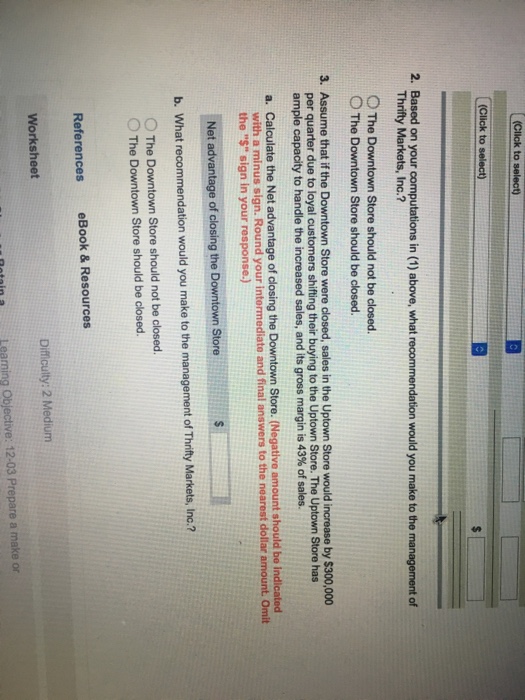

ezto Thrifty Markets, Inc., operates three stores in a large metropolitan area. The company's segmented absorption costing income statement for the last quarter is given below Income Statement For the Quarter Ended March 31 Uptown Total Sales Cost of goods sold Gross margin Selling and administrative expenses: $2,900,000 $1,100,000 $600,000 $1,200,000 1,548,000 627,000 357,000 564,000 1,352,000 473,000 243,000 636,000 Selling expenses: 115,80031,00042,000 42,800 4,965 63,000 14,000 74,000 19,820 8,000 Direct advertising 4,552 2,483 51,000 43,000 14,000 14,000 68,000 63,000 8,600 8,000 8,000 advertising Sales salaries Delivery salaries Store rent Depreciation of store fixtures Depreciation of delivery equipment 157,000 42,000 205,000 46,420 24,000 18,000 Total selling expenses 602,220194,552 181,083 226,585 Administrative expenses: 21,000 8,897 30,000 8,500 11,700 12,600 4.138 22,000 16,310 32,000 7,500 27,000 17,793 32,600 8,000 13,200 8,276 70,000 Store management salaries General office salaries Insurance on fixtures and inventory Employment taxes General office expenses-other* 94,600 24,000 37,500 20,000 7,586 97,096 85,135 106,869 333,454 s 460,680 s 181,352 s(23,218) S 302,546 289,100 Total administrative expenses 91,320291,648 266,218 Total operating expenses Net operating income (loss) Allocated on the basis of sales dollars. Management is very concened about the Downtown Store's inability to show a profft, and consideration is being given to closing the store. The company has asked you to make a recommendation as to what is available about the store: action should be taken. The following additional information transferred to another position in the company if the store were closed. His salary is $7,000 per month, or $21,000 per quarter. If the store were not closed, a new employee would be hired to fill the other position at a salary of $6,000 per month a. The manager of the store has been with the company for many years: he would be retained and b. The lease on the building housing the Downtown Store can be broken with no penalty c. The fixtures being used in the Downtown Store would be transferred to the other two stores if the Downtown Store were closed d. The company's employment taxes are 1 5% of salaries ezto Thrifty Markets, Inc., operates three stores in a large metropolitan area. The company's segmented absorption costing income statement for the last quarter is given below Income Statement For the Quarter Ended March 31 Uptown Total Sales Cost of goods sold Gross margin Selling and administrative expenses: $2,900,000 $1,100,000 $600,000 $1,200,000 1,548,000 627,000 357,000 564,000 1,352,000 473,000 243,000 636,000 Selling expenses: 115,80031,00042,000 42,800 4,965 63,000 14,000 74,000 19,820 8,000 Direct advertising 4,552 2,483 51,000 43,000 14,000 14,000 68,000 63,000 8,600 8,000 8,000 advertising Sales salaries Delivery salaries Store rent Depreciation of store fixtures Depreciation of delivery equipment 157,000 42,000 205,000 46,420 24,000 18,000 Total selling expenses 602,220194,552 181,083 226,585 Administrative expenses: 21,000 8,897 30,000 8,500 11,700 12,600 4.138 22,000 16,310 32,000 7,500 27,000 17,793 32,600 8,000 13,200 8,276 70,000 Store management salaries General office salaries Insurance on fixtures and inventory Employment taxes General office expenses-other* 94,600 24,000 37,500 20,000 7,586 97,096 85,135 106,869 333,454 s 460,680 s 181,352 s(23,218) S 302,546 289,100 Total administrative expenses 91,320291,648 266,218 Total operating expenses Net operating income (loss) Allocated on the basis of sales dollars. Management is very concened about the Downtown Store's inability to show a profft, and consideration is being given to closing the store. The company has asked you to make a recommendation as to what is available about the store: action should be taken. The following additional information transferred to another position in the company if the store were closed. His salary is $7,000 per month, or $21,000 per quarter. If the store were not closed, a new employee would be hired to fill the other position at a salary of $6,000 per month a. The manager of the store has been with the company for many years: he would be retained and b. The lease on the building housing the Downtown Store can be broken with no penalty c. The fixtures being used in the Downtown Store would be transferred to the other two stores if the Downtown Store were closed d. The company's employment taxes are 1 5% of salaries