Answered step by step

Verified Expert Solution

Question

1 Approved Answer

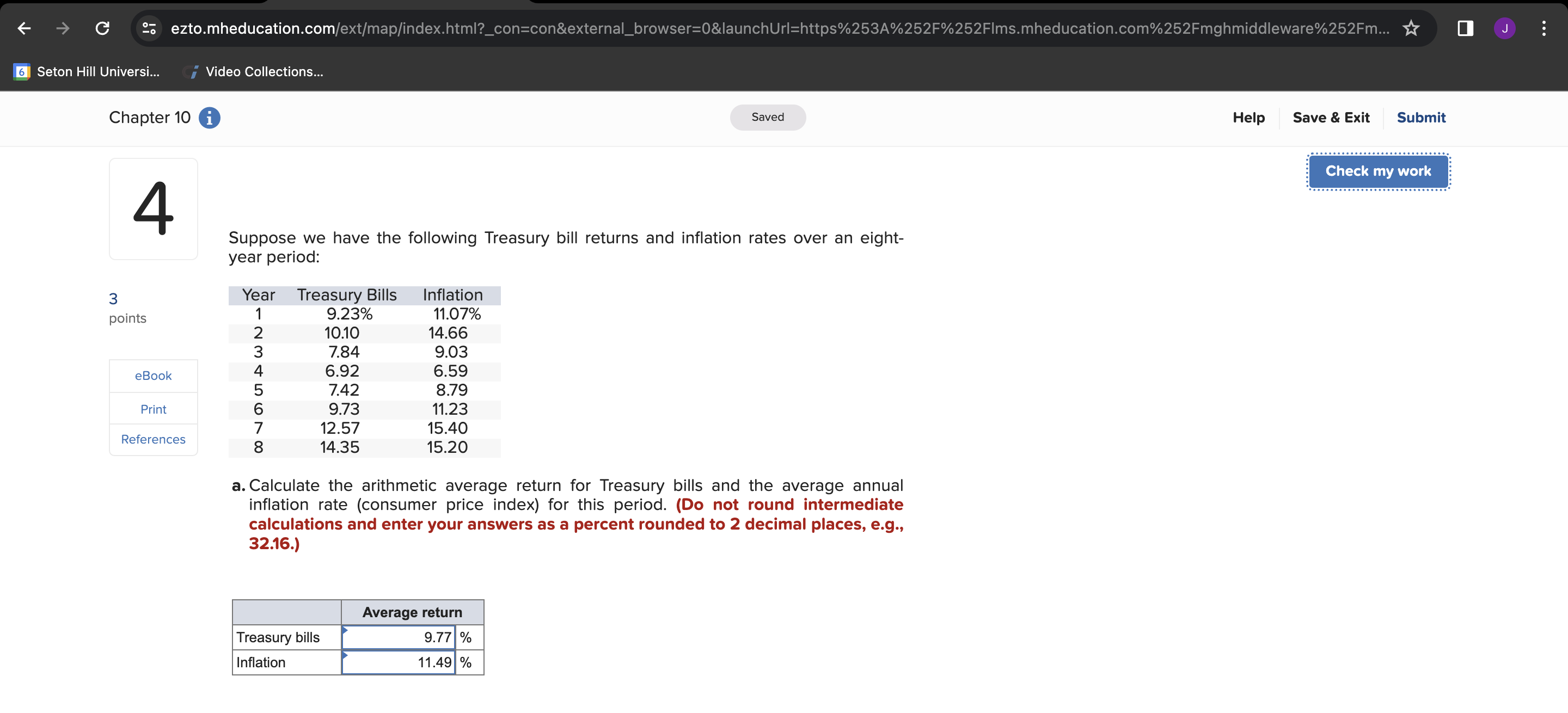

- ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%252Fm... 6 Seton Hill Universi... Video Collections... Chapter 10 i Saved 4 Suppose we have the following Treasury bill returns and inflation rates

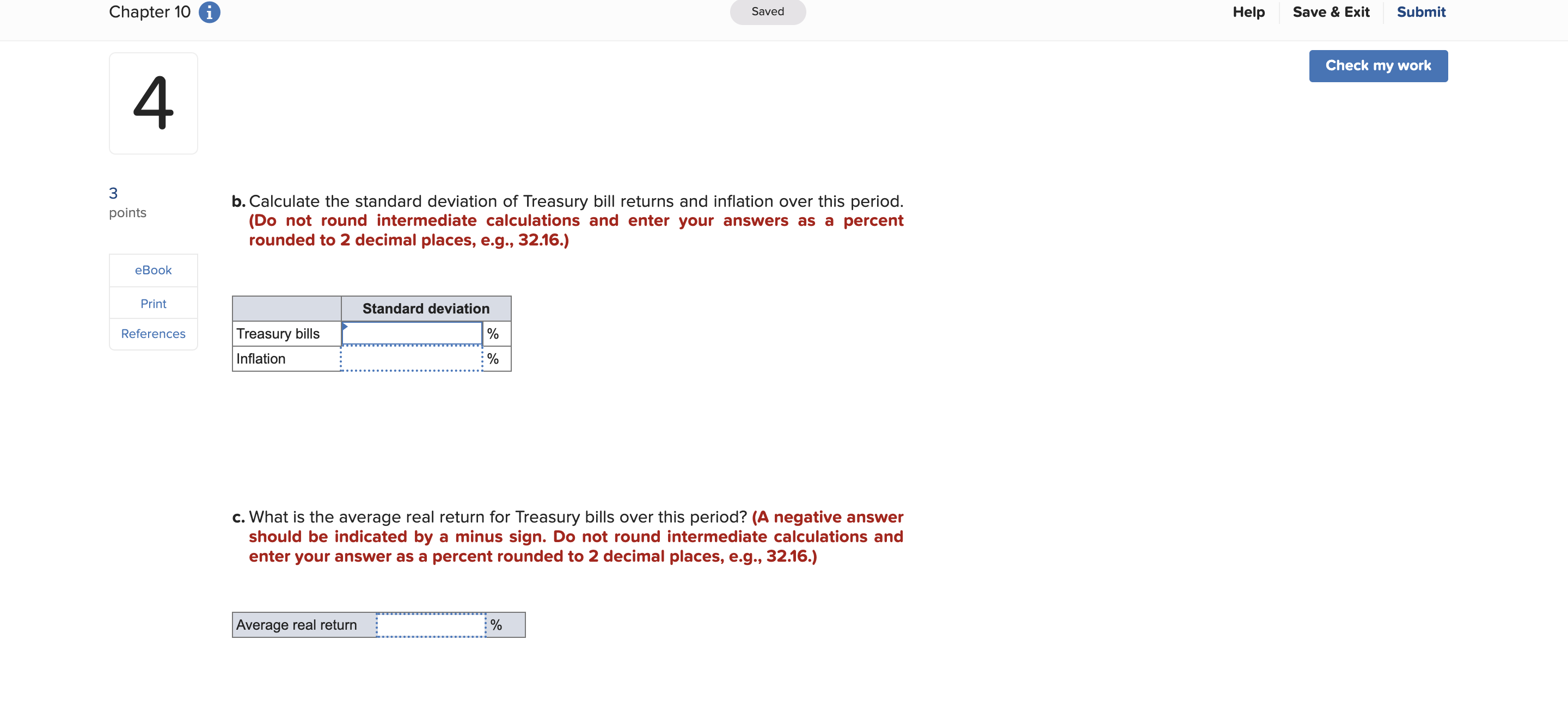

- ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%252Fm... 6 Seton Hill Universi... Video Collections... Chapter 10 i Saved 4 Suppose we have the following Treasury bill returns and inflation rates over an eight- year period: 3 points 1 Year Treasury Bills 9.23% Inflation eBook Print References 2345678 10.10 11.07% 14.66 7.84 9.03 6.92 6.59 7.42 8.79 9.73 11.23 12.57 14.35 15.40 15.20 a. Calculate the arithmetic average return for Treasury bills and the average annual inflation rate (consumer price index) for this period. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Treasury bills Inflation Average return 9.77% 11.49 % Help Save & Exit Submit Check my work Chapter 10 4 points eBook Saved b. Calculate the standard deviation of Treasury bill returns and inflation over this period. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Print Standard deviation References Treasury bills Inflation % % c. What is the average real return for Treasury bills over this period? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Average real return % Help Save & Exit Submit Check my work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started