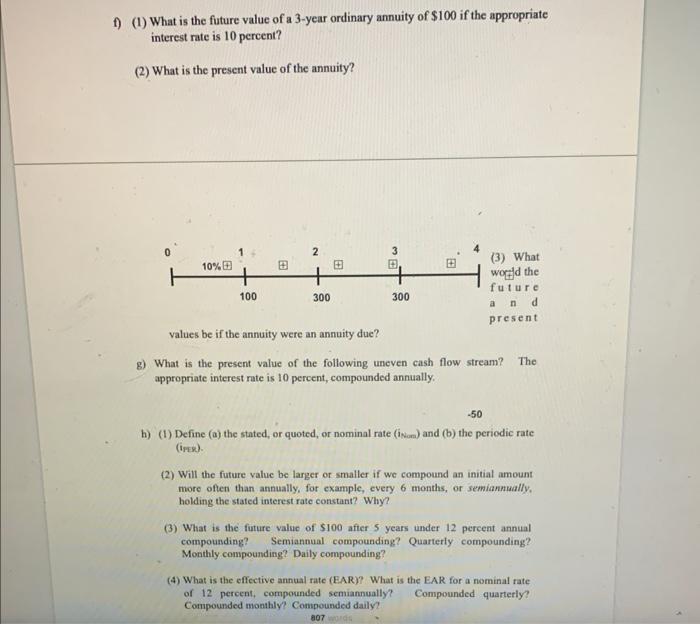

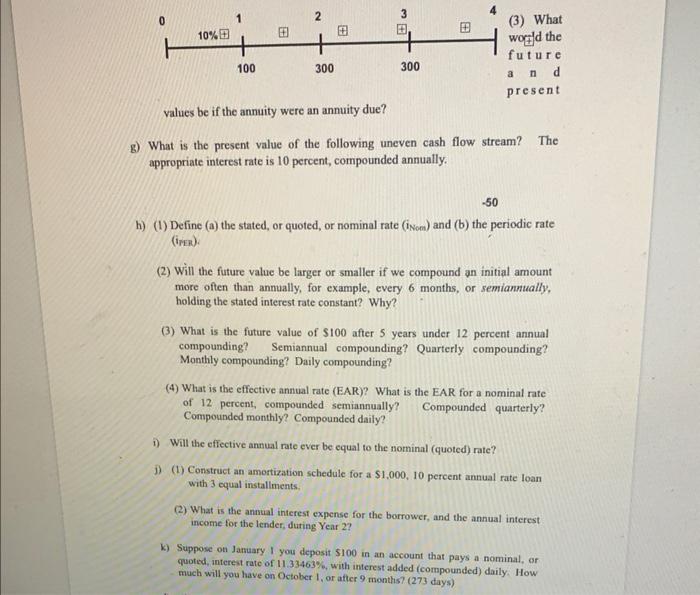

f) (1) What is the future value of a 3-year ordinary annuity of $100 if the appropriate interest rate is 10 percent? (2) What is the present value of the annuity? values be if the annuity were an annuity due? g) What is the present value of the following uneven cash flow stream? The appropriate interest rate is 10 percent, compounded annually. .50 h) (1) Define (a) the stated, or quoted, or nominal rate (iNom) and (b) the periodic rate (ifes). (2) Will the future value be larger or smaller if we compound an initial amount more often than annually, for example, every 6 months, or semiannually. holding the stated interest rate constant? Why? (3) What is the future value of $100 after 5 years under 12 percent annual compounding? Semiannual compounding? Quarterly compounding? Monthly compounding? Daily compounding? (4) What is the effective annual rate (EAR)? What is the EAR for a nominal rate of 12 pereent, compounded semiannually? Compounded quarterly? Compounded monthly? Compounded daily? 807 values be if the annuity were an annuity due? g) What is the present value of the following uneven cash flow stream? The appropriate interest rate is 10 percent, compounded annually. 50 h) (i) Define (a) the stated, or quoted, or nominal rate (iNom) and (b) the periodic rate (irEz): (2) Will the future value be larger or smaller if we compound an initial amount more often than annually, for example, every 6 months, or semiannually, holding the stated interest rate constant? Why? (3) What is the future value of $100 after 5 years under 12 percent annual compounding? Semiannual compounding? Quarterly compounding? Monthly compounding? Daily compounding? (4) What is the effective annual rate (EAR)? What is the EAR for a nominal rate of 12 percent, compounded semiannually? Compounded quarterly? Compounded monthly? Compounded daily? i) Will the effective annual rate ever be equal to the nominal (quoted) rate? j) (1) Construct an amortization schedule for a $1,000,10 percent annual rate loan with 3 equal installments. (2) What is the annual interest expense for the borrower, and the annual interest. income for the lender, during Year 2 ? k) Suppose on January I you deposit 5100 in an account that pays a nominal, of quoted, interest rate of 11.33463%, with interest added (compounded) daily. How much will you have on Oetober 1, or after 9 monthis? ( 273 days)