Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tasmanian Motor Rental (TMR) is set up as a proprietary company in car rental industry and is considering whether to enter the discount rental

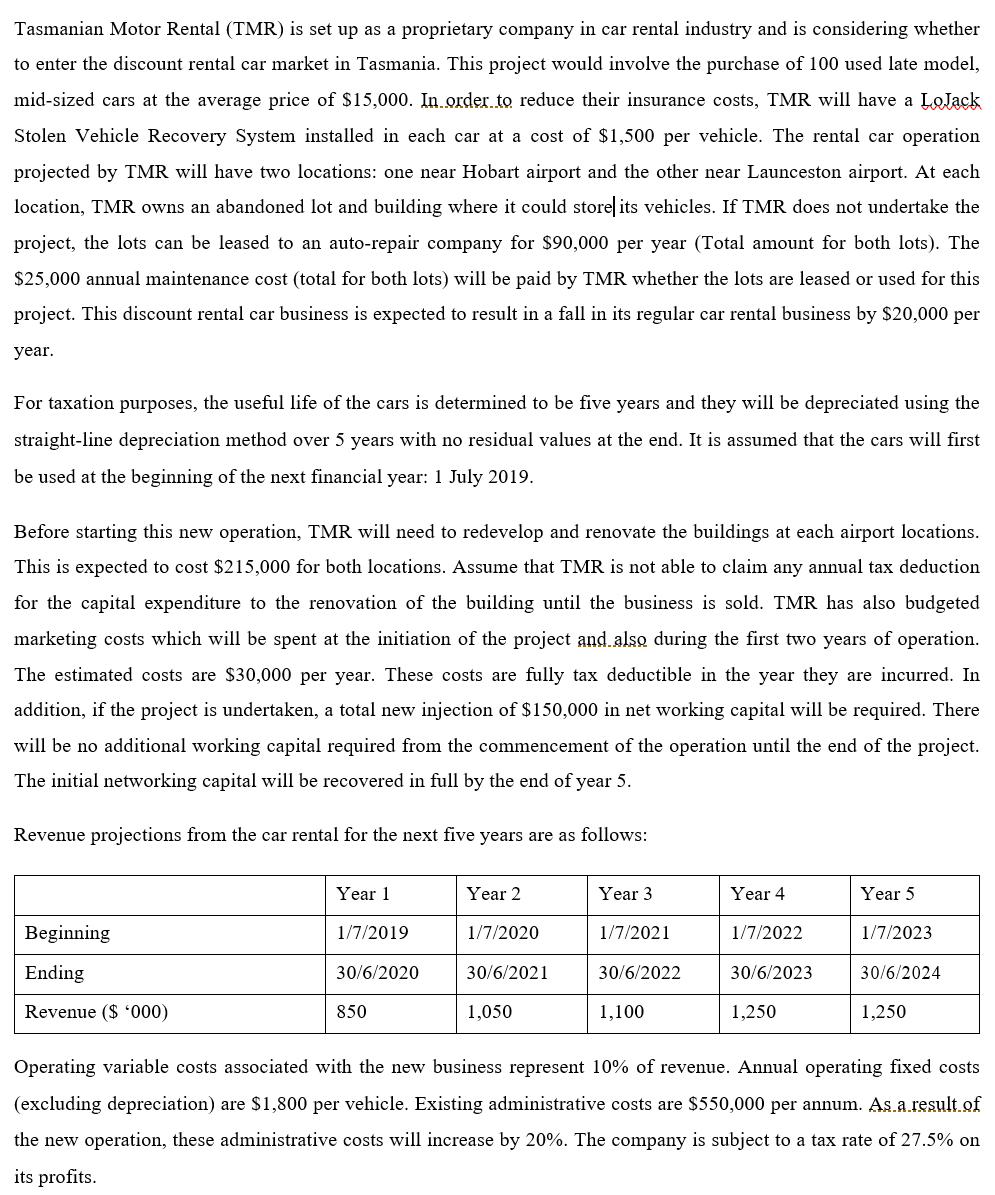

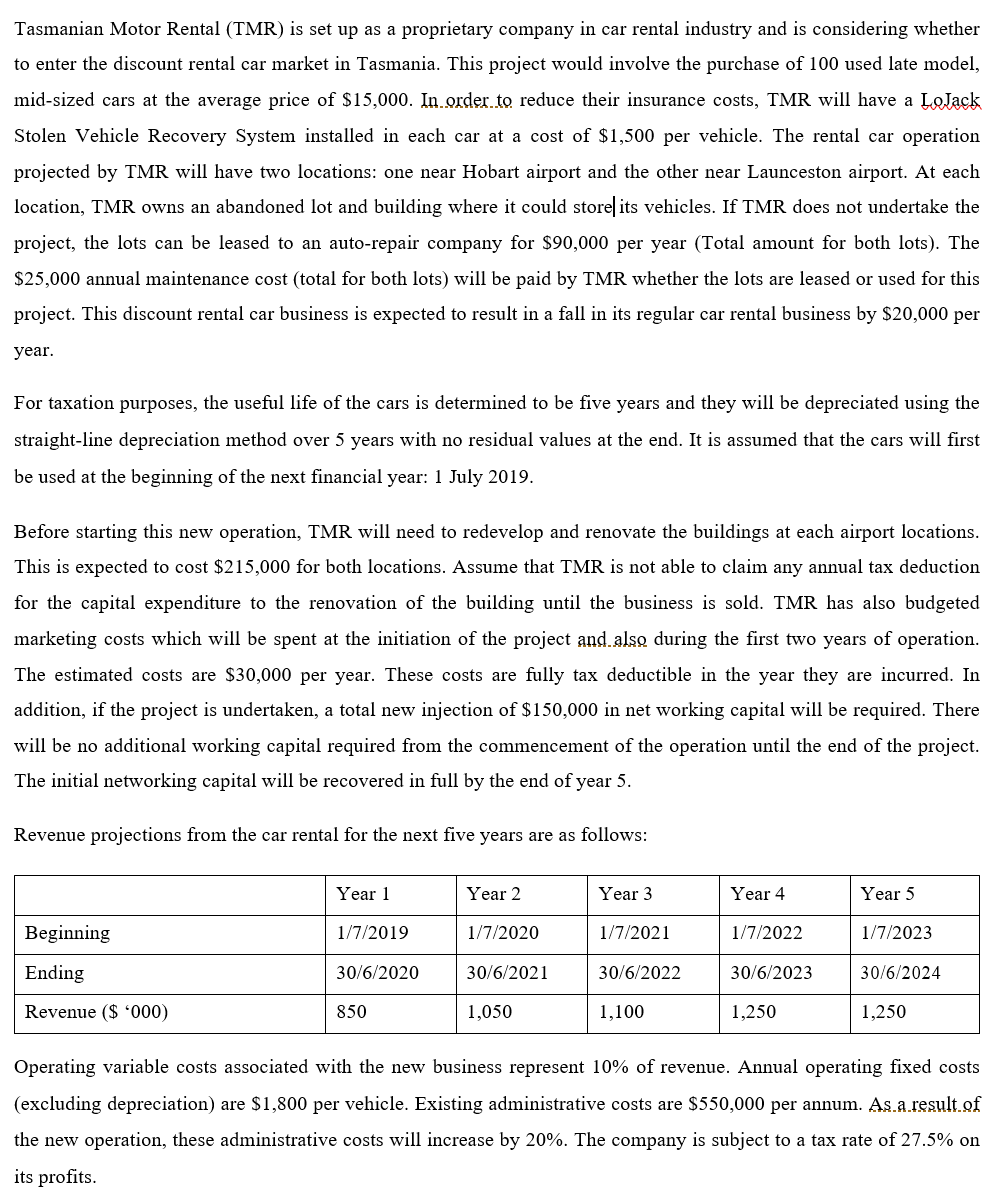

Tasmanian Motor Rental (TMR) is set up as a proprietary company in car rental industry and is considering whether to enter the discount rental car market in Tasmania. This project would involve the purchase of 100 used late model, mid-sized cars at the average price of $15,000. In.ordex.to. reduce their insurance costs, TMR will have a Stolen Vehicle Recovery System installed in each car at a cost of $1,500 per vehicle. The rental car operation projected by TMR will have two locations: one near Hobart airport and the other near Launceston airport. At each location, TMR owns an abandoned lot and building where it could storel its vehicles. If TMR does not undertake the project, the lots can be leased to an auto-repair company for S90,000 per year (Total amount for both lots). The $25 ,000 annual maintenance cost (total for both lots) will be paid by TMR whether the lots are leased or used for this project. This discount rental car business is expected to result in a fall in its regular car rental business by $20,000 per year. For taxation purposes, the useful life of the cars is determined to be five years and they will be depreciated using the straight-line depreciation method over 5 years with no residual values at the end. It is assumed that the cars will first be used at the beginning of the next financial year: I July 2019. Before starting this new operation, TMR will need to redevelop and renovate the buildings at each airport locations. This is expected to cost $215,000 for both locations. Assume that TMR is not able to claim any annual tax deduction for the capital expenditure to the renovation of the building until the business is sold. TMR has also budgeted marketing costs which will be spent at the initiation of the project and. also during the first two years of operation. The estimated costs are S30,000 per year. These costs are fully tax deductible in the year they are incurred. In addition, if the project is undertaken, a total new injection of $150,000 in net working capital will be required. There will be no additional working capital required from the commencement of the operation until the end of the project. The initial networking capital will be recovered in full by the end of year 5. Revenue projections from the car rental for the next five years are as follows: Beginning Ending Revenue ($ '000) Year 1 1/7/2019 30/6/2020 850 Year 2 1/7/2020 30/6/2021 1,050 Year 3 1/7/2021 30/6/2022 1,100 Year 4 1/7/2022 30/6/2023 1 ,250 Year 5 1/7/2023 30/6/2024 1,250 Operating variable costs associated with the new business represent 10% of revenue. Annual operating fixed costs (excluding depreciation) are Sl ,800 per vehicle. Existing administrative costs are S550,000 per annum. As.a.result.Qf the new operation, these administrative costs will increase by 20%. The company is subject to a tax rate of 27.5% on its profits.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started