Answered step by step

Verified Expert Solution

Question

1 Approved Answer

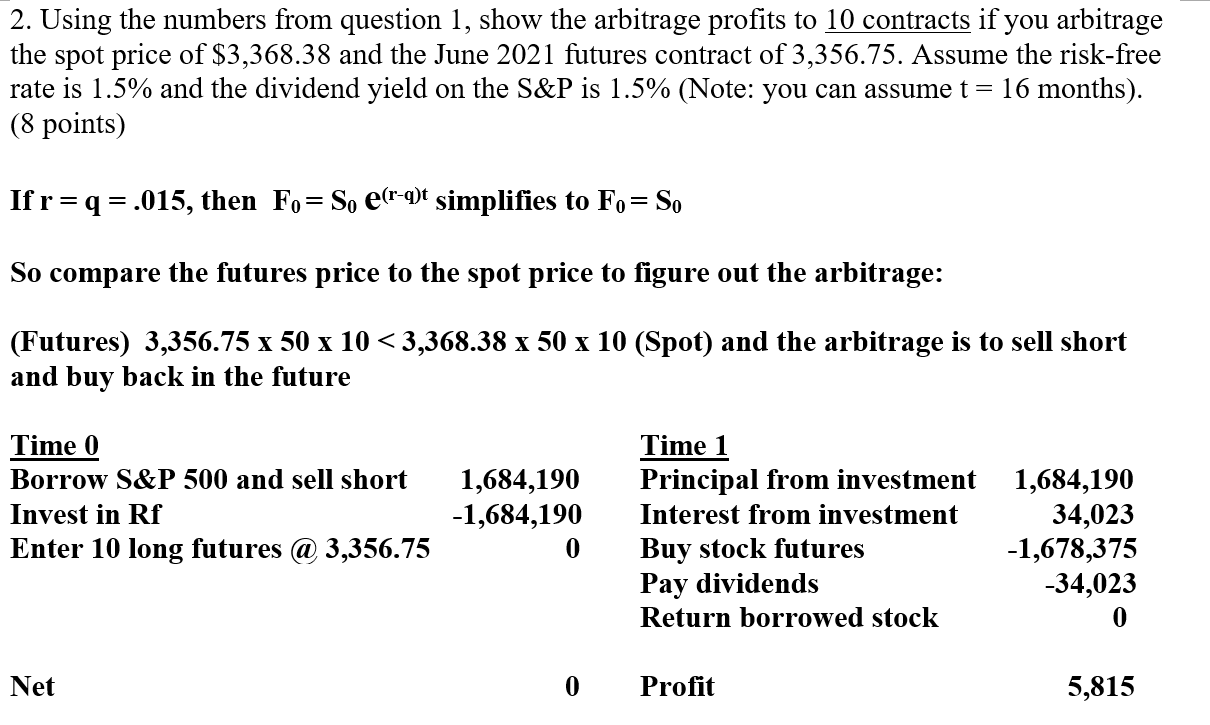

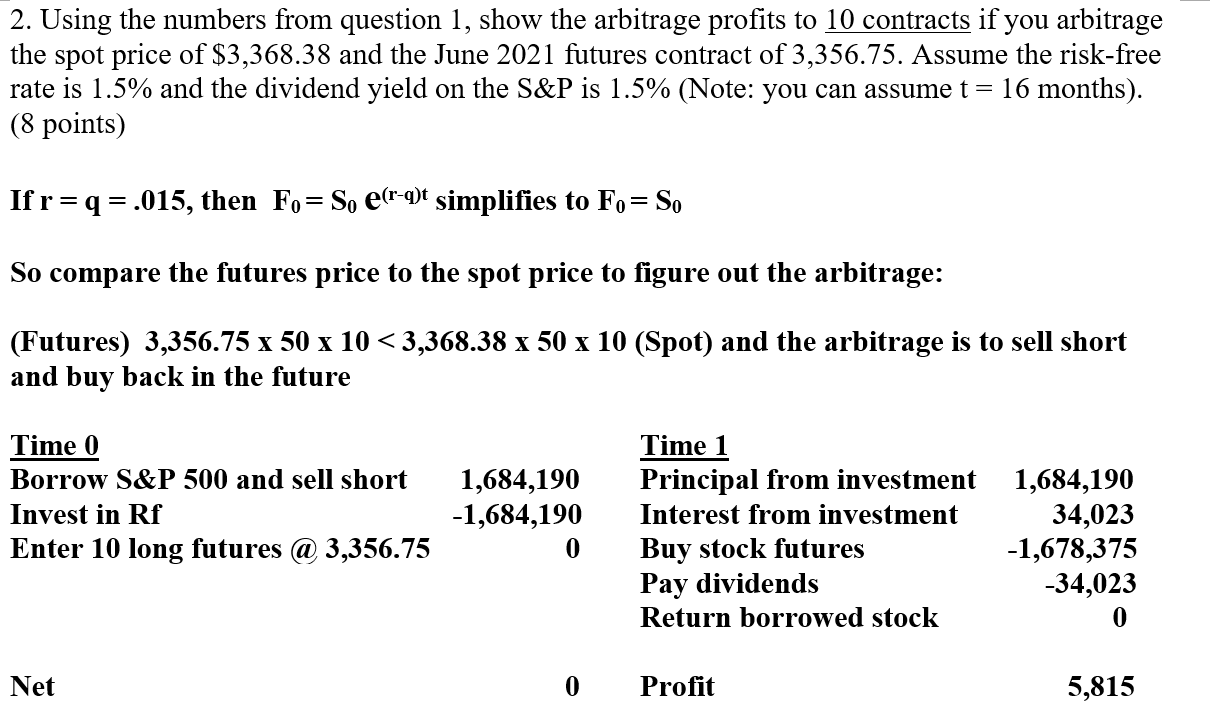

2. Using the numbers from question l, show the arbitrage profits to 10 contracts if you arbitrage the spot price of $3,368.38 and the

2. Using the numbers from question l, show the arbitrage profits to 10 contracts if you arbitrage the spot price of $3,368.38 and the June 2021 futures contract of 3,356.75. Assume the risk-free rate is 1.5% and the dividend yield on the S&P is 1.5% (Note: you can assume t = 16 months). (8 points) Ifr = q = .015, then So simplifies to Fo = So So compare the futures price to the spot price to figure out the arbitrage: (Futures) 3,356.75 x 50 x 10 < 3,368.38 x 50 x 10 (Spot) and the arbitrage is to sell short and buy back in the future Time 0 Borrow S&P 500 and sell short Invest in Rf Enter 10 long futures @ 3,356.75 Net 0 0 Time 1 Principal from investment Interest from investment Buy stock futures Pay dividends Return borrowed stock Profit 34,023 -1,678,375 -34,023 5,815

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started