Answered step by step

Verified Expert Solution

Question

1 Approved Answer

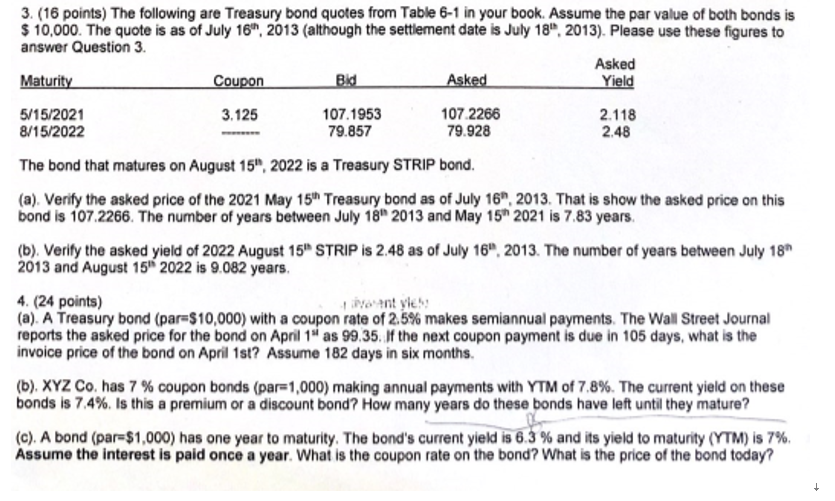

3. (16 points) The following ate Treasury bond quotes from Tab* 6-1 in your book. Assume the par value ot both bonds is $

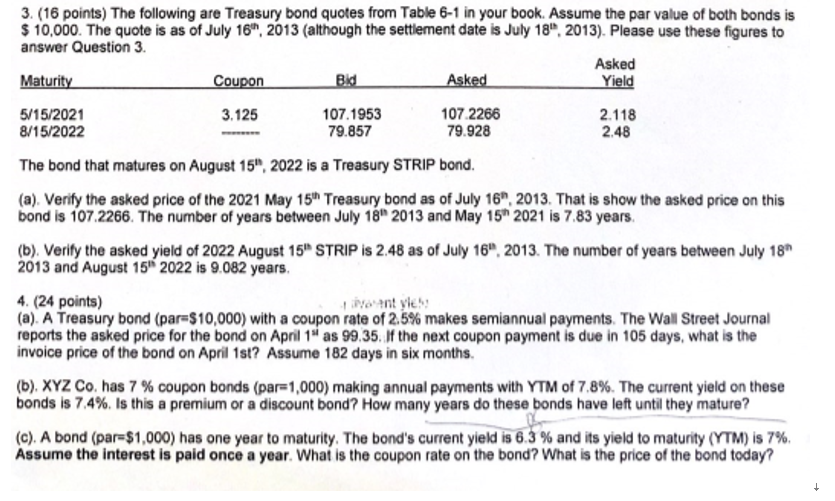

3. (16 points) The following ate Treasury bond quotes from Tab* 6-1 in your book. Assume the par value ot both bonds is $ 10,000. The quote is as Of July 16m. 2013 (athough tte date July 18".2013). Please uw ttwse fqures to answer Question 3. 5/15/2021 8/152022 3,125 107.1953 79.857 107 2266 79.928 Asked 2.118 2.48 The bond that matures on August 15".2022 is a Treuury STRIP Verity the asked price of the 2021 Wy 15th Treasury bond as Of July 16".2013. That is show asked prke On this bond i' 107.2266. The number of years between July 18" 2013 and May 15t 2021 iS 7.83 years (b). Verity the asked Of 2022 August 15" STRIP is 2.48 as Of July 160.2011 The Of years between July 18*' 2013 and August 15B 2022 is years 4. (24 points) (a). A Treasury bond (par-SIO.OOO) with a coupon rate of 2.5% makes semiannual payments The Wal Street Journal reports the asked price for the bond on Apnl 1" as 99.35. 'f the next coupon payment is in 105 days, what invoice prX;e Of the bond on Apr" 1st? Assune 182 days in six moot'S. XYZ co. has 7 % coupon (par1000) annual paynmts with YTM Of 7.8%. The current yield on these bonds is 7.4%. IS thb a premium or a discount bond? How many years do these bonds have len until they mature? A bond (parSl .000) has one year to maturity. The bond'S current yieu is 6. % and to maturity (YTM)iS Assume the interest is paid once a year, What is the coupon rate on the bond? '"hat the pnce of the bond today?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started