Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 (This question is mostly based on study unit 16) [10 Marks] Logging Ltd has paid a dividend every year over the past

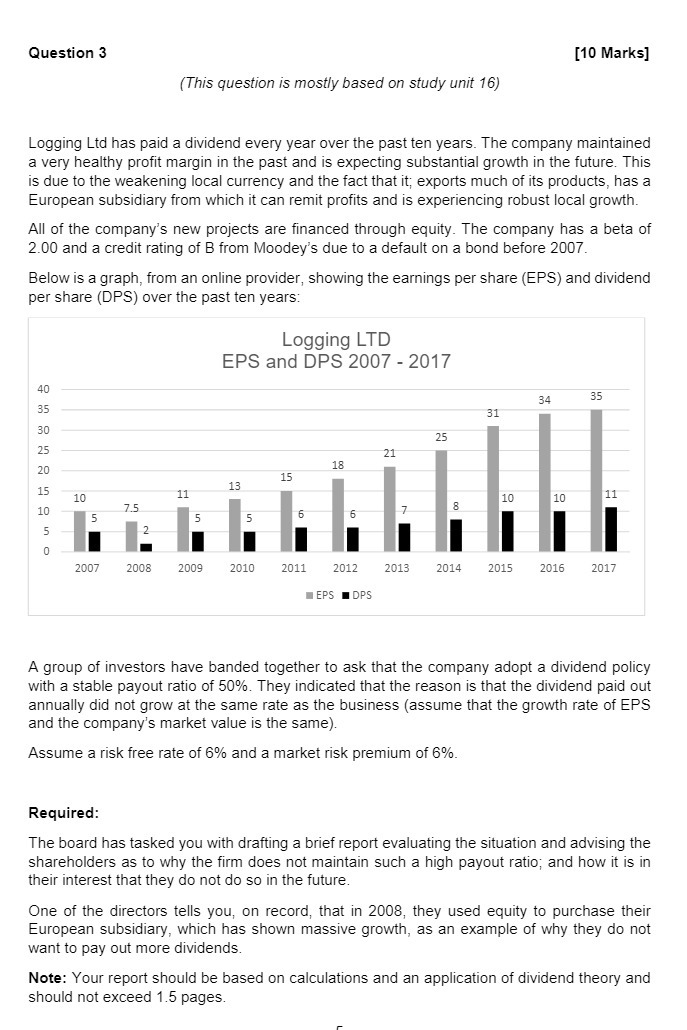

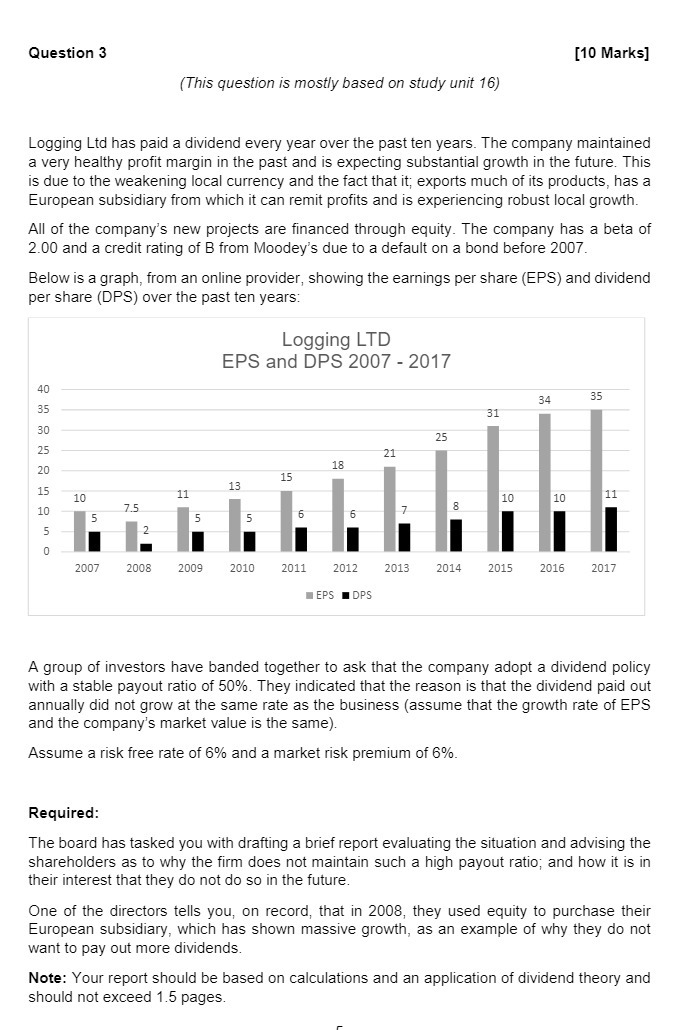

Question 3 (This question is mostly based on study unit 16) [10 Marks] Logging Ltd has paid a dividend every year over the past ten years. The company maintained a very healthy profit margin in the past and is expecting substantial grovhh in the future. This is due to the weakening local currency and the fact that itv exports much of its products, has a European subsidiary from which it can remit profits and is experiencing robust local grovhh. All of the company's new projects are financed through equity. The company has a beta of 2.00 and a credit rating of B from Moodey's due to a default on a bond before 2007 Below is a graph, from an online provider, showing the earnings per share (EPS) and dividend per share (DPS) over the past ten years Logging LTD EPS and DPS 2007 - 2017 2008 2009 2010 2011 2012 2013 . EPS .DPS 2014 2015 2016 2017 A group of investors have banded together to ask that the company adopt a dividend policy with a stable payout ratio of 50%. They indicated that the reason IS that the dividend paid out annually did not grow at the same rate as the business (assume that the growth rate of EPS and the company's market value is the same). Assume a risk free rate of 6% and a market risk premium of 6%. Required: The board has tasked you with drafting a brief report evaluating the situation and advising the shareholders as to why the firm does not maintain such a high payout ratio, and how It is in their interest that they do not do so in the future. One of the directors tells you, on record, that in 2008, they used equity to purchase their European subsidiary, which has shown massive growth, as an example of why they do not want to pay out more dividends. Note: Your report should be based on calculations and an application of dividend theory and should not exceed 1.5 pages.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started