f

f

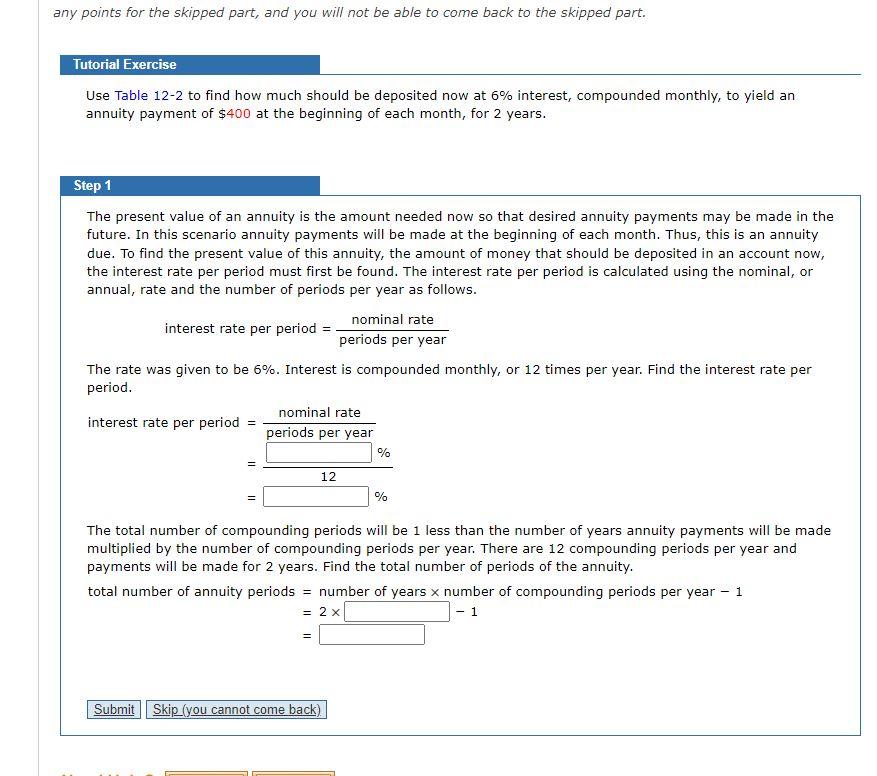

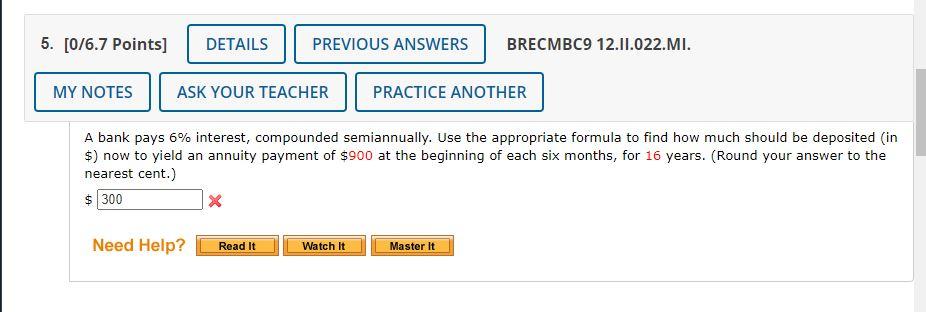

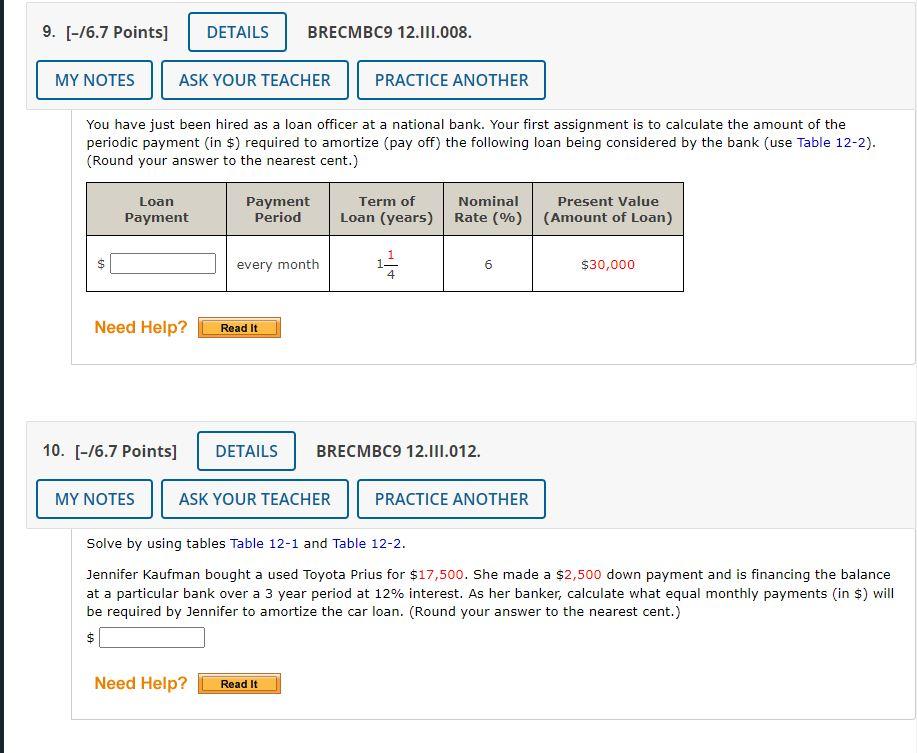

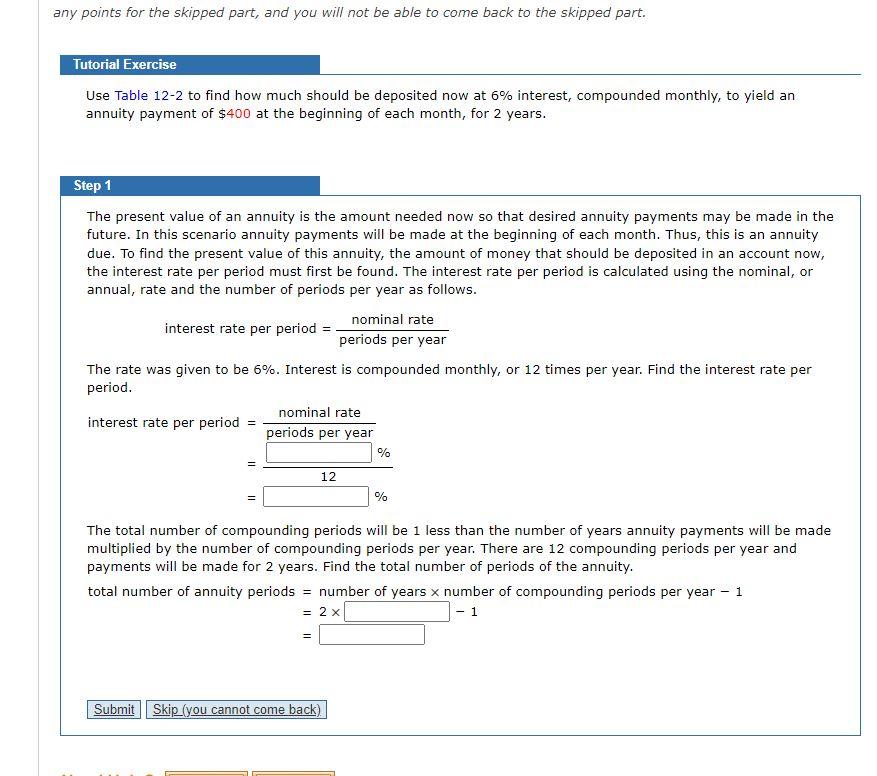

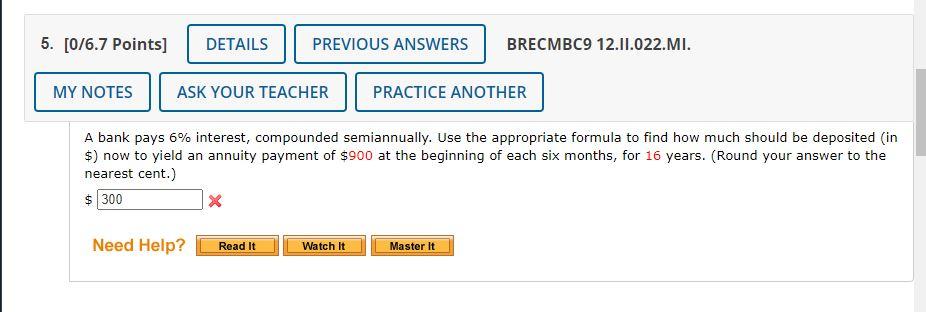

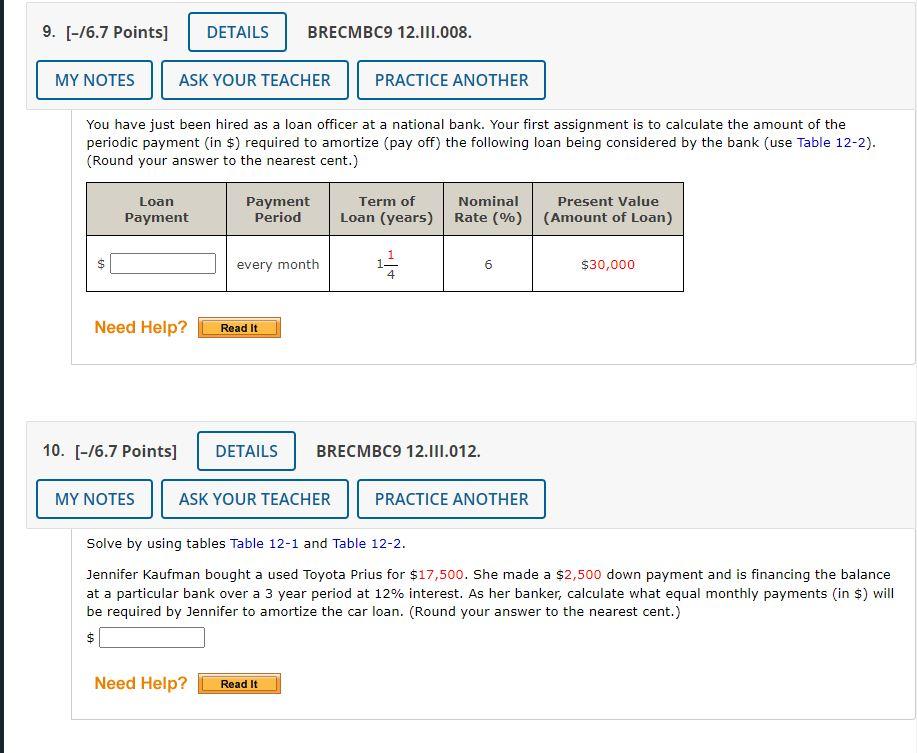

A bank pays 6% interest, compounded semiannually. Use the appropriate formula to find how much should be deposited (in $ ) now to yield an annuity payment of $900 at the beginning of each six months, for 16 years. (Round your answer to the nearest cent.) You have just been hired as a loan officer at a national bank. Your first assignment is to calculate the amount of the periodic payment (in \$) required to amortize (pay off) the following loan being considered by the bank (use Table 122 ). (Round your answer to the nearest cent.) [-/6.7 Points ] BRECMBC9 12.III.012. Solve by using tables Table 12-1 and Table 12-2. Jennifer Kaufman bought a used Toyota Prius for $17,500. She made a $2,500 down payment and is financing the balance at a particular bank over a 3 year period at 12% interest. As her banker, calculate what equal monthly payments (in $) will be required by Jennifer to amortize the car loan. (Round your answer to the nearest cent.) $ any points for the skipped part, and you will not be able to come back to the skipped part. Tutorial Exercise Use Table 12-2 to find how much should be deposited now at 6% interest, compounded monthly, to yield an annuity payment of $400 at the beginning of each month, for 2 years. Step 1 The present value of an annuity is the amount needed now so that desired annuity payments may be made in the future. In this scenario annuity payments will be made at the beginning of each month. Thus, this is an annuity due. To find the present value of this annuity, the amount of money that should be deposited in an account now, the interest rate per period must first be found. The interest rate per period is calculated using the nominal, or annual, rate and the number of periods per year as follows. interest rate per period =periodsperyearnominalrate The rate was given to be 6%. Interest is compounded monthly, or 12 times per year. Find the interest rate per period. interest rate per period =periodsperyearnominalrate The total number of compounding periods will be 1 less than the number of years annuity payments will be made multiplied by the number of compounding periods per year. There are 12 compounding periods per year and payments will be made for 2 years. Find the total number of periods of the annuity. total number of annuity periods = number of years number of compounding periods per year 1 =21

f

f