Answered step by step

Verified Expert Solution

Question

1 Approved Answer

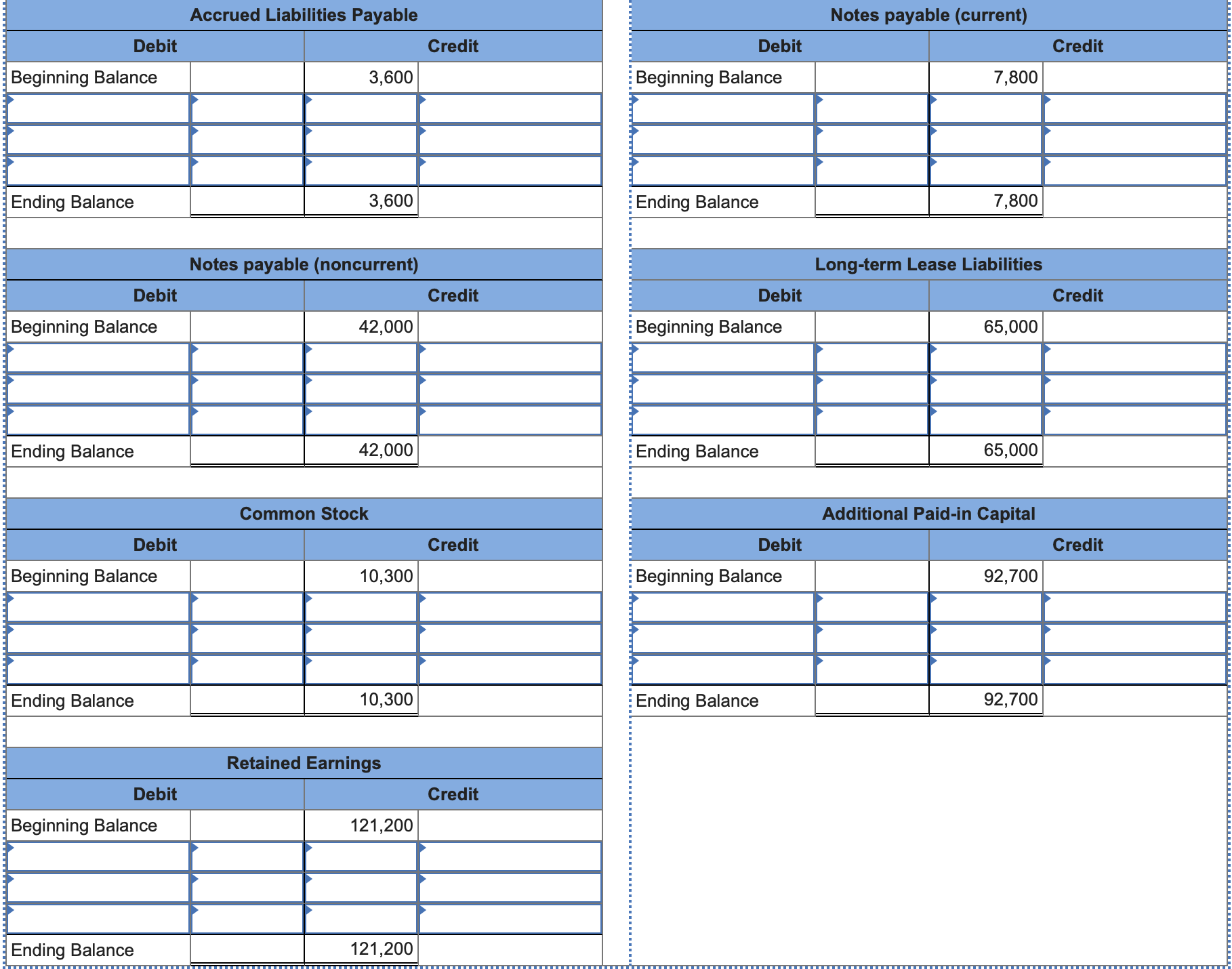

f Accrued Liabilities Payable Notes payable (current) begin{tabular}{|l|l|l|} hline multicolumn{2}{|c|}{ Debit } & multicolumn{2}{c}{ Credit } hline Beginning Balance & & 7,800 hline

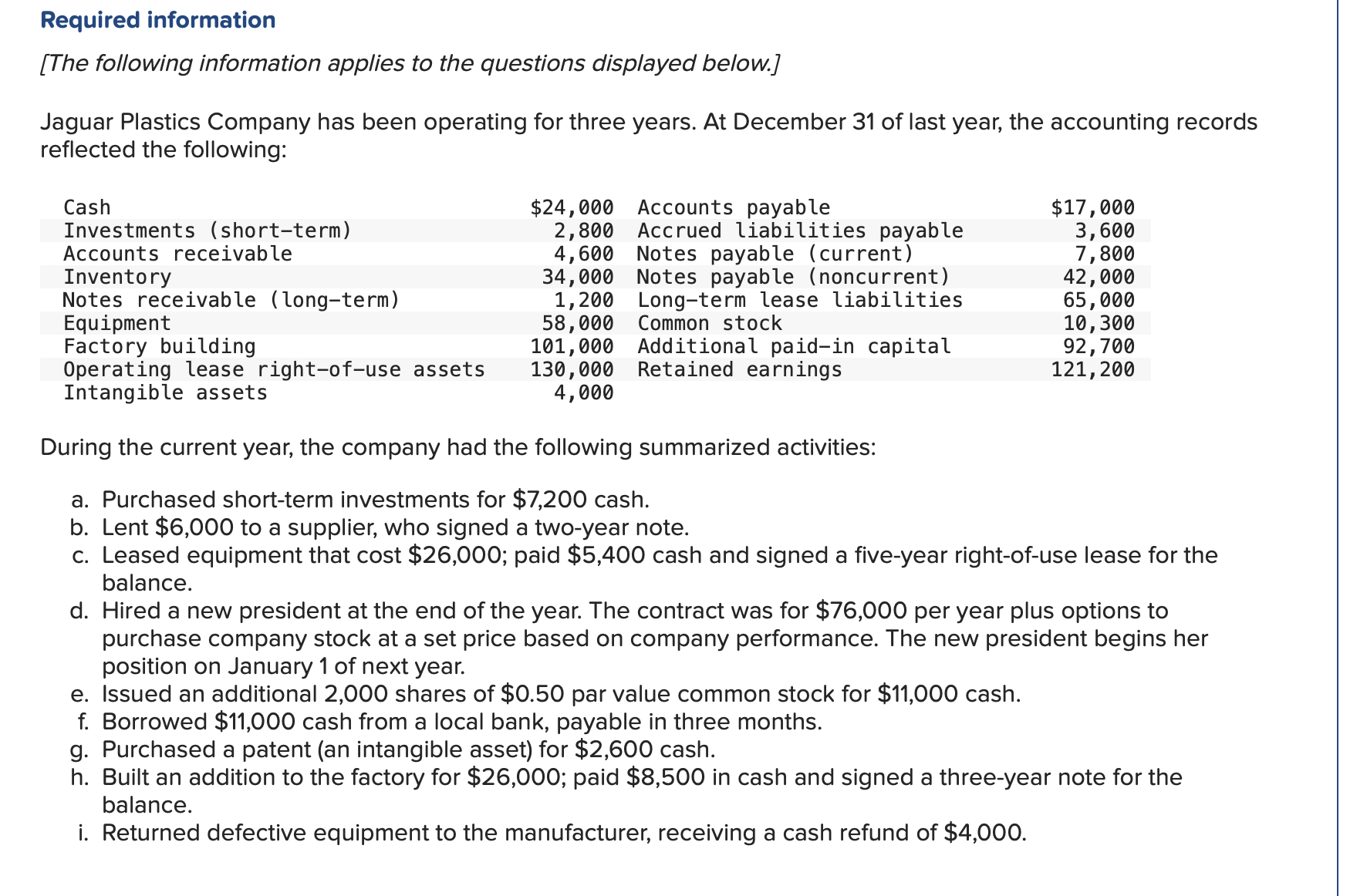

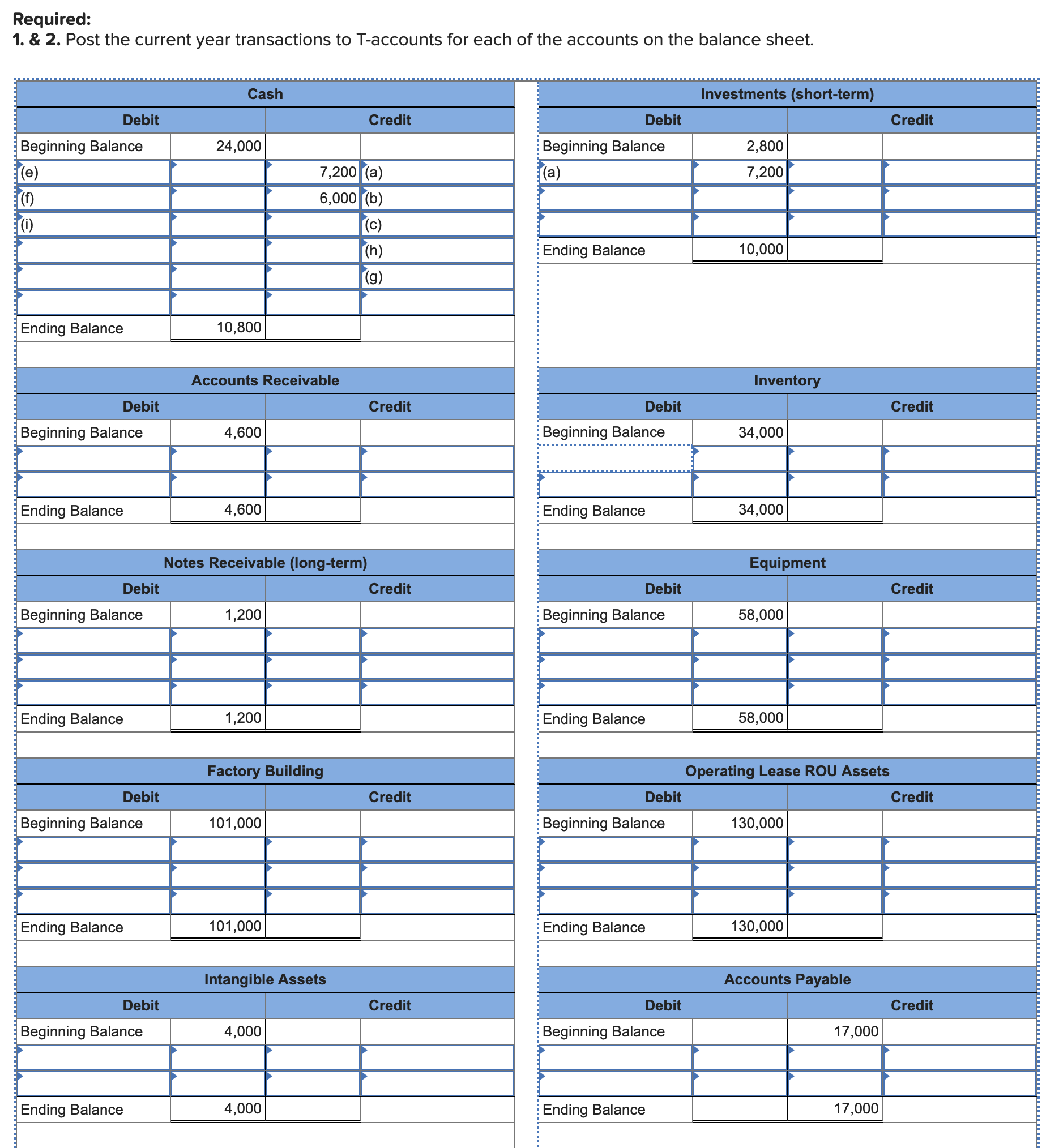

f Accrued Liabilities Payable Notes payable (current) \begin{tabular}{|l|l|l|} \hline \multicolumn{2}{|c|}{ Debit } & \multicolumn{2}{c}{ Credit } \\ \hline Beginning Balance & & 7,800 \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Long-term Lease Liabilities Required information [The following information applies to the questions displayed below.] Jaguar Plastics Company has been operating for three years. At December 31 of last year, the accounting records reflected the following: During the current year, the company had the following summarized activities: a. Purchased short-term investments for $7,200 cash. b. Lent $6,000 to a supplier, who signed a two-year note. c. Leased equipment that cost $26,000; paid $5,400 cash and signed a five-year right-of-use lease for the balance. d. Hired a new president at the end of the year. The contract was for $76,000 per year plus options to purchase company stock at a set price based on company performance. The new president begins her position on January 1 of next year. e. Issued an additional 2,000 shares of $0.50 par value common stock for $11,000 cash. f. Borrowed $11,000 cash from a local bank, payable in three months. g. Purchased a patent (an intangible asset) for $2,600 cash. h. Built an addition to the factory for $26,000; paid $8,500 in cash and signed a three-year note for the balance. i. Returned defective equipment to the manufacturer, receiving a cash refund of $4,000

f Accrued Liabilities Payable Notes payable (current) \begin{tabular}{|l|l|l|} \hline \multicolumn{2}{|c|}{ Debit } & \multicolumn{2}{c}{ Credit } \\ \hline Beginning Balance & & 7,800 \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Long-term Lease Liabilities Required information [The following information applies to the questions displayed below.] Jaguar Plastics Company has been operating for three years. At December 31 of last year, the accounting records reflected the following: During the current year, the company had the following summarized activities: a. Purchased short-term investments for $7,200 cash. b. Lent $6,000 to a supplier, who signed a two-year note. c. Leased equipment that cost $26,000; paid $5,400 cash and signed a five-year right-of-use lease for the balance. d. Hired a new president at the end of the year. The contract was for $76,000 per year plus options to purchase company stock at a set price based on company performance. The new president begins her position on January 1 of next year. e. Issued an additional 2,000 shares of $0.50 par value common stock for $11,000 cash. f. Borrowed $11,000 cash from a local bank, payable in three months. g. Purchased a patent (an intangible asset) for $2,600 cash. h. Built an addition to the factory for $26,000; paid $8,500 in cash and signed a three-year note for the balance. i. Returned defective equipment to the manufacturer, receiving a cash refund of $4,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started