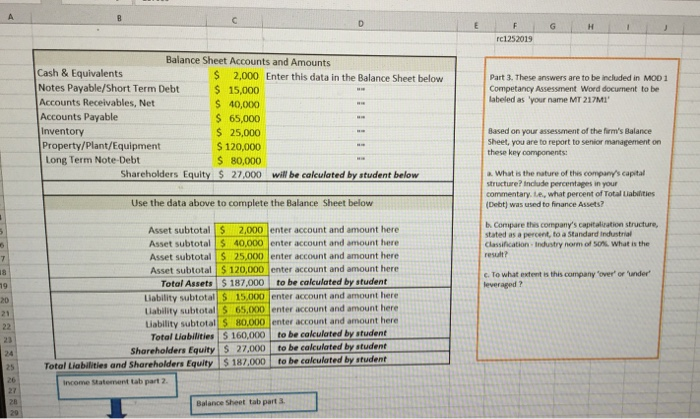

F c1252019 G H I Part 3. These answers are to be included in MOD 1 Competancy Assessment Word document to be labeled as your name MT 217M' Balance Sheet Accounts and Amounts Cash & Equivalents $ 2,000 Enter this data in the Balance Sheet below Notes Payable/Short Term Debt $ 15,000 Accounts Receivables, Net $ 40,000 Accounts Payable $ 65,000 Inventory $ 25,000 Property/Plant/Equipment $ 120,000 Long Term Note Debt $ 80,000 Shareholders Equity $ 27,000 will be caleulated by student below Based on your assessment of the firm's Balance Sheet, you are to report to senior management on these key components: What is the nature of this company's capital structure include percentages in your commentary.te, what percent of Total Liabilities (Debt) was used to finance Assets? Use the data above to complete the Balance Sheet below b. Compare this company's capitalisation structure, stated as a percent to a standard Industrial Classification Industry norm of what is the result? c. To what extent is this company 'over' or 'under leveraged? Asset subtotal $ 2.000 enter account and amount here Asset subtotal $ 40,000 enter account and amount here Asset subtotal $ 25.000 enter account and amount here Asset subtotal $ 120,000 enter account and amount here Total Assets $ 187,000 to be calculated by student Liability subtotal $15.000 enter account and amount here Liability subtotal $ 65,000 enter account and amount here Liability subtotal S 80.000 enter account and amount here Total Liabilities S 160,000 to be calculated by student Shareholders Equity S 27,000 to be calculated by student Total Liabilities and Shareholders Equity $ 187,000 to be calculated by student Income Statement tab part 2 RE Balance Sheet tab part 3 low Part 3. These answers are to be included in MOD 1 Competancy Assessment Word document to be labeled as your name MT 217M1' Based on your assessment of the firm's Balance Sheet, you are to report to senior management on these key components: a. What is the nature of this company's capital structure? Include percentages in your commentary. I.e., what percent of Total Liabilities (Debt) was used to finance Assets? b. Compare this company's capitalization structure, stated as a percent, to a Standard Industrial Classification - Industry norm of 50%. What is the result? C. To what extent is this company 'over' or 'under' leveraged