Question

F. Describe the early rounds of financing that occurred from Eco-Products inception in 1990 through 2006. Beginning in 2007, the need for external financing began

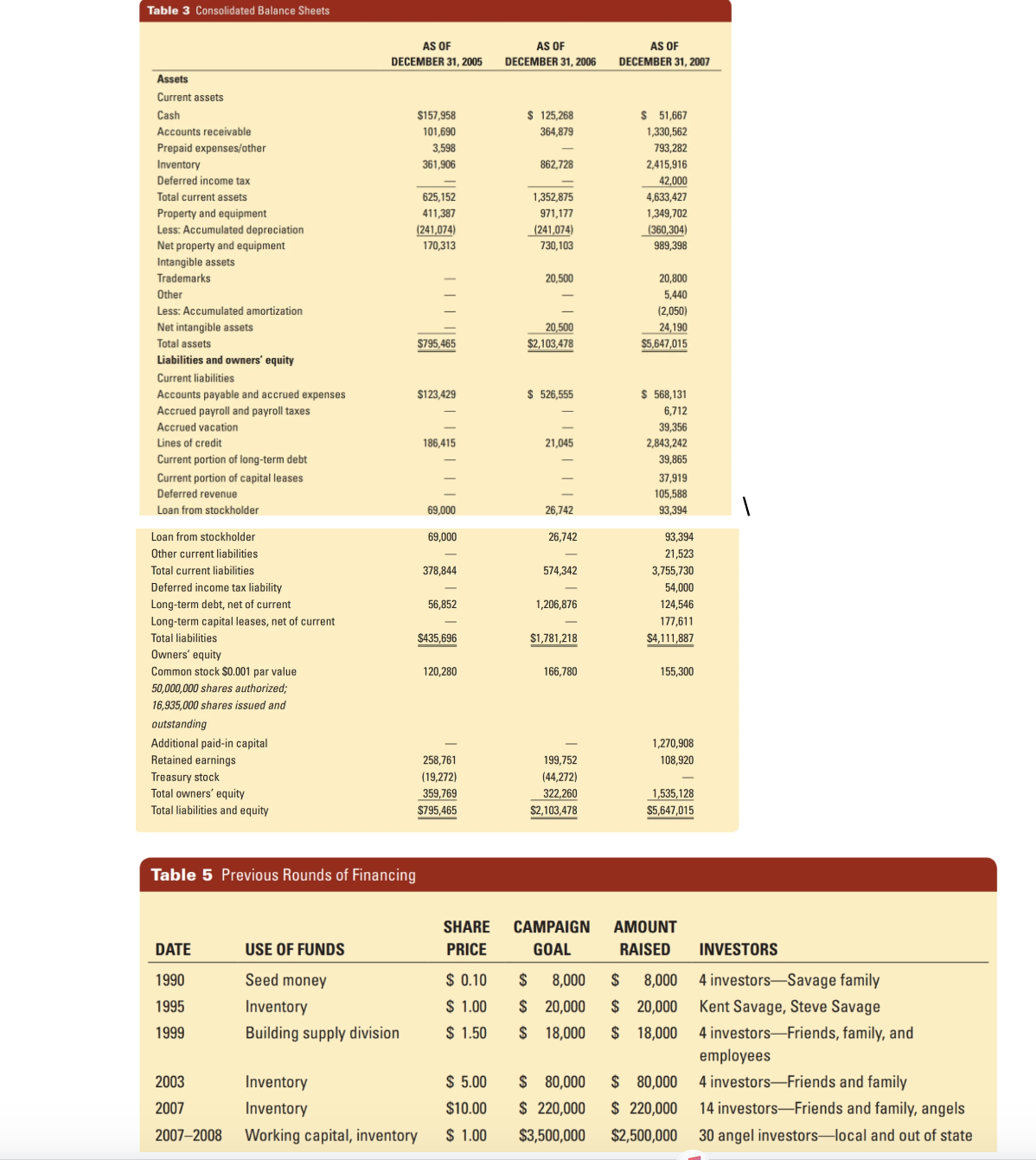

F. Describe the early rounds of financing that occurred from Eco-Products inception in 1990 through 2006. Beginning in 2007, the need for external financing began to increase. Describe the sources, amounts, and types of financing obtained during 2007 and the early part of 2008.

G. In mid-2007, Eco-Products management prepared a five-year (20072011) projec-tion of revenues and expenses (see Table 1). What annual rates of growth were projected for net sales? Make a back-of-the-envelope estimate of the amounts of additional assets needed to support the sales forecasts. How might these assets be financed? Prepare a rough estimate of the possible size of external financing needed to support these sales projections.

Table 3 Consolidated Balance Sheets AS OF AS OF AS OF DECEMBER 31, 2005 DECEMBER 31, 2006 DECEMBER 31, 2007 Assets Current assets Cash Accounts receivable Prepaid expenses/other Inventory Deferred income tax Total current assets Property and equipment Less: Accumulated depreciation Net property and equipment Intangible assets Trademarks Other Less: Accumulated amortization Net intangible assets Total assets Liabilities and owners' equity Current liabilities Accounts payable and accrued expenses Accrued payroll and payroll taxes Accrued vacation Lines of credit Current portion of long-term debt. Current portion of capital leases Deferred revenue Loan from stockholder Loan from stockholder Other current liabilities Total current liabilities Deferred income tax liability Long-term debt, net of current Long-term capital leases, net of current Total liabilities Owners' equity Common stock $0.001 par value 50,000,000 shares authorized; 16,935,000 shares issued and outstanding Additional paid-in capital Retained earnings Treasury stock Total owners' equity Total liabilities and equity $157,958 101,690 3,598 361,906 - 625,152 411,387 (241,074) 170,313 \begin{tabular}{r} - \\ - \\ - \\ - \\ \hline$795,465 \\ \hline \end{tabular} $123,429 - 186,415 - - 69,000 69,000 378,844 56,852 $435,696 120,280 \begin{tabular}{r} - \\ 258,761 \\ (19,272) \\ 359,769 \\ \hline$795,465 \\ \hline \end{tabular} \$ 125,268 364,879 862,728 1,352,875 971,177 (241,074) 730,103 \begin{tabular}{r} 20,500 \\ - \\ - \\ 20,500 \\ \hline$2,103,478 \\ \hline \end{tabular} \$ 526,555 S 568,131 6,712 39,356 2,843,242 39,865 37,919 105,588 93,394 1 Table 5 Previous Rounds of Financing \begin{tabular}{r} 93,394 \\ 21,523 \\ 3,755,730 \\ 54,000 \\ 124,546 \\ 177,611 \\ $4,111,887 \\ \hline \hline \end{tabular} 166,780 155,300 0,800 (2,050) 24,190 647,015 $5,647,0 S 51,667 1,330,562 793,282 2,415,916 42,0004,633,427 1,349,702 (360,304) (360,304) 989,398 0 20,8005,440(2,050)24,190$5,647,015 - 21,045 6,712 39,356 2,843,242 39,865 37,919 105,588 93,394 26,742 26,742 93,394 574,342 1,206,876 - $1,781,218 177,611$4,111,887 . Table 5 Previous Rounds of Financing \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{l} DATE \\ 1990 \end{tabular}} & \multirow{2}{*}{\begin{tabular}{l} USE OF FUNDS \\ Seed money \end{tabular}} & \multirow{2}{*}{\begin{tabular}{c} SHARE \\ PRICE \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{l} CAMPAIGN \\ GOAL \end{tabular}} & \begin{tabular}{l} AMOUNT \\ RAISED \end{tabular} & \multirow{2}{*}{\begin{tabular}{l} INVESTORS \\ 4 investors-Savage family \end{tabular}} \\ \hline & & & $ & 8,000 & 8,000 & \\ \hline 1995 & Inventory & $1.00 & $ & 20,000 & $20,000 & Kent Savage, Steve Savage \\ \hline 1999 & Building supply division & $1.50 & $ & 18,000 & $18,000 & \begin{tabular}{l} 4 investors - Friends, family, and \\ employees \end{tabular} \\ \hline 2003 & Inventory & $5.00 & $ & 80,000 & $80,000 & 4 investors - Friends and family \\ \hline 2007 & Inventory & $10.00 & $ & 220,000 & $220,000 & 14 investors - Friends and family, angels \\ \hline 2007-2008 & Working capital, inventory & $1.00 & & ,500,000 & $2,500,000 & 30 angel investors - local and out of state \\ \hline \end{tabular}

Table 3 Consolidated Balance Sheets AS OF AS OF AS OF DECEMBER 31, 2005 DECEMBER 31, 2006 DECEMBER 31, 2007 Assets Current assets Cash Accounts receivable Prepaid expenses/other Inventory Deferred income tax Total current assets Property and equipment Less: Accumulated depreciation Net property and equipment Intangible assets Trademarks Other Less: Accumulated amortization Net intangible assets Total assets Liabilities and owners' equity Current liabilities Accounts payable and accrued expenses Accrued payroll and payroll taxes Accrued vacation Lines of credit Current portion of long-term debt. Current portion of capital leases Deferred revenue Loan from stockholder Loan from stockholder Other current liabilities Total current liabilities Deferred income tax liability Long-term debt, net of current Long-term capital leases, net of current Total liabilities Owners' equity Common stock $0.001 par value 50,000,000 shares authorized; 16,935,000 shares issued and outstanding Additional paid-in capital Retained earnings Treasury stock Total owners' equity Total liabilities and equity $157,958 101,690 3,598 361,906 - 625,152 411,387 (241,074) 170,313 \begin{tabular}{r} - \\ - \\ - \\ - \\ \hline$795,465 \\ \hline \end{tabular} $123,429 - 186,415 - - 69,000 69,000 378,844 56,852 $435,696 120,280 \begin{tabular}{r} - \\ 258,761 \\ (19,272) \\ 359,769 \\ \hline$795,465 \\ \hline \end{tabular} \$ 125,268 364,879 862,728 1,352,875 971,177 (241,074) 730,103 \begin{tabular}{r} 20,500 \\ - \\ - \\ 20,500 \\ \hline$2,103,478 \\ \hline \end{tabular} \$ 526,555 S 568,131 6,712 39,356 2,843,242 39,865 37,919 105,588 93,394 1 Table 5 Previous Rounds of Financing \begin{tabular}{r} 93,394 \\ 21,523 \\ 3,755,730 \\ 54,000 \\ 124,546 \\ 177,611 \\ $4,111,887 \\ \hline \hline \end{tabular} 166,780 155,300 0,800 (2,050) 24,190 647,015 $5,647,0 S 51,667 1,330,562 793,282 2,415,916 42,0004,633,427 1,349,702 (360,304) (360,304) 989,398 0 20,8005,440(2,050)24,190$5,647,015 - 21,045 6,712 39,356 2,843,242 39,865 37,919 105,588 93,394 26,742 26,742 93,394 574,342 1,206,876 - $1,781,218 177,611$4,111,887 . Table 5 Previous Rounds of Financing \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{l} DATE \\ 1990 \end{tabular}} & \multirow{2}{*}{\begin{tabular}{l} USE OF FUNDS \\ Seed money \end{tabular}} & \multirow{2}{*}{\begin{tabular}{c} SHARE \\ PRICE \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{l} CAMPAIGN \\ GOAL \end{tabular}} & \begin{tabular}{l} AMOUNT \\ RAISED \end{tabular} & \multirow{2}{*}{\begin{tabular}{l} INVESTORS \\ 4 investors-Savage family \end{tabular}} \\ \hline & & & $ & 8,000 & 8,000 & \\ \hline 1995 & Inventory & $1.00 & $ & 20,000 & $20,000 & Kent Savage, Steve Savage \\ \hline 1999 & Building supply division & $1.50 & $ & 18,000 & $18,000 & \begin{tabular}{l} 4 investors - Friends, family, and \\ employees \end{tabular} \\ \hline 2003 & Inventory & $5.00 & $ & 80,000 & $80,000 & 4 investors - Friends and family \\ \hline 2007 & Inventory & $10.00 & $ & 220,000 & $220,000 & 14 investors - Friends and family, angels \\ \hline 2007-2008 & Working capital, inventory & $1.00 & & ,500,000 & $2,500,000 & 30 angel investors - local and out of state \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started