Answered step by step

Verified Expert Solution

Question

1 Approved Answer

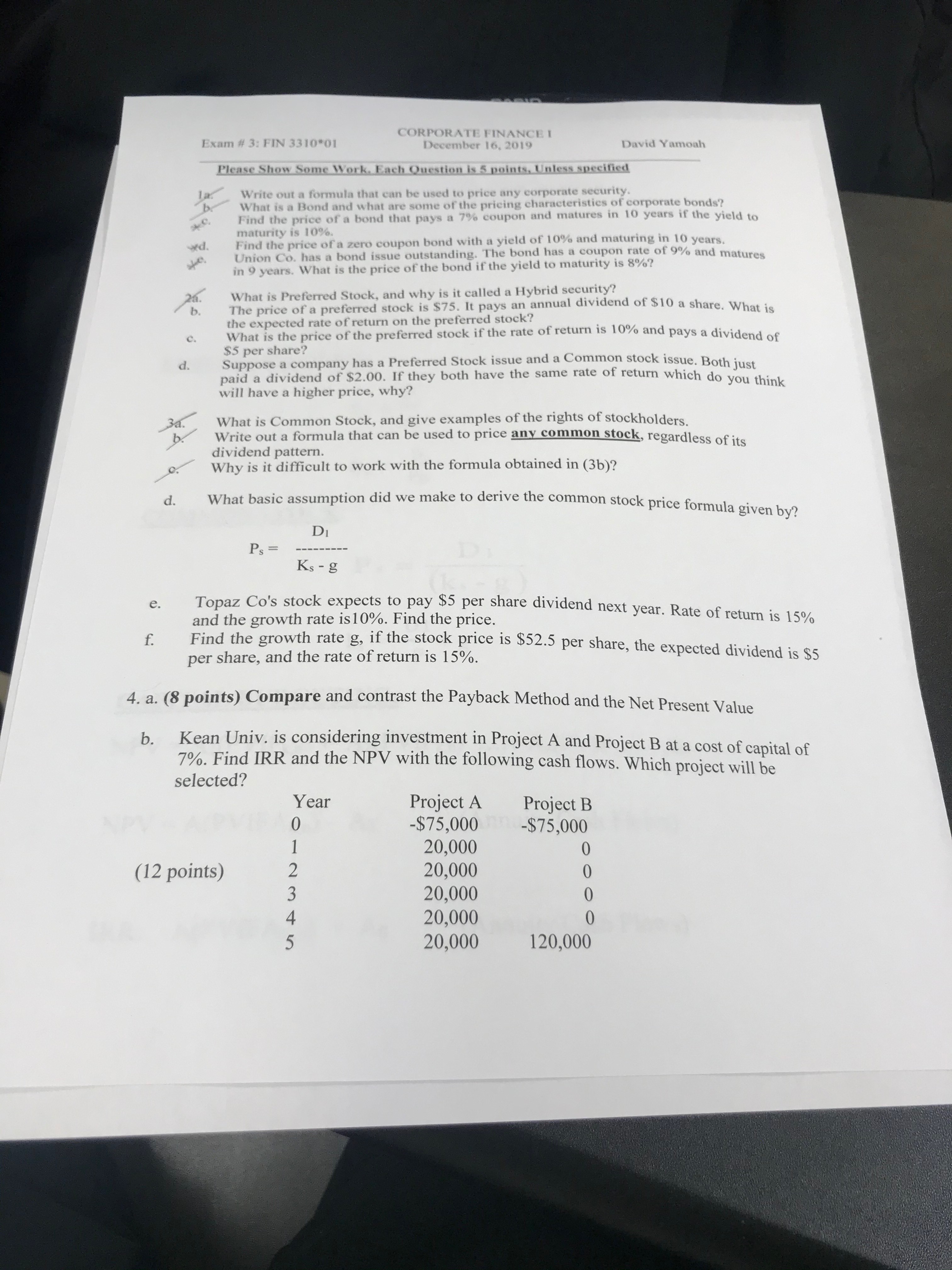

f. e. 3a d. d. b. Exam # 3: FIN 3310*01 la b *C d. *e C. b. CORPORATE FINANCE I December 16, 2019

f. e. 3a d. d. b. Exam # 3: FIN 3310*01 la b *C d. *e C. b. CORPORATE FINANCE I December 16, 2019 David Yamoah Please Show Some Work. Each Question is 5 points, Unless specified Write out a formula that can be used to price any corporate security. What is a Bond and what are some of the pricing characteristics of corporate bonds? Find the price of a bond that pays a 7% coupon and matures in 10 years if the yield to maturity is 10%. Find the price of a zero coupon bond with a yield of 10% and maturing in 10 years. Union Co. has a bond issue outstanding. The bond has a coupon rate of 9% and matures in 9 years. What is the price of the bond if the yield to maturity is 8%? What is Preferred Stock, and why is it called a Hybrid security? The price of a preferred stock is $75. It pays an annual dividend of $10 a share. What is the expected rate of return on the preferred stock? What is the price of the preferred stock if the rate of return is 10% and pays a dividend of $5 per share? paid a dividend of $2.00. If they both have the same rate of return which do you think Suppose a company has a Preferred Stock issue and a Common stock issue. Both just will have a higher price, why? What is Common Stock, and give examples of the rights of stockholders. Write out a formula that can be used to price any common stock, regardless of its dividend pattern. Why is it difficult to work with the formula obtained in (3b)? What basic assumption did we make to derive the common stock price formula given by? Ps= D Ks-g Topaz Co's stock expects to pay $5 per share dividend next year. Rate of return is 15% and the growth rate is 10%. Find the price. Find the growth rate g, if the stock price is $52.5 per share, the expected dividend is $5 per share, and the rate of return is 15%. 4. a. (8 points) Compare and contrast the Payback Method and the Net Present Value b. Kean Univ. is considering investment in Project A and Project B at a cost of capital of 7%. Find IRR and the NPV with the following cash flows. Which project will be selected? Year Project A Project B 0 -$75,000-$75,000 1 20,000 0 (12 points) 2 20,000 0 3 20,000 0 4 20,000 5 20,000 120,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started