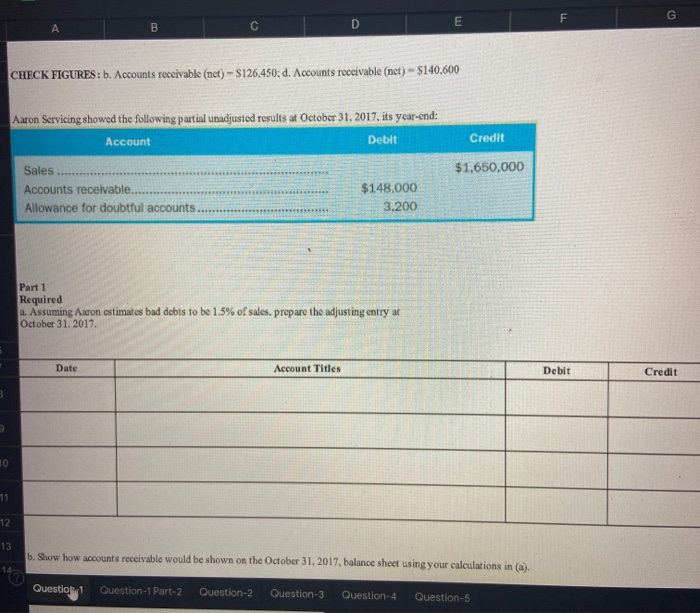

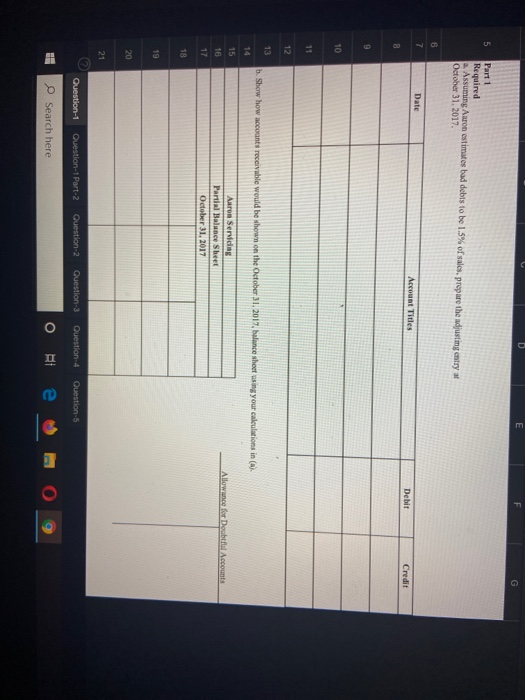

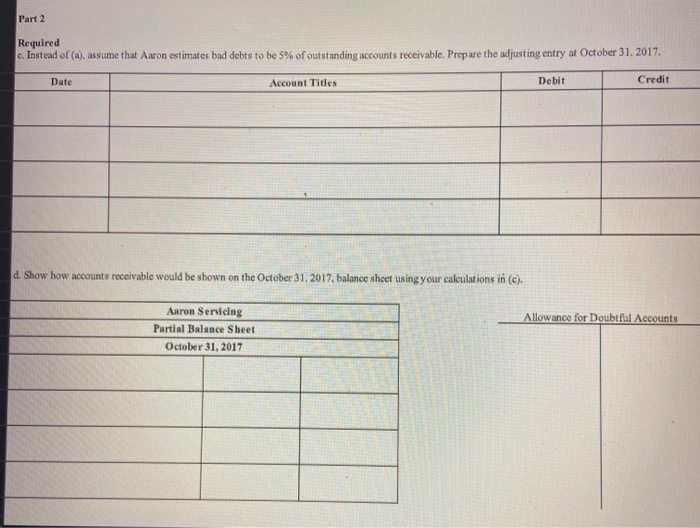

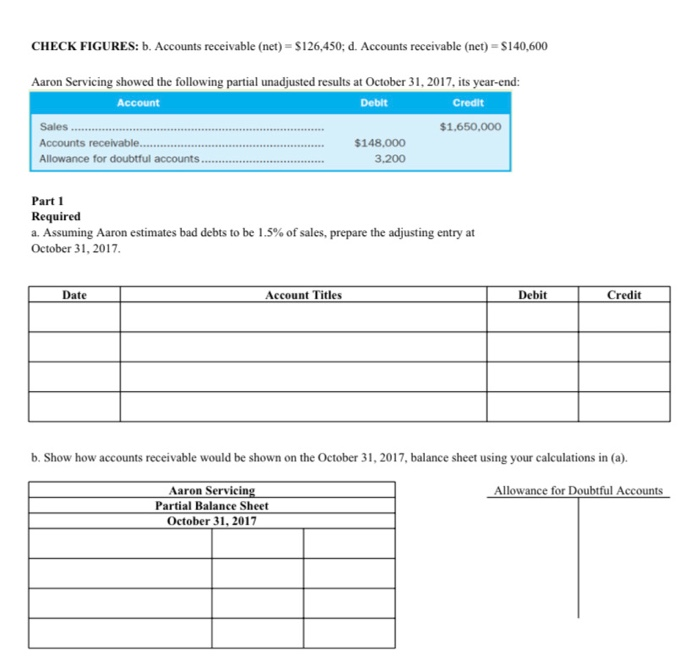

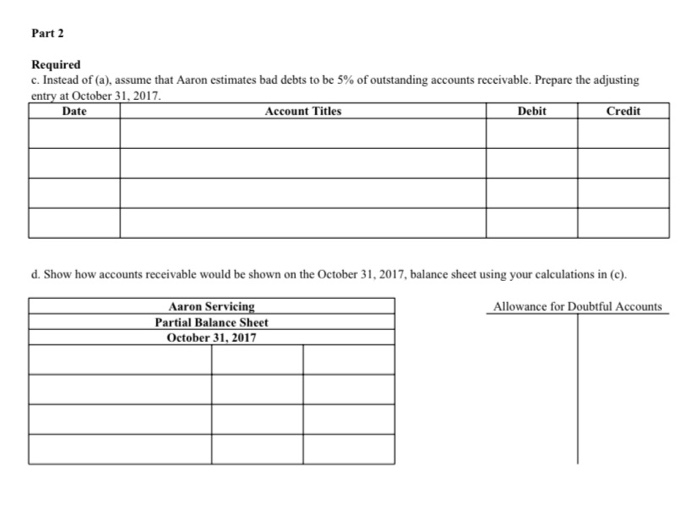

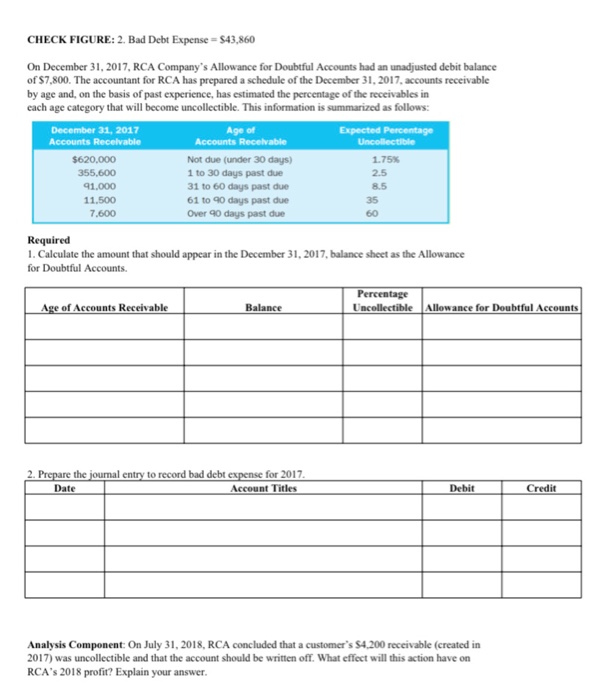

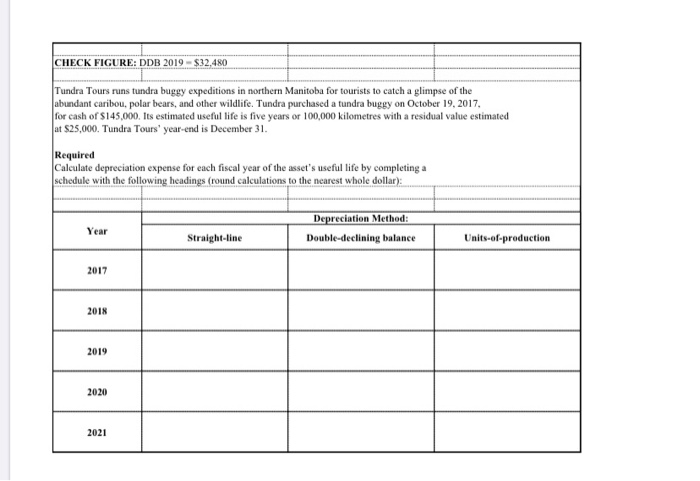

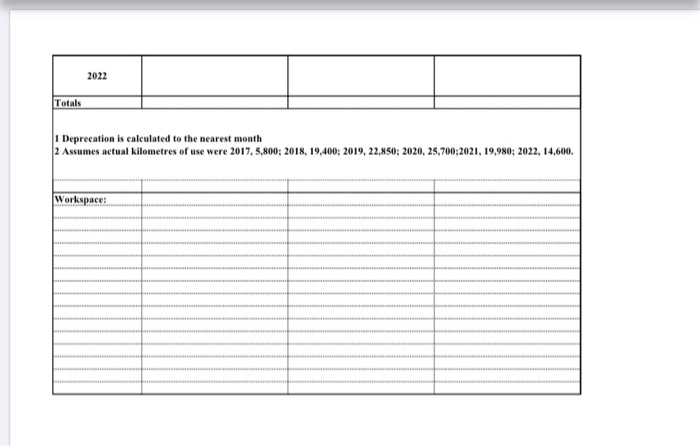

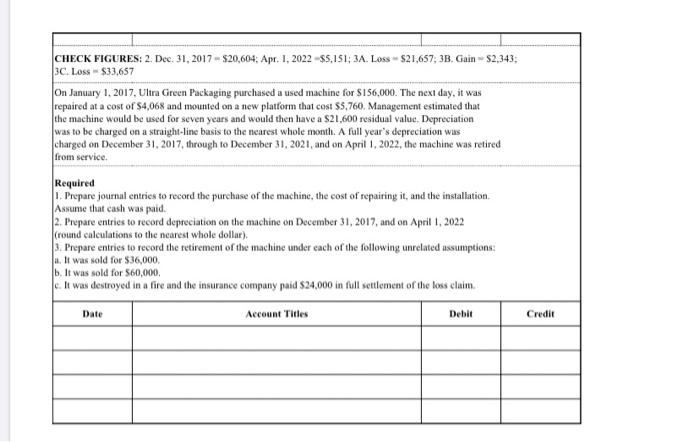

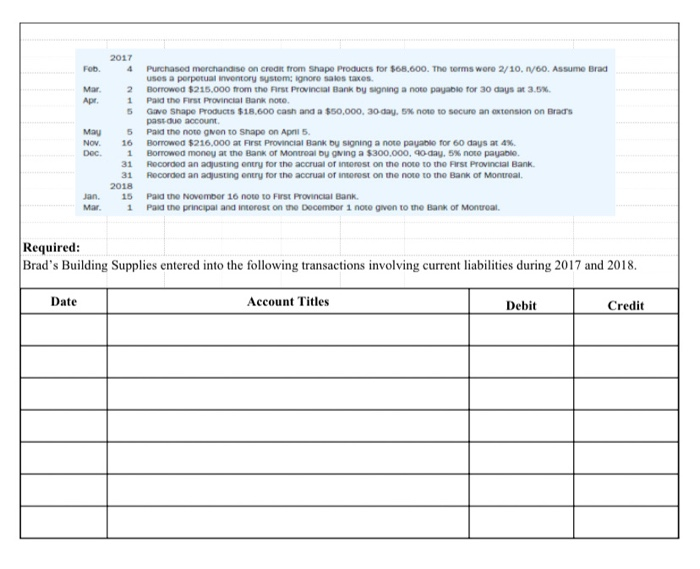

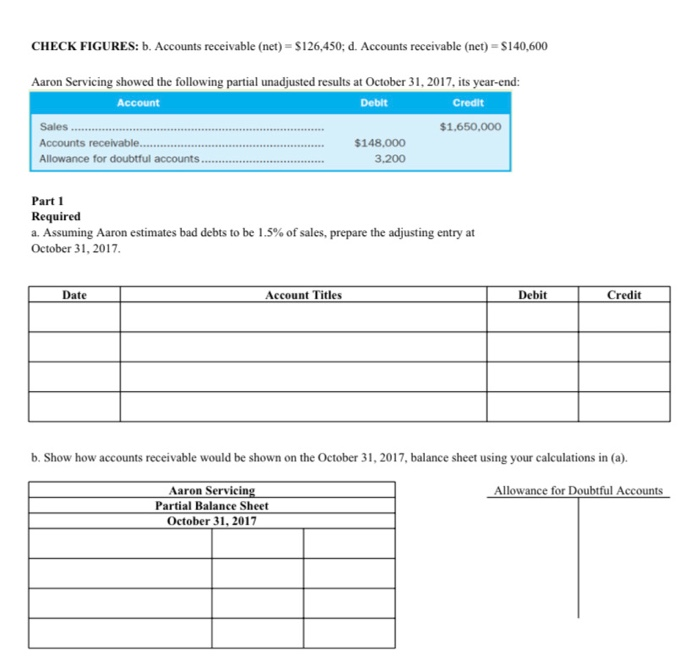

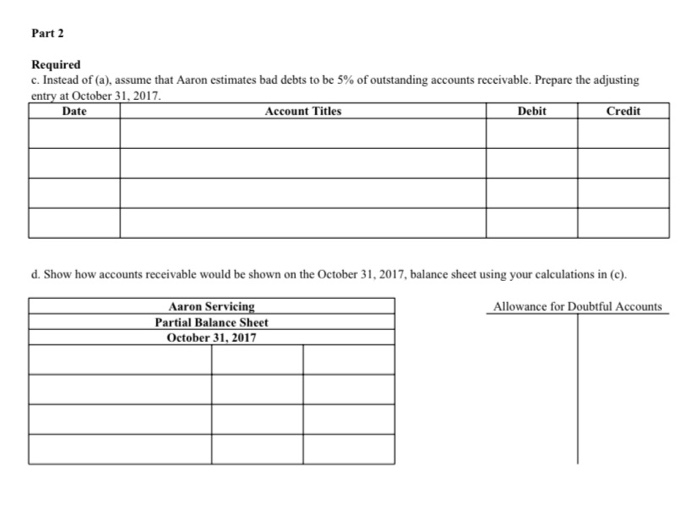

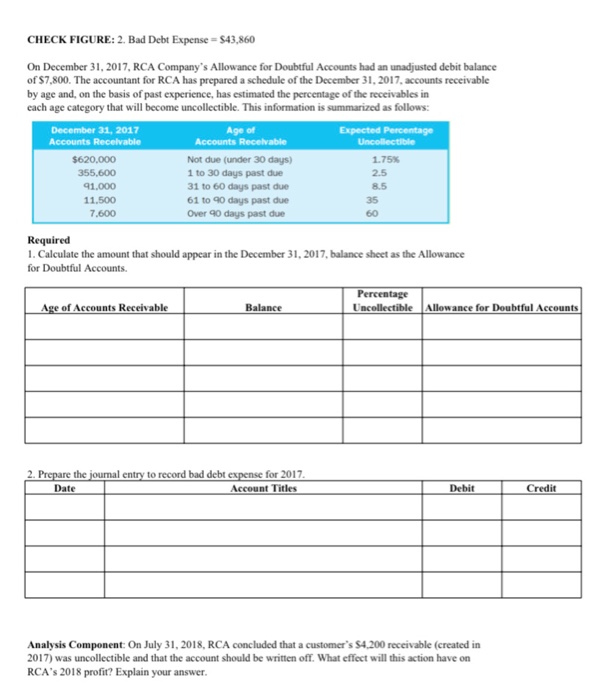

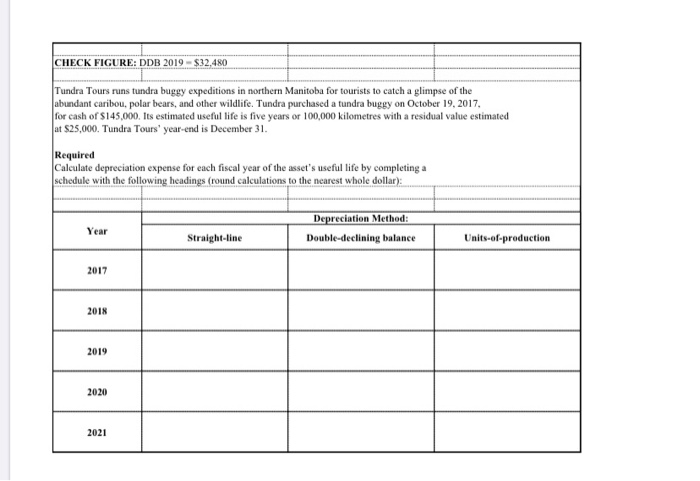

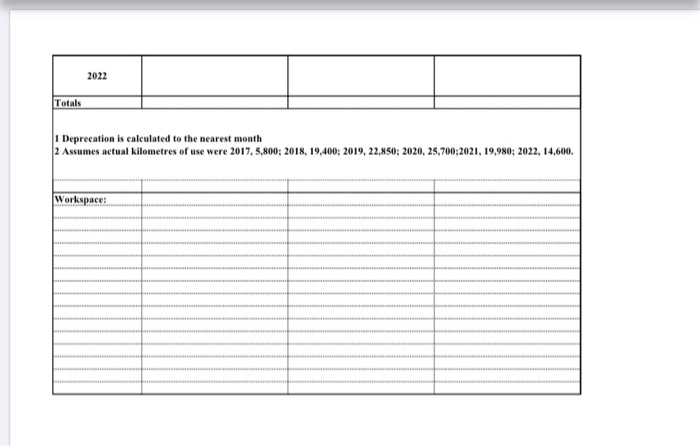

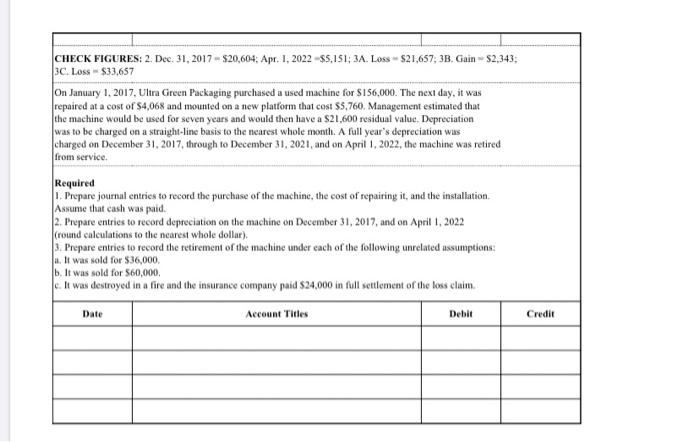

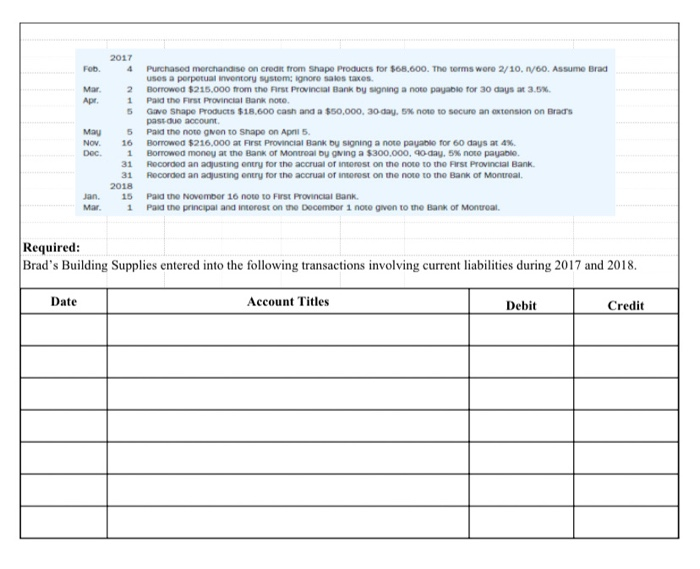

F G E D B CHECK FIGURES: b. Accounts receivable (net) - S126.450; d. Accounts receivable (net) - $140,600 Aaron Servicing showed the following partial unadjusted results at October 31, 2017, its ycar-end: Account Debit Credit Sales $1,650,000 Accounts receivable. Allowance for doubtful accounts $148.000 3.200 Part 1 Required a. Assuming Aaron estimates bad debts to be 1.5% of sales, prepare the adjusting entry at October 31, 2017. Date Account Titles Debit Credit 10 12 13 b. Show how accounts receivable would be shown on the October 31, 2017, balance sheet using your calculations in (a). Question 1 Question-1 Part-2 Question-2 Question-3 Question-4 Question-5 F G 5 Part 1 Required Assuming Aaron estimates bad debts to be 1.5% of sales, prepare the adjusting entry October 31, 2017 6 Date Account Titles Debit Credit 8 9 10 11 12 13 b. Show how accounts receivable would be shown on the October 31, 2017, balance sheet using your calculations in (a). 14 15 16 Allowance for Doubtful Accounts Aaron Servicing Partia Balance Sheet October 31, 2017 17 18 19 20 21 Question-1 Question-1 Part 2 Question-2 Question-3 Question 4 Question 5 Search here ORE e Part 2 Required c. Instead of (a), assume that Aaron estimates bad debts to be 5% of outstanding accounts receivable. Prepare the adjusting entry at October 31, 2017 Date Account Titles Debit Credit d. Show how accounts receivable would be shown on the October 31, 2017, balance sheet using your calculations in (@). Allowance for Doubtful Accounts Aaron Servicing Partial Balance Sheet October 31, 2017 CHECK FIGURES: b. Accounts receivable (net) = $126,450; d. Accounts receivable (net) = $140,600 Aaron Servicing showed the following partial unadjusted results at October 31, 2017, its year-end: Account Debit Credit Sales $1,650,000 Accounts receivable.... $148.000 Allowance for doubtful accounts. 3.200 Part 1 Required a. Assuming Aaron estimates bad debts to be 1.5% of sales, prepare the adjusting entry at October 31, 2017 Date Account Titles Debit Credit b. Show how accounts receivable would be shown on the October 31, 2017, balance sheet using your calculations in (a). Allowance for Doubtful Accounts Aaron Servicing Partial Balance Sheet October 31, 2017 Part 2 Required c. Instead of (a), assume that Aaron estimates bad debts to be 5% of outstanding accounts receivable. Prepare the adjusting entry at October 31, 2017. Date Account Titles Debit Credit d. Show how accounts receivable would be shown on the October 31, 2017, balance sheet using your calculations in (e). Allowance for Doubtful Accounts Aaron Servicing Partial Balance Sheet October 31, 2017 CHECK FIGURE: 2. Bad Debt Expense = $43,860 On December 31, 2017, RCA Company's Allowance for Doubtful Accounts had an unadjusted debit balance of $7,800. The accountant for RCA has prepared a schedule of the December 31, 2017, accounts receivable by age and, on the basis of past experience, has estimated the percentage of the receivables in each age category that will become uncollectible. This information is summarized as follows: December 31, 2017 Age of Expected Percentage Accounts Receivable Accounts Receivable Uncollectible $620,000 Not due (under 30 days) 1.75% 355,600 1 to 30 days past due 2.5 91.000 31 to 60 days past due 8.5 11,500 61 to 90 days past due 7,600 Over 40 days past due 60 Required 1. Calculate the amount that should appear in the December 31, 2017, balance sheet as the Allowance for Doubtful Accounts. Percentage Age of Accounts Receivable Balance Uncollectible Allowance for Doubtful Accounts 2. Prepare the journal entry to record bad debt expense for 2017. Date Account Titles Debit Credit Analysis Component: On July 31, 2018, RCA concluded that a customer's 54.200 receivable (created in 2017) was uncollectible and that the account should be written off. What effect will this action have on RCA's 2018 profit? Explain your answer. CHECK FIGURE: DDB 2019 - $32,480 Tundra Tours runs tundra buggy expeditions in northern Manitoba for tourists to catch a glimpse of the abundant caribou, polar bears, and other wildlife. Tundra purchased a tundra buggy on October 19, 2017, for cash of $145,000. Its estimated useful life is five years or 100,000 kilometres with a residual value estimated at $25,000. Tundra Tours' year-end is December 31. Required Calculate depreciation expense for each fiscal year of the asset's useful life by completing a schedule with the following headings (round calculations to the nearest whole dollar): Year Depreciation Method: Double-declining balance Straight line Units-of-production 2017 2018 2019 2020 2021 2022 Totals 1 Deprecation is calculated to the nearest month 2 Assumes actual kilometres of use were 2017, 5,800, 2018, 19,400; 2019, 22,850; 2020, 25,700:2021, 19,980; 2022, 14,600. Workspace: CHECK FIGURES: 2. Dec 31, 2017 - $20,604; Apr. 1, 2022-$5,151; 3A. Loss - $21,657, 3B. Gain-$2,343; 3C. Loss $33,657 On January 1, 2017, Ultra Green Packaging purchased a used machine for $156,000. The next day, it was repaired at a cost of $4,068 and mounted on a new platform that cost $5,760. Management estimated that the machine would be used for seven years and would then have a $21,600 residual value. Depreciation was to be charged on a straight-line basis to the nearest whole month. A full year's depreciation was charged on December 31, 2017, through to December 31, 2021, and on April 1, 2022, the machine was retired from service. Required 1. Prepare journal entries to record the purchase of the machine, the cost of repairing it, and the installation. Assume that cash was paid 2. Prepare entries to record depreciation on the machine on December 31, 2017, and on April 1, 2022 (round calculations to the nearest whole dollar). 3. Prepare entries to record the retirement of the machine under each of the following unrelated assumptions: a. It was sold for $36,000 b. It was sold for $60,000 c. It was destroyed in a fire and the insurance company paid $24,000 in full settlement of the loss claim. Date Account Titles Debit Credit Workspace: Fob. Mar Apr May Nov. 2017 4 Purchased merchandise on credit from Shape Products for $68,600. The torms were 2/10, 1/60. Assume Brad uses a perpetual inventory system: ignore sales taxes. 2 Borrowed $215.000 from the Prst Provincial Bank by signing a note payable for 30 days at 3.5%. 1 Paid the First Provincial Bank note. Gavo Shape Products $18.600 cash and a $50,000, 30 day, 5% noto to secure an extension on Brad's pasi due account 5 Paid the noto gion to Shape on April 5. 16 Borrowed $216,000 at First Provincial Bank by signing a note payable for 60 days at 4% 1 Borrowed money at the Bank of Montreal by giving a $300.000, 90-day, 5% note payable 31 Recorded an adjusting entry for the accrual of interest on the note to the First Provincial Bank 31 Recorded an adjusting entry for the accrual of interest on the note to the Bank of Montreal 2018 Paid the November 16 note to First Provincial Bank. 1 Paid the principal and interest on the December 1 noto given to the Bank of Montreal. Dec jan. 15 Mar. Required: Brad's Building Supplies entered into the following transactions involving current liabilities during 2017 and 2018. Date Account Titles Debit Credit