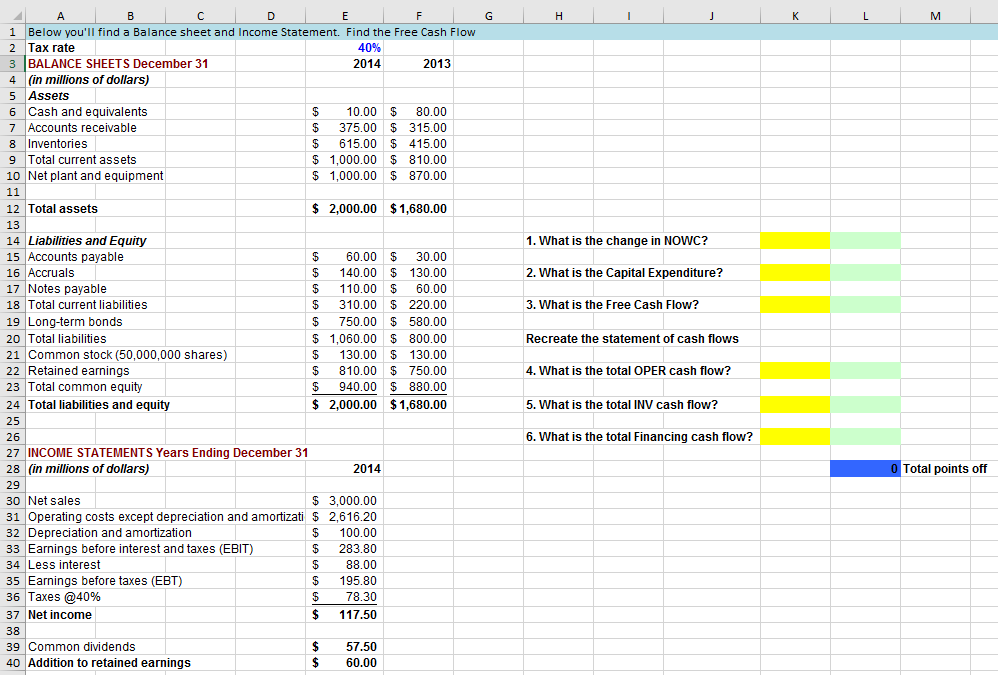

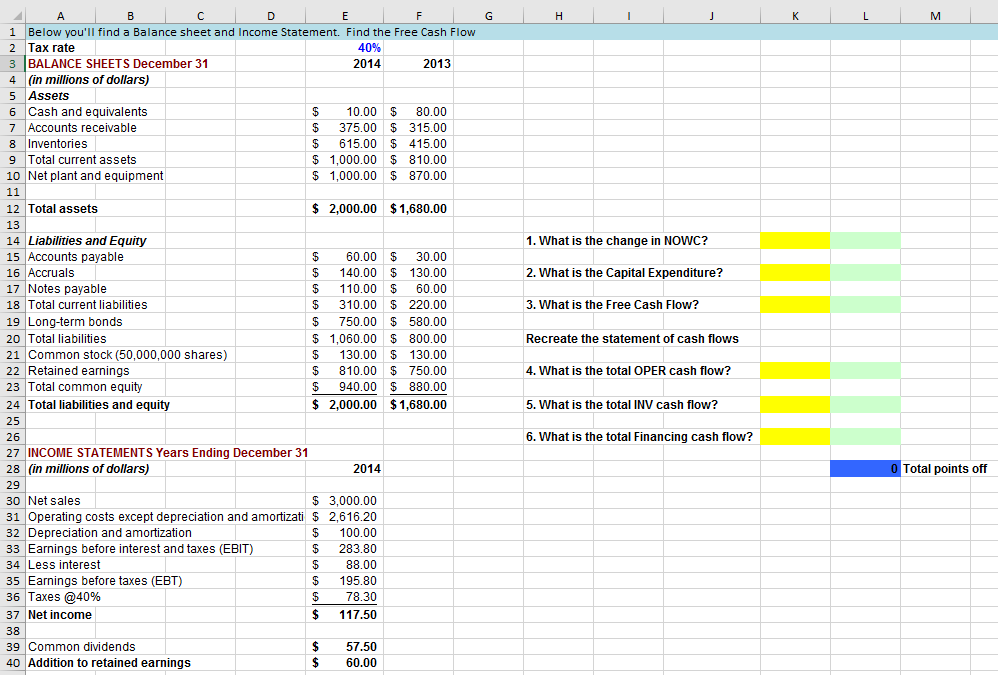

F G H I J K L M L 2013 A B C D E 1 Below you'll find a Balance sheet and Income Statement. Find the Free Cash Flow 2 Tax rate 40% 3 BALANCE SHEETS December 31 2014 4 (in millions of dollars) 5 Assets 6 Cash and equivalents $ 10.00 $ 80.00 7 Accounts receivable $ 375.00 $ 315.00 8 Inventories $ 615.00 $ 415.00 9 Total current assets $ 1,000.00 $ 810.00 10 Net plant and equipment $ 1,000.00 $ 870.00 11 1. What is the change in NOWC? 2. What is the Capital Expenditure? 3. What is the Free Cash Flow? Recreate the statement of cash flows 4. What is the total OPER cash flow? 5. What is the total INV cash flow? 12 Total assets $ 2,000.00 $1,680.00 13 14 Liabilities and Equity 15 Accounts payable $ 60.00 $ 30.00 16 Accruals $ 140.00 $ 130.00 17 Notes payable $ 110.00 $ 60.00 18 Total current liabilities $ 310.00 $ 220.00 19 Long-term bonds $ 750.00 $ 580.00 20 Total liabilities $ 1,060.00 $ 800.00 21 Common stock (50,000,000 shares) $ 130.00 $ 130.00 22 Retained earnings $ 810.00 $ 750.00 23 Total common equity $ 940.00 $ 880.00 24 Total liabilities and equity $ 2,000.00 $1,680.00 25 26 27 INCOME STATEMENTS Years Ending December 31 28 (in millions of dollars) 2014 29 30 Net sales $ 3,000.00 31 Operating costs except depreciation and amortizati $ 2,616.20 32 Depreciation and amortization $ 100.00 33 Earnings before interest and taxes (EBIT) $ 283.80 34 Less interest $ 88.00 35 Earnings before taxes (EBT) $ 195.80 36 Taxes @40% $ 78.30 37 Net income $ 117.50 38 39 Common dividends 57.50 40 Addition to retained earnings 60.00 6. What is the total Financing cash flow? 0 Total points off $ F G H I J K L M L 2013 A B C D E 1 Below you'll find a Balance sheet and Income Statement. Find the Free Cash Flow 2 Tax rate 40% 3 BALANCE SHEETS December 31 2014 4 (in millions of dollars) 5 Assets 6 Cash and equivalents $ 10.00 $ 80.00 7 Accounts receivable $ 375.00 $ 315.00 8 Inventories $ 615.00 $ 415.00 9 Total current assets $ 1,000.00 $ 810.00 10 Net plant and equipment $ 1,000.00 $ 870.00 11 1. What is the change in NOWC? 2. What is the Capital Expenditure? 3. What is the Free Cash Flow? Recreate the statement of cash flows 4. What is the total OPER cash flow? 5. What is the total INV cash flow? 12 Total assets $ 2,000.00 $1,680.00 13 14 Liabilities and Equity 15 Accounts payable $ 60.00 $ 30.00 16 Accruals $ 140.00 $ 130.00 17 Notes payable $ 110.00 $ 60.00 18 Total current liabilities $ 310.00 $ 220.00 19 Long-term bonds $ 750.00 $ 580.00 20 Total liabilities $ 1,060.00 $ 800.00 21 Common stock (50,000,000 shares) $ 130.00 $ 130.00 22 Retained earnings $ 810.00 $ 750.00 23 Total common equity $ 940.00 $ 880.00 24 Total liabilities and equity $ 2,000.00 $1,680.00 25 26 27 INCOME STATEMENTS Years Ending December 31 28 (in millions of dollars) 2014 29 30 Net sales $ 3,000.00 31 Operating costs except depreciation and amortizati $ 2,616.20 32 Depreciation and amortization $ 100.00 33 Earnings before interest and taxes (EBIT) $ 283.80 34 Less interest $ 88.00 35 Earnings before taxes (EBT) $ 195.80 36 Taxes @40% $ 78.30 37 Net income $ 117.50 38 39 Common dividends 57.50 40 Addition to retained earnings 60.00 6. What is the total Financing cash flow? 0 Total points off $