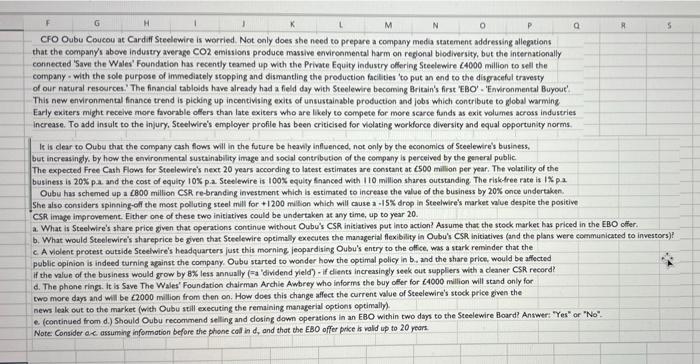

F G K M N 0 P a R 5 CFO Oubu Coucou at Cardiff Steelewire is worried. Not only does she need to prepare a company media statement addressing allegations that the company's above industry average CO2 emissions produce massive environmental harm on regional biodiversity, but the internationally connected 'Save the Wales' Foundation has recently teamed up with the Private Equity industry offering Steelewire 4000 million to sell the company with the sole purpose of inmediately stopping and dismantling the production facilities to put an end to the disgraceful travesty of our natural resources. The financial tabloids have already had a field day with Steelewire becoming Britain's first 'EBO - Environmental Buyout! This new environmental finance trend is picking up incentivising exits of unsustainable production and jobs which contribute to global warming Early exiters might receive more favorable offers than late exiters who are likely to compete for more scarce funds as exie volumes across industries increase. To add insult to the injury, Steelwire's employer profile has been criticised for violating workforce diversity and equal opportunity norms. le is clear to Oubu that the company cash flows will in the future be heavily influenced, not only by the economica of Steelewire's business, but increasingly by how the environmental sustainability image and social contribution of the company is perceived by the general public The expected Free Cash Flows for Steelewire's next 20 years according to latest estimates are constant at (500 million per year. The volatility of the business is 20% pa. and the cost of equity 10% pa Steelewire is 100% equity financed with 110 million shares outstanding. The risk-free rate is 1% pa Oubu hus schemed up a 2800 million CSR re-branding investment which is estimated to increase the value of the business by 20% once undertaken She also considers spinning-off the most polluting steel mill for +1200 million which will cause a -15% drop in Steelwire's market value despite the positive CSR image Improvement. Either one of these two initiatives could be undertaken at any time, up to year 20. a. What is Steelwire's share price given that operations continue without Oubu's CSR initiatives put into action! Assume that the stock market has priced in the EBO offer b. What would Steelewire's shareprice be gven that Steelewire optimally executes the managerial flexibility in Oubu's CSR initiatives (and the plans were communicated to investors) A violent protest outside Steelwire's headquarters just this morning jeopardising Oubu's entry to the office was a stark reminder that the public opinion is indeed turning against the company. Oubu started to wonder how the optimal policy in b, and the share price, would be affected if the value of the business would grow by 8% less annually a "dividend yield) - if clients increasingly seek out suppliers with a cleaner CSR record! d. The phone rings. It is Save The Wales' Foundation chairman Archie Awbrey who informs the buy offer for (4000 million will stand only for two more days and will be (2000 million from then on. How does this change affect the current value of Steelewire's stock price given the news leak out to the market (with Oubu still executing the remaining managerial options optimally) e continued from d.) Should Oubu recommend selling and dosing down operations in an EBO within two days to the Steelewire Board? Answer: "Yes" or "No" Note: Consider a assuming information before the phone call ind, and that the EBO offer parke is valid up to 20 years 7. F G K M N 0 P a R 5 CFO Oubu Coucou at Cardiff Steelewire is worried. Not only does she need to prepare a company media statement addressing allegations that the company's above industry average CO2 emissions produce massive environmental harm on regional biodiversity, but the internationally connected 'Save the Wales' Foundation has recently teamed up with the Private Equity industry offering Steelewire 4000 million to sell the company with the sole purpose of inmediately stopping and dismantling the production facilities to put an end to the disgraceful travesty of our natural resources. The financial tabloids have already had a field day with Steelewire becoming Britain's first 'EBO - Environmental Buyout! This new environmental finance trend is picking up incentivising exits of unsustainable production and jobs which contribute to global warming Early exiters might receive more favorable offers than late exiters who are likely to compete for more scarce funds as exie volumes across industries increase. To add insult to the injury, Steelwire's employer profile has been criticised for violating workforce diversity and equal opportunity norms. le is clear to Oubu that the company cash flows will in the future be heavily influenced, not only by the economica of Steelewire's business, but increasingly by how the environmental sustainability image and social contribution of the company is perceived by the general public The expected Free Cash Flows for Steelewire's next 20 years according to latest estimates are constant at (500 million per year. The volatility of the business is 20% pa. and the cost of equity 10% pa Steelewire is 100% equity financed with 110 million shares outstanding. The risk-free rate is 1% pa Oubu hus schemed up a 2800 million CSR re-branding investment which is estimated to increase the value of the business by 20% once undertaken She also considers spinning-off the most polluting steel mill for +1200 million which will cause a -15% drop in Steelwire's market value despite the positive CSR image Improvement. Either one of these two initiatives could be undertaken at any time, up to year 20. a. What is Steelwire's share price given that operations continue without Oubu's CSR initiatives put into action! Assume that the stock market has priced in the EBO offer b. What would Steelewire's shareprice be gven that Steelewire optimally executes the managerial flexibility in Oubu's CSR initiatives (and the plans were communicated to investors) A violent protest outside Steelwire's headquarters just this morning jeopardising Oubu's entry to the office was a stark reminder that the public opinion is indeed turning against the company. Oubu started to wonder how the optimal policy in b, and the share price, would be affected if the value of the business would grow by 8% less annually a "dividend yield) - if clients increasingly seek out suppliers with a cleaner CSR record! d. The phone rings. It is Save The Wales' Foundation chairman Archie Awbrey who informs the buy offer for (4000 million will stand only for two more days and will be (2000 million from then on. How does this change affect the current value of Steelewire's stock price given the news leak out to the market (with Oubu still executing the remaining managerial options optimally) e continued from d.) Should Oubu recommend selling and dosing down operations in an EBO within two days to the Steelewire Board? Answer: "Yes" or "No" Note: Consider a assuming information before the phone call ind, and that the EBO offer parke is valid up to 20 years 7