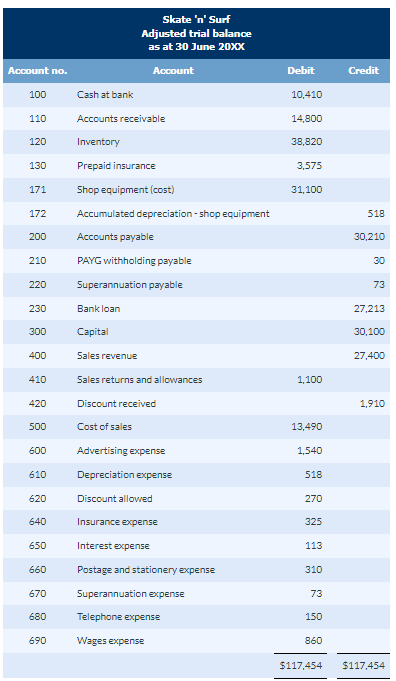

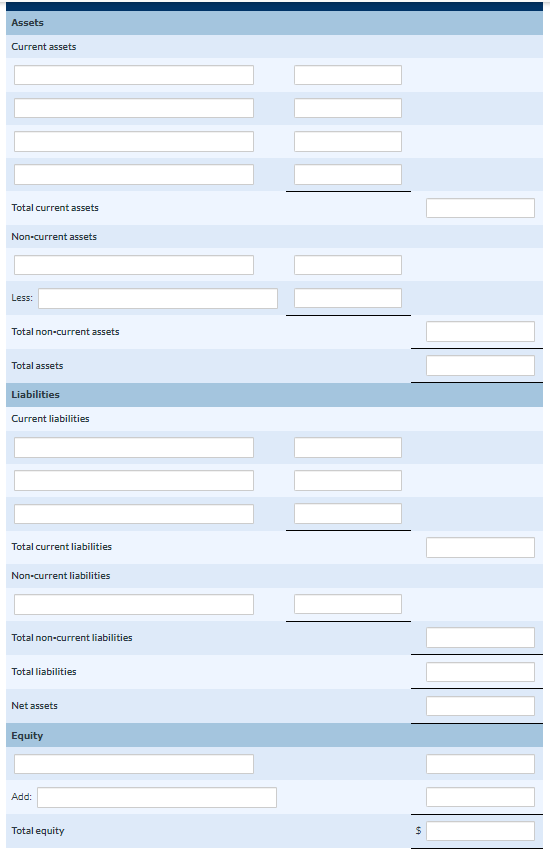

fill in the position of the financial statement below by using the information above!!;))

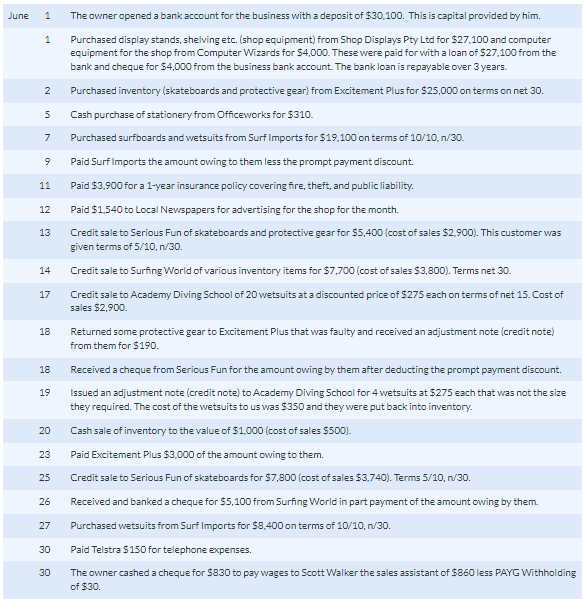

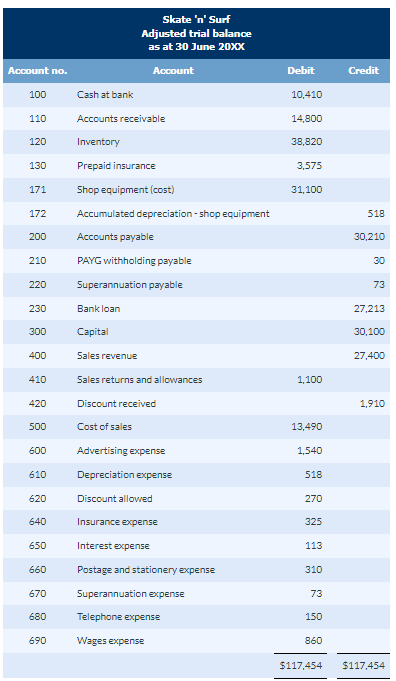

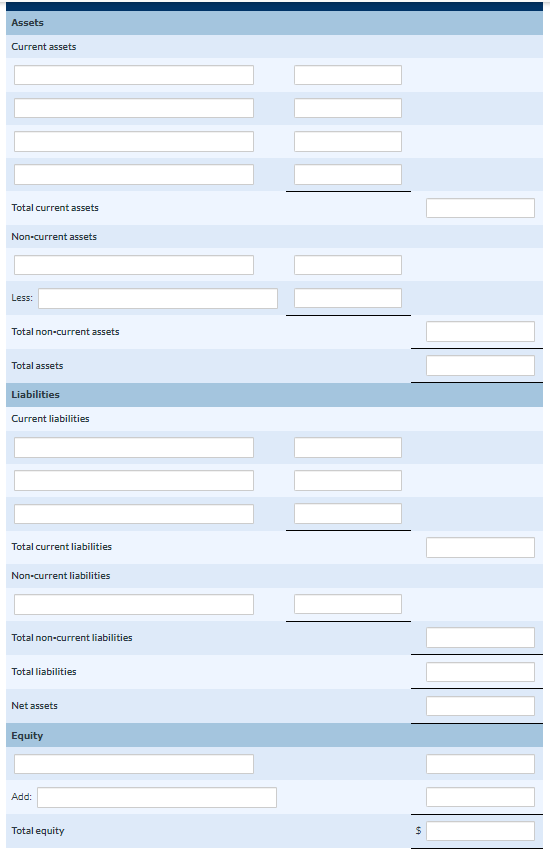

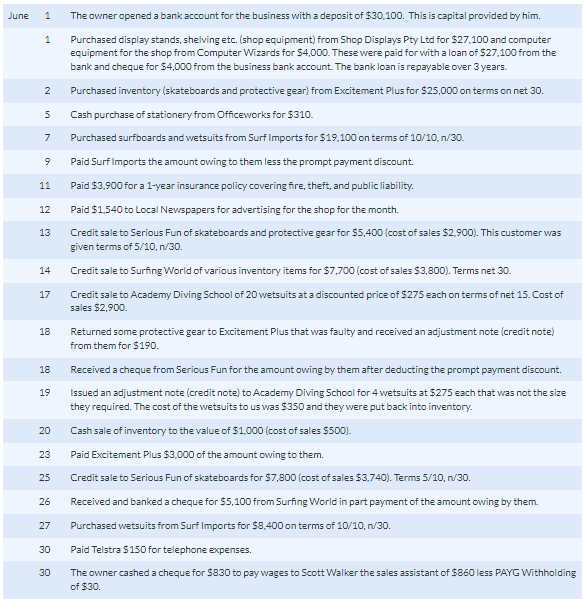

Chart of accounts vunts and account numbers below. June 1 The owner opened a bank account for the business with a deposit of $30,100. This is capital provided by him. 1 Purchased display stands, shelving etc. (shop equipment) from Shop Displays Pty Ltd for $27,100 and computer equipment for the shop from Computer Wizards for $4,000. These were paid for with a loan of $27,100 from the bank and cheque for $4,000 from the business bank account. The bank loan is repayable over 3 years. 2 Purchased inventory (skateboards and protective gear) from Excitement Plus for $25,000 on terms on net 30 . 5 Cash purchase of stationery from Officeworks for $310. 7 Purchased surfboards and wetsuits from Surf Imports for $19,100 on terms of 10/10,n/30. 9 Paid Surf lmports the amount owing to them less the prompt payment discount. 11 Paid $3,900 for a 1-year insurance policy covering fire, theft, and public liability. 12 Paid $1,540 to Local Nevspapers for advertising for the shop for the month. 13 Credit sale to Serious Fun of skateboards and protective gear for $5,400 (cost of sales $2,900 ). This customer was given terms of 5/10,n/30. 14 Credit sale to Surfing World of various inventory items for $7,700 (cost of sales $3,800 ). Terms net 30 . 17 Credit sale to Academy Diving School of 20 wetsuits at a discounted price of $275 each on terms of net 15 . Cost of sales $2,900. 18 Returned some protective gear to Excitement Plus that was faulty and received an adjustment note (credit note) from them for $190. 18 Received a cheque from Serious Fun for the amount owing by them after deducting the prompt payment discount. 19 Issued an adjustment note (credit note) to Academy Diving School for 4 wetsuits at $275 each that was not the size they required. The cost of the wetsuits to us was $350 and they were put back into inventory. 20 Cash sale of inventory to the value of $1,000 (cost of sales $500 ). 23 Paid Excitement Plus $3,000 of the amount owing to them. 25 Credit sale to Serious Fun of skateboards for $7,800 (cost of sales $3,740 ). Terms 5/10,/30. 26 Received and banked a cheque for $5,100 from Surfing World in part payment of the amount owing by them. 27 Purchased wetsuits from Surf Imports for $8,400 on terms of 10/10,/30. 30 Paid Telstra $150 for telephone expenses. 30 The owner cashed a cheque for $830 to pay wages to Scott Walker the sales assistant of $860 less PAYG Withholding of $30. Assets Current assets Total current assets Non-current assets Less: Total non-current assets Total assets Liabilities Current liabilities Total current liabilities Non-current liabilities Total non-current liabilities Total liabilities Net assets Equity Add: Total equity