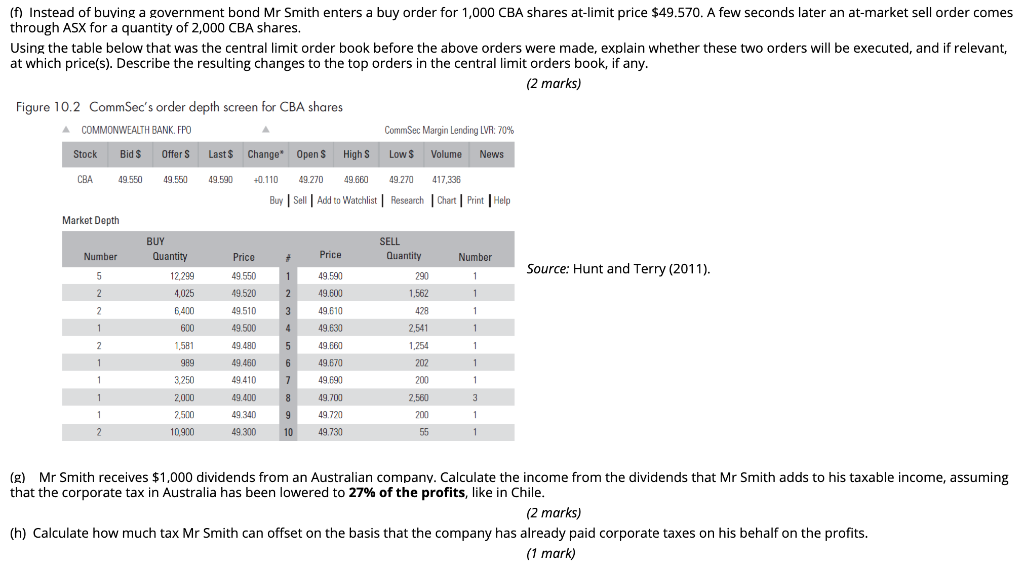

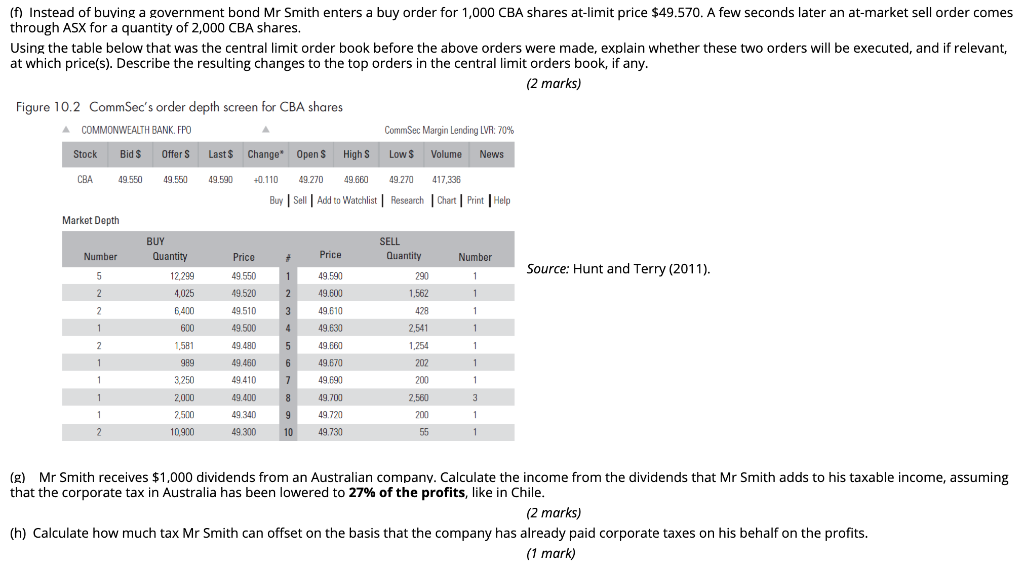

(f) Instead of buying a government bond Mr Smith enters a buy order for 1,000 CBA shares at-limit price $49.570. A few seconds later an at-market sell order comes through ASX for a quantity of 2,000 CBA shares. Using the table below that was the central limit order book before the above orders were made, explain whether these two orders will be executed, and if relevant, at which price(s). Describe the resulting changes to the top orders in the central limit orders book, if any. (2 marks) Figure 10.2 CommSec's order depth screen for CBA shares A COMMONWEALTH BANK. FPO CommSec Margin Lending LVR: 70% Stock Bid $ Offers Last $ Change* Open S Highs Low $ Volume News 49.590 49.270 Buy Sell | Add to Watchlist | Research Chart Print | Help Market Depth BUY SELL Quantity Price Quantity Number 12,299 49.550 1 Source: Hunt and Terry (2011). 290 4,025 1,562 CBA 49.550 49.550 +0.110 49.660 49.270 417,336 Number Price 5 49.590 1 2. 1 2 2 49.520 49.510 49.600 49.610 3 428 1 6,400 600 1 4 49.630 49.660 49.500 49.480 49.460 2.541 1,254 2 1,581 989 5 1 1 1 1 6 49.670 202 1 3,250 7 49.690 1 49.410 49.400 200 2,560 1 3 2,000 2.500 10.900 8 9 49.700 49.720 1 49 340 200 1 2 49 300 10 49.730 55 1 (g) Mr Smith receives $1,000 dividends from an Australian company. Calculate the income from the dividends that Mr Smith adds to his taxable income, assuming that the corporate tax in Australia has been lowered to 27% of the profits, like in Chile. (2 marks) (h) Calculate how much tax Mr Smith can offset on the basis that the company has already paid corporate taxes on his behalf on the profits. (1 mark) (f) Instead of buying a government bond Mr Smith enters a buy order for 1,000 CBA shares at-limit price $49.570. A few seconds later an at-market sell order comes through ASX for a quantity of 2,000 CBA shares. Using the table below that was the central limit order book before the above orders were made, explain whether these two orders will be executed, and if relevant, at which price(s). Describe the resulting changes to the top orders in the central limit orders book, if any. (2 marks) Figure 10.2 CommSec's order depth screen for CBA shares A COMMONWEALTH BANK. FPO CommSec Margin Lending LVR: 70% Stock Bid $ Offers Last $ Change* Open S Highs Low $ Volume News 49.590 49.270 Buy Sell | Add to Watchlist | Research Chart Print | Help Market Depth BUY SELL Quantity Price Quantity Number 12,299 49.550 1 Source: Hunt and Terry (2011). 290 4,025 1,562 CBA 49.550 49.550 +0.110 49.660 49.270 417,336 Number Price 5 49.590 1 2. 1 2 2 49.520 49.510 49.600 49.610 3 428 1 6,400 600 1 4 49.630 49.660 49.500 49.480 49.460 2.541 1,254 2 1,581 989 5 1 1 1 1 6 49.670 202 1 3,250 7 49.690 1 49.410 49.400 200 2,560 1 3 2,000 2.500 10.900 8 9 49.700 49.720 1 49 340 200 1 2 49 300 10 49.730 55 1 (g) Mr Smith receives $1,000 dividends from an Australian company. Calculate the income from the dividends that Mr Smith adds to his taxable income, assuming that the corporate tax in Australia has been lowered to 27% of the profits, like in Chile. (2 marks) (h) Calculate how much tax Mr Smith can offset on the basis that the company has already paid corporate taxes on his behalf on the profits. (1 mark)