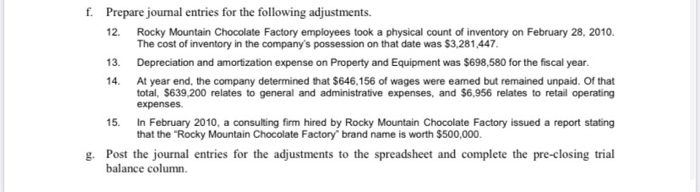

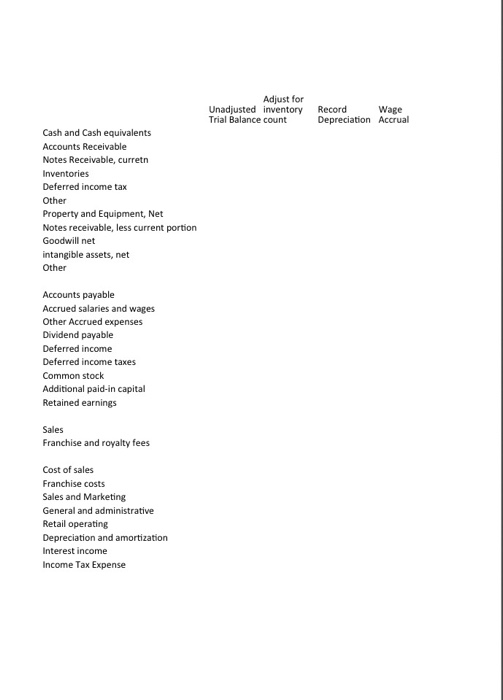

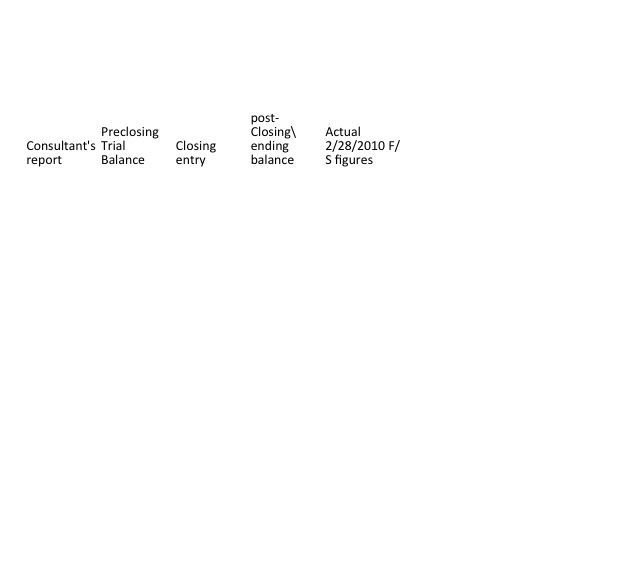

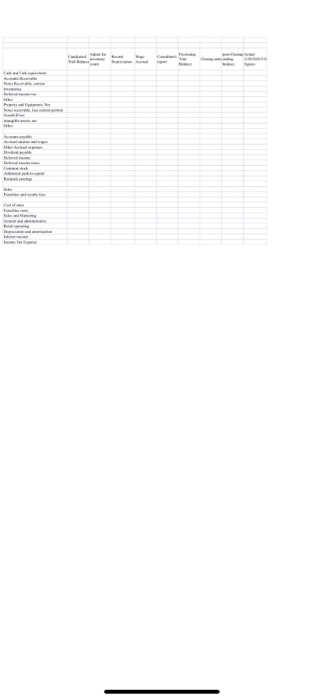

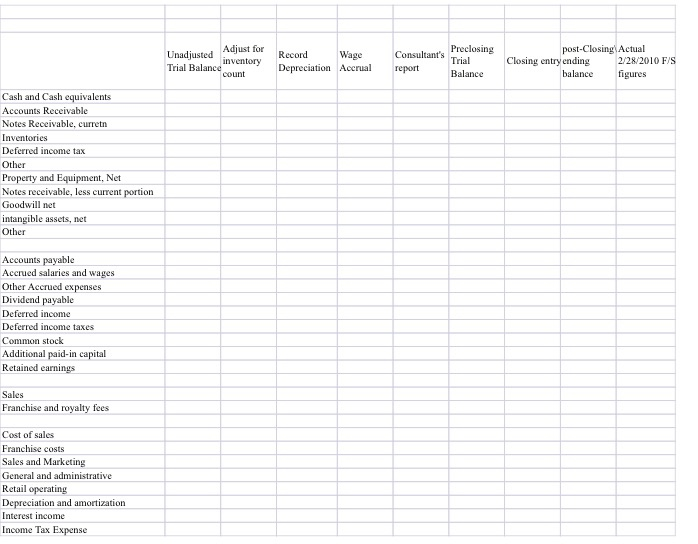

f. Prepare journal entries for the following adjustments. 12. Rocky Mountain Chocolate Factory employees took a physical count of inventory on February 28, 2010 The cost of inventory in the company's possession on that date was $3,281,447. 13. Depreciation and amortization expense on Property and Equipment was $698,580 for the fiscal year. At year end, the company determined that $646,156 of wages were eamed but remained unpaid. Of that total, $639,200 relates to general and administrative expenses, and $6,956 relates to retail operating expenses. 15. In February 2010, a consulting firm hired by Rocky Mountain Chocolate Factory issued a report stating that the "Rocky Mountain Chocolate Factory brand name is worth $500,000 g. Post the journal entries for the adjustments to the spreadsheet and complete the pre-closing trial balance column. Adjust for Unadjusted inventory Trial Balance count Record Wage Depreciation Accrual Cash and Cash equivalents Accounts Receivable Notes Receivable, curretn Inventories Deferred income tax Other Property and Equipment, Net Notes receivable, less current portion Goodwill net intangible assets, net Other Accounts payable Accrued salaries and wages Other Accrued expenses Dividend payable Deferred income Deferred income taxes Common stock Additional paid-in capital Retained earnings Sales Franchise and royalty fees Cost of sales Franchise costs Sales and Marketing General and administrative Retail operating Depreciation and amortization Interest income Income Tax Expense f. Prepare journal entries for the following adjustments. 12. Rocky Mountain Chocolate Factory employees took a physical count of inventory on February 28, 2010 The cost of inventory in the company's possession on that date was $3,281,447. 13. Depreciation and amortization expense on Property and Equipment was $698,580 for the fiscal year. At year end, the company determined that $646,156 of wages were eamed but remained unpaid. Of that total, $639,200 relates to general and administrative expenses, and $6,956 relates to retail operating expenses. 15. In February 2010, a consulting firm hired by Rocky Mountain Chocolate Factory issued a report stating that the "Rocky Mountain Chocolate Factory brand name is worth $500,000 g. Post the journal entries for the adjustments to the spreadsheet and complete the pre-closing trial balance column. Adjust for Unadjusted inventory Trial Balance count Record Wage Depreciation Accrual Cash and Cash equivalents Accounts Receivable Notes Receivable, curretn Inventories Deferred income tax Other Property and Equipment, Net Notes receivable, less current portion Goodwill net intangible assets, net Other Accounts payable Accrued salaries and wages Other Accrued expenses Dividend payable Deferred income Deferred income taxes Common stock Additional paid-in capital Retained earnings Sales Franchise and royalty fees Cost of sales Franchise costs Sales and Marketing General and administrative Retail operating Depreciation and amortization Interest income Income Tax Expense