Answered step by step

Verified Expert Solution

Question

1 Approved Answer

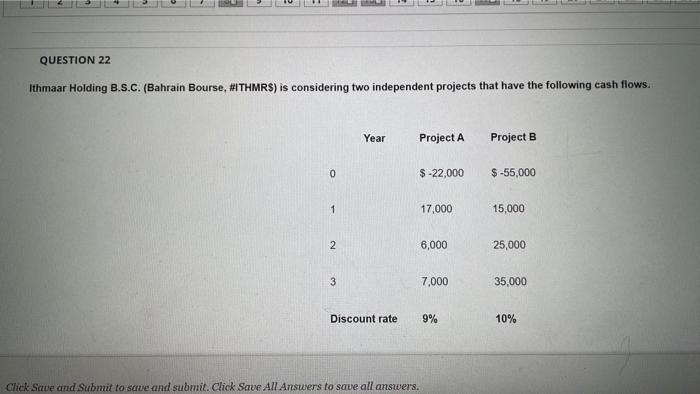

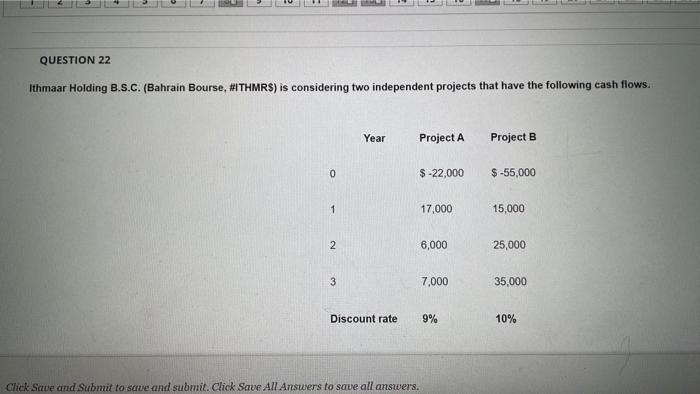

f QUESTION 22 Ithmaar Holding B.S.C. (Bahrain Bourse, #ITHMRS) is considering two independent projects that have the following cash flows. Year Project A Project B

f

QUESTION 22 Ithmaar Holding B.S.C. (Bahrain Bourse, #ITHMRS) is considering two independent projects that have the following cash flows. Year Project A Project B $ -22,000 $-55,000 17,000 15,000 6,000 25,000 3 7,000 35,000 Discount rate 9% 10% Click Save and Submit to save and submit. Click Save All Answers to save all answers. 0 1 2 Discount rate 9% 10% a) Calculate the Net Present Value (NPV) methods and explain which project is better. (1.5 marks) b) Calculate the Internal Rate of Return (IRR) of the two projects and explain which project is better. (1.5 marks) c) Calculate the Profitability Index (PI) of the two projects and explain which project is better. (1.5 mark) Note: You are allowed to use Financial Calculator For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). V BIUS Paragraph V V Arial 10pt E 6 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started