Answered step by step

Verified Expert Solution

Question

1 Approved Answer

F. The Vocal Trinity + the GOAT Corporation prepares a Statement of Affairs which presents unsecured claims that totaled P875,000 and may expect to

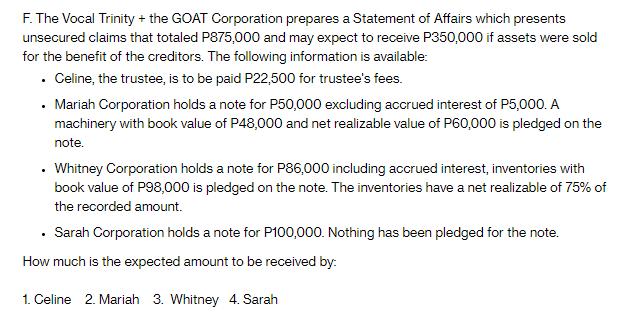

F. The Vocal Trinity + the GOAT Corporation prepares a Statement of Affairs which presents unsecured claims that totaled P875,000 and may expect to receive P350,000 if assets were sold for the benefit of the creditors. The following information is available: . Celine, the trustee, is to be paid P22,500 for trustee's fees. Mariah Corporation holds a note for P50,000 excluding accrued interest of P5,000. A machinery with book value of P48,000 and net realizable value of P60,000 is pledged on the note. . Whitney Corporation holds a note for P86,000 including accrued interest, inventories with book value of P98,000 is pledged on the note. The inventories have a net realizable of 75% of the recorded amount. Sarah Corporation holds a note for P100,000. Nothing has been pledged for the note. How much is the expected amount to be received by: 1. Celine 2. Mariah 3. Whitney 4. Sarah

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To compute the expected amount to be received by Celine Mariah Whitney and Sarah we need to prepare a Statement of Affairs and determine the distribut...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started