Answered step by step

Verified Expert Solution

Question

1 Approved Answer

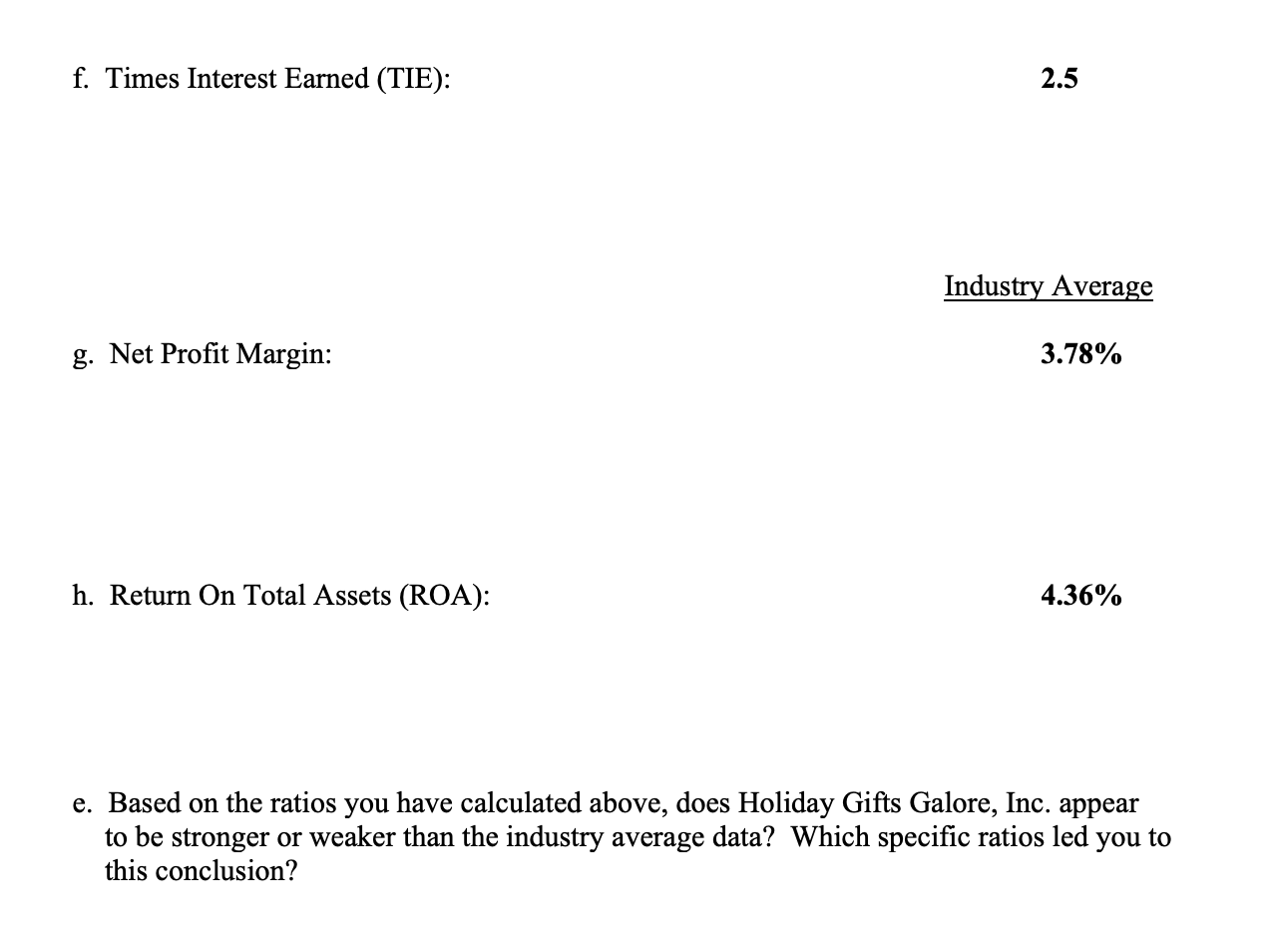

f. Times Interest Earned (TIE): g. Net Profit Margin: h. Return On Total Assets (ROA): 2.5 Industry Average 3.78% 4.36% e. Based on the

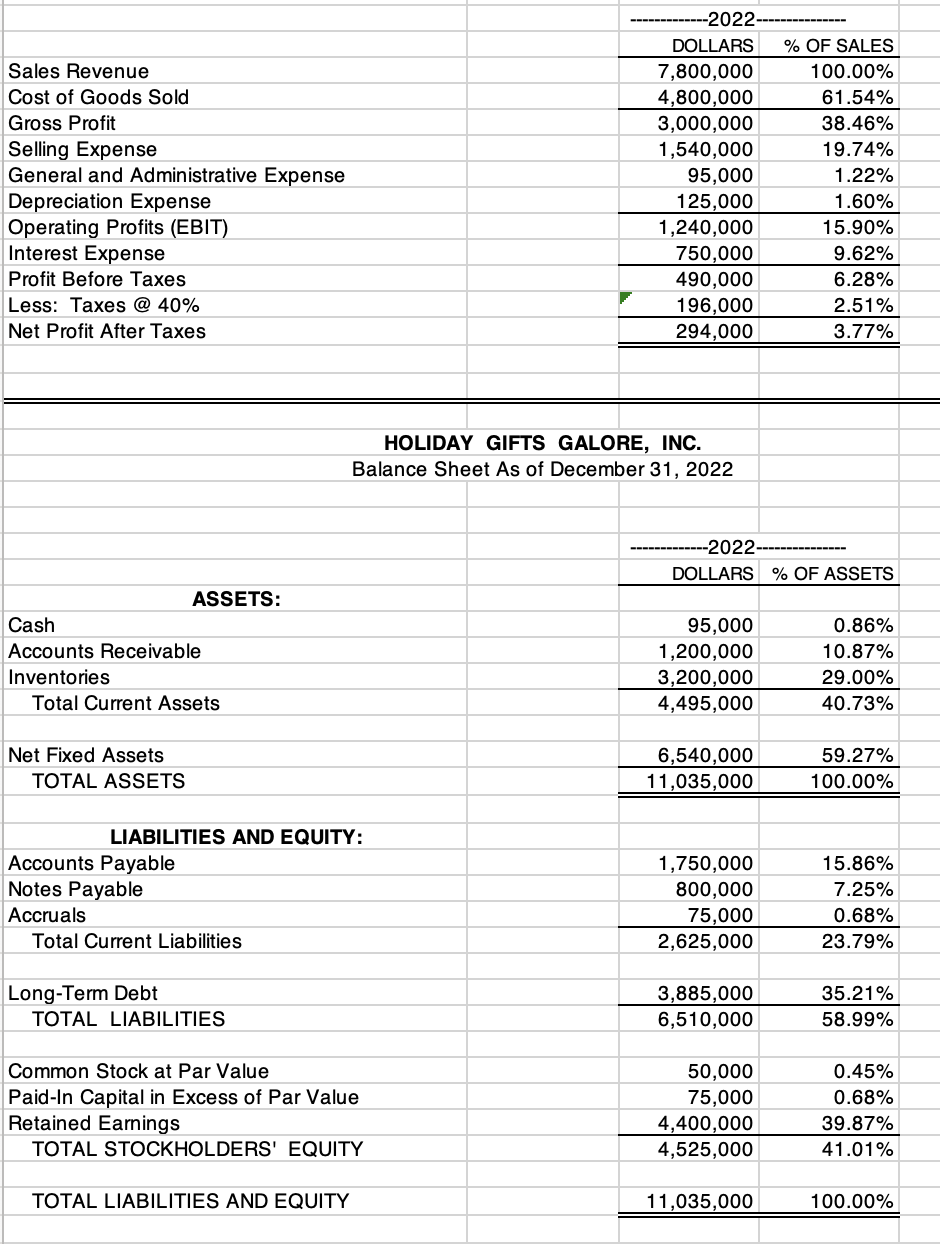

f. Times Interest Earned (TIE): g. Net Profit Margin: h. Return On Total Assets (ROA): 2.5 Industry Average 3.78% 4.36% e. Based on the ratios you have calculated above, does Holiday Gifts Galore, Inc. appear to be stronger or weaker than the industry average data? Which specific ratios led you to this conclusion? Sales Revenue Cost of Goods Sold Gross Profit Selling Expense General and Administrative Expense Depreciation Expense Operating Profits (EBIT) Interest Expense Profit Before Taxes Less: Taxes @ 40% Net Profit After Taxes Cash Accounts Receivable Inventories Total Current Assets Net Fixed Assets TOTAL ASSETS ASSETS: Accounts Payable Notes Payable Accruals LIABILITIES AND EQUITY: Total Current Liabilities Long-Term Debt TOTAL LIABILITIES Common Stock at Par Value Paid-In Capital in Excess of Par Value Retained Earnings TOTAL STOCKHOLDERS' EQUITY TOTAL LIABILITIES AND EQUITY -2022- DOLLARS % OF SALES 7,800,000 4,800,000 3,000,000 1,540,000 95,000 125,000 HOLIDAY GIFTS GALORE, INC. Balance Sheet As of December 31, 2022 1,240,000 750,000 490,000 196,000 294,000 --2022 DOLLARS % OF ASSETS 95,000 1,200,000 3,200,000 4,495,000 6,540,000 11,035,000 1,750,000 800,000 75,000 2,625,000 3,885,000 6,510,000 50,000 75,000 4,400,000 4,525,000 100.00% 61.54% 38.46% 19.74% 1.22% 1.60% 15.90% 9.62% 6.28% 2.51% 3.77% 11,035,000 0.86% 10.87% 29.00% 40.73% 59.27% 100.00% 15.86% 7.25% 0.68% 23.79% 35.21% 58.99% 0.45% 0.68% 39.87% 41.01% 100.00%

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To answer the question whether Holiday Gifts Galore Inc appears to be stronger or weaker than the industry average we need to compare the ratios menti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started