F.) What information outside the annual report may be useful to decision to invest in or lend money to this company?

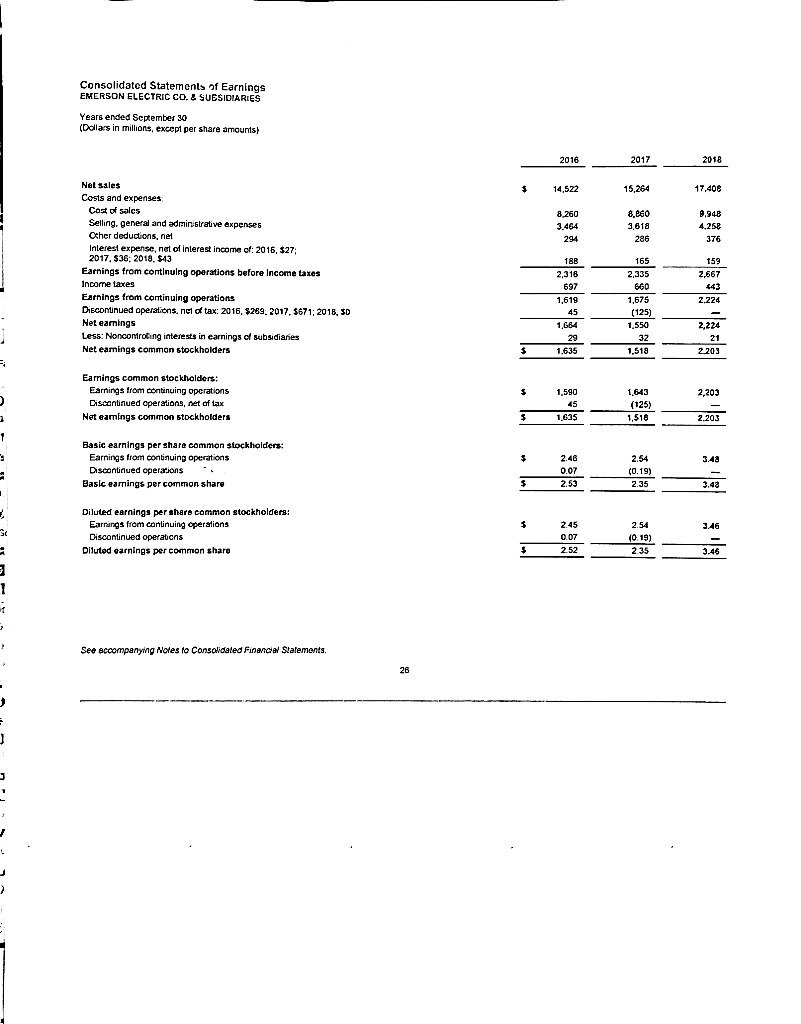

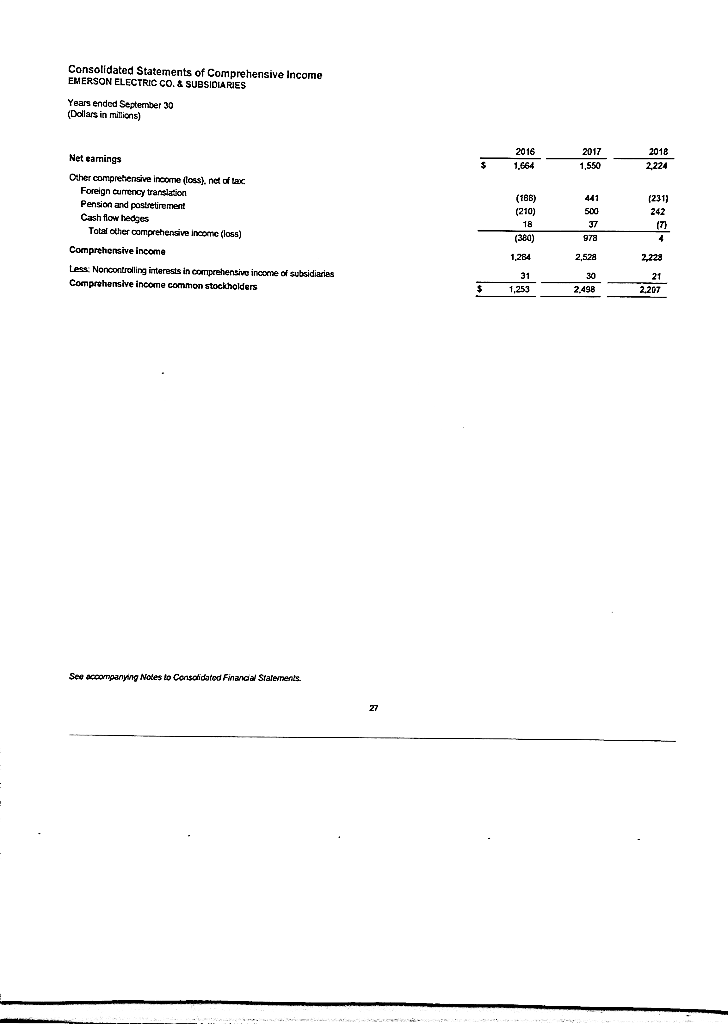

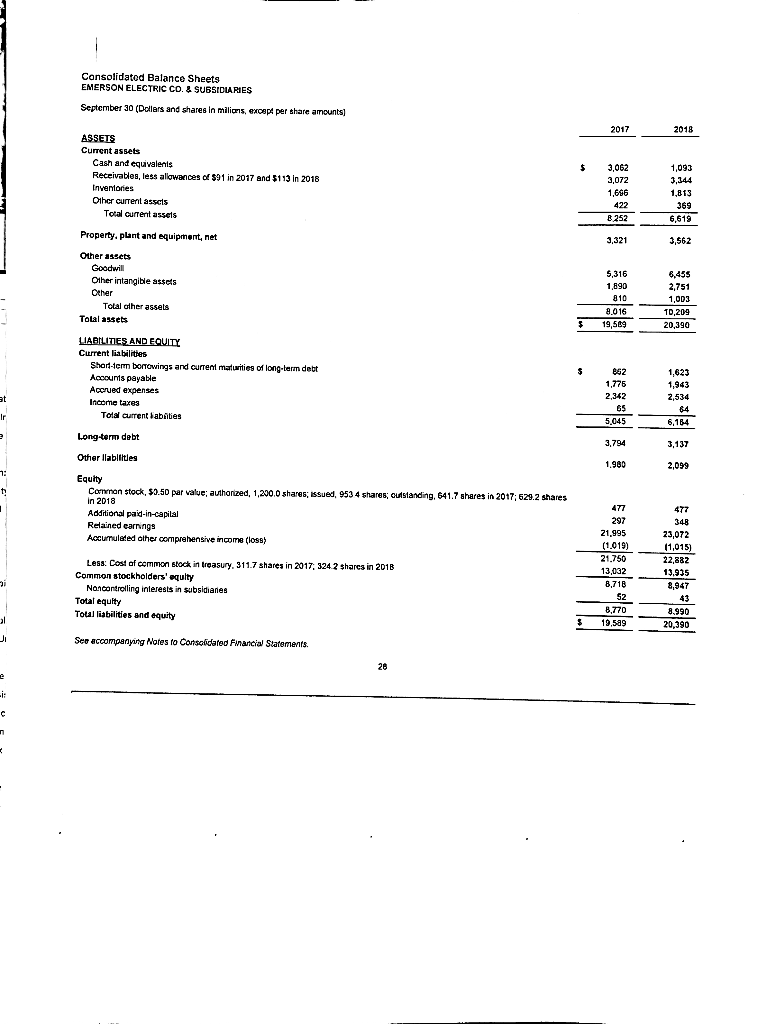

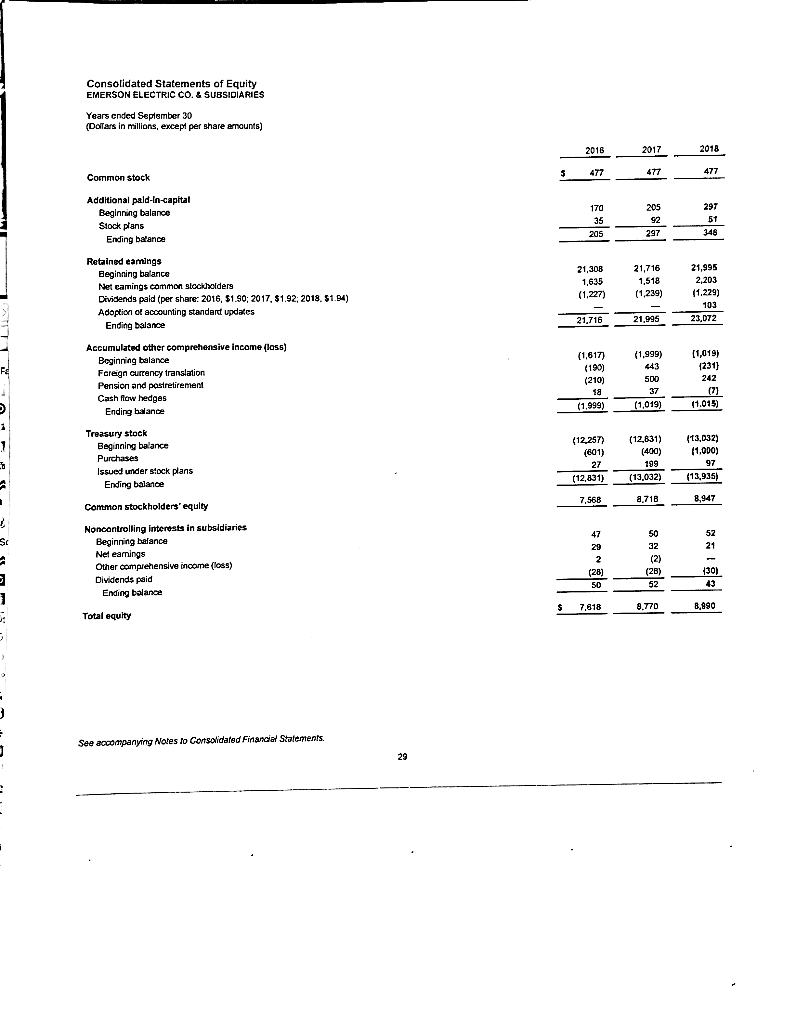

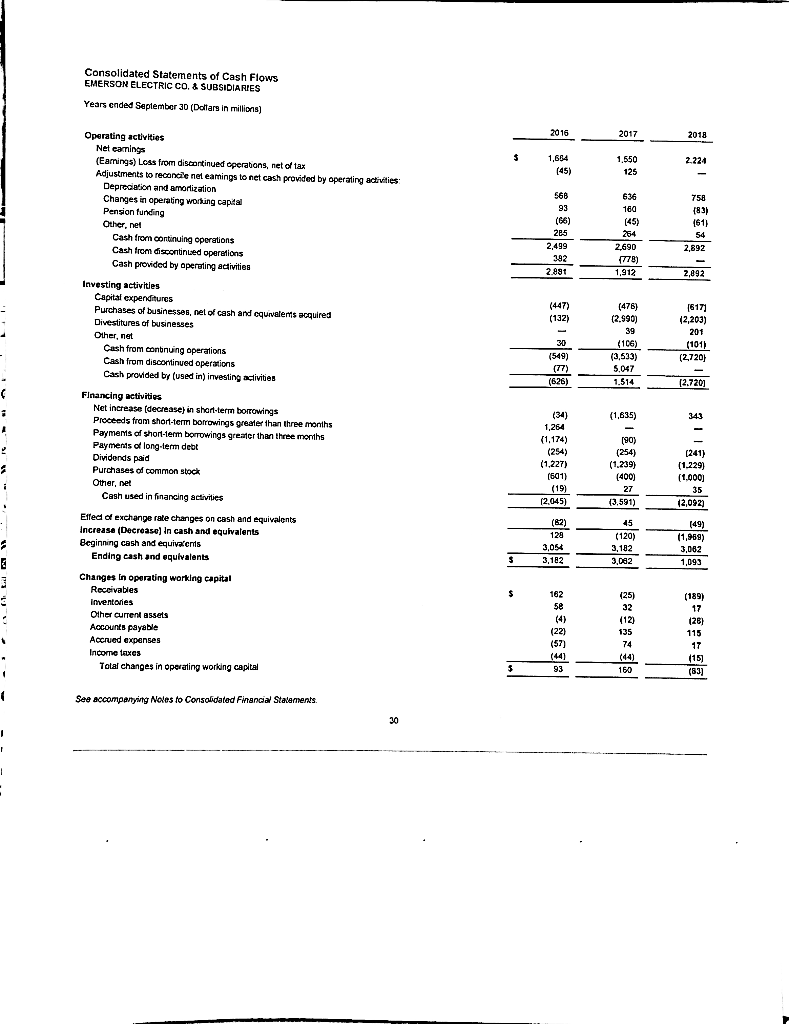

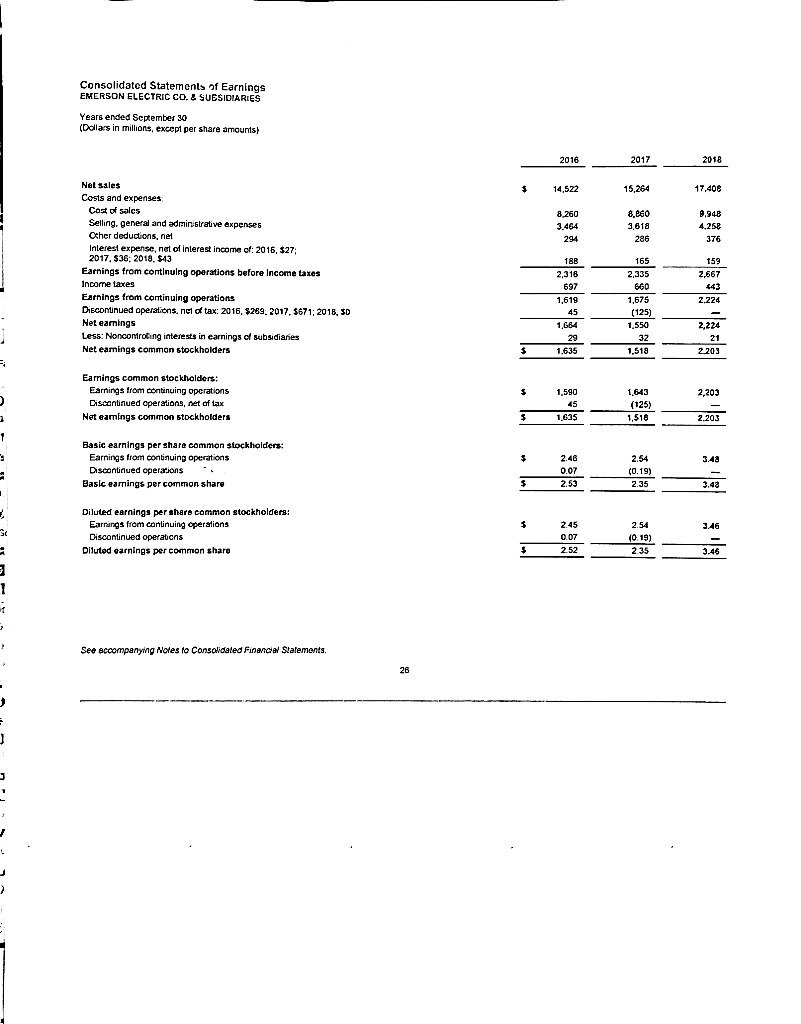

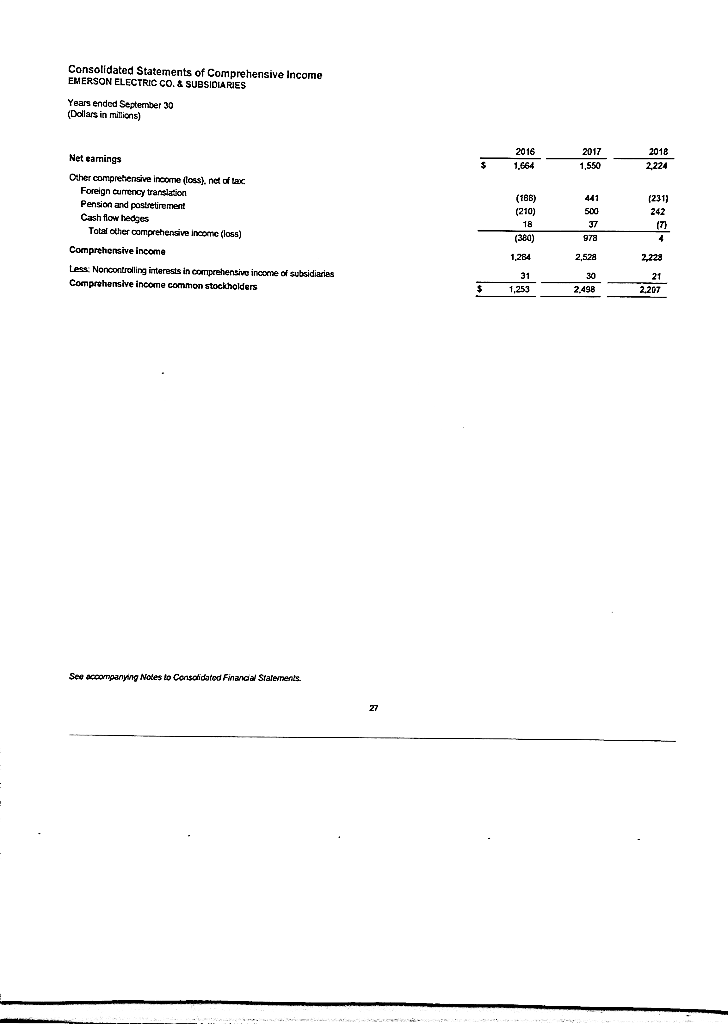

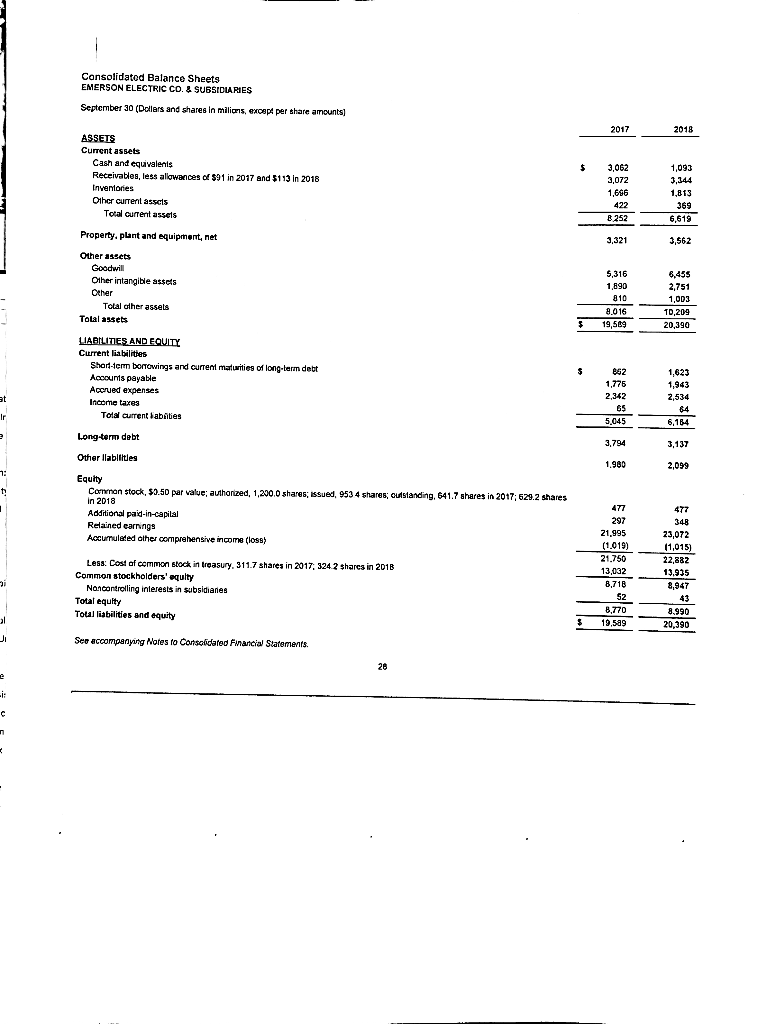

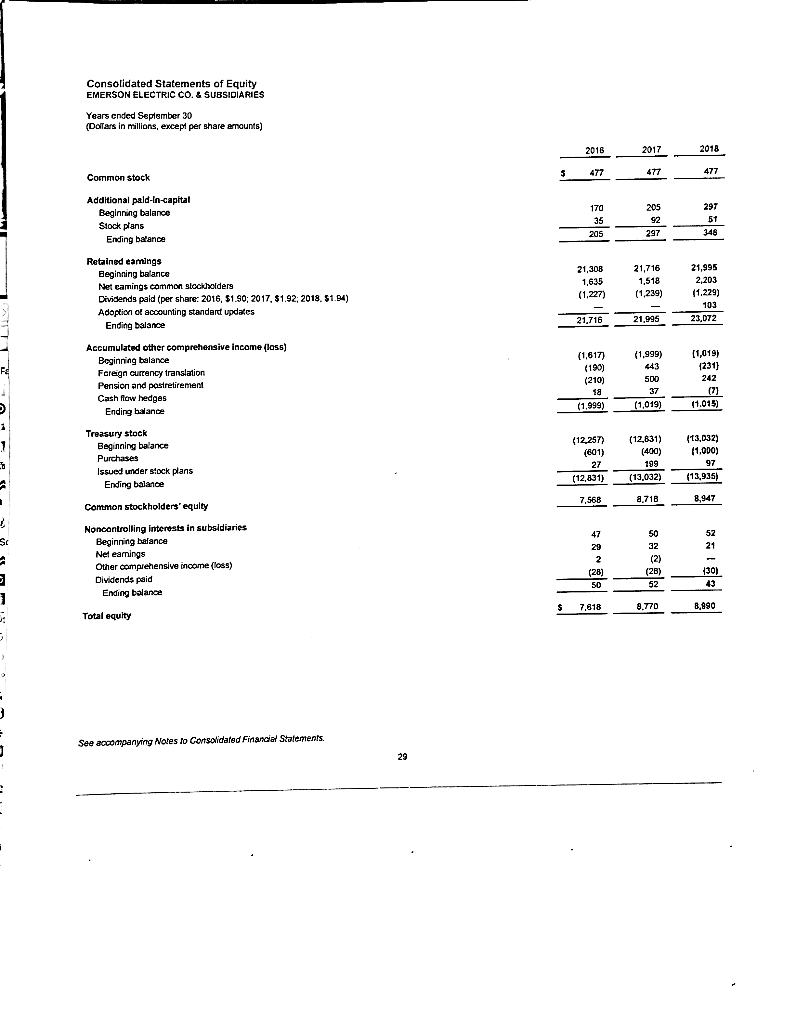

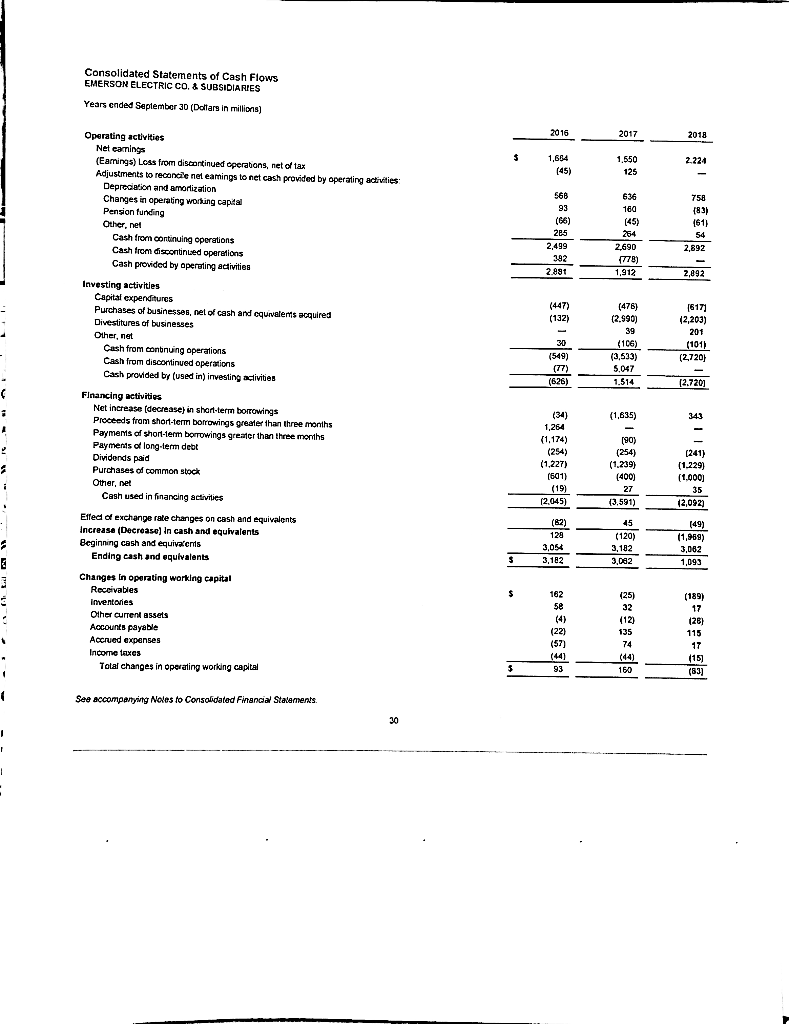

aodted Statements of Earnings C CO.&SUESIDIARIES cptember 30 except per share amounts Del 2016 2017 2018 Net sales 17,408 14.522 15.264 Costs and expenses a nel and administrative expenses 8,e60 9.948 8,260 3,6 Other deductions, net Inlerest expense, net of interest income of: 2016, $27 ... 376 165 188 159 , S13 Farni contlnulng operations before Income taxes Income taxes 697 443 Earnings from continuing operations DiEcontinued operations, net of tax: 2016, $269, 2017, $671; 2018, SD 1.619 2.224 1.675 45 (125 1.684 1.550 2,224 nings of subsidianes roting interests in 1618 ? 203 1635 Net eamings common stockholders Eaminas common stockholders: Earnings from continuing operations 1.590 1,643 2,203 Ciscantinued cperations, net af tax (125) Net eamings common stockholders 2.203 1,510 1,635 Basic earnings per share common stockholders: Earnings from continuing operations 2.46 2.54 48 Discontinued operations 0.07 (0.19) Basic earnings per common share 2.53 2.35 3.43 stockholders: Diluted earnings per share com 24 2.54 346 Discontinued operations 007 (0.19) 235 3.46 Dilutod earnings per common share 2.52 1 See accompanying Notes to Consolidated Financal Statements 26 Consolidated Statements of Comprehensive Income MERSON ELECTRIC CO. SUBSIDIARIES Years endod September 30 (Dollars in millions) 2018 2016 2017 Net earnings 1 550 1664 2224 Oth Income (loss), net of tac (231 (188) 441 Pension and postretirement Cash flow hedges. Total other comprehensive income (loss) (210) 500 242 (380) 97a Comprehensive income 84 2.528 2223 Less Noncontroling interests in comprehensive income of subsidiaries 31 Comprehensive income common stockhalders 1,253 2,498 2,207 See accompanying Notes to Consalidated Finandal Stalements. 21 Consolidatod Balance Sheets EMERSON ELECTRIC CO. & StUBSIDIARIES September 30 (Dollars and shares in milians, except per share amounts 2017 2018 ASSETS Current assets valenls less allowances of $91 in 2017 and $113 in 2018 3.062 1.093 R 3,344 3,072 Inventores Other current asscts 422 369 Total current assets 8252 6,619 Property, plant and equipment, net 3,321 3.562 Other assets Goodwill s316 Other intangibie assets 751 1890 Ceher 810 1,003 ather assels 8,016 19.509 T0.209 Tolal assets 20,390 LIABILITIES AND EQUITY Shad-tem bomowings and current maturities of long-term dett 1,623 Accounts payable Acorued expenses 2.342 65 5.045 2.536 Inc 64 ntabities 6,164 Long term debt 3.794 .137 Other labllitles 1,980 2.099 E Common stock, $0.50 par value authonized, 1,200.0 shares, issued, 953 4 shares outstanding, 641.7 shares in 2017: 529 2 shares in 2018 AT 477 Additional paid-in-cacilal 29: 21,995 23,072 Accumuleted other comprehensive income (loss) (1,019) 1.015) 22,882 Less: Cost of cemmon stock in treasury, 311.7 shares in 2017, 324 2 shares in 201B ..on Common stockholders' equlty ling inleres 47 8,718 subsidianes 52 43 Total equlty 8,770 19.589 8.990 Total liabilities and equity 20,390 See accompanying Nates to Consoidated Fnancial Statements. 28 EMERSON ELECTRIC CO&rGinBIE ES Dotars in millions, except per share amounts) 2018 2017 2016 4T7 4T7 477 Common stock Additional pald-in-capital Beginning balance 297 205 170 2 51 35 batance 297 348 Retained eamings 21,995 2,203 21,716 21.308 . 1.518 1635 slockholders (1,239) (1.229) (1,227) : 2018, $1.94 ) Dividends paid (per share: 2016, Adoption of accounting standard updates 1.S0: 2017, $1.5 27 072 21 716 1.995 Ending balance Accumulated other comprehensive income (loss) (1,019) 1,6 ... Boginning balance Fareign ourrency translation 242 500 (210 tirement (7) 37 18 Cash fow hedoes 1.015 (1,019) (1,999) Ending balance Tre (12831) (13,032) (12,2S71 Beginning balance 1.1 (400) (601) Purchases 199 (13,032) 27 Issued under stock plans (13,935) (12,831) Ending balance 8,71B 8,947 7,568 Common stockholders' equity Noncontrolling interests in subsidiaries 50 57 7 alance 21 32 29 Net eaminas Other comprehensive income (loss) Dividends paid 52 43 Ending balance 8.990 8,770 S 7,818 Total equity See acompanying Notes to Consolidated Finanaial Stalements 29 Consolidated Statements of Cash Flows EMERSON ELECTRIC CO. SUBSIDIARIES Years ended September 30 (Dollars in millions) 2017 2018 2016 Operating activities Net eamings 2.224 1,550 1.604 d aperabons, net of tan ings to net cash pravided by operating activities: (451 125 Adjustmente t.. 636 75F Depreaation and amortization Changes in operating working captal 66 (45 (66 Pension funding 264 54 285 Cash from continuing operations 2,690 2.892 2.499 778) Cash from discontinued operations 2,892 Cash provided by aperating activities Investing activities Capital expenditures Purchases of businesses, nel of cash and cquivatents acquired (447) 517 (2.990) (2 1321 39 201 businesses (106) (101) 30 Oibr not (3,533 (2720h (549) Cash from contnuing operations Cash from discontinued operations 1514 (6261 (2,7201 Cash provided by (used in) investing activities Financing activities (1,635) 341 (34) Net increase (decrease) in shart-term borrowings Proceeds fram short-term borowings greater than three months 1.264 r90 (1,174) wings greater than three months 241 (254 Payments of long-term debt Dividends paid Purchases of common stocko (254) (1.239) (1,229) 1,22r ,000) (19) 27 Other, net 12.092) (3.591) 2.045) Cash used in financing activities 45 149 (82) 129 Effecd of exchange rate changes increase (Decrease) In cash and equivalents cash and eguivalents (1.969) (120) 3.054 3,182 3,082 h and equivatents and equivalents 3.182 Endin 3082 1,093 Changes In operating working capital (251 (189 162 inventories .. Other current assets 135 (22) 115 Accounts payable 74 17 (57) Accrued expenses (15 (83 (44 (44) 93 Total changes in operating working capital See accompanying Noles to Consaidated Financial Stalaments. 30 aodted Statements of Earnings C CO.&SUESIDIARIES cptember 30 except per share amounts Del 2016 2017 2018 Net sales 17,408 14.522 15.264 Costs and expenses a nel and administrative expenses 8,e60 9.948 8,260 3,6 Other deductions, net Inlerest expense, net of interest income of: 2016, $27 ... 376 165 188 159 , S13 Farni contlnulng operations before Income taxes Income taxes 697 443 Earnings from continuing operations DiEcontinued operations, net of tax: 2016, $269, 2017, $671; 2018, SD 1.619 2.224 1.675 45 (125 1.684 1.550 2,224 nings of subsidianes roting interests in 1618 ? 203 1635 Net eamings common stockholders Eaminas common stockholders: Earnings from continuing operations 1.590 1,643 2,203 Ciscantinued cperations, net af tax (125) Net eamings common stockholders 2.203 1,510 1,635 Basic earnings per share common stockholders: Earnings from continuing operations 2.46 2.54 48 Discontinued operations 0.07 (0.19) Basic earnings per common share 2.53 2.35 3.43 stockholders: Diluted earnings per share com 24 2.54 346 Discontinued operations 007 (0.19) 235 3.46 Dilutod earnings per common share 2.52 1 See accompanying Notes to Consolidated Financal Statements 26 Consolidated Statements of Comprehensive Income MERSON ELECTRIC CO. SUBSIDIARIES Years endod September 30 (Dollars in millions) 2018 2016 2017 Net earnings 1 550 1664 2224 Oth Income (loss), net of tac (231 (188) 441 Pension and postretirement Cash flow hedges. Total other comprehensive income (loss) (210) 500 242 (380) 97a Comprehensive income 84 2.528 2223 Less Noncontroling interests in comprehensive income of subsidiaries 31 Comprehensive income common stockhalders 1,253 2,498 2,207 See accompanying Notes to Consalidated Finandal Stalements. 21 Consolidatod Balance Sheets EMERSON ELECTRIC CO. & StUBSIDIARIES September 30 (Dollars and shares in milians, except per share amounts 2017 2018 ASSETS Current assets valenls less allowances of $91 in 2017 and $113 in 2018 3.062 1.093 R 3,344 3,072 Inventores Other current asscts 422 369 Total current assets 8252 6,619 Property, plant and equipment, net 3,321 3.562 Other assets Goodwill s316 Other intangibie assets 751 1890 Ceher 810 1,003 ather assels 8,016 19.509 T0.209 Tolal assets 20,390 LIABILITIES AND EQUITY Shad-tem bomowings and current maturities of long-term dett 1,623 Accounts payable Acorued expenses 2.342 65 5.045 2.536 Inc 64 ntabities 6,164 Long term debt 3.794 .137 Other labllitles 1,980 2.099 E Common stock, $0.50 par value authonized, 1,200.0 shares, issued, 953 4 shares outstanding, 641.7 shares in 2017: 529 2 shares in 2018 AT 477 Additional paid-in-cacilal 29: 21,995 23,072 Accumuleted other comprehensive income (loss) (1,019) 1.015) 22,882 Less: Cost of cemmon stock in treasury, 311.7 shares in 2017, 324 2 shares in 201B ..on Common stockholders' equlty ling inleres 47 8,718 subsidianes 52 43 Total equlty 8,770 19.589 8.990 Total liabilities and equity 20,390 See accompanying Nates to Consoidated Fnancial Statements. 28 EMERSON ELECTRIC CO&rGinBIE ES Dotars in millions, except per share amounts) 2018 2017 2016 4T7 4T7 477 Common stock Additional pald-in-capital Beginning balance 297 205 170 2 51 35 batance 297 348 Retained eamings 21,995 2,203 21,716 21.308 . 1.518 1635 slockholders (1,239) (1.229) (1,227) : 2018, $1.94 ) Dividends paid (per share: 2016, Adoption of accounting standard updates 1.S0: 2017, $1.5 27 072 21 716 1.995 Ending balance Accumulated other comprehensive income (loss) (1,019) 1,6 ... Boginning balance Fareign ourrency translation 242 500 (210 tirement (7) 37 18 Cash fow hedoes 1.015 (1,019) (1,999) Ending balance Tre (12831) (13,032) (12,2S71 Beginning balance 1.1 (400) (601) Purchases 199 (13,032) 27 Issued under stock plans (13,935) (12,831) Ending balance 8,71B 8,947 7,568 Common stockholders' equity Noncontrolling interests in subsidiaries 50 57 7 alance 21 32 29 Net eaminas Other comprehensive income (loss) Dividends paid 52 43 Ending balance 8.990 8,770 S 7,818 Total equity See acompanying Notes to Consolidated Finanaial Stalements 29 Consolidated Statements of Cash Flows EMERSON ELECTRIC CO. SUBSIDIARIES Years ended September 30 (Dollars in millions) 2017 2018 2016 Operating activities Net eamings 2.224 1,550 1.604 d aperabons, net of tan ings to net cash pravided by operating activities: (451 125 Adjustmente t.. 636 75F Depreaation and amortization Changes in operating working captal 66 (45 (66 Pension funding 264 54 285 Cash from continuing operations 2,690 2.892 2.499 778) Cash from discontinued operations 2,892 Cash provided by aperating activities Investing activities Capital expenditures Purchases of businesses, nel of cash and cquivatents acquired (447) 517 (2.990) (2 1321 39 201 businesses (106) (101) 30 Oibr not (3,533 (2720h (549) Cash from contnuing operations Cash from discontinued operations 1514 (6261 (2,7201 Cash provided by (used in) investing activities Financing activities (1,635) 341 (34) Net increase (decrease) in shart-term borrowings Proceeds fram short-term borowings greater than three months 1.264 r90 (1,174) wings greater than three months 241 (254 Payments of long-term debt Dividends paid Purchases of common stocko (254) (1.239) (1,229) 1,22r ,000) (19) 27 Other, net 12.092) (3.591) 2.045) Cash used in financing activities 45 149 (82) 129 Effecd of exchange rate changes increase (Decrease) In cash and equivalents cash and eguivalents (1.969) (120) 3.054 3,182 3,082 h and equivatents and equivalents 3.182 Endin 3082 1,093 Changes In operating working capital (251 (189 162 inventories .. Other current assets 135 (22) 115 Accounts payable 74 17 (57) Accrued expenses (15 (83 (44 (44) 93 Total changes in operating working capital See accompanying Noles to Consaidated Financial Stalaments. 30