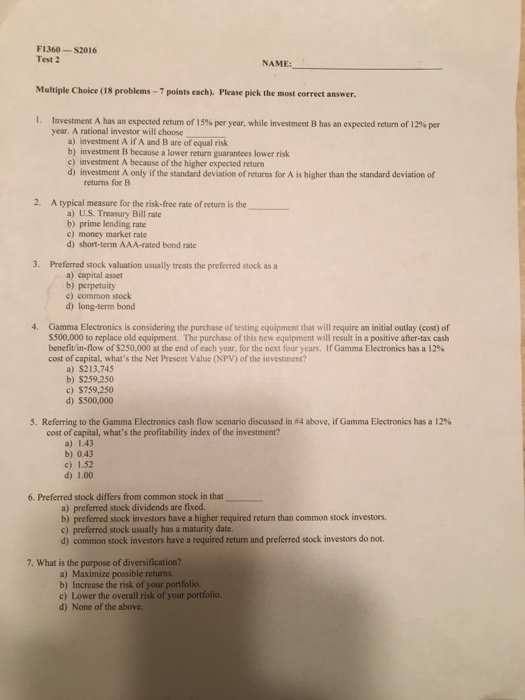

Question: F1360--S2016 Test 2 NAME: Multiple Choice (18 problems-7 points each). Please pick the most correet answer l. Investment A has an expected return of year.

F1360--S2016 Test 2 NAME: Multiple Choice (18 problems-7 points each). Please pick the most correet answer l. Investment A has an expected return of year. A rational investor will choose 5% per year, while investment B has an expected return of i 2% per a) investment A if A and B are of equal risk b) investment B because a lower return guarantees lower risk e) investment A because of the higher expected return d) investment A only if the standard deviation of returns for A is higher than the standard deviation of returns for B 2. A typical measure for the risk-free rate of return is the a) U.S. Treasury Bill rate b) prime lending rate e) money market rate d) short-term AAA-rated bond rate 3. Preferred stock valuation usually treats the preferred stock as a a) capital asset b) perpetuity c) common stock d) long-term bond Gamma Electronics is considering the purchase of testing equipment that will require an initial outlay (cost) of $500,000 to replace old equipment. The purchase of this new equipment will result in a positive after-tax cash benefitin-flow of$250.000 at the end ofeach year, for the next four years. If Gamma Electronics has a 12% cost of capital, what's the Net Present Value (NPV) of the investment 4. a) $213,745 b) $259,250 c) $759,250 d) $500,000 5. Referring to the Gamma Electronics cash flow scenario discussed in #4 above, if Gamma Electronics has a 12% cost of capital, what's the profitability index of the investment? a) 1.43 b) 0.43 c) 1.52 d) 1.00 6. Preferred stock differs from common stock in that a) preferred stock dividends are fixed. b) preferred stock investors have a higher required return than common stock investors. c) preferred stock usually has a maturity date. d) common stock investors have a required return and preferred stock investors do not. 7. Wha t is the purpose of diversification? a) Maximize possible returns b) Increase the risk of your portfolio. c) Lower the overall risk of your portfolio. d) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts