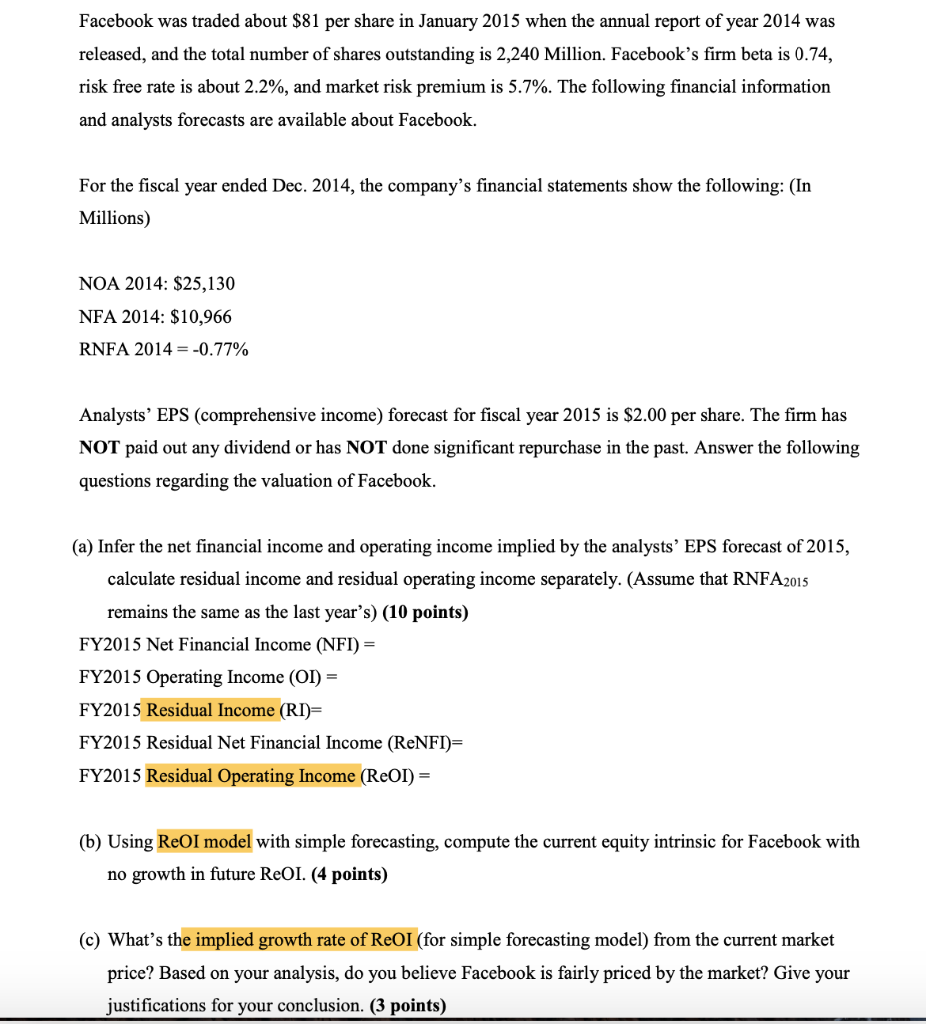

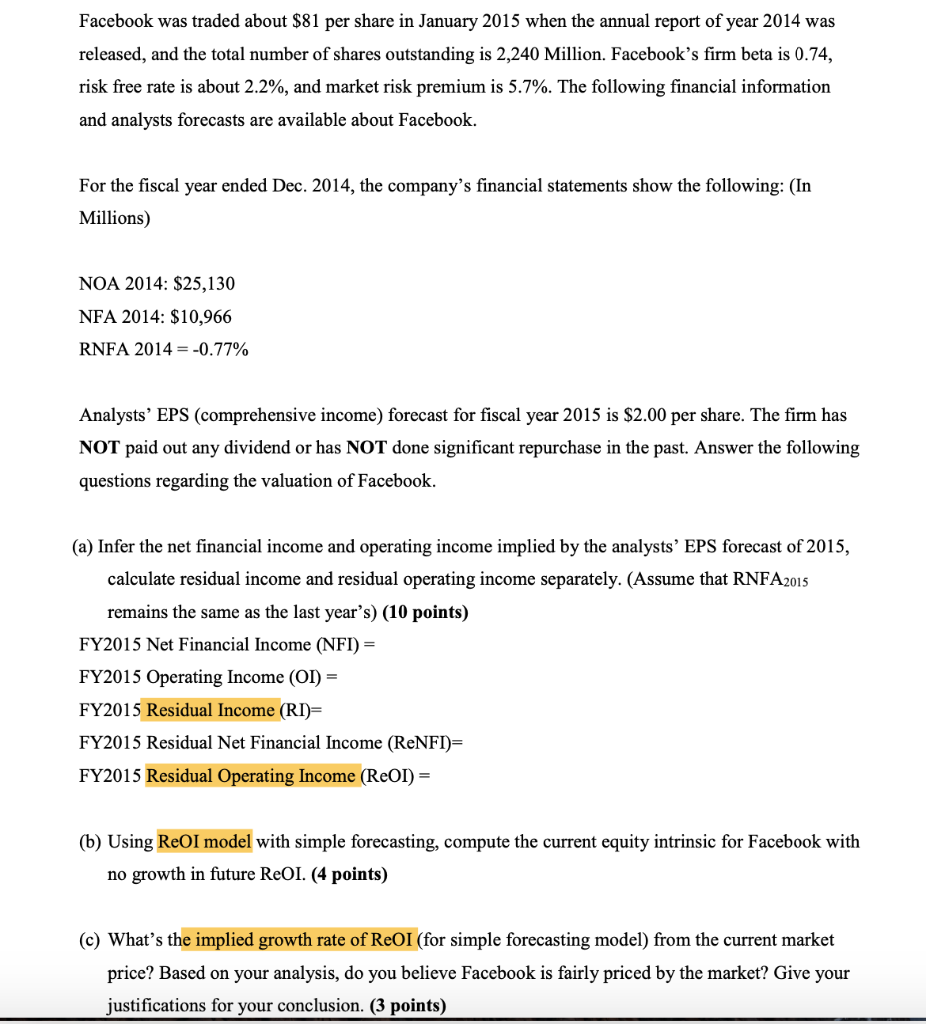

Facebook was traded about $81 per share in January 2015 when the annual report of year 2014 was released, and the total number of shares outstanding is 2,240 Million. Facebook's firm beta is 0.74, risk free rate is about 2.2%, and market risk premium is 5.7%. The following financial information and analysts forecasts are available about Facebook. For the fiscal year ended Dec. 2014, the company's financial statements show the following: (In Millions) NOA 2014: $25,130 NFA 2014: $10,966 RNFA 2014 = -0.77% Analysts' EPS (comprehensive income) forecast for fiscal year 2015 is $2.00 per share. The firm has NOT paid out any dividend or has NOT done significant repurchase in the past. Answer the following questions regarding the valuation of Facebook. (a) Infer the net financial income and operating income implied by the analysts' EPS forecast of 2015, calculate residual income and residual operating income separately. (Assume that RNFA2015 remains the same as the last year's) (10 points) FY2015 Net Financial Income (NFI) = FY2015 Operating Income (OI) = FY2015 Residual Income (RI)= FY2015 Residual Net Financial Income (ReNFI)= FY2015 Residual Operating Income (ReOI) = (b) Using ReOI model with simple forecasting, compute the current equity intrinsic for Facebook with no growth in future ReOI. (4 points) (c) What's the implied growth rate of ReOI (for simple forecasting model) from the current market price? Based on your analysis, do you believe Facebook is fairly priced by the market? Give your justifications for your conclusion. (3 points) Facebook was traded about $81 per share in January 2015 when the annual report of year 2014 was released, and the total number of shares outstanding is 2,240 Million. Facebook's firm beta is 0.74, risk free rate is about 2.2%, and market risk premium is 5.7%. The following financial information and analysts forecasts are available about Facebook. For the fiscal year ended Dec. 2014, the company's financial statements show the following: (In Millions) NOA 2014: $25,130 NFA 2014: $10,966 RNFA 2014 = -0.77% Analysts' EPS (comprehensive income) forecast for fiscal year 2015 is $2.00 per share. The firm has NOT paid out any dividend or has NOT done significant repurchase in the past. Answer the following questions regarding the valuation of Facebook. (a) Infer the net financial income and operating income implied by the analysts' EPS forecast of 2015, calculate residual income and residual operating income separately. (Assume that RNFA2015 remains the same as the last year's) (10 points) FY2015 Net Financial Income (NFI) = FY2015 Operating Income (OI) = FY2015 Residual Income (RI)= FY2015 Residual Net Financial Income (ReNFI)= FY2015 Residual Operating Income (ReOI) = (b) Using ReOI model with simple forecasting, compute the current equity intrinsic for Facebook with no growth in future ReOI. (4 points) (c) What's the implied growth rate of ReOI (for simple forecasting model) from the current market price? Based on your analysis, do you believe Facebook is fairly priced by the market? Give your justifications for your conclusion. (3 points)