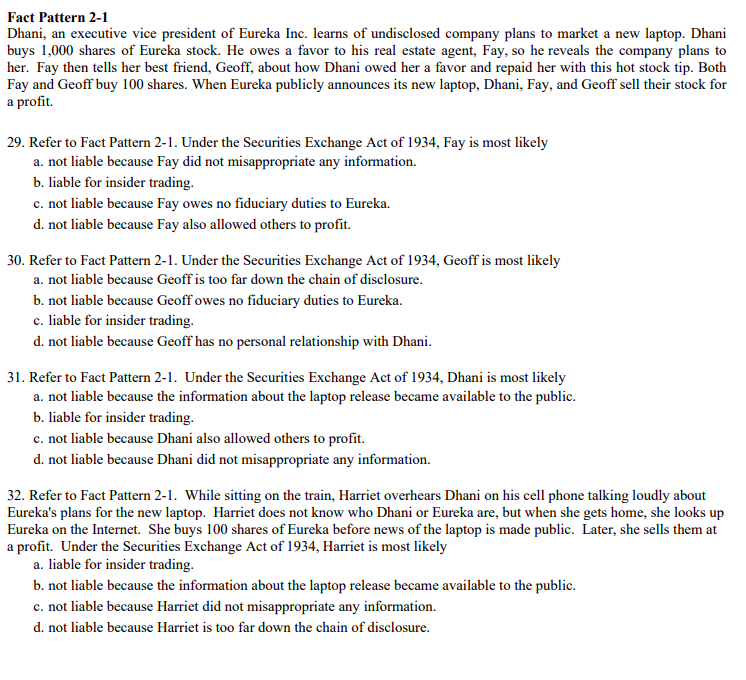

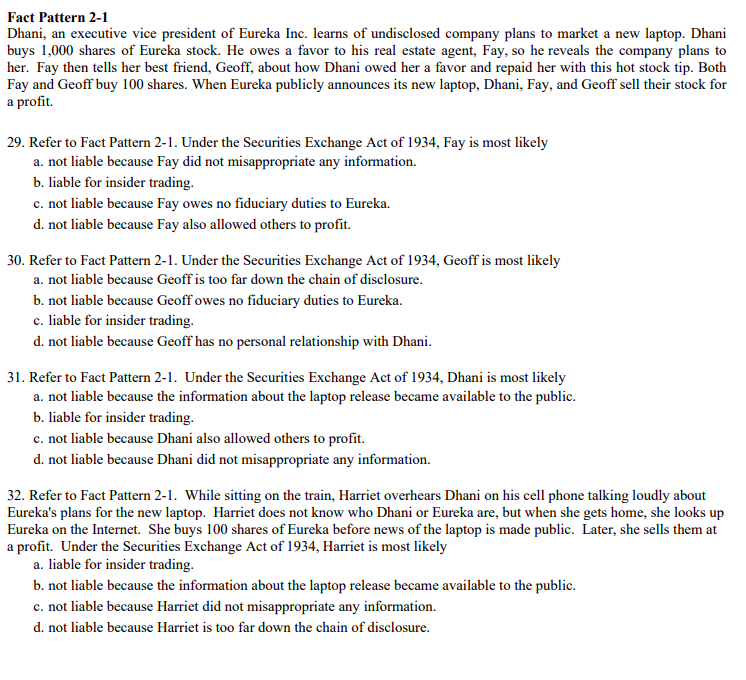

Fact Pattern 2-1 Dhani, an executive vice president of Eureka Inc. learns of undisclosed company plans to market a new laptop. Dhani buys 1,000 shares of Eureka stock. He owes a favor to his real estate agent, Fay, so he reveals the company plans to her. Fay then tells her best friend, Geoff, about how Dhani owed her a favor and repaid her with this hot stock tip. Both Fay and Geoff buy 100 shares. When Eureka publicly announces its new laptop, Dhani, Fay, and Geoff sell their stock for a profit. 29. Refer to Fact Pattern 2-1. Under the Securities Exchange Act of 1934, Fay is most likely a. not liable because Fay did not misappropriate any information. b. liable for insider trading. c. not liable because Fay owes no fiduciary duties to Eureka. d. not liable because Fay also allowed others to profit. 30. Refer to Fact Pattern 2-1. Under the Securities Exchange Act of 1934, Geoff is most likely a. not liable because Geoff is too far down the chain of disclosure. b. not liable because Geoff owes no fiduciary duties to Eureka. c. liable for insider trading. d. not liable because Geoff has no personal relationship with Dhani. 31. Refer to Fact Pattern 2-1. Under the Securities Exchange Act of 1934, Dhani is most likely a. not liable because the information about the laptop release became available to the public. b. liable for insider trading. c. not liable because Dhani also allowed others to profit. d. not liable because Dhani did not misappropriate any information. 32. Refer to Fact Pattern 2-1. While sitting on the train, Harriet overhears Dhani on his cell phone talking loudly about Eureka's plans for the new laptop. Harriet does not know who Dhani or Eureka are, but when she gets home, she looks up Eureka on the Internet. She buys 100 shares of Eureka before news of the laptop is made public. Later, she sells them at a profit. Under the Securities Exchange Act of 1934, Harriet is most likely a. liable for insider trading. b. not liable because the information about the laptop release became available to the public. c. not liable because Harriet did not misappropriate any information. d. not liable because Harriet is too far down the chain of disclosure