Answered step by step

Verified Expert Solution

Question

1 Approved Answer

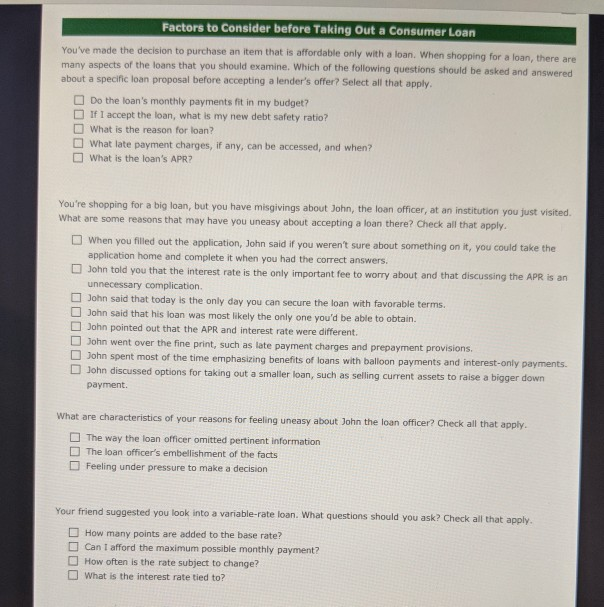

Factors to Consider before Taking Out a Consumer Loan You've made the decision to purchase an item that is affordable only with a loan. When

Factors to Consider before Taking Out a Consumer Loan You've made the decision to purchase an item that is affordable only with a loan. When shopping for many aspects of the loans that you should examine. Which of the following questions should be asked and answered about a specific loan proposal before accepting a lender's offer? Select all that apply. a loan, there are Do the loan's monthly payments fit in my budget? If I accept the loan, what is my new debt safety ratio? What is the reason for loan? What late payment charges, if any, can be accessed, and when? What is the loan's APR? You're shopping for a big loan, but you have misgivings about John, the loan officer, at an institution you just visited What are some reasons that may have you uneasy about accepting a loan there? Check all that apply. When you filled out the application, John said if you weren't sure about something on it, you could take the application home and complete it when you had the correct answers John told you that the interest rate is the only important fee to worry about and that discussing the APR is an unnecessary complication. said that today is the only day you can secure the loan with favorable terms. John said that his loan was most likely the only one you'd be able to obtain. John pointed out that the APR and interest rate were different. John went over the fine print, such as late payment charges and prepayment provisions hn spent most of the time emphasizing benefits of loans with balloon payments and interest-only payments. Joh n discussed options for taking out a smaller loan, such as selling current assets to raise a bigger dowr payment. What are characteristics of your reasons for feeling uneasy about John the loan officer? Check all that apply. The way the loan officer omitted pertinent information The loan officer's embellishment of the facts Feeling under pressure to make a decision Your friend suggested you look into a variable-rate loan. What questions should you ask? Check all that apply. How many points are added to the base rate? Can I afford the maximum possible monthly payment? How often is the rate subject to change? What is the interest rate tied to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started