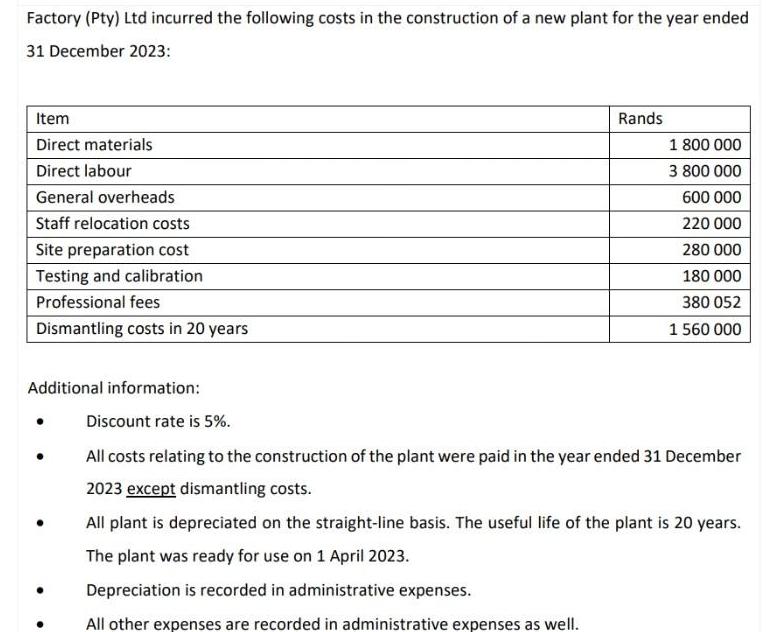

Factory (Pty) Ltd incurred the following costs in the construction of a new plant for the year ended 31 December 2023: Item Direct materials

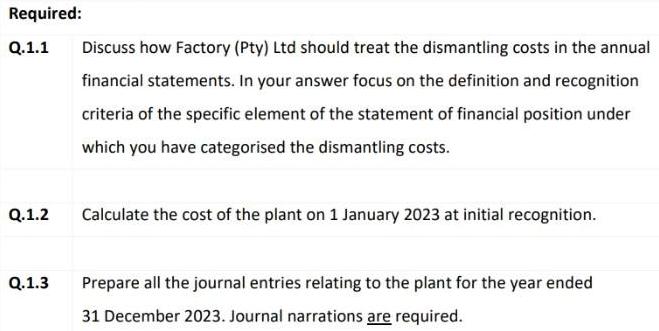

Factory (Pty) Ltd incurred the following costs in the construction of a new plant for the year ended 31 December 2023: Item Direct materials Direct labour General overheads Staff relocation costs Site preparation cost Testing and calibration Professional fees Dismantling costs in 20 years Additional information: Rands 1 800 000 3 800 000 600 000 220 000 280 000 180 000 380 052 1 560 000 Discount rate is 5%. All costs relating to the construction of the plant were paid in the year ended 31 December 2023 except dismantling costs. All plant is depreciated on the straight-line basis. The useful life of the plant is 20 years. The plant was ready for use on 1 April 2023. Depreciation is recorded in administrative expenses. All other expenses are recorded in administrative expenses as well. Required: Q.1.1 Q.1.2 Q.1.3 Discuss how Factory (Pty) Ltd should treat the dismantling costs in the annual financial statements. In your answer focus on the definition and recognition criteria of the specific element of the statement of financial position under which you have categorised the dismantling costs. Calculate the cost of the plant on 1 January 2023 at initial recognition. Prepare all the journal entries relating to the plant for the year ended 31 December 2023. Journal narrations are required.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Q11 Factory Pty Ltd should treat the dismantling costs as part of the cost of the plant Dismantling costs incurred in the future to retire or decommis...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started