Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr Sun purchased a residential flat in Mong Kok on 1 May 2021 for long-term investment purpose. He engaged a property agent to let

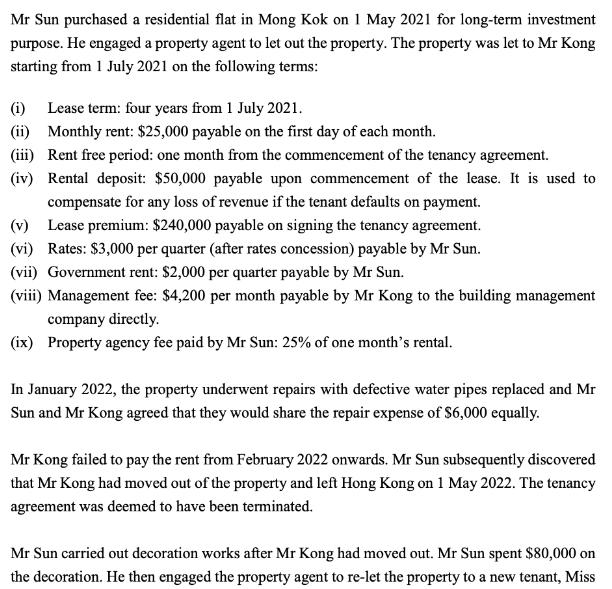

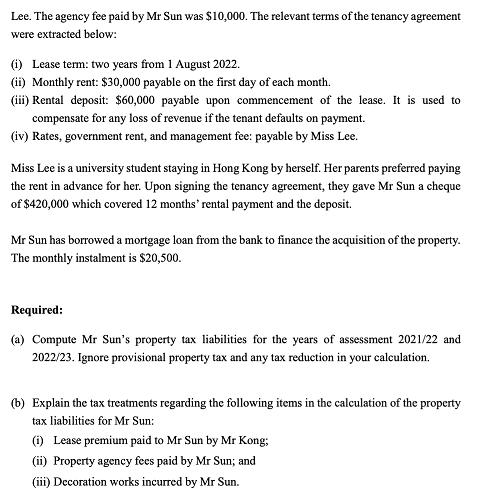

Mr Sun purchased a residential flat in Mong Kok on 1 May 2021 for long-term investment purpose. He engaged a property agent to let out the property. The property was let to Mr Kong starting from 1 July 2021 on the following terms: (i) Lease term: four years from 1 July 2021. (ii) Monthly rent: $25,000 payable on the first day of each month. (iii) (iv) Rent free period: one month from the commencement of the tenancy agreement. Rental deposit: $50,000 payable upon commencement of the lease. It is used to compensate for any loss of revenue if the tenant defaults on payment. (v) Lease premium: $240,000 payable on signing the tenancy agreement. (vi) Rates: $3,000 per quarter (after rates concession) payable by Mr Sun. (vii) Government rent: $2,000 per quarter payable by Mr Sun. (viii) Management fee: $4,200 per month payable by Mr Kong to the building management company directly. (ix) Property agency fee paid by Mr Sun: 25% of one month's rental. In January 2022, the property underwent repairs with defective water pipes replaced and Mr Sun and Mr Kong agreed that they would share the repair expense of $6,000 equally. Mr Kong failed to pay the rent from February 2022 onwards. Mr Sun subsequently discovered that Mr Kong had moved out of the property and left Hong Kong on 1 May 2022. The tenancy agreement was deemed to have been terminated. Mr Sun carried out decoration works after Mr Kong had moved out. Mr Sun spent $80,000 on the decoration. He then engaged the property agent to re-let the property to a new tenant, Miss Lee. The agency fee paid by Mr Sun was $10,000. The relevant terms of the tenancy agreement were extracted below: (i) Lease term: two years from 1 August 2022. (ii) Monthly rent: $30,000 payable on the first day of each month. (iii) Rental deposit: $60,000 payable upon commencement of the lease. It is used to compensate for any loss of revenue if the tenant defaults on payment. (iv) Rates, government rent, and management fee: payable by Miss Lee. Miss Lee is a university student staying in Hong Kong by herself. Her parents preferred paying the rent in advance for her. Upon signing the tenancy agreement, they gave Mr Sun a cheque of $420,000 which covered 12 months' rental payment and the deposit. Mr Sun has borrowed a mortgage loan from the bank to finance the acquisition of the property. The monthly instalment is $20,500. Required: (a) Compute Mr Sun's property tax liabilities for the years of assessment 2021/22 and 2022/23. Ignore provisional property tax and any tax reduction in your calculation. (b) Explain the tax treatments regarding the following items in the calculation of the property tax liabilities for Mr Sun: (i) Lease premium paid to Mr Sun by Mr Kong; (ii) Property agency fees paid by Mr Sun; and (iii) Decoration works incurred by Mr Sun.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To compute Mr Suns property tax liabilities for the years of assessment 202122 and 202223 we need to consider his rental income and allowable deduct...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started