Question

Facts: 1.The income statements for Road Inc. and Runner Inc. for the year ended December 31, 2021 are attached. Road Inc. acquired 60% of the

Facts:

1.The income statements for Road Inc. and Runner Inc. for the year ended December 31, 2021 are attached. Road Inc. acquired 60% of the shares of Runner Inc. on the date that Runner Inc. was incorporated.

2.Road sells inventory parts to Runner at 25% above cost. Sales by Road to Runner in 2021 were

$ 100,000. Included in Runners inventories were parts purchased from Road amounting to $ 21,250 in beginning inventory (which were sold in 2021 to third parties) and $ 28,750 in ending inventory.

3.Runner sells finished goods back to Road at a price which generates a 30% gross profit. Total sales by Runner to Road in 2021 were $ 180,000. Included in the inventories of Road were finished goods purchased from Runner amounting to $ 11,000 in beginning inventory (which were sold in 2021 to third parties) and $ 3,000 in ending inventory.

4.Runner rents an office building from Road and paid monthly rent of $ 2,400 in 2021.

5.Road issued $ 600,000 of notes payable at 5% , of which Runner owns $ 460,000 as notes receivable.

6.The income tax rate for both companies is 40 %.

7. The retained earnings balance at December 31, 2020 for Road was $ 685,000 and for Runner was $ 375,000. Also, dividends declared in 2021 by Road were $ 40,000 and by Runner were $ 30,000.

Required

1.(a)Using the above information, prepare a consolidated statement of income for the year ended December 31, 2021 using the worksheet provided. Calculate the allocation of consolidated income between the CI and NCI and disclose on the income statement.

(b)Prepare all elimination consolidation journal entries. Show any necessary calculations.

( c)Calculate consolidated retained earnings at January 1, 2021 and dividends declared that would appear in the consolidated financial statements. Show all calculations.

(d)Calculate the CIs share of consolidated income using two different methods.

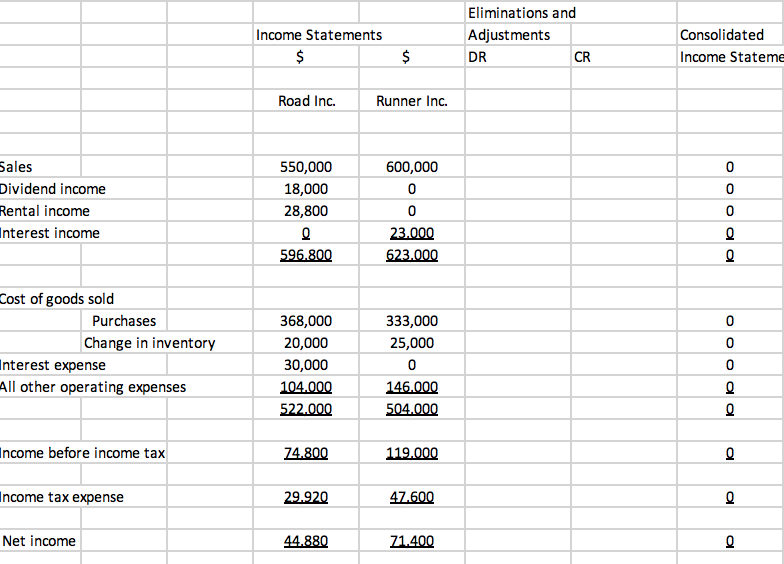

Worksheet Provided:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started