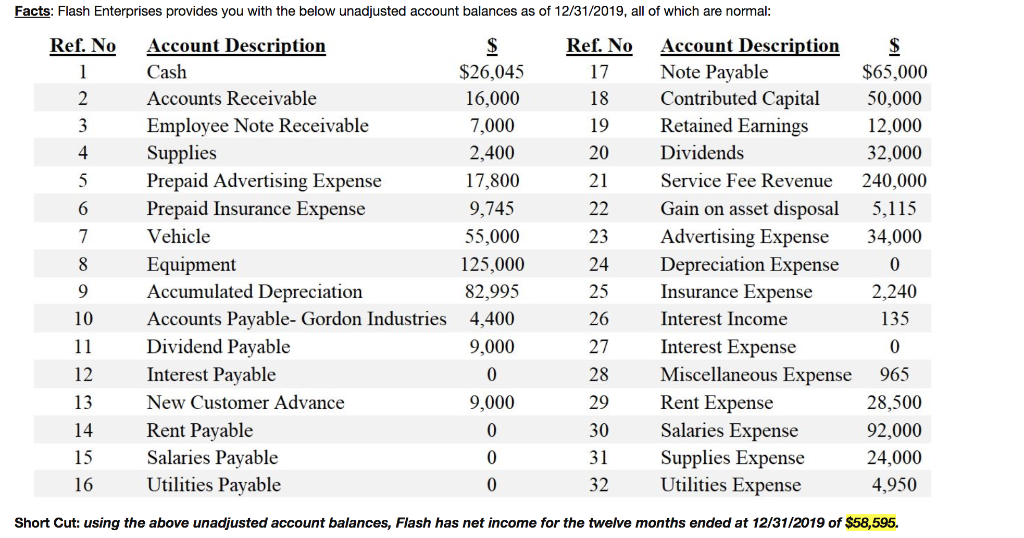

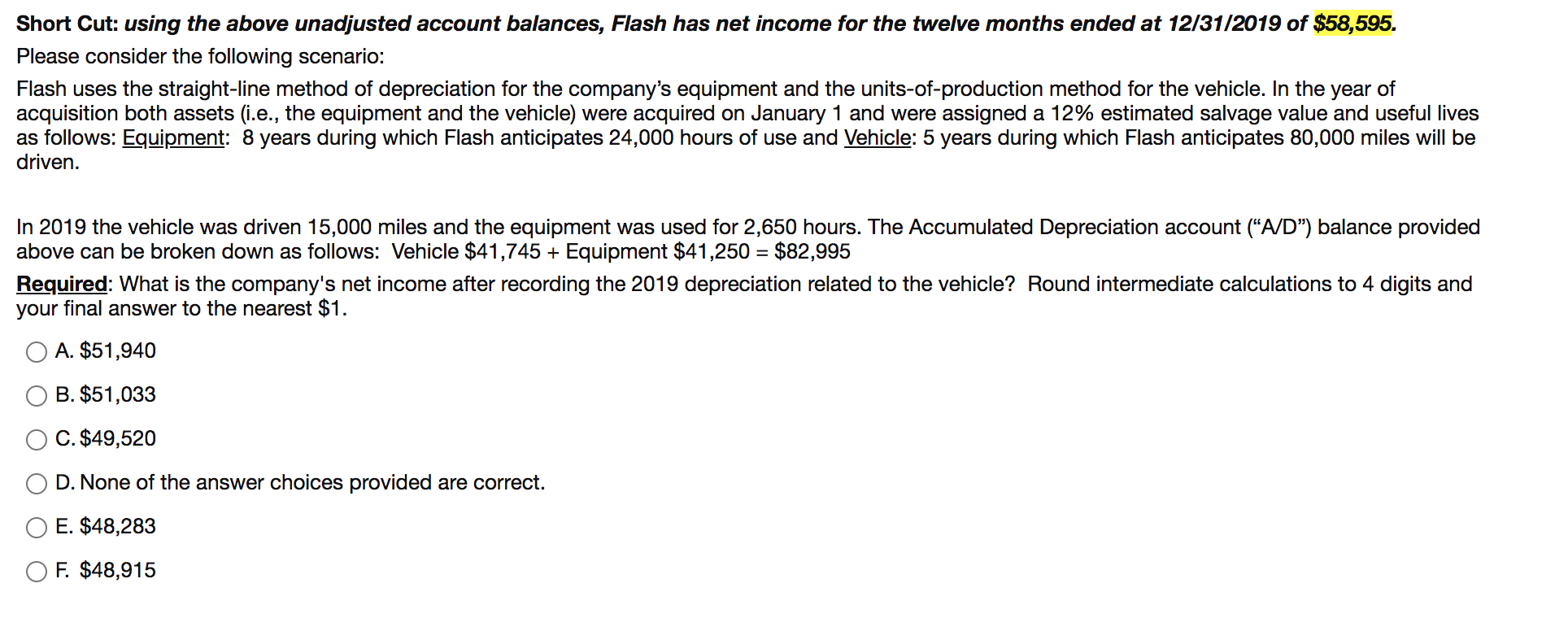

Facts: Flash Enterprises provides you with the below unadjusted account balances as of 12/31/2019, all of which are normal: Ref. No 1 Ref. No 17 18 2 3 4 19 20 5 6 21 22 23 7 Account Description $ Cash $26,045 Accounts Receivable 16,000 Employee Note Receivable 7,000 Supplies 2,400 Prepaid Advertising Expense 17,800 Prepaid Insurance Expense 9,745 Vehicle 55,000 Equipment 125,000 Accumulated Depreciation 82,995 Accounts Payable-Gordon Industries 4,400 Dividend Payable 9,000 Interest Payable 0 New Customer Advance 9,000 Rent Payable 0 Salaries Payable 0 Utilities Payable 0 $ $65,000 50,000 12,000 32,000 240,000 5,115 34,000 0 2.240 135 8 Account Description Note Payable Contributed Capital Retained Earnings Dividends Service Fee Revenue Gain on asset disposal Advertising Expense Depreciation Expense Insurance Expense Interest Income Interest Expense Miscellaneous Expense Rent Expense Salaries Expense Supplies Expense Utilities Expense 9 24 25 26 27 28 10 11 0 12 13 29 14 965 28,500 92,000 24,000 4,950 30 31 32 15 16 Short Cut: using the above unadjusted account balances, Flash has net income for the twelve months ended at 12/31/2019 of $58,595. Short Cut: using the above unadjusted account balances, Flash has net income for the twelve months ended at 12/31/2019 of $58,595. Please consider the following scenario: Flash uses the straight-line method of depreciation for the company's equipment and the units-of-production method for the vehicle. In the year of acquisition both assets (i.e., the equipment and the vehicle) were acquired on January 1 and were assigned a 12% estimated salvage value and useful lives as follows: Equipment: 8 years during which Flash anticipates 24,000 hours of use and Vehicle: 5 years during which Flash anticipates 80,000 miles will be driven. In 2019 the vehicle was driven 15,000 miles and the equipment was used for 2,650 hours. The Accumulated Depreciation account ("A/D) balance provided above can be broken down as follows: Vehicle $41,745 + Equipment $41,250 = $82,995 Required: What is the company's net income after recording the 2019 depreciation related to the vehicle? Round intermediate calculations to 4 digits and your final answer to the nearest $1. A. $51,940 B. $51,033 C. $49,520 D. None of the answer choices provided are correct. E. $48,283 O F. $48,915