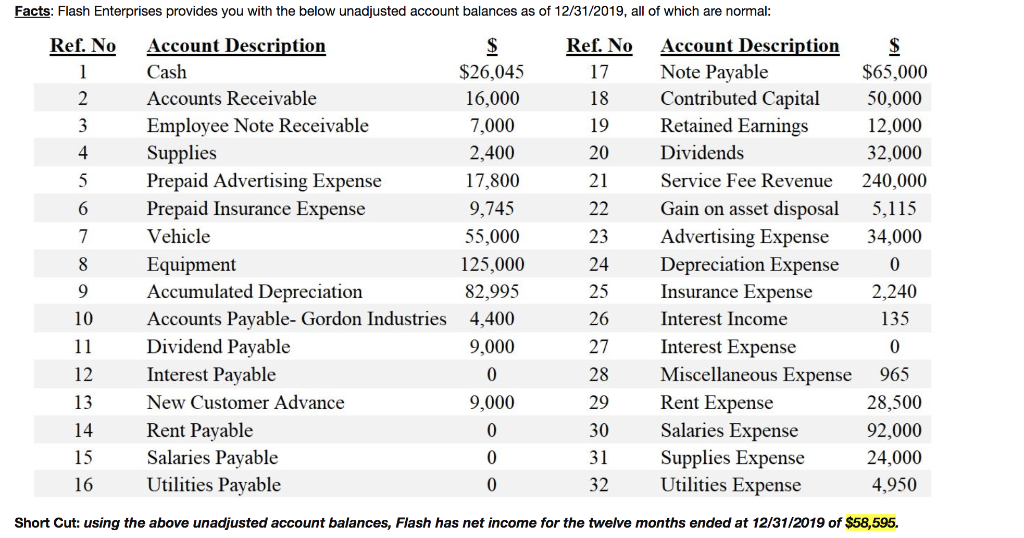

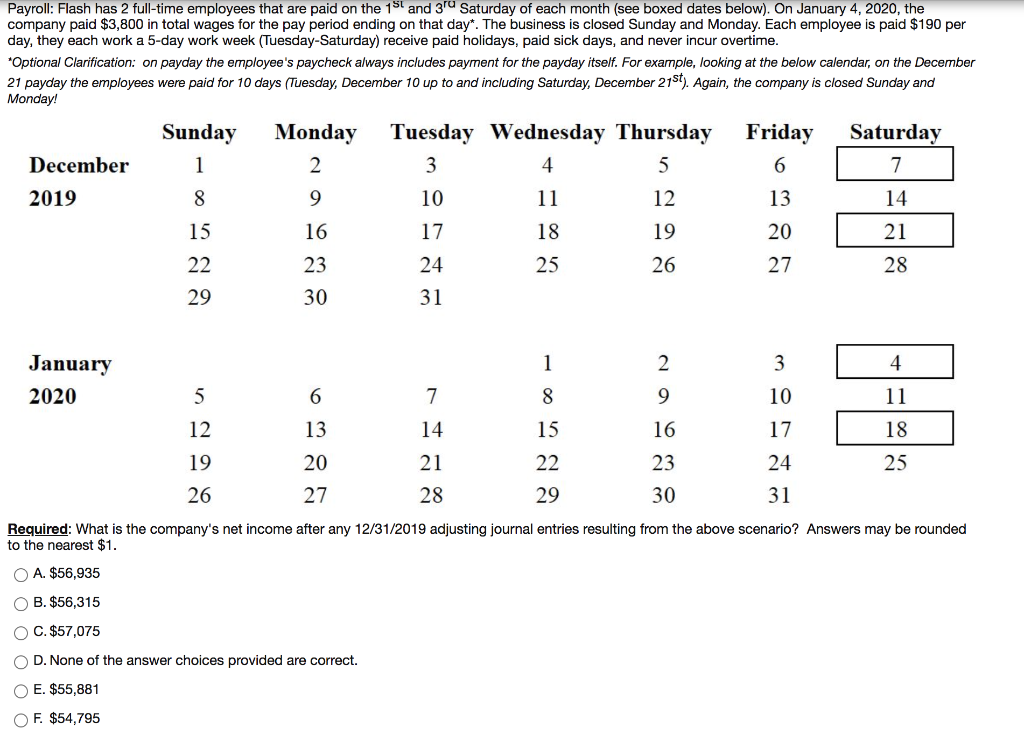

Facts: Flash Enterprises provides you with the below unadjusted account balances as of 12/31/2019, all of which are normal: Ref. No 1 Ref. No 17 18 2 3 4 19 20 5 6 21 22 23 7 Account Description $ Cash $26,045 Accounts Receivable 16,000 Employee Note Receivable 7,000 Supplies 2,400 Prepaid Advertising Expense 17,800 Prepaid Insurance Expense 9,745 Vehicle 55,000 Equipment 125,000 Accumulated Depreciation 82,995 Accounts Payable-Gordon Industries 4,400 Dividend Payable 9,000 Interest Payable 0 New Customer Advance 9,000 Rent Payable 0 Salaries Payable 0 Utilities Payable 0 $ $65,000 50,000 12,000 32,000 240,000 5,115 34,000 0 2.240 135 8 Account Description Note Payable Contributed Capital Retained Earnings Dividends Service Fee Revenue Gain on asset disposal Advertising Expense Depreciation Expense Insurance Expense Interest Income Interest Expense Miscellaneous Expense Rent Expense Salaries Expense Supplies Expense Utilities Expense 9 24 25 26 27 28 10 11 0 12 13 29 14 965 28,500 92,000 24,000 4,950 30 31 32 15 16 Short Cut: using the above unadjusted account balances, Flash has net income for the twelve months ended at 12/31/2019 of $58,595. Payroll: Flash has 2 full-time employees that are paid on the 15 and 3" Saturday of each month (see boxed dates below). On January 4, 2020, the company paid $3,800 in total wages for the pay period ending on that day. The business is closed Sunday and Monday. Each employee is paid $190 per day, they each work a 5-day work week (Tuesday-Saturday) receive paid holidays, paid sick days, and never incur overtime. Optional Clarification: on payday the employee's paycheck always includes payment for the payday itself. For example, looking at the below calendar, on the December 21 payday the employees were paid for 10 days (Tuesday, December 10 up to and including Saturday, December 21st). Again, the company is closed Sunday and Monday! Sunday Monday Tuesday Wednesday Thursday Friday Saturday December 1 2 3 4 5 6 7 2019 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 1 2 3 4 January 2020 5 6 7 8 9 10 11 12 13 15 16 17 18 14 21 19 20 22 23 24 25 26 27 28 29 30 31 Required: What is the company's net income after any 12/31/2019 adjusting journal entries resulting from the above scenario? Answers may be rounded to the nearest $1. A. $56,935 OB. $56,315 C. $57,075 OD. None of the answer choices provided are correct. E. $55,881 OF. $54,795 Facts: Flash Enterprises provides you with the below unadjusted account balances as of 12/31/2019, all of which are normal: Ref. No 1 Ref. No 17 18 2 3 4 19 20 5 6 21 22 23 7 Account Description $ Cash $26,045 Accounts Receivable 16,000 Employee Note Receivable 7,000 Supplies 2,400 Prepaid Advertising Expense 17,800 Prepaid Insurance Expense 9,745 Vehicle 55,000 Equipment 125,000 Accumulated Depreciation 82,995 Accounts Payable-Gordon Industries 4,400 Dividend Payable 9,000 Interest Payable 0 New Customer Advance 9,000 Rent Payable 0 Salaries Payable 0 Utilities Payable 0 $ $65,000 50,000 12,000 32,000 240,000 5,115 34,000 0 2.240 135 8 Account Description Note Payable Contributed Capital Retained Earnings Dividends Service Fee Revenue Gain on asset disposal Advertising Expense Depreciation Expense Insurance Expense Interest Income Interest Expense Miscellaneous Expense Rent Expense Salaries Expense Supplies Expense Utilities Expense 9 24 25 26 27 28 10 11 0 12 13 29 14 965 28,500 92,000 24,000 4,950 30 31 32 15 16 Short Cut: using the above unadjusted account balances, Flash has net income for the twelve months ended at 12/31/2019 of $58,595. Payroll: Flash has 2 full-time employees that are paid on the 15 and 3" Saturday of each month (see boxed dates below). On January 4, 2020, the company paid $3,800 in total wages for the pay period ending on that day. The business is closed Sunday and Monday. Each employee is paid $190 per day, they each work a 5-day work week (Tuesday-Saturday) receive paid holidays, paid sick days, and never incur overtime. Optional Clarification: on payday the employee's paycheck always includes payment for the payday itself. For example, looking at the below calendar, on the December 21 payday the employees were paid for 10 days (Tuesday, December 10 up to and including Saturday, December 21st). Again, the company is closed Sunday and Monday! Sunday Monday Tuesday Wednesday Thursday Friday Saturday December 1 2 3 4 5 6 7 2019 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 1 2 3 4 January 2020 5 6 7 8 9 10 11 12 13 15 16 17 18 14 21 19 20 22 23 24 25 26 27 28 29 30 31 Required: What is the company's net income after any 12/31/2019 adjusting journal entries resulting from the above scenario? Answers may be rounded to the nearest $1. A. $56,935 OB. $56,315 C. $57,075 OD. None of the answer choices provided are correct. E. $55,881 OF. $54,795