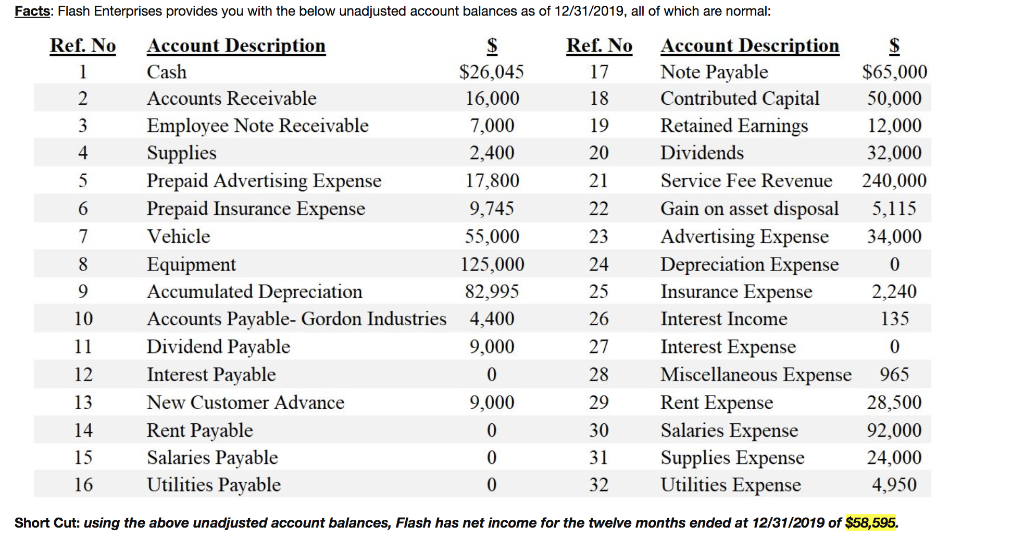

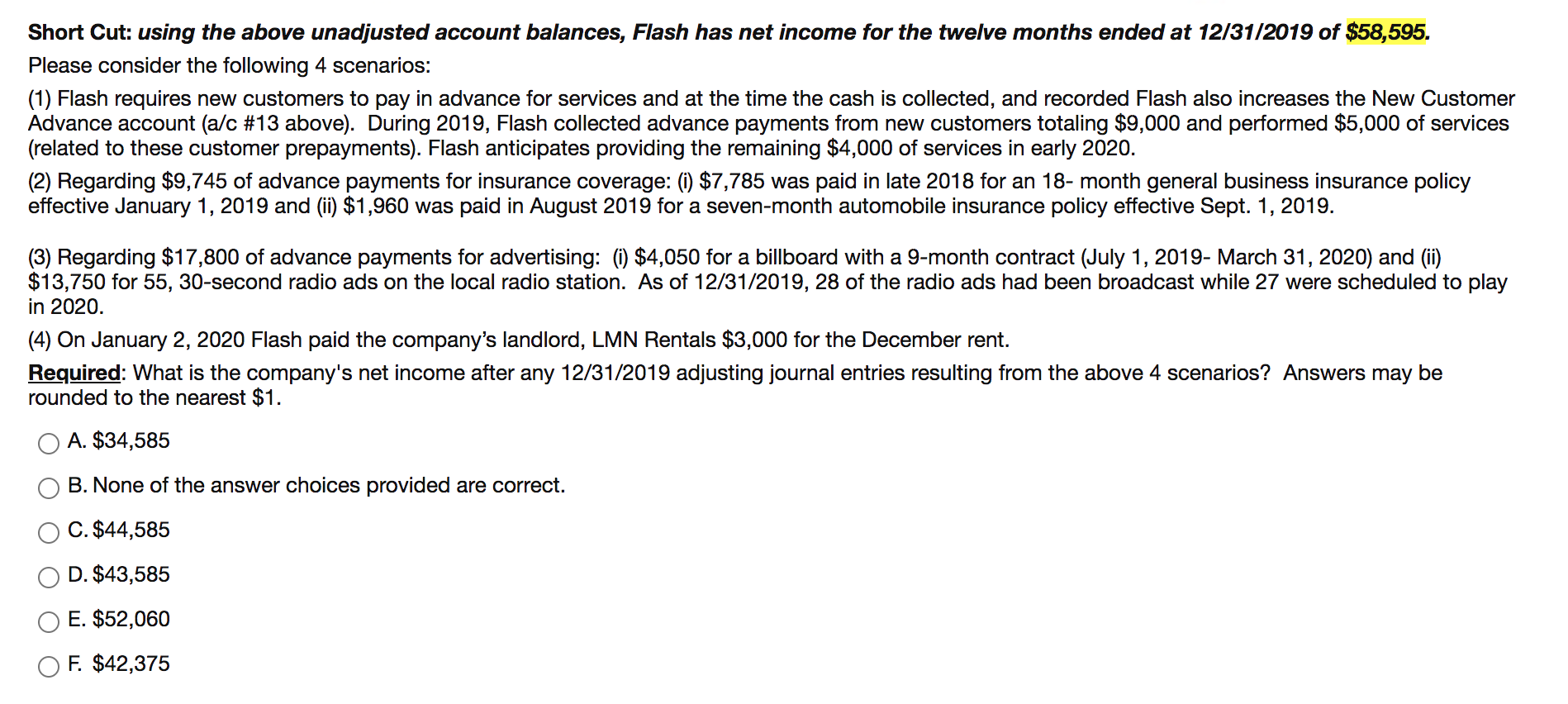

Facts: Flash Enterprises provides you with the below unadjusted account balances as of 12/31/2019, all of which are normal: Ref. No 1 Ref. No 17 18 2 3 4 19 20 5 6 21 22 23 7 Account Description $ Cash $26,045 Accounts Receivable 16,000 Employee Note Receivable 7,000 Supplies 2,400 Prepaid Advertising Expense 17,800 Prepaid Insurance Expense 9,745 Vehicle 55,000 Equipment 125,000 Accumulated Depreciation 82,995 Accounts Payable-Gordon Industries 4,400 Dividend Payable 9,000 Interest Payable 0 New Customer Advance 9,000 Rent Payable 0 Salaries Payable 0 Utilities Payable 0 $ $65,000 50,000 12,000 32,000 240,000 5,115 34,000 0 2.240 135 8 Account Description Note Payable Contributed Capital Retained Earnings Dividends Service Fee Revenue Gain on asset disposal Advertising Expense Depreciation Expense Insurance Expense Interest Income Interest Expense Miscellaneous Expense Rent Expense Salaries Expense Supplies Expense Utilities Expense 9 24 25 26 27 28 10 11 0 12 13 29 14 965 28,500 92,000 24,000 4,950 30 31 32 15 16 Short Cut: using the above unadjusted account balances, Flash has net income for the twelve months ended at 12/31/2019 of $58,595. Short Cut: using the above unadjusted account balances, Flash has net income for the twelve months ended at 12/31/2019 of $58,595. Please consider the following 4 scenarios: (1) Flash requires new customers to pay in advance for services and at the time the cash is collected, and recorded Flash also increases the New Customer Advance account (a/c #13 above). During 2019, Flash collected advance payments from new customers totaling $9,000 and performed $5,000 of services (related to these customer prepayments). Flash anticipates providing the remaining $4,000 of services in early 2020. (2) Regarding $9,745 of advance payments for insurance coverage: (i) $7,785 was paid in late 2018 for an 18-month general business insurance policy effective January 1, 2019 and (ii) $1,960 was paid in August 2019 for a seven-month automobile insurance policy effective Sept. 1, 2019. (3) Regarding $17,800 of advance payments for advertising: (i) $4,050 for a billboard with a 9-month contract (July 1, 2019- March 31, 2020) and (ii) $13,750 for 55, 30-second radio ads on the local radio station. As of 12/31/2019, 28 of the radio ads had been broadcast while 27 were scheduled to play in 2020. (4) On January 2, 2020 Flash paid the company's landlord, LMN Rentals $3,000 for the December rent. Required: What is the company's net income after any 12/31/2019 adjusting journal entries resulting from the above 4 scenarios? Answers may be rounded to the nearest $1. A. $34,585 B. None of the answer choices provided are correct. C. $44,585 D. $43,585 E. $52,060 F. $42,375