Question

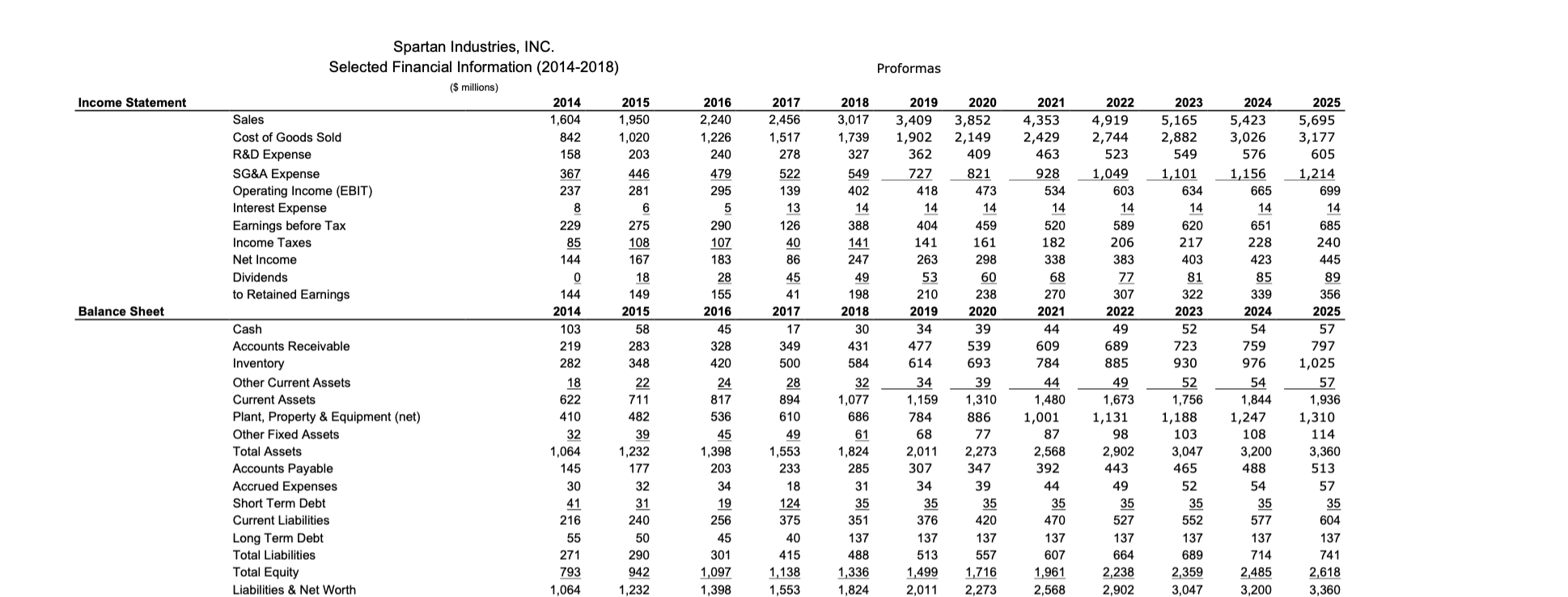

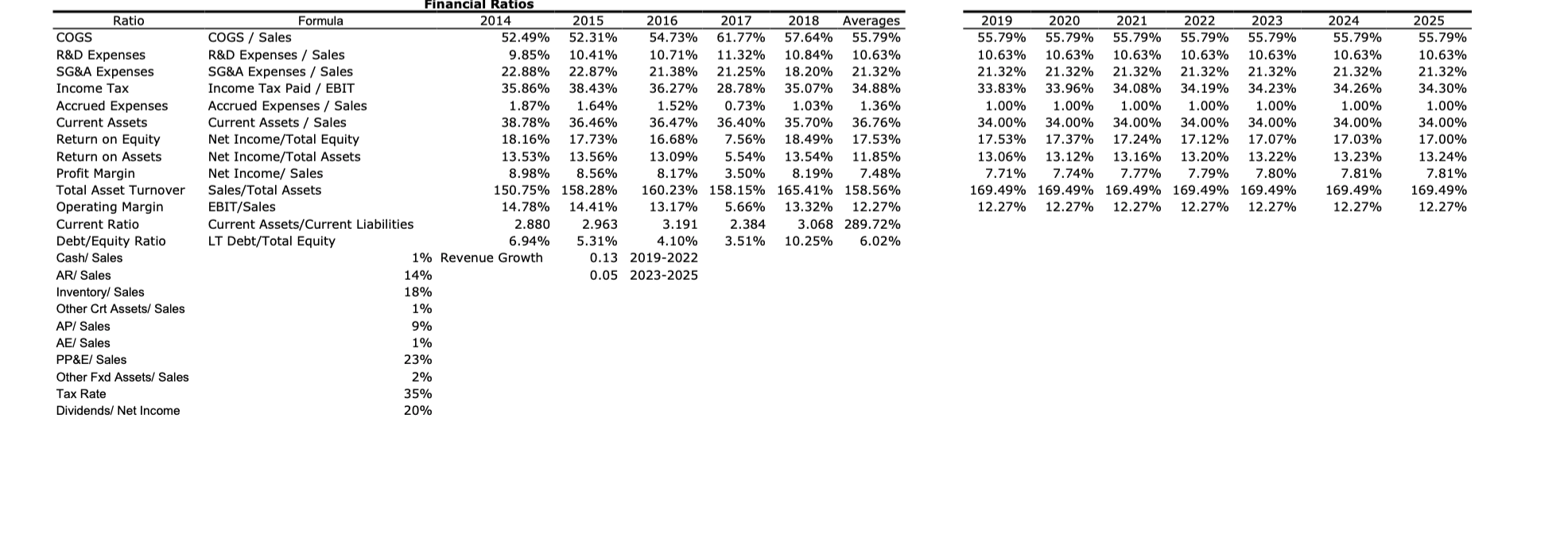

Facts: It is 2019 Wolverine Inc. is considering making an offer to purchase Spartan Industries, Inc. (Spartan). You are a financial analyst working at an

Facts:

It is 2019 Wolverine Inc. is considering making an offer to purchase Spartan Industries, Inc. (Spartan). You are a financial analyst working at an investment bank hired by Spartan tasked with determining a value of the company so they may evaluate the offer.

You determined that Spartan will require additional capital to support the production and distribution of its second generation of products. Accordingly, you must now determine the optimal debt level Spartan can comfortably support.

You are uncertain of Spartans appropriate Coverage Ratio (h) and Cost of Capital (rD), but you are aware of the following:

1.In 2018, Spartan issued $97 million in debt with an interest rate of 8.25%; and

2.Wolverine, a direct competitor of Spartan, uses a Coverage Ratio of 2.

Additionally, you are aware that Spartan has 50,000,000 shares outstanding with a current stock price of $58/share.

Using the historical financial information provided in the Excel file titled HW #3 Exhibit, and the above-provided information, calculate the following for BCI:

Optimal debt level;

Current short-and long-term debt;

Additional long-term debt;

Proformas Income Statement 278 281 418 14 14 14 8 229 6 275 126 520 685 0 141 228 338 28 68 81 85 89 4. Balance Sheet Spartan Industries, INC. selected Financial Information (2014-2018) ($ millions) 2014 2015 Sales 1,604 1,950 Cost of Goods Sold 842 1,020 R&D Expense 158 203 SG&A Expense 367 446 Operating Income (EBIT) 237 Interest Expense Earnings before Tax Income Taxes 108 Net Income 144 167 Dividends 18 to Retained Earnings 144 149 2014 2015 Cash 103 Accounts Receivable 219 283 Inventory 282 348 Other Current Assets 18 22 Current Assets 622 Plant, Property & Equipment (net) 410 482 Other Fixed Assets Total Assets 1,064 1,232 Accounts Payable 145 177 Accrued Expenses Short Term Debt 41 Current Liabilities 216 240 Long Term Debt 55 Total Liabilities 271 290 Total Equity 793 942 Liabilities & Net Worth 1,064 1,232 58 45 30 52 54 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2,240 2,4563,017 3,4093.8524 .3534,9195,1655,4235,695 1,226 1,517 1,739 1,9022 ,1492,4292,744 2,8823,0263,177 _240 327362409 463 523 549 576 605 479 522 549 727821 928 1,0491,101 1,156 1,214 295 402 473 534 603 634 665 699 14 14 14 14 14 290 388 404 459 589 620 651 141 161 182 206 217 240 183 247 263 298 383 403 423 445 49 53 60 77 155 198 210 238 270 307 322 339 356 2016 2017 2014 2019 2020 2021 2022 2023 2014 2025 17 34 39 44 49 57 328 349 431 477 539 609 689 723 797 420 500 584 614 693 784 885 930 976 1,025 34 39 52 57 817 1,077 1,159 1,310 1,480 1,673 1,756 1,844 1,936 536 610 686 784 1,001 1,131 1,188 1,247 1,310 49 61 6877 87 98 103 108 114 1,398 1,553 1,824 2,273 2,568 2,902 3,047 3,200 3,360 203 307347 392 443 488 513 34 18 39 44 52 54 19 35 35 35 35 256 375 351 376 420 470 527 552 577 604 45 137 137 137 137 137 137 137 137 301 415 488 513 557 607 664 689 714 741 1,097 1,138 1,336 1,499 1,716 1 ,961 2,238 2,359 2,485 2,618 1.3981 .5531 .8242.01. 2.2732 .5682.9023.0473 .2003.360 759 24 # 32 44 49 54 714 | @ # 894 886 32 39 45 2,011 285 465 3o 32 34 49 35 57 35 124 35 35 50 40 Financial Ratios Formula 2014 COGS / Sales 52.49% R&D Expenses / Sales 9.85% SG&A Expenses / Sales 22.88% Income Tax Paid / EBIT 35.86% Accrued Expenses / Sales 1.87% Current Assets / Sales 38.78% Net Income/Total Equity 18.16% Net Income/Total Assets 13.53% Net Income/ Sales 8.98% Sales/Total Assets 150.75% EBIT/Sales 14.78% Current Assets/Current Liabilities 2.880 LT Debt/Total Equity 6.94% 1% Revenue Growth 14% 18% 1% 9% 1% 23% 2% 2015 2016 52.31% 54.73% 10.41% 10.71% 22.87% 21.38% 38.43% 36.27% 1.64% 1.52% 36.46% 36.47% 17.73% 16.68% 13.56% 13.09% 8.56% 8.17% 158.28% 160.23% 14.41% 13.17% 2.963 3.191 5.31% 4.10% 0.13 2019-2022 0.05 2023-2025 2017 61.77% 11.32% 21.25% 28.78% 0.73% 36.40% 7.56% 5.54% 3.50% 158.15% 5.66% 2.384 3.51% 2018 Averages 57.64% 55.79% 10.84% 10.63% 18.20% 21.32% 35.07% 34.88% 1.03% 1.36% 35.70% 36.76% 18.49% 17.53% 13.54% 11.85% 8.19% 7.48% 165.41% 158.56% 13.32% 12.27% 3.068 289.72% 10.25% 6.02% 2019 55.79% 10.63% 21.32% 33.83% 1.00% 34.00% 17.53% 13.06% 7.71% 169.49% 12.27% 2020 55.79% 10.63% 21.32% 33.96% 1.00% 34.00% 17.37% 13.12% 7.74% 169.49% 12.27% 2021 55.79% 10.63% 21.32% 34.08% 1.00% 34.00% 17.24% 13.16% 7.77% 169.49% 12.27% Ratio COGS R&D Expenses SG&A Expenses Income Tax Accrued Expenses Current Assets Return on Equity Return on Assets Profit Margin Total Asset Turnover Operating Margin Current Ratio Debt/Equity Ratio Cash/ Sales AR/ Sales Inventory/ Sales Other Crt Assets/ Sales AP/ Sales AE/ Sales PP&E/ Sales Other Fxd Assets/ Sales Tax Rate Dividends/ Net Income 2022 55.79% 10.63% 21.32% 34.19% 1.00% 34.00% 17.12% 13.20% 7.79% 169.49% 12.27% 2023 55.79% 10.63% 21.32% 34.23% 1.00% 34.00% 17.07% 13.22% 7.80% 169.49% 12.27% 2024 55.79% 10.63% 21.32% 34.26% 1.00% 34.00% 17.03% 13.23% 7.81% 169.49% 12.27% 2025 55.79% 10.63% 21.32% 34.30% 1.00% 34.00% 17.00% 13.24% 7.81% 169.49% 12.27% 35% 20% Proformas Income Statement 278 281 418 14 14 14 8 229 6 275 126 520 685 0 141 228 338 28 68 81 85 89 4. Balance Sheet Spartan Industries, INC. selected Financial Information (2014-2018) ($ millions) 2014 2015 Sales 1,604 1,950 Cost of Goods Sold 842 1,020 R&D Expense 158 203 SG&A Expense 367 446 Operating Income (EBIT) 237 Interest Expense Earnings before Tax Income Taxes 108 Net Income 144 167 Dividends 18 to Retained Earnings 144 149 2014 2015 Cash 103 Accounts Receivable 219 283 Inventory 282 348 Other Current Assets 18 22 Current Assets 622 Plant, Property & Equipment (net) 410 482 Other Fixed Assets Total Assets 1,064 1,232 Accounts Payable 145 177 Accrued Expenses Short Term Debt 41 Current Liabilities 216 240 Long Term Debt 55 Total Liabilities 271 290 Total Equity 793 942 Liabilities & Net Worth 1,064 1,232 58 45 30 52 54 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2,240 2,4563,017 3,4093.8524 .3534,9195,1655,4235,695 1,226 1,517 1,739 1,9022 ,1492,4292,744 2,8823,0263,177 _240 327362409 463 523 549 576 605 479 522 549 727821 928 1,0491,101 1,156 1,214 295 402 473 534 603 634 665 699 14 14 14 14 14 290 388 404 459 589 620 651 141 161 182 206 217 240 183 247 263 298 383 403 423 445 49 53 60 77 155 198 210 238 270 307 322 339 356 2016 2017 2014 2019 2020 2021 2022 2023 2014 2025 17 34 39 44 49 57 328 349 431 477 539 609 689 723 797 420 500 584 614 693 784 885 930 976 1,025 34 39 52 57 817 1,077 1,159 1,310 1,480 1,673 1,756 1,844 1,936 536 610 686 784 1,001 1,131 1,188 1,247 1,310 49 61 6877 87 98 103 108 114 1,398 1,553 1,824 2,273 2,568 2,902 3,047 3,200 3,360 203 307347 392 443 488 513 34 18 39 44 52 54 19 35 35 35 35 256 375 351 376 420 470 527 552 577 604 45 137 137 137 137 137 137 137 137 301 415 488 513 557 607 664 689 714 741 1,097 1,138 1,336 1,499 1,716 1 ,961 2,238 2,359 2,485 2,618 1.3981 .5531 .8242.01. 2.2732 .5682.9023.0473 .2003.360 759 24 # 32 44 49 54 714 | @ # 894 886 32 39 45 2,011 285 465 3o 32 34 49 35 57 35 124 35 35 50 40 Financial Ratios Formula 2014 COGS / Sales 52.49% R&D Expenses / Sales 9.85% SG&A Expenses / Sales 22.88% Income Tax Paid / EBIT 35.86% Accrued Expenses / Sales 1.87% Current Assets / Sales 38.78% Net Income/Total Equity 18.16% Net Income/Total Assets 13.53% Net Income/ Sales 8.98% Sales/Total Assets 150.75% EBIT/Sales 14.78% Current Assets/Current Liabilities 2.880 LT Debt/Total Equity 6.94% 1% Revenue Growth 14% 18% 1% 9% 1% 23% 2% 2015 2016 52.31% 54.73% 10.41% 10.71% 22.87% 21.38% 38.43% 36.27% 1.64% 1.52% 36.46% 36.47% 17.73% 16.68% 13.56% 13.09% 8.56% 8.17% 158.28% 160.23% 14.41% 13.17% 2.963 3.191 5.31% 4.10% 0.13 2019-2022 0.05 2023-2025 2017 61.77% 11.32% 21.25% 28.78% 0.73% 36.40% 7.56% 5.54% 3.50% 158.15% 5.66% 2.384 3.51% 2018 Averages 57.64% 55.79% 10.84% 10.63% 18.20% 21.32% 35.07% 34.88% 1.03% 1.36% 35.70% 36.76% 18.49% 17.53% 13.54% 11.85% 8.19% 7.48% 165.41% 158.56% 13.32% 12.27% 3.068 289.72% 10.25% 6.02% 2019 55.79% 10.63% 21.32% 33.83% 1.00% 34.00% 17.53% 13.06% 7.71% 169.49% 12.27% 2020 55.79% 10.63% 21.32% 33.96% 1.00% 34.00% 17.37% 13.12% 7.74% 169.49% 12.27% 2021 55.79% 10.63% 21.32% 34.08% 1.00% 34.00% 17.24% 13.16% 7.77% 169.49% 12.27% Ratio COGS R&D Expenses SG&A Expenses Income Tax Accrued Expenses Current Assets Return on Equity Return on Assets Profit Margin Total Asset Turnover Operating Margin Current Ratio Debt/Equity Ratio Cash/ Sales AR/ Sales Inventory/ Sales Other Crt Assets/ Sales AP/ Sales AE/ Sales PP&E/ Sales Other Fxd Assets/ Sales Tax Rate Dividends/ Net Income 2022 55.79% 10.63% 21.32% 34.19% 1.00% 34.00% 17.12% 13.20% 7.79% 169.49% 12.27% 2023 55.79% 10.63% 21.32% 34.23% 1.00% 34.00% 17.07% 13.22% 7.80% 169.49% 12.27% 2024 55.79% 10.63% 21.32% 34.26% 1.00% 34.00% 17.03% 13.23% 7.81% 169.49% 12.27% 2025 55.79% 10.63% 21.32% 34.30% 1.00% 34.00% 17.00% 13.24% 7.81% 169.49% 12.27% 35% 20%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started