Peter and Samantha Holland (ages 42 and 39) are married and live in Charlotte, NC. Their address is 1308 Chatham Ave, Charlotte, NC 28205.

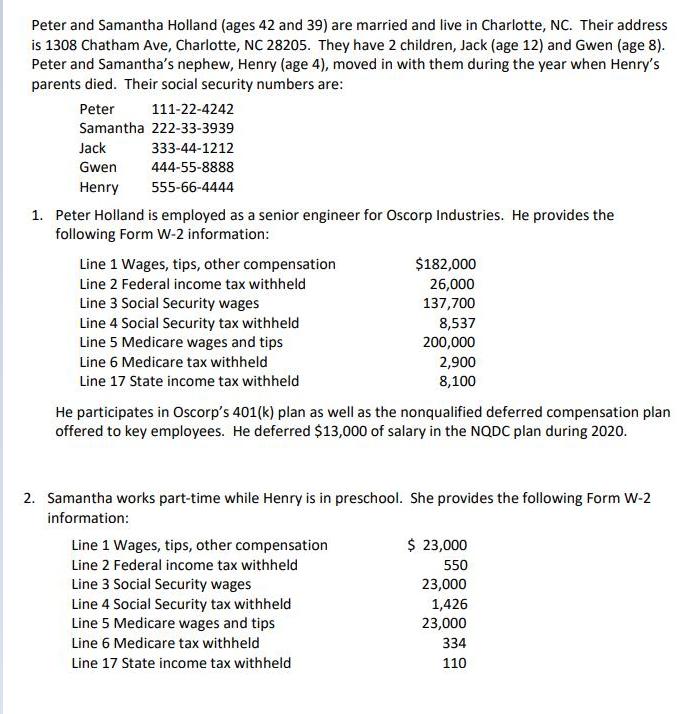

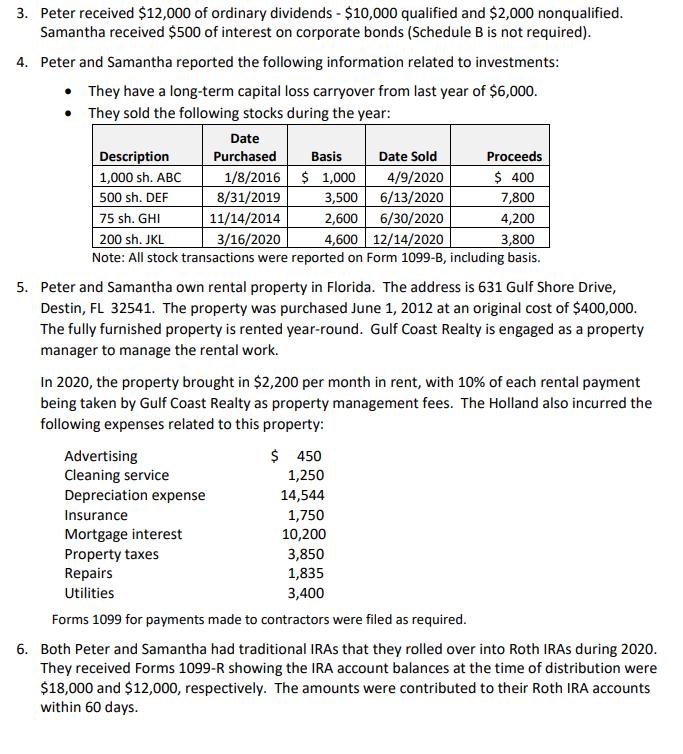

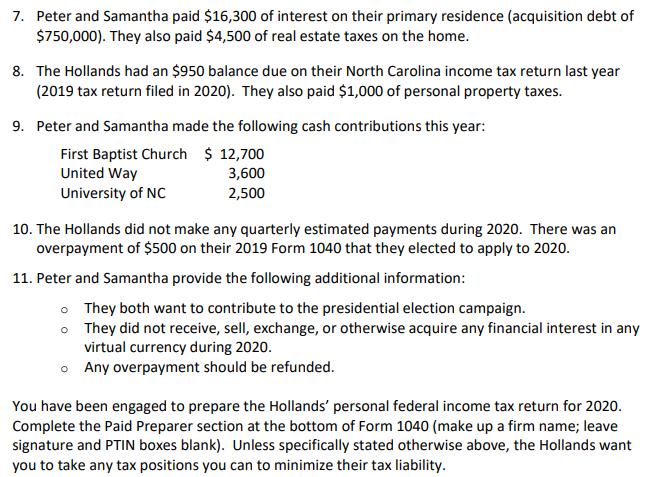

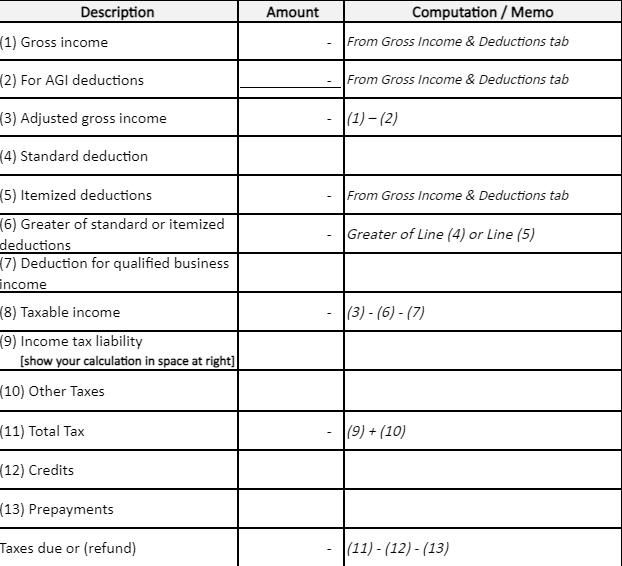

Peter and Samantha Holland (ages 42 and 39) are married and live in Charlotte, NC. Their address is 1308 Chatham Ave, Charlotte, NC 28205. They have 2 children, Jack (age 12) and Gwen (age 8). Peter and Samantha's nephew, Henry (age 4), moved in with them during the year when Henry's parents died. Their social security numbers are: Peter 111-22-4242 Samantha 222-33-3939 333-44-1212 444-55-8888 555-66-4444 Jack Gwen Henry 1. Peter Holland is employed as a senior engineer for Oscorp Industries. He provides the following Form W-2 information: Line 1 Wages, tips, other compensation Line 2 Federal income tax withheld Line 3 Social Security wages Line 4 Social Security tax withheld Line 5 Medicare wages and tips Line 6 Medicare tax withheld Line 17 State income tax withheld $182,000 26,000 137,700 8,537 200,000 2,900 8,100 He participates in Oscorp's 401(k) plan as well as the nonqualified deferred compensation plan offered to key employees. He deferred $13,000 of salary in the NQDC plan during 2020. 2. Samantha works part-time while Henry is in preschool. She provides the following Form W-2 information: Line 1 Wages, tips, other compensation Line 2 Federal income tax withheld Line 3 Social Security wages Line 4 Social Security tax withheld Line 5 Medicare wages and tips Line 6 Medicare tax withheld Line 17 State income tax withheld $ 23,000 550 23,000 1,426 23,000 334 110 3. Peter received $12,000 of ordinary dividends - $10,000 qualified and $2,000 nonqualified. Samantha received $500 of interest on corporate bonds (Schedule B is not required). 4. Peter and Samantha reported the following information related to investments: They have a long-term capital loss carryover from last year of $6,000. They sold the following stocks during the year: Proceeds Description 1,000 sh. ABC $ 400 500 sh. DEF 7,800 75 sh. GHI 4,200 200 sh. JKL 3,800 Note: All stock transactions were reported on Form 1099-B, including basis. Date Purchased Advertising Cleaning service Basis Date Sold $ 1,000 4/9/2020 3,500 6/13/2020 2,600 6/30/2020 4,600 12/14/2020 1/8/2016 8/31/2019 11/14/2014 3/16/2020 5. Peter and Samantha own rental property in Florida. The address is 631 Gulf Shore Drive, Destin, FL 32541. The property was purchased June 1, 2012 at an original cost of $400,000. The fully furnished property is rented year-round. Gulf Coast Realty is engaged as a property manager to manage the rental work. In 2020, the property brought in $2,200 per month in rent, with 10% of each rental payment being taken by Gulf Coast Realty as property management fees. The Holland also incurred the following expenses related to this property: Depreciation expense Insurance Mortgage interest Property taxes Repairs Utilities $ 450 1,250 14,544 1,750 10,200 3,850 1,835 3,400 Forms 1099 for payments made to contractors were filed as required. 6. Both Peter and Samantha had traditional IRAs that they rolled over into Roth IRAs during 2020. They received Forms 1099-R showing the IRA account balances at the time of distribution were $18,000 and $12,000, respectively. The amounts were contributed to their Roth IRA accounts within 60 days. 7. Peter and Samantha paid $16,300 of interest on their primary residence (acquisition debt of $750,000). They also paid $4,500 of real estate taxes on the home. 8. The Hollands had an $950 balance due on their North Carolina income tax return last year (2019 tax return filed in 2020). They also paid $1,000 of personal property taxes. 9. Peter and Samantha made the following cash contributions this year: First Baptist Church $ 12,700 United Way 3,600 University of NC 2,500 10. The Hollands did not make any quarterly estimated payments during 2020. There was an overpayment of $500 on their 2019 Form 1040 that they elected to apply to 2020. 11. Peter and Samantha provide the following additional information: o They both want to contribute to the presidential election campaign. o They did not receive, sell, exchange, or otherwise acquire any financial interest in any virtual currency during 2020. Any overpayment should be refunded. You have been engaged to prepare the Hollands' personal federal income tax return for 2020. Complete the Paid Preparer section at the bottom of Form 1040 (make up a firm name; leave signature and PTIN boxes blank). Unless specifically stated otherwise above, the Hollands want you to take any tax positions you can to minimize their tax liability. Description (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Itemized deductions (6) Greater of standard or itemized deductions (7) Deduction for qualified business income (8) Taxable income (9) Income tax liability [show your calculation in space at right] (10) Other Taxes (11) Total Tax (12) Credits (13) Prepayments Taxes due or (refund) Amount - Computation / Memo From Gross Income & Deductions tab From Gross Income & Deductions tab (1)-(2) From Gross Income & Deductions tab Greater of Line (4) or Line (5) (3) - (6) - (7) (9) + (10) (11)-(12)-(13) Use the space below to enter items of gross income and deductions: Description GROSS INCOME Wages Interest Income Dividend Income State Tax Refund Alimony Received Business Income or (Loss) Capital Gain (Losses) Other Gains (Losses) IRA Distributions Pensions and Annuities Rental Income Royalties Flow Through Entities Farm Income or (Loss) Unemployment Compensation Social Security Other Income TOTAL GROSS INCOME FOR AGI (Above-the-Line) DEDUCTIONS IRA Deduction Self-Employed Health Insurance Deduction Self-employed SEP, SIMPLE, and Qual. Plans One-Half of Self-Employment Tax Penalty on Early Withdrawal of Savings Student Loan Interest Deduction Alimony Paid TOTAL FOR AGI DEDUCTIONS ITEMIZED DEDUCTIONS Medical State and Local Property Taxes State Income Tax State Sales Tax Home Mortgage Interest Investment Interest Contributions - Cash Contributions - Non-Cash Use higher of two Casualty and Theft Losses Other Itemized Deductions TOTAL ITEMIZED DEDUCTIONS Amount 0 0 Memo 0 State taxes limited to $10,000 0 Description (1) Rental Revenues (2) Expenses (3) Rental income (loss) reported on Schedule E (4) Deductible rental real estate loss after limitation, if any. Amount (1)-(2) Computation/Memo Peter and Samantha Holland (ages 42 and 39) are married and live in Charlotte, NC. Their address is 1308 Chatham Ave, Charlotte, NC 28205. They have 2 children, Jack (age 12) and Gwen (age 8). Peter and Samantha's nephew, Henry (age 4), moved in with them during the year when Henry's parents died. Their social security numbers are: Peter 111-22-4242 Samantha 222-33-3939 333-44-1212 444-55-8888 555-66-4444 Jack Gwen Henry 1. Peter Holland is employed as a senior engineer for Oscorp Industries. He provides the following Form W-2 information: Line 1 Wages, tips, other compensation Line 2 Federal income tax withheld Line 3 Social Security wages Line 4 Social Security tax withheld Line 5 Medicare wages and tips Line 6 Medicare tax withheld Line 17 State income tax withheld $182,000 26,000 137,700 8,537 200,000 2,900 8,100 He participates in Oscorp's 401(k) plan as well as the nonqualified deferred compensation plan offered to key employees. He deferred $13,000 of salary in the NQDC plan during 2020. 2. Samantha works part-time while Henry is in preschool. She provides the following Form W-2 information: Line 1 Wages, tips, other compensation Line 2 Federal income tax withheld Line 3 Social Security wages Line 4 Social Security tax withheld Line 5 Medicare wages and tips Line 6 Medicare tax withheld Line 17 State income tax withheld $ 23,000 550 23,000 1,426 23,000 334 110 3. Peter received $12,000 of ordinary dividends - $10,000 qualified and $2,000 nonqualified. Samantha received $500 of interest on corporate bonds (Schedule B is not required). 4. Peter and Samantha reported the following information related to investments: They have a long-term capital loss carryover from last year of $6,000. They sold the following stocks during the year: Proceeds Description 1,000 sh. ABC $ 400 500 sh. DEF 7,800 75 sh. GHI 4,200 200 sh. JKL 3,800 Note: All stock transactions were reported on Form 1099-B, including basis. Date Purchased Advertising Cleaning service Basis Date Sold $ 1,000 4/9/2020 3,500 6/13/2020 2,600 6/30/2020 4,600 12/14/2020 1/8/2016 8/31/2019 11/14/2014 3/16/2020 5. Peter and Samantha own rental property in Florida. The address is 631 Gulf Shore Drive, Destin, FL 32541. The property was purchased June 1, 2012 at an original cost of $400,000. The fully furnished property is rented year-round. Gulf Coast Realty is engaged as a property manager to manage the rental work. In 2020, the property brought in $2,200 per month in rent, with 10% of each rental payment being taken by Gulf Coast Realty as property management fees. The Holland also incurred the following expenses related to this property: Depreciation expense Insurance Mortgage interest Property taxes Repairs Utilities $ 450 1,250 14,544 1,750 10,200 3,850 1,835 3,400 Forms 1099 for payments made to contractors were filed as required. 6. Both Peter and Samantha had traditional IRAs that they rolled over into Roth IRAs during 2020. They received Forms 1099-R showing the IRA account balances at the time of distribution were $18,000 and $12,000, respectively. The amounts were contributed to their Roth IRA accounts within 60 days. 7. Peter and Samantha paid $16,300 of interest on their primary residence (acquisition debt of $750,000). They also paid $4,500 of real estate taxes on the home. 8. The Hollands had an $950 balance due on their North Carolina income tax return last year (2019 tax return filed in 2020). They also paid $1,000 of personal property taxes. 9. Peter and Samantha made the following cash contributions this year: First Baptist Church $ 12,700 United Way 3,600 University of NC 2,500 10. The Hollands did not make any quarterly estimated payments during 2020. There was an overpayment of $500 on their 2019 Form 1040 that they elected to apply to 2020. 11. Peter and Samantha provide the following additional information: o They both want to contribute to the presidential election campaign. o They did not receive, sell, exchange, or otherwise acquire any financial interest in any virtual currency during 2020. Any overpayment should be refunded. You have been engaged to prepare the Hollands' personal federal income tax return for 2020. Complete the Paid Preparer section at the bottom of Form 1040 (make up a firm name; leave signature and PTIN boxes blank). Unless specifically stated otherwise above, the Hollands want you to take any tax positions you can to minimize their tax liability. Description (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Itemized deductions (6) Greater of standard or itemized deductions (7) Deduction for qualified business income (8) Taxable income (9) Income tax liability [show your calculation in space at right] (10) Other Taxes (11) Total Tax (12) Credits (13) Prepayments Taxes due or (refund) Amount - Computation / Memo From Gross Income & Deductions tab From Gross Income & Deductions tab (1)-(2) From Gross Income & Deductions tab Greater of Line (4) or Line (5) (3) - (6) - (7) (9) + (10) (11)-(12)-(13) Use the space below to enter items of gross income and deductions: Description GROSS INCOME Wages Interest Income Dividend Income State Tax Refund Alimony Received Business Income or (Loss) Capital Gain (Losses) Other Gains (Losses) IRA Distributions Pensions and Annuities Rental Income Royalties Flow Through Entities Farm Income or (Loss) Unemployment Compensation Social Security Other Income TOTAL GROSS INCOME FOR AGI (Above-the-Line) DEDUCTIONS IRA Deduction Self-Employed Health Insurance Deduction Self-employed SEP, SIMPLE, and Qual. Plans One-Half of Self-Employment Tax Penalty on Early Withdrawal of Savings Student Loan Interest Deduction Alimony Paid TOTAL FOR AGI DEDUCTIONS ITEMIZED DEDUCTIONS Medical State and Local Property Taxes State Income Tax State Sales Tax Home Mortgage Interest Investment Interest Contributions - Cash Contributions - Non-Cash Use higher of two Casualty and Theft Losses Other Itemized Deductions TOTAL ITEMIZED DEDUCTIONS Amount 0 0 Memo 0 State taxes limited to $10,000 0 Description (1) Rental Revenues (2) Expenses (3) Rental income (loss) reported on Schedule E (4) Deductible rental real estate loss after limitation, if any. Amount (1)-(2) Computation/Memo Peter and Samantha Holland (ages 42 and 39) are married and live in Charlotte, NC. Their address is 1308 Chatham Ave, Charlotte, NC 28205. They have 2 children, Jack (age 12) and Gwen (age 8). Peter and Samantha's nephew, Henry (age 4), moved in with them during the year when Henry's parents died. Their social security numbers are: Peter 111-22-4242 Samantha 222-33-3939 333-44-1212 444-55-8888 555-66-4444 Jack Gwen Henry 1. Peter Holland is employed as a senior engineer for Oscorp Industries. He provides the following Form W-2 information: Line 1 Wages, tips, other compensation Line 2 Federal income tax withheld Line 3 Social Security wages Line 4 Social Security tax withheld Line 5 Medicare wages and tips Line 6 Medicare tax withheld Line 17 State income tax withheld $182,000 26,000 137,700 8,537 200,000 2,900 8,100 He participates in Oscorp's 401(k) plan as well as the nonqualified deferred compensation plan offered to key employees. He deferred $13,000 of salary in the NQDC plan during 2020. 2. Samantha works part-time while Henry is in preschool. She provides the following Form W-2 information: Line 1 Wages, tips, other compensation Line 2 Federal income tax withheld Line 3 Social Security wages Line 4 Social Security tax withheld Line 5 Medicare wages and tips Line 6 Medicare tax withheld Line 17 State income tax withheld $ 23,000 550 23,000 1,426 23,000 334 110 3. Peter received $12,000 of ordinary dividends - $10,000 qualified and $2,000 nonqualified. Samantha received $500 of interest on corporate bonds (Schedule B is not required). 4. Peter and Samantha reported the following information related to investments: They have a long-term capital loss carryover from last year of $6,000. They sold the following stocks during the year: Proceeds Description 1,000 sh. ABC $ 400 500 sh. DEF 7,800 75 sh. GHI 4,200 200 sh. JKL 3,800 Note: All stock transactions were reported on Form 1099-B, including basis. Date Purchased Advertising Cleaning service Basis Date Sold $ 1,000 4/9/2020 3,500 6/13/2020 2,600 6/30/2020 4,600 12/14/2020 1/8/2016 8/31/2019 11/14/2014 3/16/2020 5. Peter and Samantha own rental property in Florida. The address is 631 Gulf Shore Drive, Destin, FL 32541. The property was purchased June 1, 2012 at an original cost of $400,000. The fully furnished property is rented year-round. Gulf Coast Realty is engaged as a property manager to manage the rental work. In 2020, the property brought in $2,200 per month in rent, with 10% of each rental payment being taken by Gulf Coast Realty as property management fees. The Holland also incurred the following expenses related to this property: Depreciation expense Insurance Mortgage interest Property taxes Repairs Utilities $ 450 1,250 14,544 1,750 10,200 3,850 1,835 3,400 Forms 1099 for payments made to contractors were filed as required. 6. Both Peter and Samantha had traditional IRAs that they rolled over into Roth IRAs during 2020. They received Forms 1099-R showing the IRA account balances at the time of distribution were $18,000 and $12,000, respectively. The amounts were contributed to their Roth IRA accounts within 60 days. 7. Peter and Samantha paid $16,300 of interest on their primary residence (acquisition debt of $750,000). They also paid $4,500 of real estate taxes on the home. 8. The Hollands had an $950 balance due on their North Carolina income tax return last year (2019 tax return filed in 2020). They also paid $1,000 of personal property taxes. 9. Peter and Samantha made the following cash contributions this year: First Baptist Church $ 12,700 United Way 3,600 University of NC 2,500 10. The Hollands did not make any quarterly estimated payments during 2020. There was an overpayment of $500 on their 2019 Form 1040 that they elected to apply to 2020. 11. Peter and Samantha provide the following additional information: o They both want to contribute to the presidential election campaign. o They did not receive, sell, exchange, or otherwise acquire any financial interest in any virtual currency during 2020. Any overpayment should be refunded. You have been engaged to prepare the Hollands' personal federal income tax return for 2020. Complete the Paid Preparer section at the bottom of Form 1040 (make up a firm name; leave signature and PTIN boxes blank). Unless specifically stated otherwise above, the Hollands want you to take any tax positions you can to minimize their tax liability. Description (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Itemized deductions (6) Greater of standard or itemized deductions (7) Deduction for qualified business income (8) Taxable income (9) Income tax liability [show your calculation in space at right] (10) Other Taxes (11) Total Tax (12) Credits (13) Prepayments Taxes due or (refund) Amount - Computation / Memo From Gross Income & Deductions tab From Gross Income & Deductions tab (1)-(2) From Gross Income & Deductions tab Greater of Line (4) or Line (5) (3) - (6) - (7) (9) + (10) (11)-(12)-(13) Use the space below to enter items of gross income and deductions: Description GROSS INCOME Wages Interest Income Dividend Income State Tax Refund Alimony Received Business Income or (Loss) Capital Gain (Losses) Other Gains (Losses) IRA Distributions Pensions and Annuities Rental Income Royalties Flow Through Entities Farm Income or (Loss) Unemployment Compensation Social Security Other Income TOTAL GROSS INCOME FOR AGI (Above-the-Line) DEDUCTIONS IRA Deduction Self-Employed Health Insurance Deduction Self-employed SEP, SIMPLE, and Qual. Plans One-Half of Self-Employment Tax Penalty on Early Withdrawal of Savings Student Loan Interest Deduction Alimony Paid TOTAL FOR AGI DEDUCTIONS ITEMIZED DEDUCTIONS Medical State and Local Property Taxes State Income Tax State Sales Tax Home Mortgage Interest Investment Interest Contributions - Cash Contributions - Non-Cash Use higher of two Casualty and Theft Losses Other Itemized Deductions TOTAL ITEMIZED DEDUCTIONS Amount 0 0 Memo 0 State taxes limited to $10,000 0 Description (1) Rental Revenues (2) Expenses (3) Rental income (loss) reported on Schedule E (4) Deductible rental real estate loss after limitation, if any. Amount (1)-(2) Computation/Memo Peter and Samantha Holland (ages 42 and 39) are married and live in Charlotte, NC. Their address is 1308 Chatham Ave, Charlotte, NC 28205. They have 2 children, Jack (age 12) and Gwen (age 8). Peter and Samantha's nephew, Henry (age 4), moved in with them during the year when Henry's parents died. Their social security numbers are: Peter 111-22-4242 Samantha 222-33-3939 333-44-1212 444-55-8888 555-66-4444 Jack Gwen Henry 1. Peter Holland is employed as a senior engineer for Oscorp Industries. He provides the following Form W-2 information: Line 1 Wages, tips, other compensation Line 2 Federal income tax withheld Line 3 Social Security wages Line 4 Social Security tax withheld Line 5 Medicare wages and tips Line 6 Medicare tax withheld Line 17 State income tax withheld $182,000 26,000 137,700 8,537 200,000 2,900 8,100 He participates in Oscorp's 401(k) plan as well as the nonqualified deferred compensation plan offered to key employees. He deferred $13,000 of salary in the NQDC plan during 2020. 2. Samantha works part-time while Henry is in preschool. She provides the following Form W-2 information: Line 1 Wages, tips, other compensation Line 2 Federal income tax withheld Line 3 Social Security wages Line 4 Social Security tax withheld Line 5 Medicare wages and tips Line 6 Medicare tax withheld Line 17 State income tax withheld $ 23,000 550 23,000 1,426 23,000 334 110 3. Peter received $12,000 of ordinary dividends - $10,000 qualified and $2,000 nonqualified. Samantha received $500 of interest on corporate bonds (Schedule B is not required). 4. Peter and Samantha reported the following information related to investments: They have a long-term capital loss carryover from last year of $6,000. They sold the following stocks during the year: Proceeds Description 1,000 sh. ABC $ 400 500 sh. DEF 7,800 75 sh. GHI 4,200 200 sh. JKL 3,800 Note: All stock transactions were reported on Form 1099-B, including basis. Date Purchased Advertising Cleaning service Basis Date Sold $ 1,000 4/9/2020 3,500 6/13/2020 2,600 6/30/2020 4,600 12/14/2020 1/8/2016 8/31/2019 11/14/2014 3/16/2020 5. Peter and Samantha own rental property in Florida. The address is 631 Gulf Shore Drive, Destin, FL 32541. The property was purchased June 1, 2012 at an original cost of $400,000. The fully furnished property is rented year-round. Gulf Coast Realty is engaged as a property manager to manage the rental work. In 2020, the property brought in $2,200 per month in rent, with 10% of each rental payment being taken by Gulf Coast Realty as property management fees. The Holland also incurred the following expenses related to this property: Depreciation expense Insurance Mortgage interest Property taxes Repairs Utilities $ 450 1,250 14,544 1,750 10,200 3,850 1,835 3,400 Forms 1099 for payments made to contractors were filed as required. 6. Both Peter and Samantha had traditional IRAs that they rolled over into Roth IRAs during 2020. They received Forms 1099-R showing the IRA account balances at the time of distribution were $18,000 and $12,000, respectively. The amounts were contributed to their Roth IRA accounts within 60 days. 7. Peter and Samantha paid $16,300 of interest on their primary residence (acquisition debt of $750,000). They also paid $4,500 of real estate taxes on the home. 8. The Hollands had an $950 balance due on their North Carolina income tax return last year (2019 tax return filed in 2020). They also paid $1,000 of personal property taxes. 9. Peter and Samantha made the following cash contributions this year: First Baptist Church $ 12,700 United Way 3,600 University of NC 2,500 10. The Hollands did not make any quarterly estimated payments during 2020. There was an overpayment of $500 on their 2019 Form 1040 that they elected to apply to 2020. 11. Peter and Samantha provide the following additional information: o They both want to contribute to the presidential election campaign. o They did not receive, sell, exchange, or otherwise acquire any financial interest in any virtual currency during 2020. Any overpayment should be refunded. You have been engaged to prepare the Hollands' personal federal income tax return for 2020. Complete the Paid Preparer section at the bottom of Form 1040 (make up a firm name; leave signature and PTIN boxes blank). Unless specifically stated otherwise above, the Hollands want you to take any tax positions you can to minimize their tax liability. Description (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Itemized deductions (6) Greater of standard or itemized deductions (7) Deduction for qualified business income (8) Taxable income (9) Income tax liability [show your calculation in space at right] (10) Other Taxes (11) Total Tax (12) Credits (13) Prepayments Taxes due or (refund) Amount - Computation / Memo From Gross Income & Deductions tab From Gross Income & Deductions tab (1)-(2) From Gross Income & Deductions tab Greater of Line (4) or Line (5) (3) - (6) - (7) (9) + (10) (11)-(12)-(13) Use the space below to enter items of gross income and deductions: Description GROSS INCOME Wages Interest Income Dividend Income State Tax Refund Alimony Received Business Income or (Loss) Capital Gain (Losses) Other Gains (Losses) IRA Distributions Pensions and Annuities Rental Income Royalties Flow Through Entities Farm Income or (Loss) Unemployment Compensation Social Security Other Income TOTAL GROSS INCOME FOR AGI (Above-the-Line) DEDUCTIONS IRA Deduction Self-Employed Health Insurance Deduction Self-employed SEP, SIMPLE, and Qual. Plans One-Half of Self-Employment Tax Penalty on Early Withdrawal of Savings Student Loan Interest Deduction Alimony Paid TOTAL FOR AGI DEDUCTIONS ITEMIZED DEDUCTIONS Medical State and Local Property Taxes State Income Tax State Sales Tax Home Mortgage Interest Investment Interest Contributions - Cash Contributions - Non-Cash Use higher of two Casualty and Theft Losses Other Itemized Deductions TOTAL ITEMIZED DEDUCTIONS Amount 0 0 Memo 0 State taxes limited to $10,000 0 Description (1) Rental Revenues (2) Expenses (3) Rental income (loss) reported on Schedule E (4) Deductible rental real estate loss after limitation, if any. Amount (1)-(2) Computation/Memo Peter and Samantha Holland (ages 42 and 39) are married and live in Charlotte, NC. Their address is 1308 Chatham Ave, Charlotte, NC 28205. They have 2 children, Jack (age 12) and Gwen (age 8). Peter and Samantha's nephew, Henry (age 4), moved in with them during the year when Henry's parents died. Their social security numbers are: Peter 111-22-4242 Samantha 222-33-3939 333-44-1212 444-55-8888 555-66-4444 Jack Gwen Henry 1. Peter Holland is employed as a senior engineer for Oscorp Industries. He provides the following Form W-2 information: Line 1 Wages, tips, other compensation Line 2 Federal income tax withheld Line 3 Social Security wages Line 4 Social Security tax withheld Line 5 Medicare wages and tips Line 6 Medicare tax withheld Line 17 State income tax withheld $182,000 26,000 137,700 8,537 200,000 2,900 8,100 He participates in Oscorp's 401(k) plan as well as the nonqualified deferred compensation plan offered to key employees. He deferred $13,000 of salary in the NQDC plan during 2020. 2. Samantha works part-time while Henry is in preschool. She provides the following Form W-2 information: Line 1 Wages, tips, other compensation Line 2 Federal income tax withheld Line 3 Social Security wages Line 4 Social Security tax withheld Line 5 Medicare wages and tips Line 6 Medicare tax withheld Line 17 State income tax withheld $ 23,000 550 23,000 1,426 23,000 334 110 3. Peter received $12,000 of ordinary dividends - $10,000 qualified and $2,000 nonqualified. Samantha received $500 of interest on corporate bonds (Schedule B is not required). 4. Peter and Samantha reported the following information related to investments: They have a long-term capital loss carryover from last year of $6,000. They sold the following stocks during the year: Proceeds Description 1,000 sh. ABC $ 400 500 sh. DEF 7,800 75 sh. GHI 4,200 200 sh. JKL 3,800 Note: All stock transactions were reported on Form 1099-B, including basis. Date Purchased Advertising Cleaning service 1/8/2016 8/31/2019 11/14/2014 3/16/2020 Basis Date Sold $ 1,000 4/9/2020 3,500 6/13/2020 2,600 6/30/2020 4,600 12/14/2020 5. Peter and Samantha own rental property in Florida. The address is 631 Gulf Shore Drive, Destin, FL 32541. The property was purchased June 1, 2012 at an original cost of $400,000. The fully furnished property is rented year-round. Gulf Coast Realty is engaged as a property manager to manage the rental work. In 2020, the property brought in $2,200 per month in rent, with 10% of each rental payment being taken by Gulf Coast Realty as property management fees. The Holland also incurred the following expenses related to this property: Depreciation expense Insurance Mortgage interest Property taxes Repairs Utilities $ 450 1,250 14,544 1,750 10,200 3,850 1,835 3,400 Forms 1099 for payments made to contractors were filed as required. 6. Both Peter and Samantha had traditional IRAs that they rolled over into Roth IRAs during 2020. They received Forms 1099-R showing the IRA account balances at the time of distribution were $18,000 and $12,000, respectively. The amounts were contributed to their Roth IRA accounts within 60 days. 7. Peter and Samantha paid $16,300 of interest on their primary residence (acquisition debt of $750,000). They also paid $4,500 of real estate taxes on the home. 8. The Hollands had an $950 balance due on their North Carolina income tax return last year (2019 tax return filed in 2020). They also paid $1,000 of personal property taxes. 9. Peter and Samantha made the following cash contributions this year: First Baptist Church $ 12,700 United Way 3,600 University of NC 2,500 10. The Hollands did not make any quarterly estimated payments during 2020. There was an overpayment of $500 on their 2019 Form 1040 that they elected to apply to 2020. 11. Peter and Samantha provide the following additional information: o They both want to contribute to the presidential election campaign. o They did not receive, sell, exchange, or otherwise acquire any financial interest in any virtual currency during 2020. Any overpayment should be refunded. You have been engaged to prepare the Hollands' personal federal income tax return for 2020. Complete the Paid Preparer section at the bottom of Form 1040 (make up a firm name; leave signature and PTIN boxes blank). Unless specifically stated otherwise above, the Hollands want you to take any tax positions you can to minimize their tax liability. Description (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Itemized deductions (6) Greater of standard or itemized deductions (7) Deduction for qualified business income (8) Taxable income (9) Income tax liability [show your calculation in space at right] (10) Other Taxes (11) Total Tax (12) Credits (13) Prepayments Taxes due or (refund) Amount - Computation / Memo From Gross Income & Deductions tab From Gross Income & Deductions tab (1)-(2) From Gross Income & Deductions tab Greater of Line (4) or Line (5) (3) - (6) - (7) (9) + (10) (11)-(12)-(13) Use the space below to enter items of gross income and deductions: Description GROSS INCOME Wages Interest Income Dividend Income State Tax Refund Alimony Received Business Income or (Loss) Capital Gain (Losses) Other Gains (Losses) IRA Distributions Pensions and Annuities Rental Income Royalties Flow Through Entities Farm Income or (Loss) Unemployment Compensation Social Security Other Income TOTAL GROSS INCOME FOR AGI (Above-the-Line) DEDUCTIONS IRA Deduction Self-Employed Health Insurance Deduction Self-employed SEP, SIMPLE, and Qual. Plans One-Half of Self-Employment Tax Penalty on Early Withdrawal of Savings Student Loan Interest Deduction Alimony Paid TOTAL FOR AGI DEDUCTIONS ITEMIZED DEDUCTIONS Medical State and Local Property Taxes State Income Tax State Sales Tax Home Mortgage Interest Investment Interest Contributions - Cash Contributions - Non-Cash Use higher of two Casualty and Theft Losses Other Itemized Deductions TOTAL ITEMIZED DEDUCTIONS Amount 0 0 Memo 0 State taxes limited to $10,000 0 Description (1) Rental Revenues (2) Expenses (3) Rental income (loss) reported on Schedule E (4) Deductible rental real estate loss after limitation, if any. Amount (1)-(2) Computation/Memo

Step by Step Solution

3.49 Rating (185 Votes )

There are 3 Steps involved in it

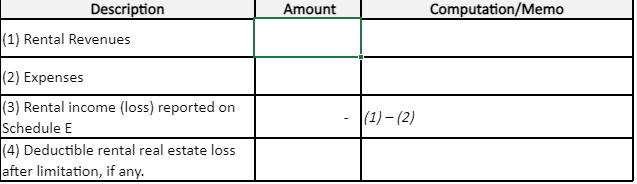

Step: 1

Peter Holland and Samantha Holland COMPUTATION OF TOTAL IN...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

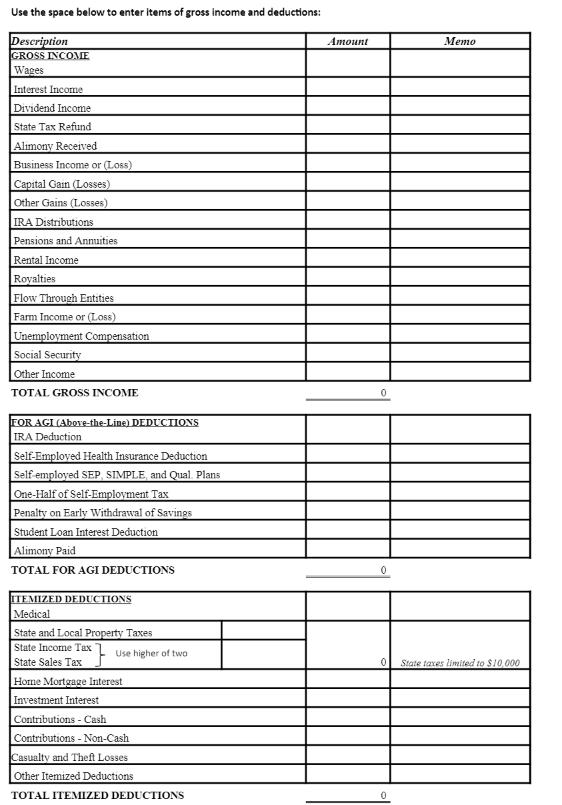

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started