Answered step by step

Verified Expert Solution

Question

1 Approved Answer

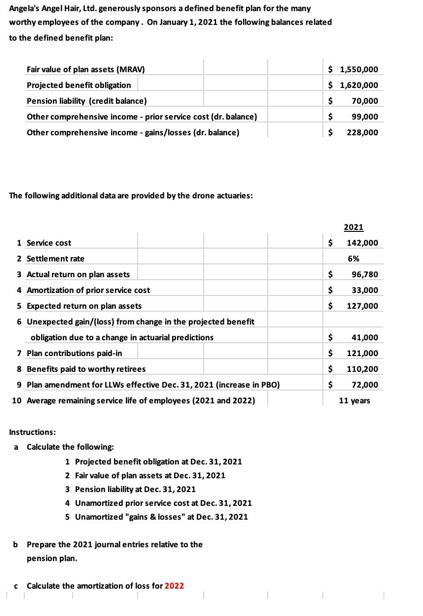

Angela's Angel Hair, Ltd. generously sponsors a defined benefit plan for the many worthy employees of the company. On January 1, 2021 the following

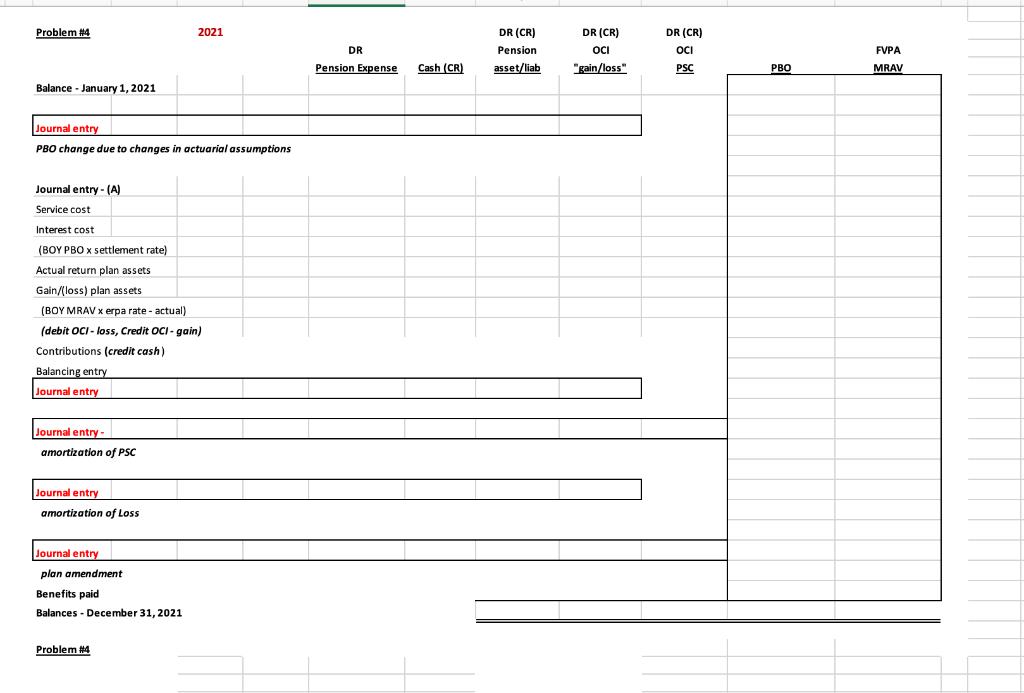

Angela's Angel Hair, Ltd. generously sponsors a defined benefit plan for the many worthy employees of the company. On January 1, 2021 the following balances related to the defined benefit plan: $ 1,550,000 $ 1,620,000 Fair value of plan assets (MRAV) Projected benefit obligation Pension liability (credit balance) 70,000 Other comprehensive income - prior service cost (dr. balance) 99,000 Other comprehensive income - gains/losses (dr. balance) $ 228,000 The following additional data are provided by the drone actuaries: 2021 1 Service cost 142,000 2 Settlement rate 6% 3 Actual return on plan assets 4 Amortization of prior service cost 5 Expected return on plan assets 6 Unexpected gain/(loss) from change in the projected benefit 96,780 33,000 127,000 obligation due to a change in actuarial predictions 41,000 7 Plan contributions paid-in 8 Benefits paid to worthy retirees 9 Plan amendment for LLWS effective Dec. 31, 2021 (increase in PBO) 24 121,000 110,200 72,000 10 Average remaining service life of employees (2021 and 2022) 11 years Instructions: a Calculate the following 1 Projected benefit obligation at Dec. 31, 2021 2 Fair value of plan assets at Dec. 31, 2021 3 Pension liability at Dec. 31, 2021 4 Unamortized prior service cost at Dec. 31, 2021 5 Unamortized "gains & losses" at Dec. 31, 2021 b Prepare the 2021 journal entries relative to the pension plan. e Calculate the amortization of loss for 2022 Problem #4 2021 DR (CR) DR (CR) DR (CR) DR Pension OCI OCI FVPA Pension Expense Cash (CR) asset/liab "gain/loss" PSC PBO MRAV Balance - January 1, 2021 Journal entry PBO change due to changes in actuarial assumptions Journal entry - (A) Service cost Interest cost (BOY PBO x settlement rate) Actual return plan assets Gain/(loss) plan assets (BOY MRAV x erpa rate - actual) (debit OCI - loss, Credit OCI - gain) Contributions (credit cash) Balancing entry Journal entry Journal entry - amortization of PSC Journal entry amortization of Loss Journal entry plan amendment Benefits paid Balances - December 31, 2021 Problem #4

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Pension Worksheet 2021 Items Annual Pension Expense Cash OCIPrior Service Cost OCIGainLoss Pension A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started