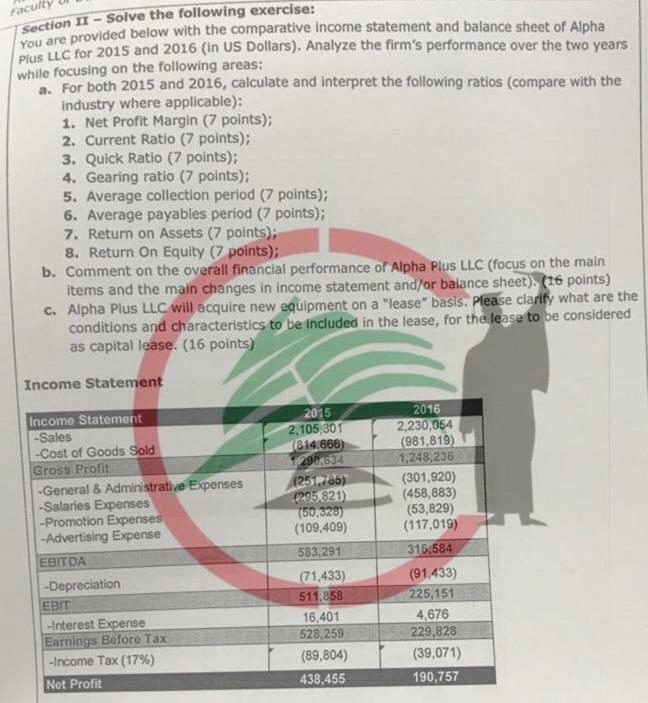

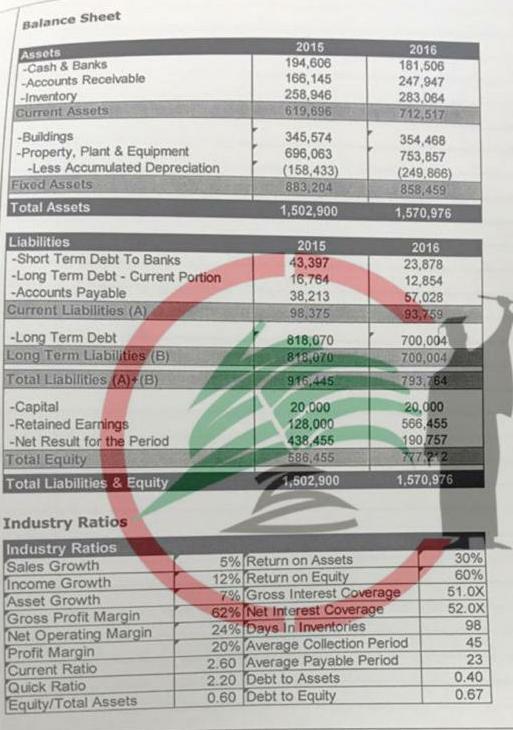

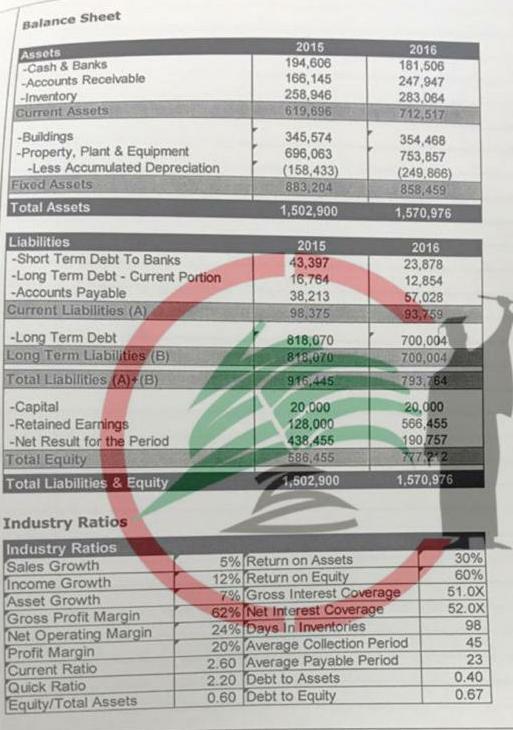

Faculty You are provided below with the comparative Income statement and balance sheet of Alpha Section II - Solve the following exercise: pias LLC for 2015 and 2016 (in US Dollars). Analyze the firm's performance over the two years while focusing on the following areas: a. For both 2015 and 2016, calculate and interpret the following ratios (compare with the Industry where applicable): 1. Net Profit Margin (7 points); 2. Current Ratio (7 points); 3. Quick Ratio (7 points); 4. Gearing ratio (7 points); 5. Average collection period (7 points); 6. Average payables period (7 points); 7. Return on Assets (7 points); 8. Return On Equity (7 points); b. Comment on the overall financial performance of Alpha Plus LLC (focus on the main items and the main changes in income statement and/or balance sheet) (16 points) c. Alpha Plus LLC will acquire new equipment on a "lease" basis. Please clarify what are the conditions and characteristics to be included in the lease, for the lease to be considered as capital lease. (16 points) Income Statement Income Statement -Sales -Cost of Goods Sold Gross Profit -General & Administrative Expenses -Salaries Expenses -Promotion Expenses -Advertising Expense EBITDA -Depreciation EBIT -Interest Expense Earnings Before Tax -Income Tax (17%) Net Profit 2015 2,105,30T 814.666) 290,634 (251,785) (295.821) 150,328) (109,409) 583.291 (71.433) 511.858 16,401 528,259 (89,804) 438,455 2016 2.230,354 (981,819) 1,248,236 (301,920) (458,883) (53,829) (117,019) 316,584 (91.433) 225,151 4,676 229,828 (39,071) 190,757 Balance Sheet Assets -Cash & Banks -Accounts Receivable -Inventory Current Assets -Buildings -Property, Plant & Equipment -Less Accumulated Depreciation Fixed Assots Total Assets 2015 194,606 166,145 258,946 619,696 345,574 696,063 (158,433) 883,204 1,502,900 2016 181,506 247.947 283,064 712,517 354 468 753,857 (249,866) 858,459 1,570,976 - 2015 43,397 16,784 38,213 98,375 2016 23,878 12,854 67,028 93,759 Liabilities -Short Term Debt To Banks -Long Term Debt - Current Portion - Accounts Payable Current Liabilities (A) -Long Term Debt Long Term Liabilities (B) Total Liabilities (A) (B) -Capital -Retained Earnings -Net Result for the Period Total Equity Total Liabilities & Equity 818,070 813,070 916.445 20.000 128,000 438,455 586,455 1,502,900 700,004 700,004 793.764 20,000 566.455 190757 17:22 1,570,976 Industry Ratios Industry Ratios Sales Growth Income Growth Asset Growth Gross Profit Margin Net Operating Margin Profit Margin Current Ratio Quick Ratio Equity/Total Assets 5% Return on Assets 12% Return on Equity 7% Gross Interest Coverage 62% Net Interest Coverage 24% Days In Inventories 20% Average Collection Period 2.60 Average Payable Period 2.20 Debt to Assets 0.60 Debt to Equity 30% 60% 51.0X 52.OX 98 45 23 0.40 0.67