Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fahad owns a cement industry in Saudi Arabia. One of the machines at his industry was purchased nine years ago for SR 150,000. This

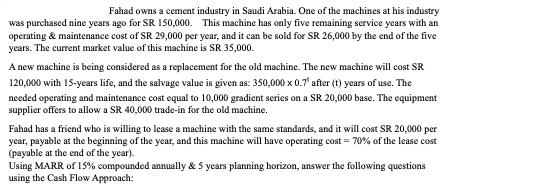

Fahad owns a cement industry in Saudi Arabia. One of the machines at his industry was purchased nine years ago for SR 150,000. This machine has only five remaining service years with an operating & maintenance cost of SR 29,000 per year, and it can be sold for SR 26,000 by the end of the five years. The current market value of this machine is SR 35,000. A new machine is being considered as a replacement for the old machine. The new machine will cost SR 120,000 with 15-years life, and the salvage value is given as: 350,000 x 0.7 after (t) years of use. The needed operating and maintenance cost equal to 10,000 gradient series on a SR 20,000 base. The equipment supplier offers to allow a SR 40,000 trade-in for the old machine. Fahad has a friend who is willing to lease a machine with the same standards, and it will cost SR 20,000 per year, payable at the beginning of the year, and this machine will have operating cost = 70% of the lease cost (payable at the end of the year). Using MARR of 15% compounded annually & 5 years planning horizon, answer the following questions using the Cash Flow Approach: What is the EUAC of the old machine? (unit: SR) a) 35,585 b) 25,832 c) 38,847 What is the EUAC of the new machine? (unit: SR) a) 52,369 b) 62,810 c) 58,211 What is the EUAC of the leased machine? (unit: SR) a) 37,000 b) 21,985 c) 35,000 a) c) Replace with the lease Keep the old machine d) 25,144 d) 71,225 Let's assume that the calculated EUACs for the old machine, the new machine and the lease are SR 130,000, SR 150,000 and SR 170,000; respectively, then what will be your recommendation for Fahad? d) 26.559 b) Replace with the new machine d) Cannot be determined The recommendation if we used the Opportunity Cost Approach would be ... a) Different from the Cash Flow Approach. b) Same or different, we cannot tell without going through the calculations. c) Same as the Cash Flow Approach. d) Most likely the same, but it could be different.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

12 a 35585 We first chalk out the cashflows for the old machine We take all the cashoutflows as nega...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started