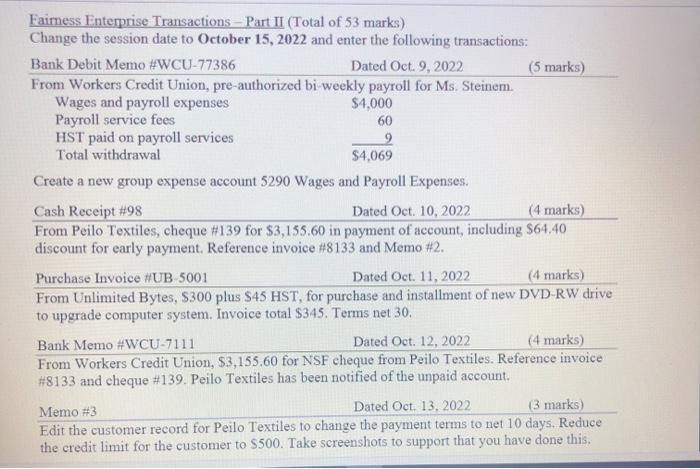

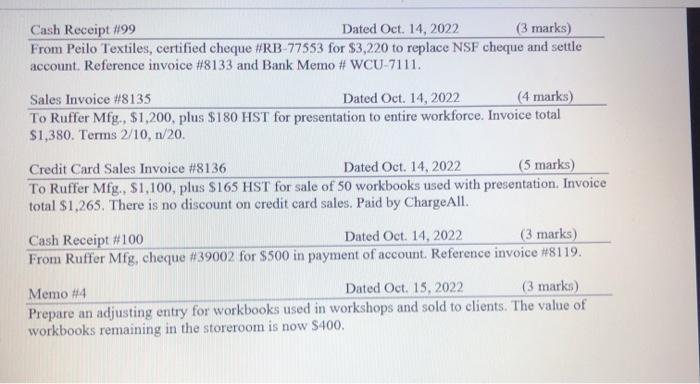

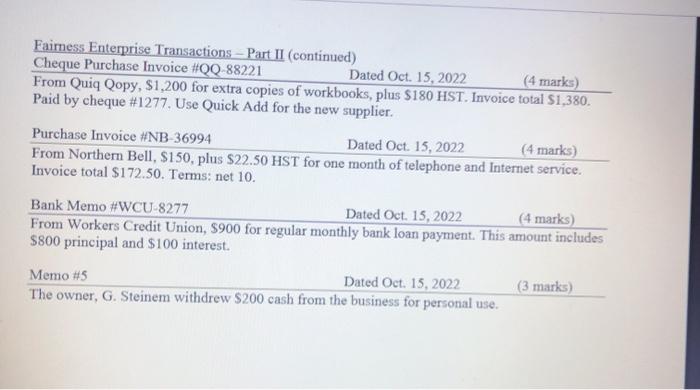

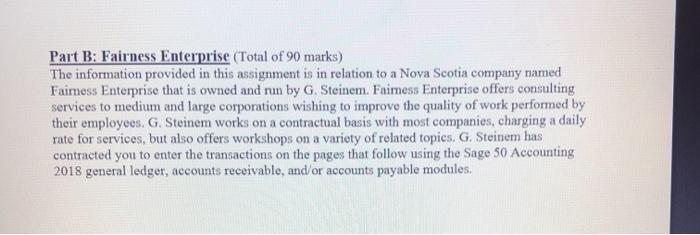

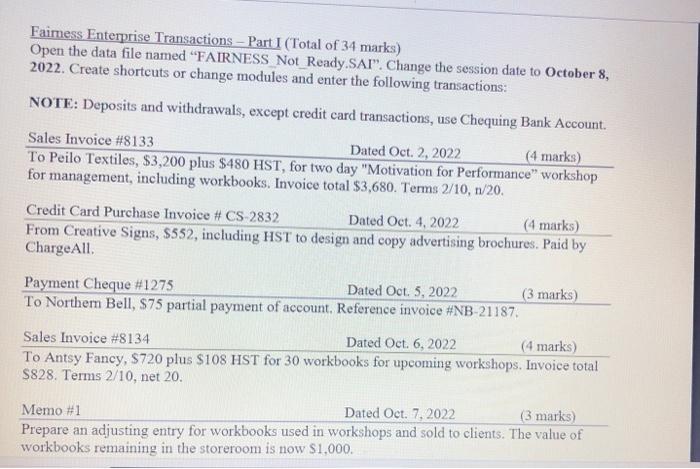

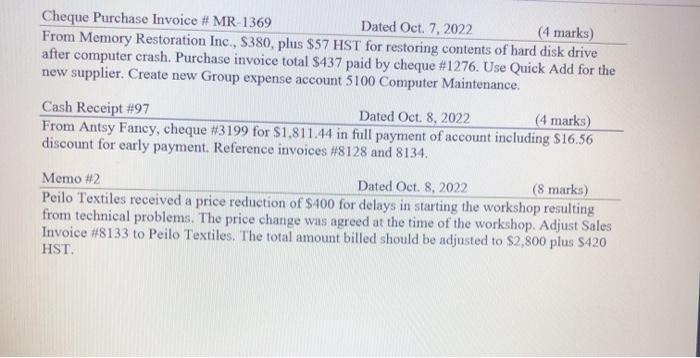

Faimess Enterprise Transactions - Part II (Total of 53 marks) Change the session date to October 15, 2022 and enter the following transactions: Bank Debit Memo #WCU-77386 Dated Oct. 9,2022 (5 marks) From Workers Credit Union, pre-authorized bi weekly payroll for Ms. Steinem. Wages and payroll expenses $4,000 Payroll service fees 60 HST paid on payroll services 9 Total withdrawal $4,069 Create a new group expense account 5290 Wages and Payroll Expenses. Cash Receipt #98 Dated Oct. 10. 2022 (4 marks) From Peilo Textiles, cheque #139 for $3,155.60 in payment of account, including $64.40 discount for early payment. Reference invoice #8133 and Memo #2 Purchase Invoice #UB 5001 Dated Oct. 11, 2022 (4 marks) From Unlimited Bytes, $300 plus S45 HST, for purchase and installment of new DVD-RW drive to upgrade computer system. Invoice total $345. Terms net 30. Bank Memo #WCU-7111 Dated Oct. 12, 2022 (4 marks) From Workers Credit Union, $3,155.60 for NSF cheque from Peilo Textiles. Reference invoice #8133 and cheque #139. Peilo Textiles has been notified of the unpaid account. Memo #3 Dated Oct. 13.2022 (3 marks) Edit the customer record for Peilo Textiles to change the payment terms to net 10 days. Reduce the credit limit for the customer to $500. Take screenshots to support that you have done this. Cash Receipt #99 Dated Oct. 14,2022 (3 marks) From Peilo Textiles, certified cheque WRB-77553 for $3,220 to replace NSF cheque and settle account. Reference invoice #8133 and Bank Memo # WCU-7111. Sales Invoice #8135 Dated Oct. 14,2022 (4 marks) To Ruffer Mfg., $1,200, plus $180 HST for presentation to entire workforce. Invoice total $1,380. Terms 2/10,n/20. Credit Card Sales Invoice #8136 Dated Oct. 14, 2022 (5 marks) To Ruffer Mfg., $1,100, plus $165 HST for sale of 50 workbooks used with presentation. Invoice total $1,265. There is no discount on credit card sales. Paid by ChargeAll. Cash Receipt #100 Dated Oct. 14, 2022 (3 marks) From Ruffer Mfg, cheque #39002 for $500 in payment of account. Reference invoice #8119. Memo #4 Dated Oct. 15, 2022 (3 marks) Prepare an adjusting entry for workbooks used in workshops and sold to clients. The value of workbooks remaining in the storeroom is now $400. Faimess Enterprise Transactions - Part II (continued) Cheque Purchase Invoice #QQ-88221 Dated Oct. 15, 2022 (4 marks) From Quiq Qopy, $1,200 for extra copies of workbooks, plus $180 HST. Invoice total $1,380. Paid by cheque #1277. Use Quick Add for the new supplier. Purchase Invoice #NB-36994 Dated Oct. 15, 2022 (4 marks) From Northern Bell, $150, plus $22.50 HST for one month of telephone and Internet service. Invoice total $172.50. Terms: net 10. Bank Memo #WCU-8277 Dated Oct. 15, 2022 (4 marks) From Workers Credit Union, 5900 for regular monthly bank loan payment. This amount includes $800 principal and $100 interest. Memo #5 Dated Oct. 15, 2022 (3 marks) The owner, G. Steinem withdrew $200 cash from the business for personal use. Part B: Fairness Enterprise (Total of 90 marks) The information provided in this assignment is in relation to a Nova Scotia company named Faimess Enterprise that is owned and nn by G. Steinem. Faimess Enterprise offers consulting services to medium and large corporations wishing to improve the quality of work performed by their employees. G. Steinem works on a contractual basis with most companies, charging a daily rate for services, but also offers workshops on a variety of related topics. G. Steinem has contracted you to enter the transactions on the pages that follow using the Sage 50 Accounting 2018 general ledger, accounts receivable, and/or accounts payable modules. Faimess Enterprise Transactions - Part I (Total of 34 marks) Open the data file named FAIRNESS Not Ready.SAI". Change the session date to October 8, 2022. Create shortcuts or change modules and enter the following transactions: NOTE: Deposits and withdrawals, except credit card transactions, use Chequing Bank Account. Sales Invoice #8133 Dated Oct. 2,2022 (4 marks) To Peilo Textiles, $3,200 plus $480 HST, for two day "Motivation for Performance" workshop for management, including workbooks. Invoice total $3,680. Terms 2/10, 1/20. Credit Card Purchase Invoice # CS-2832 Dated Oct. 4, 2022 (4 marks) From Creative Signs, $552, including HST to design and copy advertising brochures. Paid by ChargeAll Payment Cheque #1275 Dated Oct. 5, 2022 (3 marks) To Northern Bell, $75 partial payment of account. Reference invoice #NB-21187 Sales Invoice #8134 Dated Oct. 6, 2022 (4 marks) To Antsy Fancy, S720 plus $108 HST for 30 workbooks for upcoming workshops. Invoice total $828. Terms 2/10, net 20. Memo #1 Dated Oct. 7, 2022 (3 marks) Prepare an adjusting entry for workbooks used in workshops and sold to clients. The value of workbooks remaining in the storeroom is now $1,000. Cheque Purchase Invoice # MR 1369 Dated Oct. 7, 2022 (4 marks) From Memory Restoration Inc., $380, plus $57 HST for restoring contents of hard disk drive after computer crash. Purchase invoice total $437 paid by cheque #1276. Use Quick Add for the new supplier. Create new Group expense account 5100 Computer Maintenance. Cash Receipt #97 Dated Oct. 8, 2022 (4 marks) From Antsy Fancy, cheque #3199 for $1,811.44 in full payment of account including $16.56 discount for early payment. Reference invoices #8128 and 8134. Memo #2 Dated Oct 8, 2022 (8 marks) Peilo Textiles received a price reduction of $400 for delays in starting the workshop resulting from technical problems. The price change was agreed at the time of the workshop. Adjust Sales Invoice #8133 to Peilo Textiles. The total amount billed should be adjusted to $2,800 plus S420 HST Faimess Enterprise Transactions - Part II (Total of 53 marks) Change the session date to October 15, 2022 and enter the following transactions: Bank Debit Memo #WCU-77386 Dated Oct. 9,2022 (5 marks) From Workers Credit Union, pre-authorized bi weekly payroll for Ms. Steinem. Wages and payroll expenses $4,000 Payroll service fees 60 HST paid on payroll services 9 Total withdrawal $4,069 Create a new group expense account 5290 Wages and Payroll Expenses. Cash Receipt #98 Dated Oct. 10. 2022 (4 marks) From Peilo Textiles, cheque #139 for $3,155.60 in payment of account, including $64.40 discount for early payment. Reference invoice #8133 and Memo #2 Purchase Invoice #UB 5001 Dated Oct. 11, 2022 (4 marks) From Unlimited Bytes, $300 plus S45 HST, for purchase and installment of new DVD-RW drive to upgrade computer system. Invoice total $345. Terms net 30. Bank Memo #WCU-7111 Dated Oct. 12, 2022 (4 marks) From Workers Credit Union, $3,155.60 for NSF cheque from Peilo Textiles. Reference invoice #8133 and cheque #139. Peilo Textiles has been notified of the unpaid account. Memo #3 Dated Oct. 13.2022 (3 marks) Edit the customer record for Peilo Textiles to change the payment terms to net 10 days. Reduce the credit limit for the customer to $500. Take screenshots to support that you have done this. Cash Receipt #99 Dated Oct. 14,2022 (3 marks) From Peilo Textiles, certified cheque WRB-77553 for $3,220 to replace NSF cheque and settle account. Reference invoice #8133 and Bank Memo # WCU-7111. Sales Invoice #8135 Dated Oct. 14,2022 (4 marks) To Ruffer Mfg., $1,200, plus $180 HST for presentation to entire workforce. Invoice total $1,380. Terms 2/10,n/20. Credit Card Sales Invoice #8136 Dated Oct. 14, 2022 (5 marks) To Ruffer Mfg., $1,100, plus $165 HST for sale of 50 workbooks used with presentation. Invoice total $1,265. There is no discount on credit card sales. Paid by ChargeAll. Cash Receipt #100 Dated Oct. 14, 2022 (3 marks) From Ruffer Mfg, cheque #39002 for $500 in payment of account. Reference invoice #8119. Memo #4 Dated Oct. 15, 2022 (3 marks) Prepare an adjusting entry for workbooks used in workshops and sold to clients. The value of workbooks remaining in the storeroom is now $400. Faimess Enterprise Transactions - Part II (continued) Cheque Purchase Invoice #QQ-88221 Dated Oct. 15, 2022 (4 marks) From Quiq Qopy, $1,200 for extra copies of workbooks, plus $180 HST. Invoice total $1,380. Paid by cheque #1277. Use Quick Add for the new supplier. Purchase Invoice #NB-36994 Dated Oct. 15, 2022 (4 marks) From Northern Bell, $150, plus $22.50 HST for one month of telephone and Internet service. Invoice total $172.50. Terms: net 10. Bank Memo #WCU-8277 Dated Oct. 15, 2022 (4 marks) From Workers Credit Union, 5900 for regular monthly bank loan payment. This amount includes $800 principal and $100 interest. Memo #5 Dated Oct. 15, 2022 (3 marks) The owner, G. Steinem withdrew $200 cash from the business for personal use. Part B: Fairness Enterprise (Total of 90 marks) The information provided in this assignment is in relation to a Nova Scotia company named Faimess Enterprise that is owned and nn by G. Steinem. Faimess Enterprise offers consulting services to medium and large corporations wishing to improve the quality of work performed by their employees. G. Steinem works on a contractual basis with most companies, charging a daily rate for services, but also offers workshops on a variety of related topics. G. Steinem has contracted you to enter the transactions on the pages that follow using the Sage 50 Accounting 2018 general ledger, accounts receivable, and/or accounts payable modules. Faimess Enterprise Transactions - Part I (Total of 34 marks) Open the data file named FAIRNESS Not Ready.SAI". Change the session date to October 8, 2022. Create shortcuts or change modules and enter the following transactions: NOTE: Deposits and withdrawals, except credit card transactions, use Chequing Bank Account. Sales Invoice #8133 Dated Oct. 2,2022 (4 marks) To Peilo Textiles, $3,200 plus $480 HST, for two day "Motivation for Performance" workshop for management, including workbooks. Invoice total $3,680. Terms 2/10, 1/20. Credit Card Purchase Invoice # CS-2832 Dated Oct. 4, 2022 (4 marks) From Creative Signs, $552, including HST to design and copy advertising brochures. Paid by ChargeAll Payment Cheque #1275 Dated Oct. 5, 2022 (3 marks) To Northern Bell, $75 partial payment of account. Reference invoice #NB-21187 Sales Invoice #8134 Dated Oct. 6, 2022 (4 marks) To Antsy Fancy, S720 plus $108 HST for 30 workbooks for upcoming workshops. Invoice total $828. Terms 2/10, net 20. Memo #1 Dated Oct. 7, 2022 (3 marks) Prepare an adjusting entry for workbooks used in workshops and sold to clients. The value of workbooks remaining in the storeroom is now $1,000. Cheque Purchase Invoice # MR 1369 Dated Oct. 7, 2022 (4 marks) From Memory Restoration Inc., $380, plus $57 HST for restoring contents of hard disk drive after computer crash. Purchase invoice total $437 paid by cheque #1276. Use Quick Add for the new supplier. Create new Group expense account 5100 Computer Maintenance. Cash Receipt #97 Dated Oct. 8, 2022 (4 marks) From Antsy Fancy, cheque #3199 for $1,811.44 in full payment of account including $16.56 discount for early payment. Reference invoices #8128 and 8134. Memo #2 Dated Oct 8, 2022 (8 marks) Peilo Textiles received a price reduction of $400 for delays in starting the workshop resulting from technical problems. The price change was agreed at the time of the workshop. Adjust Sales Invoice #8133 to Peilo Textiles. The total amount billed should be adjusted to $2,800 plus S420 HST