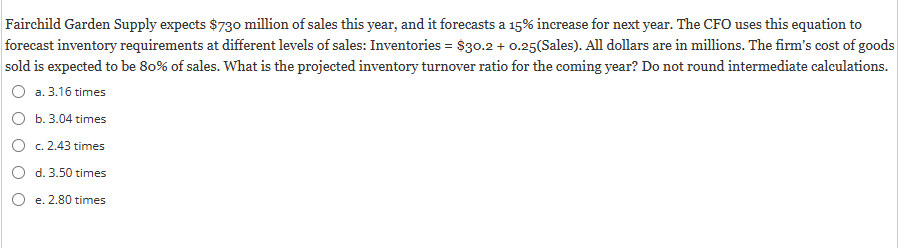

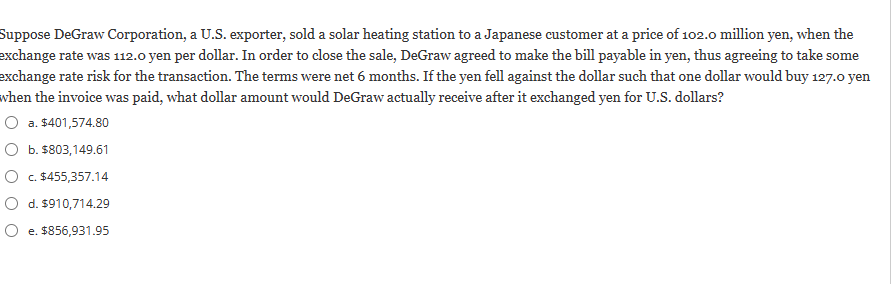

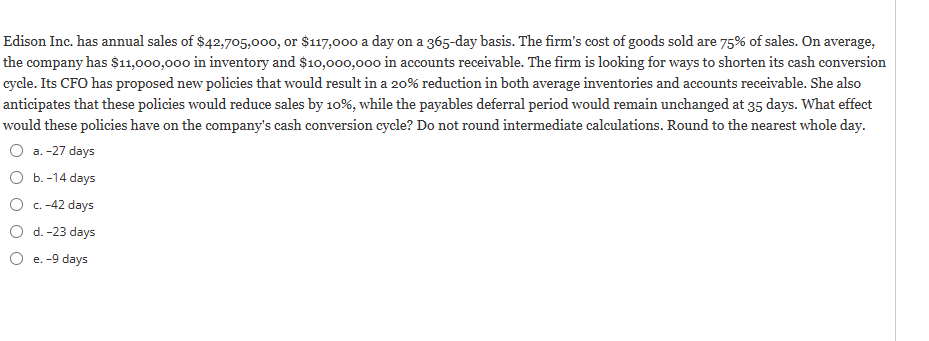

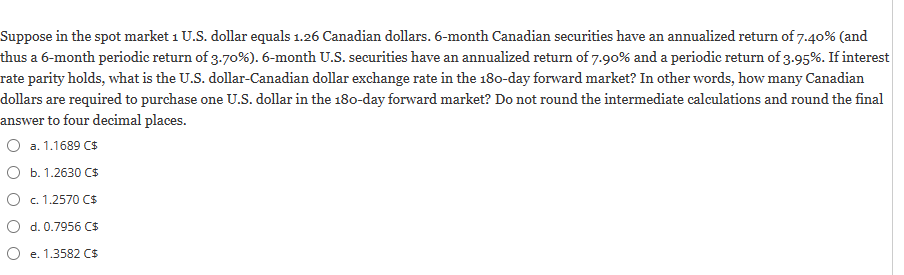

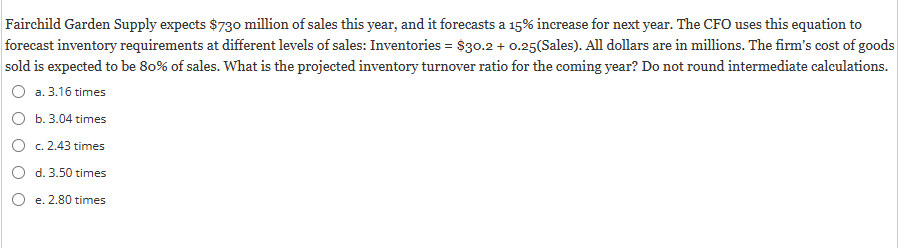

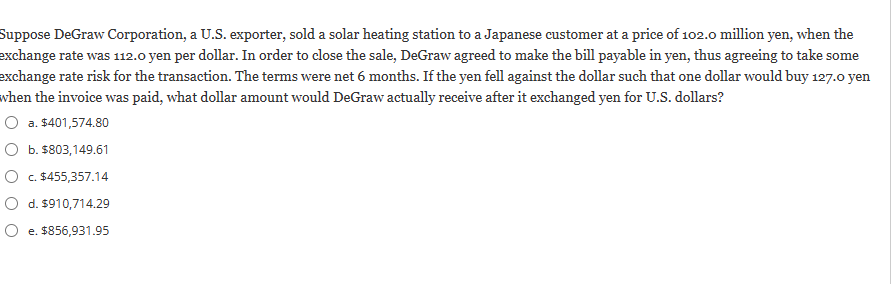

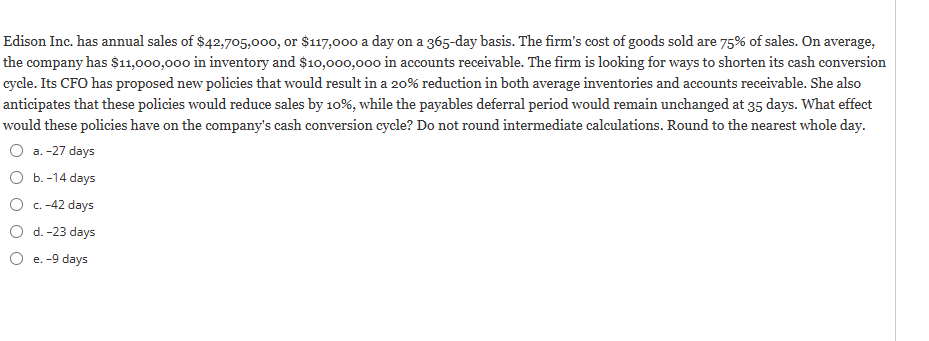

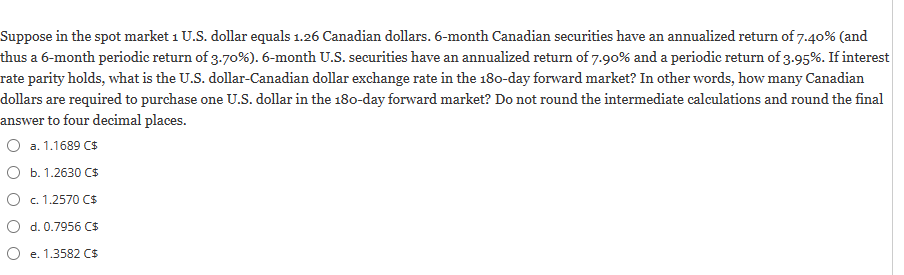

Fairchild Garden Supply expects $730 million of sales this year, and it forecasts a 15% increase for next year. The CFO uses this equation to forecast inventory requirements at different levels of sales: Inventories =$30.2+0.25 (Sales). All dollars are in millions. The firm's cost of goods sold is expected to be 80% of sales. What is the projected inventory turnover ratio for the coming year? Do not round intermediate calculations. a. 3.16 times b. 3.04 times c. 2.43 times d. 3.50 times e. 2.80 times suppose DeGraw Corporation, a U.S. exporter, sold a solar heating station to a Japanese customer at a price of 102.0 million yen, when the exchange rate was 112.o yen per dollar. In order to close the sale, DeGraw agreed to make the bill payable in yen, thus agreeing to take some xxchange rate risk for the transaction. The terms were net 6 months. If the yen fell against the dollar such that one dollar would buy 127.0 yen when the invoice was paid, what dollar amount would DeGraw actually receive after it exchanged yen for U.S. dollars? a. $401,574.80 b. $803,149.61 c. $455,357.14 d. $910,714.29 e. $856,931.95 Edison Inc. has annual sales of $42,705,000, or $117,000 a day on a 365 -day basis. The firm's cost of goods sold are 75% of sales. On average, the company has $11,000,000 in inventory and $10,000,000 in accounts receivable. The firm is looking for ways to shorten its cash conversion cycle. Its CFO has proposed new policies that would result in a 20% reduction in both average inventories and accounts receivable. She also anticipates that these policies would reduce sales by 10%, while the payables deferral period would remain unchanged at 35 days. What effect would these policies have on the company's cash conversion cycle? Do not round intermediate calculations. Round to the nearest whole day. a. -27 days b. -14 days c. -42 days d. -23 days e. -9 days Suppose in the spot market 1 U.S. dollar equals 1.26 Canadian dollars. 6-month Canadian securities have an annualized return of 7.40% (and thus a 6-month periodic return of 3.70\%). 6-month U.S. securities have an annualized return of 7.90% and a periodic return of 3.95%. If interest ate parity holds, what is the U.S. dollar-Canadian dollar exchange rate in the 180-day forward market? In other words, how many Canadian dollars are required to purchase one U.S. dollar in the 180-day forward market? Do not round the intermediate calculations and round the final answer to four decimal places. a. 1.1689C b. 1.2630$ c. 1.2570$ d. 0.7956$ e. 1.3582C$