Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FAIRFAX JEANS INC. AND THE FAIRFAX BELL - BOTTOMS BACKGROUND Today is March 2 2 , 2 0 2 4 . Vanessa Tran, CEO of

FAIRFAX JEANS INC. AND THE "FAIRFAX BELLBOTTOMS"

BACKGROUND

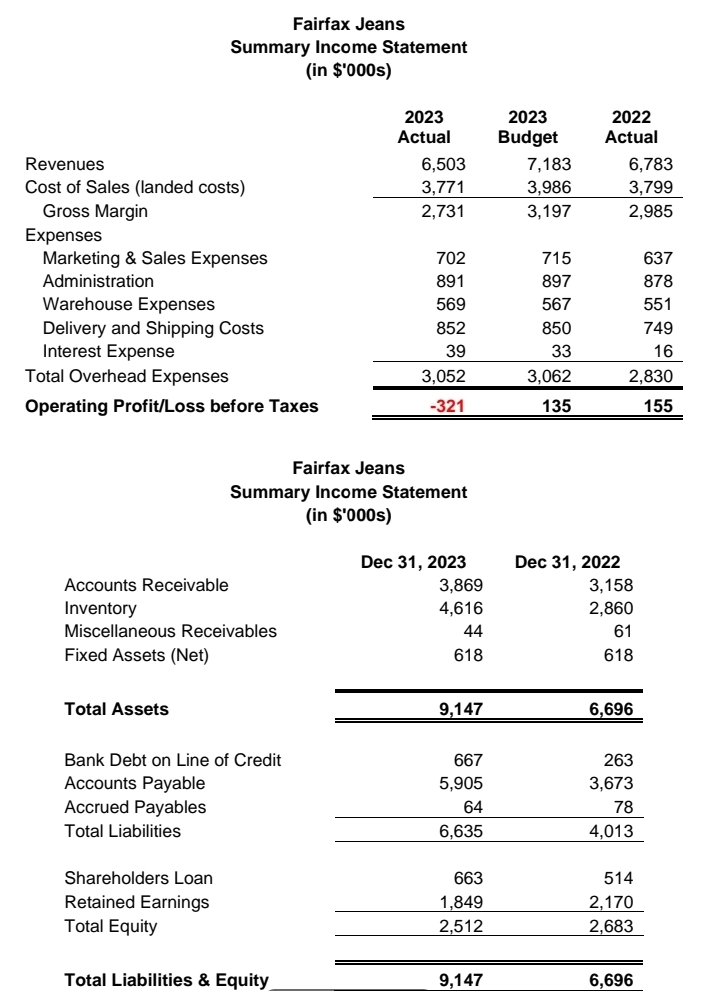

Today is March Vanessa Tran, CEO of Fairfax Jeans Inc. "Fairfax", is reviewing the Statement of Financial Position and Statement of Income, as shown in appendix Vanessa is very disappointed with past year's results and is concerned with how quickly the retail market is changing and how much business conditions have deteriorated over the past year, mostly due to COVID Just over a year ago, the business was profitable, shareholders were supportive, and the bank had no concerns about the company's financial position. The bank last year had even offered to increase the company's available line of credit to $ so that Fairfax could finance its forecasted sales growth the line of credit is the maximum amount that the company can borrow from the bank at the stated annual rate of interest Fairfax is only charged interest on the actual amount borrowed. The actual amount borrowed is shown as "Bank debt on line of credit" in the accompanying financial statements. The loan is secured by the company's inventory and accounts receivables.

Online retailing is threatening sales in a variety of "brick and mortar" retail businesses, including the jean retail sector. industry sales for retail businesses in Canada decreased by an unprecedented from previous levels. This decrease in sales resulted in an important meeting with the bank last week and the bank stated that the rate currently charged on the line of credit will increase by percent by the end of the month due to the poor results.

The March results have not been encouraging either and the month is traditionally a difficult one financially. As a result, the line of credit is projected to reach only $ by March The current bank agreement states that the annual rate on the line of credit is "prime plus The current prime rate is at

An annual general shareholder meeting is scheduled for April and Vanessa will need to defend the most recent results and have a plan for going forward.

PRODUCTS AND DISTRIBUTION

Fairfax is an importer and retailer specializing in fashionforward trendy legwear. The Fairfax Jeans brand is targeted primarily towards female consumers, ages Most of the company's sales are direct to consumers and the brand is promoted with an aggressive advertising campaign. Since markets change rapidly, what is fashionable this season is soon outoffashion. Fairfax Jeans offers a range of trendsetting styles and colours and one of the topselling jeans in Canada this season is expected to be "Fairfax BellBottoms", which features an exaggerated flaredout bellbottom that becomes very fitted above the knee. It is the company's first time offering a bellbottom jean.

Page

Fairfax Jeans only sells its own brand through eleven companyoperated retail stores located in the Greater Toronto Area GTA The company also leases a squarefoot storage warehouse with square feet of office space. At this central facility, product is received, stored, and then supplied to its retail stores to meet the stores' demand. The company does not currently have any website online selling efforts.

Inventory planning in this market is an ongoing challenge. The company's three buyers consider many factors when placing their orders with suppliers, such as market demand, lead times, and discounts from suppliers. A buyer knows that they have done a good job if there is very little inventory left over at the end of each buying season. Part of the buyer's remuneration is based on keeping inventory at manageable levels as measured by inventory turnover ratios Obsolete product has not been a major issue for Fairfax in the past, however the styles and trends continue to change at what seems an everincreasing rate. It is very difficult to sell obsolete product.

Most of Fairfax's purchases are from various manufacturers located in Vietnam. Supply contracts are usually negotiated annually, and suppliers are paid promptly by a bank letter of credit, five days after the product is received in the Toronto warehouse. Fairfax is responsible for paying all the inbound transportation costs to its Toronto warehouse and customs and duty costs into Canada.

THE JEANFADE DEAL

Six months ago, the head buyer from JeanFade, a major jean retailer in Central Canada, approached Vanessa and asked if she would be interested in selling the "Fairfax BellBottoms" jean through JeanFade's retail stores. Vanessa was very excited about the business prospect especially since JeanFade owns and operates retail stores in Ontario and Quebec and the company seems to be a good fit geographically. Vanessa believes that the JeanFade stores would be a suitable additional retail channel for the "Fairfax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started