Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fairfield estimates that its Gross profit will be approximately 60% of sales, its Operating expenses will be 30% of sales and its support overhead

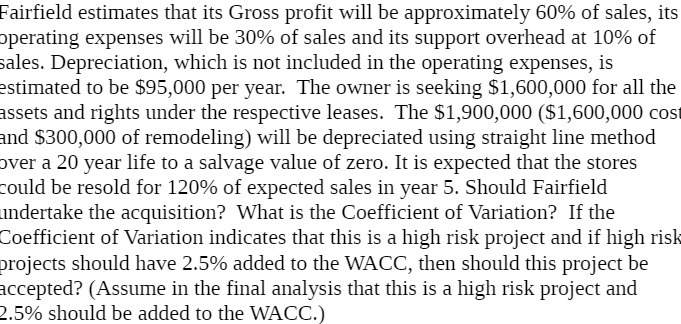

Fairfield estimates that its Gross profit will be approximately 60% of sales, its Operating expenses will be 30% of sales and its support overhead at 10% of sales. Depreciation, which is not included in the operating expenses, is estimated to be $95,000 per year. The owner is seeking $1,600,000 for all the assets and rights under the respective leases. The $1,900,000 ($1,600,000 cost and $300,000 of remodeling) will be depreciated using straight line method over a 20 year life to a salvage value of zero. It is expected that the stores could be resold for 120% of expected sales in year 5. Should Fairfield undertake the acquisition? What is the Coefficient of Variation? If the Coefficient of Variation indicates that this is a high risk project and if high risk projects should have 2.5% added to the WACC, then should this project be accepted? (Assume in the final analysis that this is a high risk project and 2.5% should be added to the WACC.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine whether Fairfield should undertake the acquisition we need to calculate the net present ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started