Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fairfield Office Supplies Inc. has a regional chain of office supply stores in the Midwest. Fairfield is trying to compete with the large nationwide

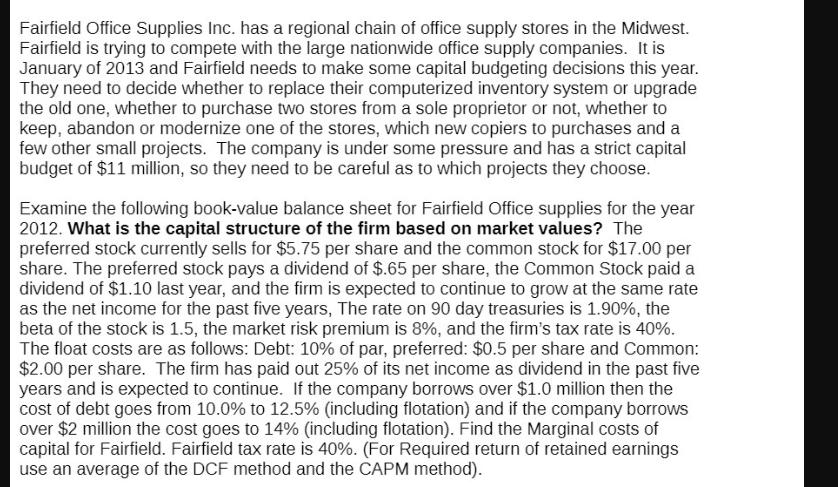

Fairfield Office Supplies Inc. has a regional chain of office supply stores in the Midwest. Fairfield is trying to compete with the large nationwide office supply companies. It is January of 2013 and Fairfield needs to make some capital budgeting decisions this year. They need to decide whether to replace their computerized inventory system or upgrade the old one, whether to purchase two stores from a sole proprietor or not, whether to keep, abandon or modernize one of the stores, which new copiers to purchases and a few other small projects. The company is under some pressure and has a strict capital budget of $11 million, so they need to be careful as to which projects they choose. Examine the following book-value balance sheet for Fairfield Office supplies for the year 2012. What is the capital structure of the firm based on market values? The preferred stock currently sells for $5.75 per share and the common stock for $17.00 per share. The preferred stock pays a dividend of $.65 per share, the Common Stock paid a dividend of $1.10 last year, and the firm is expected to continue to grow at the same rate as the net income for the past five years, The rate on 90 day treasuries is 1.90%, the beta of the stock is 1.5, the market risk premium is 8%, and the firm's tax rate is 40%. The float costs are as follows: Debt: 10% of par, preferred: $0.5 per share and Common: $2.00 per share. The firm has paid out 25% of its net income as dividend in the past five years and is expected to continue. If the company borrows over $1.0 million then the cost of debt goes from 10.0% to 12.5% (including flotation) and if the company borrows over $2 million the cost goes to 14% (including flotation). Find the Marginal costs of capital for Fairfield. Fairfield tax rate is 40%. (For Required return of retained earnings use an average of the DCF method and the CAPM method).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

o calculate the marginal costs of capital for Fairfield Office Supplies we need to determine the required return for each component of the companys ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started