Answered step by step

Verified Expert Solution

Question

1 Approved Answer

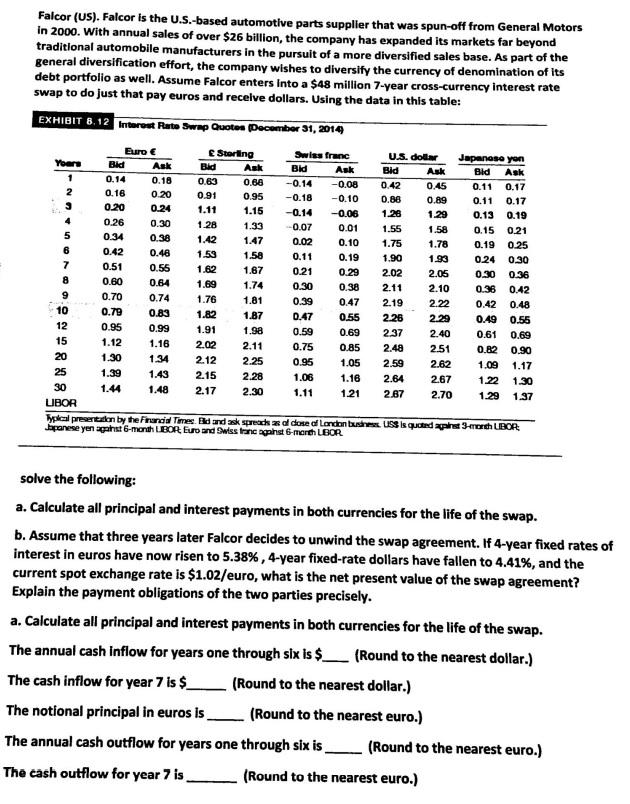

Falcor (US). Falcor is the U.S.-based automotive parts supplier that was spun-off from General Motors in 2000. With annual sales of over $26 billion, the

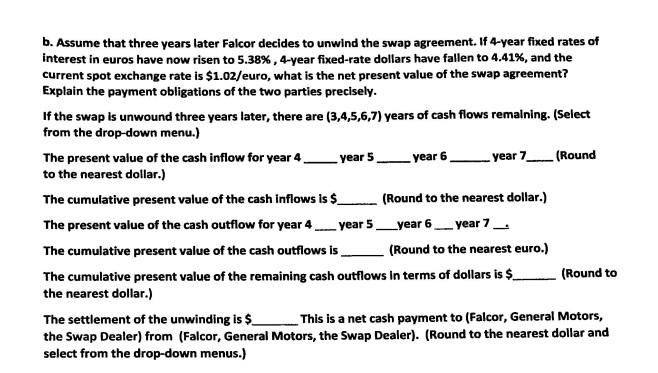

Falcor (US). Falcor is the U.S.-based automotive parts supplier that was spun-off from General Motors in 2000. With annual sales of over $26 billion, the company has expanded its markets far beyond traditional automobile manufacturers in the pursuit of a more diversified sales base. As part of the general diversification effort, the company wishes to diversify the currency of denomination of its debt portfolio as well. Assume Falcor enters into a $48 million 7-year cross-currency interest rate swap to do just that pay euros and receive dollars. Using the data in this table: EXHIBIT 8.12 Interest Rate Swap Quotes December 31, 2014 Japanese yon Yours Ask 0.18 -0.08 1.75 0.51 Euro Sterling Swiss franc U.S. doler Bid Ask Bid Ask Bld Ask Bid Ask Bld 0.14 0.63 0.66 -0.14 0.42 0.45 0.11 0.17 0.16 0.20 0.91 0.95 -0.18 -0.10 0.86 0.89 0.11 0.17 0.20 0.24 1.11 1.15 -0.14 -0.06 126 1.29 0.13 0.19 4 0.26 0.30 1.28 1.33 -0.07 0.01 1.55 1.58 0.15 0.21 5 0.34 0.38 1.42 1.47 0.02 0.10 1.78 0.19 0.25 6 0.42 0.46 1.53 1.58 0.11 0.19 1.90 1.93 0.24 0.30 7 0.55 1.62 1.87 0.21 0.29 2.02 2.05 0.30 0.36 8 0.60 0.64 1.69 1.74 0.30 0.38 2.11 2.10 0.36 0.42 9 0.70 0.74 1.76 1.81 0.39 0.47 2.19 2.22 0.42 0.48 10 0.79 0.83 1.82 1.87 0.47 0.55 2.29 0.49 0.55 12 0.95 0.99 1.91 1.98 0.59 0.69 2.37 2.40 0.61 0.69 15 1.12 1.16 2.02 2.11 0.75 0.85 2.48 2.51 0.82 0.90 20 1.30 1.34 2.12 2.25 0.95 1.05 2.59 2.62 1.09 1.17 25 1.39 1.43 2.15 2.28 1.06 1.16 2.64 2.67 1.22 1.30 30 1.44 1.48 2.17 2.30 1.11 1.21 2.67 2.70 1.29 1.37 LIBOR ypal presentation by the Francid Times Bed and ask spreached dose of London buses. LSS is quoted pistrert LBOR Japanese yen part 6-month LBOR Euro and Swiss franc against 6-month LBOR 226 solve the following: a. Calculate all principal and interest payments in both currencies for the life of the swap. b. Assume that three years later Falcor decides to unwind the swap agreement. If 4-year fixed rates of interest in euros have now risen to 5.38%, 4-year fixed-rate dollars have fallen to 4.41%, and the current spot exchange rate is $1.02/euro, what is the net present value of the swap agreement? Explain the payment obligations of the two parties precisely. a. Calculate all principal and interest payments in both currencies for the life of the swap. The annual cash inflow for years one through six is $ _ (Round to the nearest dollar.) The cash inflow for year 7 is $_ (Round to the nearest dollar.) The notional principal in euros is (Round to the nearest euro.) The annual cash outflow for years one through six is (Round to the nearest euro.) The cash outflow for year 7 is (Round to the nearest euro.) b. Assume that three years later Falcor decides to unwind the swap agreement. If 4-year fixed rates of interest in euros have now risen to 5.38%, 4-year fixed-rate dollars have fallen to 4.41%, and the current spot exchange rate is $1.02/euro, what is the net present value of the swap agreement? Explain the payment obligations of the two parties precisely. If the swap is unwound three years later, there are (3,4,5,6,7) years of cash flows remaining. (Select from the drop-down menu.) The present value of the cash inflow for year 4 year 5 Year 6 year 7 (Round to the nearest dollar.) The cumulative present value of the cash inflows is $_ (Round to the nearest dollar.) The present value of the cash outflow for year 4 year 5 year 6 __year 7 The cumulative present value of the cash outflows is (Round to the nearest euro.) The cumulative present value of the remaining cash outflows in terms of dollars is $ (Round to the nearest dollar.) The settlement of the unwinding is $ This is a net cash payment to (Falcor, General Motors, the Swap Dealer) from (Falcor, General Motors, the Swap Dealer). (Round to the nearest dollar and select from the drop-down menus.) Falcor (US). Falcor is the U.S.-based automotive parts supplier that was spun-off from General Motors in 2000. With annual sales of over $26 billion, the company has expanded its markets far beyond traditional automobile manufacturers in the pursuit of a more diversified sales base. As part of the general diversification effort, the company wishes to diversify the currency of denomination of its debt portfolio as well. Assume Falcor enters into a $48 million 7-year cross-currency interest rate swap to do just that pay euros and receive dollars. Using the data in this table: EXHIBIT 8.12 Interest Rate Swap Quotes December 31, 2014 Japanese yon Yours Ask 0.18 -0.08 1.75 0.51 Euro Sterling Swiss franc U.S. doler Bid Ask Bid Ask Bld Ask Bid Ask Bld 0.14 0.63 0.66 -0.14 0.42 0.45 0.11 0.17 0.16 0.20 0.91 0.95 -0.18 -0.10 0.86 0.89 0.11 0.17 0.20 0.24 1.11 1.15 -0.14 -0.06 126 1.29 0.13 0.19 4 0.26 0.30 1.28 1.33 -0.07 0.01 1.55 1.58 0.15 0.21 5 0.34 0.38 1.42 1.47 0.02 0.10 1.78 0.19 0.25 6 0.42 0.46 1.53 1.58 0.11 0.19 1.90 1.93 0.24 0.30 7 0.55 1.62 1.87 0.21 0.29 2.02 2.05 0.30 0.36 8 0.60 0.64 1.69 1.74 0.30 0.38 2.11 2.10 0.36 0.42 9 0.70 0.74 1.76 1.81 0.39 0.47 2.19 2.22 0.42 0.48 10 0.79 0.83 1.82 1.87 0.47 0.55 2.29 0.49 0.55 12 0.95 0.99 1.91 1.98 0.59 0.69 2.37 2.40 0.61 0.69 15 1.12 1.16 2.02 2.11 0.75 0.85 2.48 2.51 0.82 0.90 20 1.30 1.34 2.12 2.25 0.95 1.05 2.59 2.62 1.09 1.17 25 1.39 1.43 2.15 2.28 1.06 1.16 2.64 2.67 1.22 1.30 30 1.44 1.48 2.17 2.30 1.11 1.21 2.67 2.70 1.29 1.37 LIBOR ypal presentation by the Francid Times Bed and ask spreached dose of London buses. LSS is quoted pistrert LBOR Japanese yen part 6-month LBOR Euro and Swiss franc against 6-month LBOR 226 solve the following: a. Calculate all principal and interest payments in both currencies for the life of the swap. b. Assume that three years later Falcor decides to unwind the swap agreement. If 4-year fixed rates of interest in euros have now risen to 5.38%, 4-year fixed-rate dollars have fallen to 4.41%, and the current spot exchange rate is $1.02/euro, what is the net present value of the swap agreement? Explain the payment obligations of the two parties precisely. a. Calculate all principal and interest payments in both currencies for the life of the swap. The annual cash inflow for years one through six is $ _ (Round to the nearest dollar.) The cash inflow for year 7 is $_ (Round to the nearest dollar.) The notional principal in euros is (Round to the nearest euro.) The annual cash outflow for years one through six is (Round to the nearest euro.) The cash outflow for year 7 is (Round to the nearest euro.) b. Assume that three years later Falcor decides to unwind the swap agreement. If 4-year fixed rates of interest in euros have now risen to 5.38%, 4-year fixed-rate dollars have fallen to 4.41%, and the current spot exchange rate is $1.02/euro, what is the net present value of the swap agreement? Explain the payment obligations of the two parties precisely. If the swap is unwound three years later, there are (3,4,5,6,7) years of cash flows remaining. (Select from the drop-down menu.) The present value of the cash inflow for year 4 year 5 Year 6 year 7 (Round to the nearest dollar.) The cumulative present value of the cash inflows is $_ (Round to the nearest dollar.) The present value of the cash outflow for year 4 year 5 year 6 __year 7 The cumulative present value of the cash outflows is (Round to the nearest euro.) The cumulative present value of the remaining cash outflows in terms of dollars is $ (Round to the nearest dollar.) The settlement of the unwinding is $ This is a net cash payment to (Falcor, General Motors, the Swap Dealer) from (Falcor, General Motors, the Swap Dealer). (Round to the nearest dollar and select from the drop-down menus.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started