Answered step by step

Verified Expert Solution

Question

1 Approved Answer

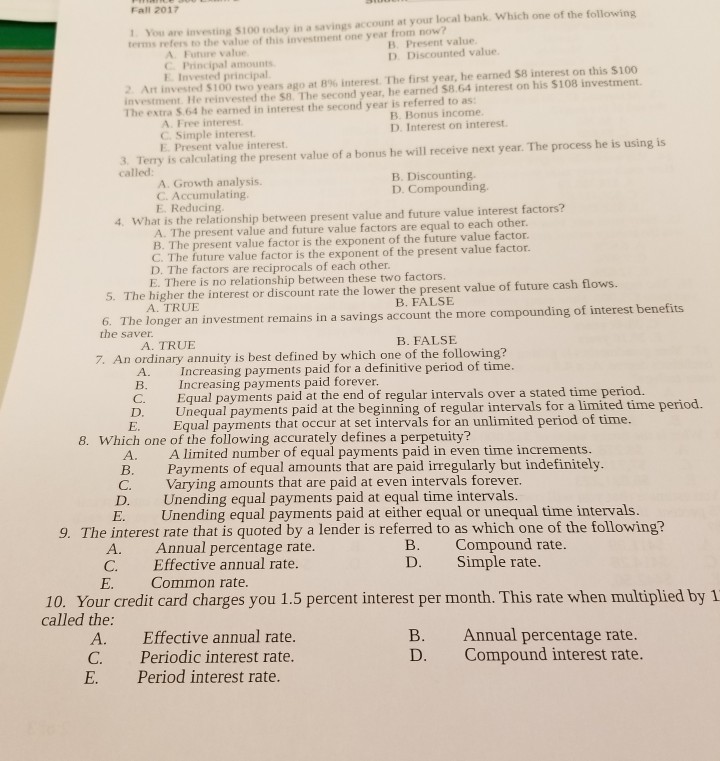

Fall 2017 1. You are investing $100 today in a savings account at your local bank. Which one of the following terms refers to the

Fall 2017 1. You are investing $100 today in a savings account at your local bank. Which one of the following terms refers to the value of this investment one year from now? B. Present value D. Discounted value A Future value C Principal amounts E Invested principal 2 Art invested 5100 two years ago at 8% interest. The first year, he earned $8 interest on this $100 investment He reinvested the $8. The second The extra $.64 he earned in interest the nd year, he earned S8.64 interest on his $108 investment. year is referred to as: B. Bonus income D. Interest on interest A. Free interest C. Simple interest E. Present value interest 3. Terry is calculating the present value of a bonus he will receive next year. The process he is using is called unting A. Growth analysis. C. Accumulatin E. Reducing 4. What is the relationship between present value and future value interest factors? The present value and future value factors are equal to each other B. The present value factor is the exponent of the future value factor. e future value factor is the exponent of the present value factor D. The factors are reciprocals of each other E. There is no relationship between these two factors igher the interest or discount rate the lower the present value of future cash flows. A. TRUE B. FALSE 6. The longer an investment remains in a savings account the more compounding of interest the saver A. TRUE B. FALSE 7. An ordinary annuity is best defined by which one of the following? Increasing payments paid for a definitive period of time Increasing payments paid forever C. Eal payments paid at the end of regular intervals over a stated time period Unequal payments paid at the beginning of regular intervals for a limited time period. Equal payments that occur at set intervals for an unlimited period of time. 8. Which one of the following accurately defines a perpetuity? A. B. C. D. Alimited number of equal payments paid in even time increments. Payments of equal amounts that are paid irregularly but indefinitely. Varying amounts that are paid at even intervals forever. Unending equal payments paid at equal time intervals. Unending equal payments paid at either equal or unequal time intervals. 9. The interest rate that is quoted by a lender is referred to as which one of the following? A. C. Annual percentage rate. Effective annual rate. B. D. Simple rate. Compound rate E. Common rate. 10. Your credit card charges you 1.5 percent interest per month. This rate when multiplied by 1 called the: A. Effective annual rate. C. Periodic interest rate. E. Period interest rate. B. D. Annual percentage rate. Compound interest rate. Fall 2017 1. You are investing $100 today in a savings account at your local bank. Which one of the following terms refers to the value of this investment one year from now? B. Present value D. Discounted value A Future value C Principal amounts E Invested principal 2 Art invested 5100 two years ago at 8% interest. The first year, he earned $8 interest on this $100 investment He reinvested the $8. The second The extra $.64 he earned in interest the nd year, he earned S8.64 interest on his $108 investment. year is referred to as: B. Bonus income D. Interest on interest A. Free interest C. Simple interest E. Present value interest 3. Terry is calculating the present value of a bonus he will receive next year. The process he is using is called unting A. Growth analysis. C. Accumulatin E. Reducing 4. What is the relationship between present value and future value interest factors? The present value and future value factors are equal to each other B. The present value factor is the exponent of the future value factor. e future value factor is the exponent of the present value factor D. The factors are reciprocals of each other E. There is no relationship between these two factors igher the interest or discount rate the lower the present value of future cash flows. A. TRUE B. FALSE 6. The longer an investment remains in a savings account the more compounding of interest the saver A. TRUE B. FALSE 7. An ordinary annuity is best defined by which one of the following? Increasing payments paid for a definitive period of time Increasing payments paid forever C. Eal payments paid at the end of regular intervals over a stated time period Unequal payments paid at the beginning of regular intervals for a limited time period. Equal payments that occur at set intervals for an unlimited period of time. 8. Which one of the following accurately defines a perpetuity? A. B. C. D. Alimited number of equal payments paid in even time increments. Payments of equal amounts that are paid irregularly but indefinitely. Varying amounts that are paid at even intervals forever. Unending equal payments paid at equal time intervals. Unending equal payments paid at either equal or unequal time intervals. 9. The interest rate that is quoted by a lender is referred to as which one of the following? A. C. Annual percentage rate. Effective annual rate. B. D. Simple rate. Compound rate E. Common rate. 10. Your credit card charges you 1.5 percent interest per month. This rate when multiplied by 1 called the: A. Effective annual rate. C. Periodic interest rate. E. Period interest rate. B. D. Annual percentage rate. Compound interest rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started