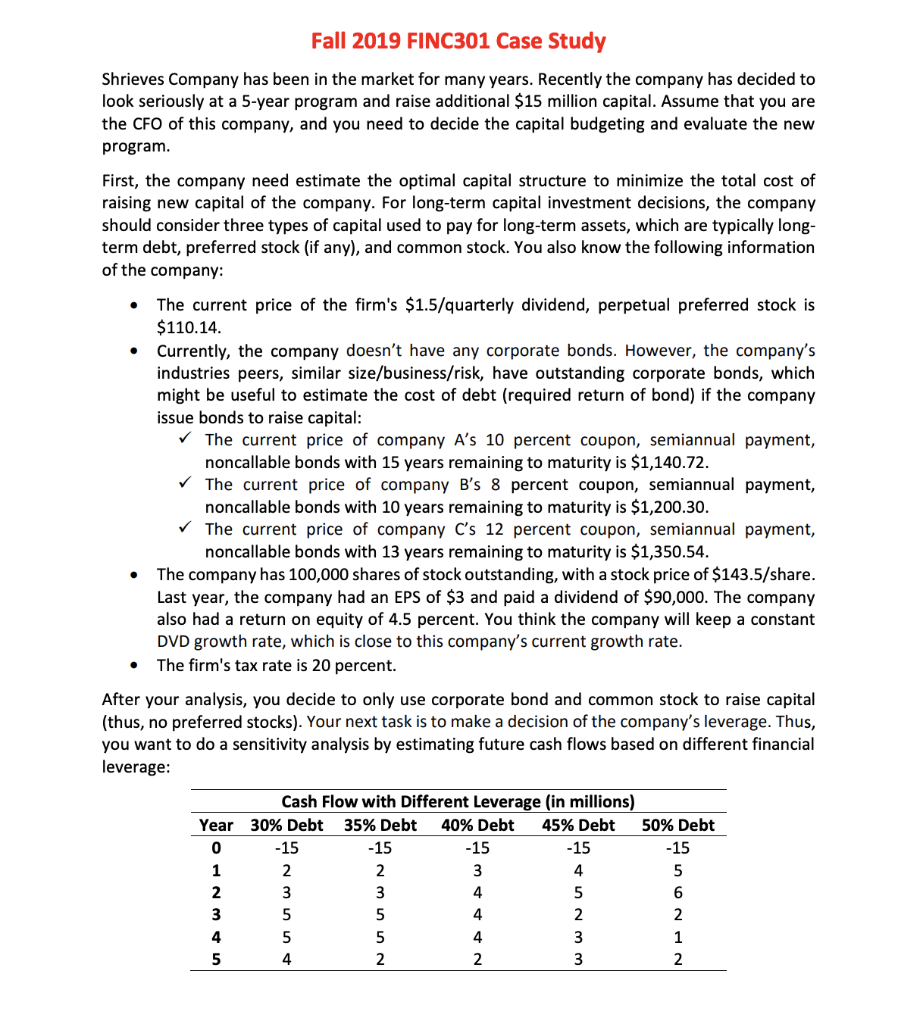

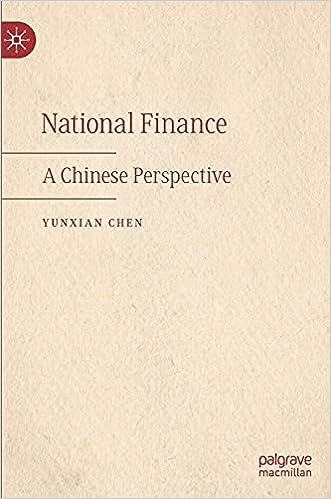

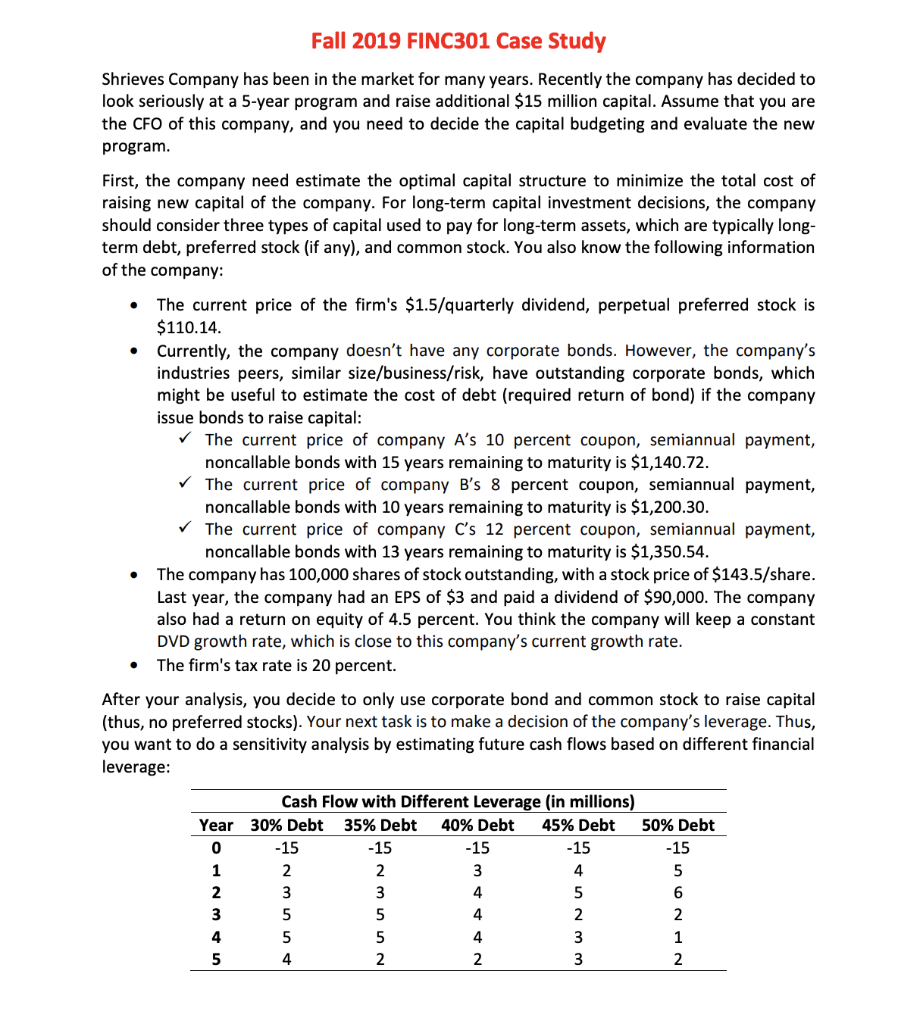

Fall 2019 FINC301 Case Study Shrieves Company has been in the market for many years. Recently the company has decided to look seriously at a 5-year program and raise additional $15 million capital. Assume that you are the CFO of this company, and you need to decide the capital budgeting and evaluate the new program. First, the company need estimate the optimal capital structure to minimize the total cost of raising new capital of the company. For long-term capital investment decisions, the company should consider three types of capital used to pay for long-term assets, which are typically long- term debt, preferred stock (if any), and common stock. You also know the following information of the company: The current price of the firm's $1.5/quarterly dividend, perpetual preferred stock is $110.14. Currently, the company doesn't have any corporate bonds. However, the company's industries peers, similar size/business/risk, have outstanding corporate bonds, which might be useful to estimate the cost of debt (required return of bond) if the company issue bonds to raise capital: The current price of company A's 10 percent coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity is $1,140.72. The current price of company B's 8 percent coupon, semiannual payment, noncallable bonds with 10 years remaining to maturity is $1,200.30. The current price of company C's 12 percent coupon, semiannual payment, noncallable bonds with 13 years remaining to maturity is $1,350.54. The company has 100,000 shares of stock outstanding, with a stock price of $143.5/share. Last year, the company had an EPS of $3 and paid a dividend of $90,000. The company also had a return on equity of 4.5 percent. You think the company will keep a constant DVD growth rate, which is close to this company's current growth rate. The firm's tax rate is 20 percent. After your analysis, you decide to only use corporate bond and common stock to raise capital (thus, no preferred stocks). Your next task is to make a decision of the company's leverage. Thus, you want to do a sensitivity analysis by estimating future cash flows based on different financial leverage: Cash Flow with Different Leverage (in millions) Year 30% Debt 35% Debt 40% Debt 45% Debt 50% Debt -15 MAN 5 wwNUAR - 4 The total money needed is 15 million, thus year 0 cash flow is -15. You want to test the total cost of capital (combining bond and common stock) and choose the lowest one. For example, "30% Debt" means in this scenario, within in the 15 million capital, you want 30% comes from debt (bond) and 70% (1-30%) comes from equity (common stocks). Questions: 1. In the report, describe what is capital budgeting and capital structure. Why they are important to a company? 2. Estimate the company's cost of debt (required return of bond), cost of preferred stock (required return of preferred stock), and cost of equity (required return of stock). Solely based on these numbers, which type of capital should the company use the most? What are the risks of raising this type of capital? 3. In your sensitivity analysis, using NPV, IRR, PI and Payback Period methods to find the best financial leverage for the company and explain the rationale, advantages, and disadvantages of each method. What is your final decision? 4. Assume in year 6 of all cases, the company need to spend addition $2 million for closing the project. Will that change your decision? What is the new NPV of the best choice? Name at least two elements that can influence your final decision and explain briefly how it can influence your decision. (For example, the cost of equity (required return of common stocks) is estimated using outstanding stocks, but if the company issuing more stocks, the required return may change (mostly likely increase), which will cause the estimated cost of capital smaller than actual). Hints: To estimate the real cost of debt (bond) for the company, you need to use the after-tax cost of debt. In other words, the real cost of capital by issuing bond is cost of debt * (1-Tax rate). A company's current growth rate can be estimated using sustainable growth rate. A company's overall cost of capital is estimated as Wd*Rd*(1-T)+We*Re+Wps *Rps. Wd is the weight of debt, which is the percentage of debt in the company; Rd is the cost of debt (before tax); T is the tax rate; We is the weight of equity; Re is the cost of equity; Wps is the weight of preferred stocks, and Rps is cost of preferred stocks. A project's required return is the overall cost of capital of the company under that financial leverage. Fall 2019 FINC301 Case Study Shrieves Company has been in the market for many years. Recently the company has decided to look seriously at a 5-year program and raise additional $15 million capital. Assume that you are the CFO of this company, and you need to decide the capital budgeting and evaluate the new program. First, the company need estimate the optimal capital structure to minimize the total cost of raising new capital of the company. For long-term capital investment decisions, the company should consider three types of capital used to pay for long-term assets, which are typically long- term debt, preferred stock (if any), and common stock. You also know the following information of the company: The current price of the firm's $1.5/quarterly dividend, perpetual preferred stock is $110.14. Currently, the company doesn't have any corporate bonds. However, the company's industries peers, similar size/business/risk, have outstanding corporate bonds, which might be useful to estimate the cost of debt (required return of bond) if the company issue bonds to raise capital: The current price of company A's 10 percent coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity is $1,140.72. The current price of company B's 8 percent coupon, semiannual payment, noncallable bonds with 10 years remaining to maturity is $1,200.30. The current price of company C's 12 percent coupon, semiannual payment, noncallable bonds with 13 years remaining to maturity is $1,350.54. The company has 100,000 shares of stock outstanding, with a stock price of $143.5/share. Last year, the company had an EPS of $3 and paid a dividend of $90,000. The company also had a return on equity of 4.5 percent. You think the company will keep a constant DVD growth rate, which is close to this company's current growth rate. The firm's tax rate is 20 percent. After your analysis, you decide to only use corporate bond and common stock to raise capital (thus, no preferred stocks). Your next task is to make a decision of the company's leverage. Thus, you want to do a sensitivity analysis by estimating future cash flows based on different financial leverage: Cash Flow with Different Leverage (in millions) Year 30% Debt 35% Debt 40% Debt 45% Debt 50% Debt -15 MAN 5 wwNUAR - 4 The total money needed is 15 million, thus year 0 cash flow is -15. You want to test the total cost of capital (combining bond and common stock) and choose the lowest one. For example, "30% Debt" means in this scenario, within in the 15 million capital, you want 30% comes from debt (bond) and 70% (1-30%) comes from equity (common stocks). Questions: 1. In the report, describe what is capital budgeting and capital structure. Why they are important to a company? 2. Estimate the company's cost of debt (required return of bond), cost of preferred stock (required return of preferred stock), and cost of equity (required return of stock). Solely based on these numbers, which type of capital should the company use the most? What are the risks of raising this type of capital? 3. In your sensitivity analysis, using NPV, IRR, PI and Payback Period methods to find the best financial leverage for the company and explain the rationale, advantages, and disadvantages of each method. What is your final decision? 4. Assume in year 6 of all cases, the company need to spend addition $2 million for closing the project. Will that change your decision? What is the new NPV of the best choice? Name at least two elements that can influence your final decision and explain briefly how it can influence your decision. (For example, the cost of equity (required return of common stocks) is estimated using outstanding stocks, but if the company issuing more stocks, the required return may change (mostly likely increase), which will cause the estimated cost of capital smaller than actual). Hints: To estimate the real cost of debt (bond) for the company, you need to use the after-tax cost of debt. In other words, the real cost of capital by issuing bond is cost of debt * (1-Tax rate). A company's current growth rate can be estimated using sustainable growth rate. A company's overall cost of capital is estimated as Wd*Rd*(1-T)+We*Re+Wps *Rps. Wd is the weight of debt, which is the percentage of debt in the company; Rd is the cost of debt (before tax); T is the tax rate; We is the weight of equity; Re is the cost of equity; Wps is the weight of preferred stocks, and Rps is cost of preferred stocks. A project's required return is the overall cost of capital of the company under that financial leverage