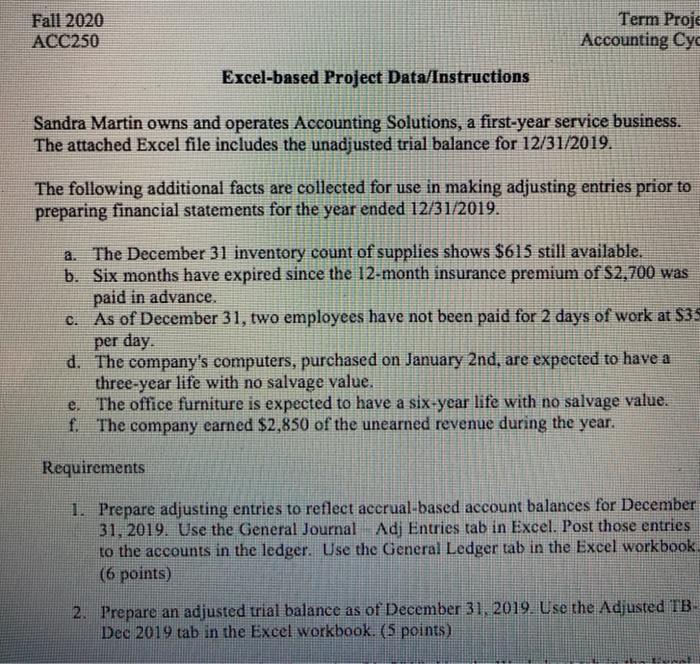

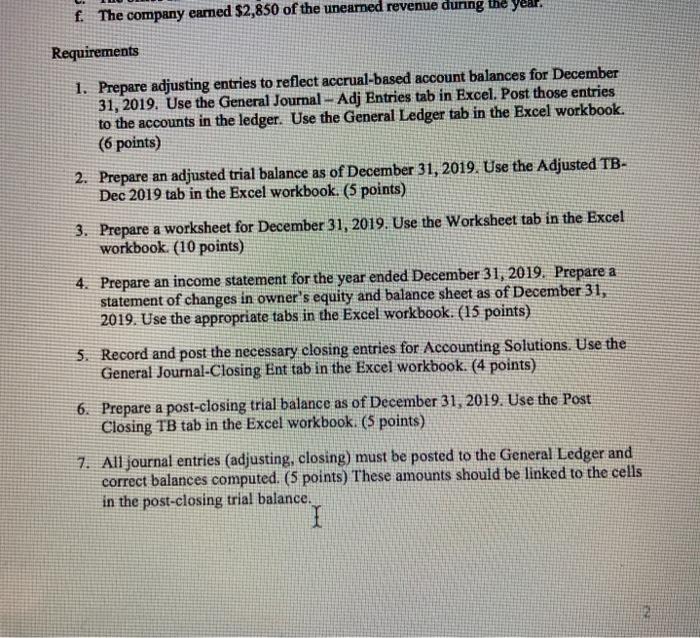

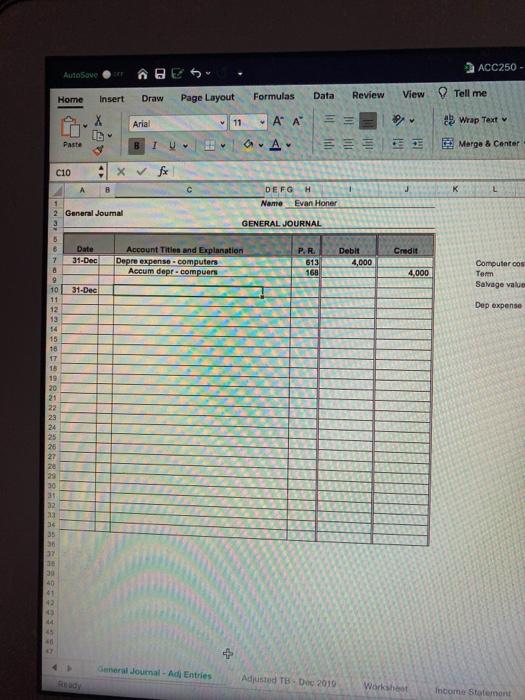

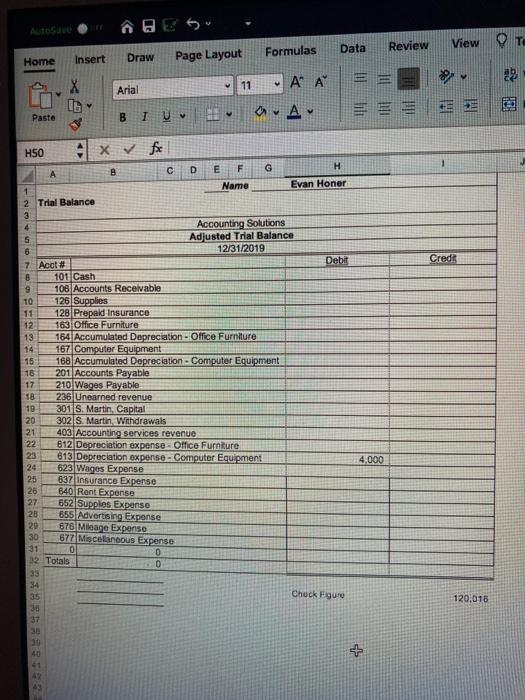

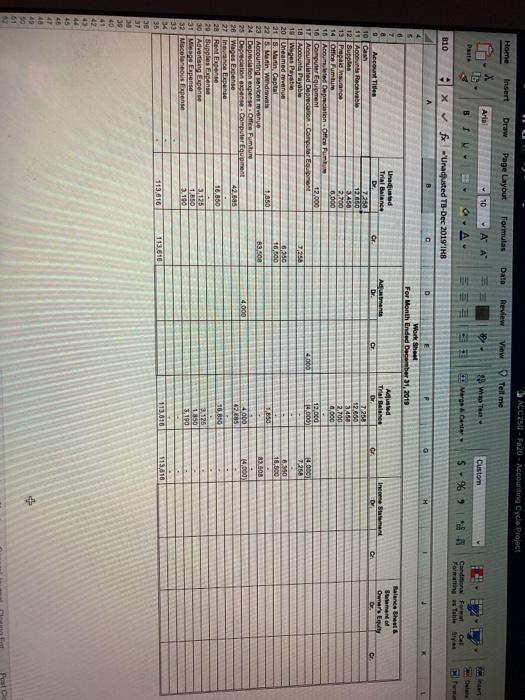

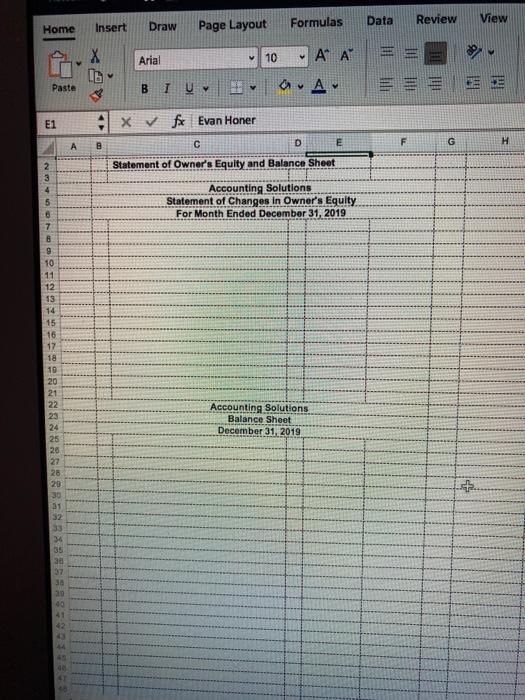

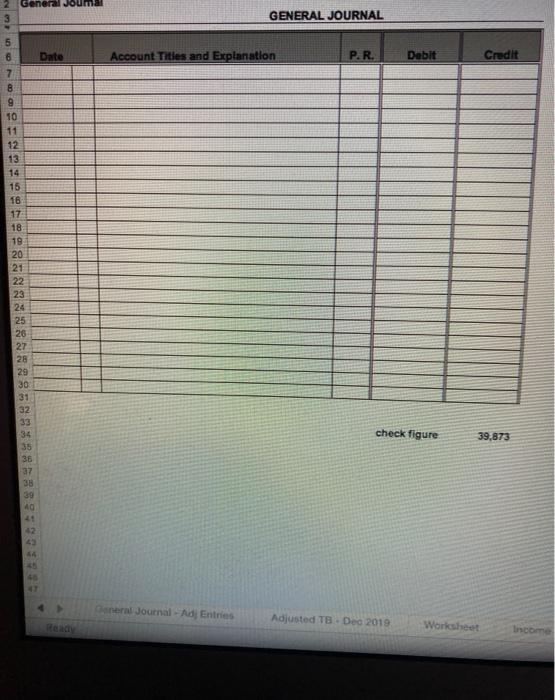

Fall 2020 ACC250 Term Proje Accounting Cyc Excel-based Project Data/Instructions Sandra Martin owns and operates Accounting Solutions, a first-year service business. The attached Excel file includes the unadjusted trial balance for 12/31/2019. The following additional facts are collected for use in making adjusting entries prior to preparing financial statements for the year ended 12/31/2019. a. The December 31 inventory count of supplies shows $615 still available. b. Six months have expired since the 12-month insurance premium of $2,700 was paid in advance. c. As of December 31, two employees have not been paid for 2 days of work at $35 per day. d. The company's computers, purchased on January 2nd, are expected to have a three-year life with no salvage value. e. The office furniture is expected to have a six-year life with no salvage value. f. The company earned $2,850 of the unearned revenue during the year. Requirements 1. Prepare adjusting entries to reflect accrual-based account balances for December 31, 2019. Use the General Journal Adj Entries tab in Excel. Post those entries to the accounts in the ledger. Use the General Ledger tab in the Excel workbook (6 points) 2. Prepare an adjusted trial balance as of December 31, 2019. Use the Adjusted TB. Dec 2019 tab in the Excel workbook (5 points) f. The company eamed $2,850 of the uneared revenue during the year. Requirements 1. Prepare adjusting entries to reflect accrual-based account balances for December 31, 2019. Use the General Journal - Adj Entries tab in Excel. Post those entries to the accounts in the ledger. Use the General Ledger tab in the Excel workbook. (6 points) 2. Prepare an adjusted trial balance as of December 31, 2019. Use the Adjusted TB- Dec 2019 tab in the Excel workbook. (5 points) 3. Prepare a worksheet for December 31, 2019. Use the Worksheet tab in the Excel workbook. (10 points) 4. Prepare an income statement for the year ended December 31, 2019. Prepare a statement of changes in owner's equity and balance sheet as of December 31, 2019. Use the appropriate tabs in the Excel workbook. (15 points) 5. Record and post the necessary closing entries for Accounting Solutions. Use the General Journal-Closing Ent tab in the Excel workbook. (4 points) 6. Prepare a post-closing trial balance as of December 31, 2019. Use the Post Closing TB tab in the Excel workbook (5 points) 7. All journal entries (adjusting, closing) must be posted to the General Ledger and correct balances computed. (5 points) These amounts should be linked to the cells in the post-closing trial balance. I a ACC250 - Aug Home Insert Draw Formulas View Tell me Data Page Layout Review Arial 11 ' A Wrap Text Marge & Center Paste B 1 Ili C10 B J DEFG H Name Evan Honer 1 2 General Journal GENERAL JOURNAL Date 31-Dec Credit Account Tities and Explanation Depre expense computers Accum depr.compuers PR 513 168 Debit 4,000 4,000 Computer cos Term Salvage value 31-Dec 5 8 7 8 9 10 11 12 13 14 15 18 17 Dep expense 19 20 21 22 23 24 25 25 27 20 30 23 34 35 37 30 14 49 36 General Journal - Adi Entries Adjusted TBS - Dec 2010 Worksheet Income Statement Autosave View Formulas Review TO Data Home Insert Draw Page Layout 22 10 11 A A Arial X UG Paste B 1 U $ 1 Credit H50 x fx D B E F H G A Name Evan Honer 1 2 Trial Balance 3 4 Accounting Solutions 5 Adjusted Trial Balance 6 12/31/2019 7. Acct# Debit 8 101 Cash 9 106 Accounts Receivable 10 126 Supplies 11 128 Prepaid Insurance 12 163 Office Furniture 13 164 Accumulated Depreciation - Office Furniture 14 167 Computer Equipment 16 168 Accumulated Depreciation - Computer Equipment 16 201 Accounts Payable 17 210 Wages Payable 18 236 Unearned revenue 19 301 S. Martin Capital 20 302 S. Martin Withdrawals 21 403 Accounting services revenue 22 612 Depreciation expense - Office Furniture 23 613 Depreciation expense - Computer Equipment 24 623 Wages Expense 25 637 Insurance Expense 26 640 Rent Expense 27 652 Supplies Expenso 656 Advertising Expense 676 Mileage Expense 30 677 Miscellaneous Expense 31 0 0 32 Totals 0 4,000 Chuck Figure 34 35 30 37 120.015 * 41 42 ACC250-F20- Accounting Cycle Project Home Insert Draw Page Layout Formulas Data Review View Tell me Aria 10 CA A W ten Custom BT WA Merge Cente S%) Conditions for For Tobie B10 XfxUnadjusted TB-Dec 201918 A B c F H 4 Work Sheet For Month Ended December 31, 2019 Balance sheet Samen Owner's Cr Austrante Dr. Income D Cr CE Cr Adjusted Tral Balance Dr 72551 12.800 37400 2.700 000 4000 12, 14.000 14000) 2256 7 Unada Trial Balance Account Dr. 10 Cash 7250 11 Anos Receivable 12 Supp 3X450 19 Papuidurance 27700 14 Off umum 4,000 16 Acum, Depreciation of 16 Computer Equipment 12.000 17 Accumulated Depreca.com 18 Accounts Payable 19 Wagas Payata 20 Uneamed revenue 21 S. Martin Captal 22 5 Manin, Windows 1,850 23 Accounting services eve 24 Depreciation expers Office Future 25 Decationen - Computer Equipment 26 Wages Expense 42 cas 27 na FB 2e Rent Expert 18,850 20 Supplies Expense 30 Advertising Expense 1125 31 Mage Expense 1.850 32 Moscous pense 3.190 23 G250 16,500 5.40 10,500 3,850 B350 83.508 4.000 4 000 62 14.00 21125 1850 3.100 1137810 113 010 113.810 113.610 35 3e 3 39 40 41 142 44 45 46 41 48 49 + 51 AutoSave Insert Draw Formulas Data Page Layout OT Home Review View X Arial 11 v ' ' e HER Paste U V A E C8 fx A B D E F G Name Evan Honor Accounting Solutions Income Statement For Month Ended December 31, 2019 2 Income Statement 3 4 5 6 7 8 9 10 11 12 13 15 10 17 18 19 20 21 22 23 20 25 26 27 20 20 30 23 34 36 BY 40 41 Review Formulas Data View Home Insert Draw Page Layout Arial 10 LG Paste B ST U av A E1 XV fx Evan Honer B D E F G H Statement of Owner's Equity and Balance Sheet 2 3 4 Accounting Solutions Statement of Changes in Owner's Equity For Month Ended December 31, 2019 7 B 9 10 11 12 13 14 15 16 17 18 10 20 21 22 23 24 25 28 27 26 20 Accounting Solutions Balance Sheet December 31, 2019 31 32 33 36 30 37 Je 20 40 41 40 41 General GENERAL JOURNAL 5 Date Account Tities and Explanation P.R. Dabit Credit 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 check figure 39,873 32 33 34 35 36 37 38 39 40 42 eneral Journal - Adi Entries Adjusted TB. De 2019 Worksheet Income ONO UNA Accounting Solutions Post-Closing Trial Balance December 31, 2019 Debit Credit 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Totals 29 30 31 32 33 34 35 36 37 38 39 40 43 44 45 46 47 General Journal Adi Entries Adjusted TB-Dec 2019 Worksheet Trico Fall 2020 ACC250 Term Proje Accounting Cyc Excel-based Project Data/Instructions Sandra Martin owns and operates Accounting Solutions, a first-year service business. The attached Excel file includes the unadjusted trial balance for 12/31/2019. The following additional facts are collected for use in making adjusting entries prior to preparing financial statements for the year ended 12/31/2019. a. The December 31 inventory count of supplies shows $615 still available. b. Six months have expired since the 12-month insurance premium of $2,700 was paid in advance. c. As of December 31, two employees have not been paid for 2 days of work at $35 per day. d. The company's computers, purchased on January 2nd, are expected to have a three-year life with no salvage value. e. The office furniture is expected to have a six-year life with no salvage value. f. The company earned $2,850 of the unearned revenue during the year. Requirements 1. Prepare adjusting entries to reflect accrual-based account balances for December 31, 2019. Use the General Journal Adj Entries tab in Excel. Post those entries to the accounts in the ledger. Use the General Ledger tab in the Excel workbook (6 points) 2. Prepare an adjusted trial balance as of December 31, 2019. Use the Adjusted TB. Dec 2019 tab in the Excel workbook (5 points) f. The company eamed $2,850 of the uneared revenue during the year. Requirements 1. Prepare adjusting entries to reflect accrual-based account balances for December 31, 2019. Use the General Journal - Adj Entries tab in Excel. Post those entries to the accounts in the ledger. Use the General Ledger tab in the Excel workbook. (6 points) 2. Prepare an adjusted trial balance as of December 31, 2019. Use the Adjusted TB- Dec 2019 tab in the Excel workbook. (5 points) 3. Prepare a worksheet for December 31, 2019. Use the Worksheet tab in the Excel workbook. (10 points) 4. Prepare an income statement for the year ended December 31, 2019. Prepare a statement of changes in owner's equity and balance sheet as of December 31, 2019. Use the appropriate tabs in the Excel workbook. (15 points) 5. Record and post the necessary closing entries for Accounting Solutions. Use the General Journal-Closing Ent tab in the Excel workbook. (4 points) 6. Prepare a post-closing trial balance as of December 31, 2019. Use the Post Closing TB tab in the Excel workbook (5 points) 7. All journal entries (adjusting, closing) must be posted to the General Ledger and correct balances computed. (5 points) These amounts should be linked to the cells in the post-closing trial balance. I a ACC250 - Aug Home Insert Draw Formulas View Tell me Data Page Layout Review Arial 11 ' A Wrap Text Marge & Center Paste B 1 Ili C10 B J DEFG H Name Evan Honer 1 2 General Journal GENERAL JOURNAL Date 31-Dec Credit Account Tities and Explanation Depre expense computers Accum depr.compuers PR 513 168 Debit 4,000 4,000 Computer cos Term Salvage value 31-Dec 5 8 7 8 9 10 11 12 13 14 15 18 17 Dep expense 19 20 21 22 23 24 25 25 27 20 30 23 34 35 37 30 14 49 36 General Journal - Adi Entries Adjusted TBS - Dec 2010 Worksheet Income Statement Autosave View Formulas Review TO Data Home Insert Draw Page Layout 22 10 11 A A Arial X UG Paste B 1 U $ 1 Credit H50 x fx D B E F H G A Name Evan Honer 1 2 Trial Balance 3 4 Accounting Solutions 5 Adjusted Trial Balance 6 12/31/2019 7. Acct# Debit 8 101 Cash 9 106 Accounts Receivable 10 126 Supplies 11 128 Prepaid Insurance 12 163 Office Furniture 13 164 Accumulated Depreciation - Office Furniture 14 167 Computer Equipment 16 168 Accumulated Depreciation - Computer Equipment 16 201 Accounts Payable 17 210 Wages Payable 18 236 Unearned revenue 19 301 S. Martin Capital 20 302 S. Martin Withdrawals 21 403 Accounting services revenue 22 612 Depreciation expense - Office Furniture 23 613 Depreciation expense - Computer Equipment 24 623 Wages Expense 25 637 Insurance Expense 26 640 Rent Expense 27 652 Supplies Expenso 656 Advertising Expense 676 Mileage Expense 30 677 Miscellaneous Expense 31 0 0 32 Totals 0 4,000 Chuck Figure 34 35 30 37 120.015 * 41 42 ACC250-F20- Accounting Cycle Project Home Insert Draw Page Layout Formulas Data Review View Tell me Aria 10 CA A W ten Custom BT WA Merge Cente S%) Conditions for For Tobie B10 XfxUnadjusted TB-Dec 201918 A B c F H 4 Work Sheet For Month Ended December 31, 2019 Balance sheet Samen Owner's Cr Austrante Dr. Income D Cr CE Cr Adjusted Tral Balance Dr 72551 12.800 37400 2.700 000 4000 12, 14.000 14000) 2256 7 Unada Trial Balance Account Dr. 10 Cash 7250 11 Anos Receivable 12 Supp 3X450 19 Papuidurance 27700 14 Off umum 4,000 16 Acum, Depreciation of 16 Computer Equipment 12.000 17 Accumulated Depreca.com 18 Accounts Payable 19 Wagas Payata 20 Uneamed revenue 21 S. Martin Captal 22 5 Manin, Windows 1,850 23 Accounting services eve 24 Depreciation expers Office Future 25 Decationen - Computer Equipment 26 Wages Expense 42 cas 27 na FB 2e Rent Expert 18,850 20 Supplies Expense 30 Advertising Expense 1125 31 Mage Expense 1.850 32 Moscous pense 3.190 23 G250 16,500 5.40 10,500 3,850 B350 83.508 4.000 4 000 62 14.00 21125 1850 3.100 1137810 113 010 113.810 113.610 35 3e 3 39 40 41 142 44 45 46 41 48 49 + 51 AutoSave Insert Draw Formulas Data Page Layout OT Home Review View X Arial 11 v ' ' e HER Paste U V A E C8 fx A B D E F G Name Evan Honor Accounting Solutions Income Statement For Month Ended December 31, 2019 2 Income Statement 3 4 5 6 7 8 9 10 11 12 13 15 10 17 18 19 20 21 22 23 20 25 26 27 20 20 30 23 34 36 BY 40 41 Review Formulas Data View Home Insert Draw Page Layout Arial 10 LG Paste B ST U av A E1 XV fx Evan Honer B D E F G H Statement of Owner's Equity and Balance Sheet 2 3 4 Accounting Solutions Statement of Changes in Owner's Equity For Month Ended December 31, 2019 7 B 9 10 11 12 13 14 15 16 17 18 10 20 21 22 23 24 25 28 27 26 20 Accounting Solutions Balance Sheet December 31, 2019 31 32 33 36 30 37 Je 20 40 41 40 41 General GENERAL JOURNAL 5 Date Account Tities and Explanation P.R. Dabit Credit 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 check figure 39,873 32 33 34 35 36 37 38 39 40 42 eneral Journal - Adi Entries Adjusted TB. De 2019 Worksheet Income ONO UNA Accounting Solutions Post-Closing Trial Balance December 31, 2019 Debit Credit 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Totals 29 30 31 32 33 34 35 36 37 38 39 40 43 44 45 46 47 General Journal Adi Entries Adjusted TB-Dec 2019 Worksheet Trico